Property Tax Rate Lorain Ohio

The tax collected by the City of Lorain is based on income and residency status not on property ownership. Lorain County collects very high property taxes and is among the top 25 of counties in the United States ranked by property tax collections.

Ohio Property Tax Calculator Smartasset

Ohio Property Tax Calculator Smartasset

Real Estate Taxes are Billed by the Treasurer.

Property tax rate lorain ohio. If you have questions about making a payment or when taxes are due contact the Treasurer 440-329-5787. Do I receive credit for taxes paid to other cities. A simple percentage used to estimate total property taxes for a home.

Lorain CityElyria CSD 227 Elyria CityKeystone LSD 180 Tax as a Percentage of Market. Residents receive a credit up to 200 for taxes paid to other cities. The median property tax in Ohio is 183600 per year for a home worth the median value of 13460000.

216-228-9472 Tax as a Percentage of Market. The median property tax on. While the countys average effective property tax rate of 169 ranks as the 10th-highest in the state it is still well below the rate in neighboring Cuyahoga County 244.

Its fast easy secure and your payment is processed immediately. Located on Lake Erie in northern Ohio Lorain County is part of the greater Cleveland metropolitan area. Assessed value in Lorain County is usually calculated by multiplying market value by the countys predetermined ratio which currently is.

The sales and use tax rate for Lorain County will decrease from 675 to 650 effective April 1 2021. Property owners will receive their bills from the County Treasurer a minium of 20 days prior to the due date. Lorain County has one of the highest median property taxes in the United States and is ranked 450th of the 3143 counties in order of median property taxes.

The property tax calculation for a residential value of 100000 is a follows. The lawyer can review the assessors property tax records searching for errors that impact your tax bill file your appeal and be your advocate in the appeal process. The median property tax also known as real estate tax in Lorain County is 199100 per year based on a median home value of 14740000 and a median effective property tax rate of 135 of property value.

What is the City of Lorains tax rate. Makes it easy to pay Ohio property taxes using your favorite debit or credit card. If you need to find your propertys most recent tax assessment or the actual property tax due on your property contact the Lorain County Tax Appraisers office.

The rates are expressed as millages ie the actual rates multiplied by 1000. Median Property Taxes Mortgage 2637. Lorain County Property Tax Payments Annual Lorain County Ohio.

Counties in Ohio collect an average of 136 of a propertys assesed fair market value as property tax per year. For a more detailed explanation of Geauga County Property Tax Rates call the County Auditor at. 2019 Lorain County Residential Property Tax Rates Payable in 2020 Tax as a Percentage of Market for owner occupied properties only.

For a more detailed explanation of County Property Tax Rates call. A simple percentage used to estimate total property taxes for a home. The sales and use tax rate for Portage County will be decreasing from.

Lorains tax rate is 25 effective January 1 2013. Ohio is ranked number twenty two out of the fifty states in order of the average amount of property taxes collected. Pay Ohio Property Taxes Online On time.

A simple percentage used to estimate total property taxes for a home. The median property tax on a 14740000 house is 198990 in Lorain County. Youll have access to basic tax information property characteristics maps images and sketches.

The current effective tax rate is 65369 mills. Lorain County collects on average 135 of a propertys assessed fair market value as property tax. The median property tax in Lorain County Ohio is 1991 per year for a home worth the median value of 147400.

Although property owners can contest their property tax without a lawyer using the services of a Lorain property tax lawyer is beneficial. 100000 X 35 35000 Assessed value 35000 X 065369 228792 Tax before credits. 136 of home value.

The sales and use tax rate for Athens County will increase from 700 to 725 effective April 1 2021. Theres nothing better than knowing your Ohio property tax bill is paid on time on. You may even earn rewards points from your card.

Tax amount varies by county. If you need help with your tax bill call the Treasurer at 440-329-5787. A mill is equal to one tenth of one percent.

Property tax is calculated by multiplying the assessed value with the corresponding millage rates applicable to it. Geauga Tax Rate 21380 Lorain Ave Fairview Park OH 44126 PH. Lorains tax rate is 25.

Click here to access the Lorain County Real Estate Records.

Proposal In Ohio Senate Would Slightly Boost Local Government Funding But There S A Catch Scene And Heard Scene S News Blog

Proposal In Ohio Senate Would Slightly Boost Local Government Funding But There S A Catch Scene And Heard Scene S News Blog

Ohio Property Tax Calculator Smartasset

Ohio Property Tax Calculator Smartasset

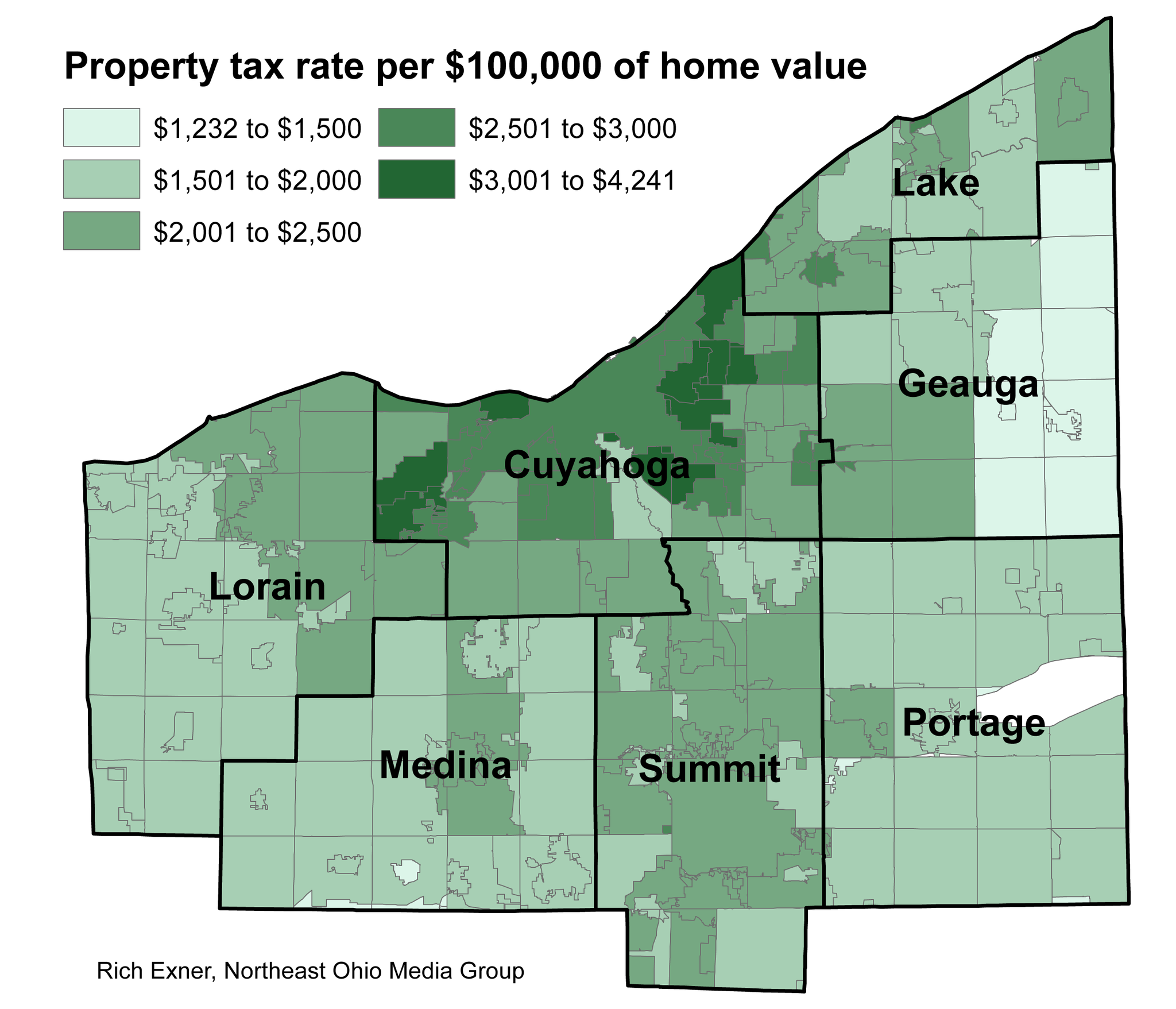

Compare New Property Tax Rates In Greater Cleveland Akron Part Of South Euclid Now Has Top Rate In Northeast Ohio Cleveland Com

Compare New Property Tax Rates In Greater Cleveland Akron Part Of South Euclid Now Has Top Rate In Northeast Ohio Cleveland Com

Llc Ohio How To Start An Llc In Ohio Truic Guides

Find Out Where Your City Or Township Ranks For Property Tax Rates In Greater Cleveland Akron Area Cleveland Com

Haves And Have Nots County Property Taxes Provided 2 5 Billion In Local Health And Social Service Funding But It Was Unevenly Distributed The Center For Community Solutions

Haves And Have Nots County Property Taxes Provided 2 5 Billion In Local Health And Social Service Funding But It Was Unevenly Distributed The Center For Community Solutions

Property Tax Rates For 2015 Up For Most In Greater Cleveland Akron Database Cleveland Com

Property Tax Rates For 2015 Up For Most In Greater Cleveland Akron Database Cleveland Com

Lorain County Property Values Up Some Taxes Too Auditor Says Lorain County Morningjournal Com

Lorain County Property Values Up Some Taxes Too Auditor Says Lorain County Morningjournal Com

Greater Cleveland S Wide Spread In Property Tax Rates See Where Your Community Ranks Cleveland Com

Property Tax Rates Will Decrease For Most Lorain County Residents Ohio Morningjournal Com

Property Tax Rates Will Decrease For Most Lorain County Residents Ohio Morningjournal Com

Http Www Tax Ohio Gov Portals 0 Tax Analysis Tax Data Series All Property Taxes Pr6 Pr6cy06 Pdf

Haves And Have Nots County Property Taxes Provided 2 5 Billion In Local Health And Social Service Funding But It Was Unevenly Distributed The Center For Community Solutions

Haves And Have Nots County Property Taxes Provided 2 5 Billion In Local Health And Social Service Funding But It Was Unevenly Distributed The Center For Community Solutions

How Much Does It Really Cost To Sell A House In Ohio Clever

How Much Does It Really Cost To Sell A House In Ohio Clever

These Cuyahoga County Places Have Ohio S 6 Highest Property Tax Rates That S Rich Recap Cleveland Com

These Cuyahoga County Places Have Ohio S 6 Highest Property Tax Rates That S Rich Recap Cleveland Com

Compare New Property Tax Rates In Greater Cleveland Akron Garfield Heights Now Has Top Rate In Northeast Ohio Cleveland Com

Compare New Property Tax Rates In Greater Cleveland Akron Garfield Heights Now Has Top Rate In Northeast Ohio Cleveland Com

Property Tax Rates For 2015 Up For Most In Greater Cleveland Akron Database Cleveland Com

Property Tax Rates For 2015 Up For Most In Greater Cleveland Akron Database Cleveland Com

Ohio Property Tax Calculator Smartasset

Ohio Property Tax Calculator Smartasset

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home