Property Tax History New Jersey

ORIGINS OF THE PROPERTY TAX IN NEW JERSEY Our property tax goes back to the earliest years of English rule. Salem County Tax Records are documents related to property taxes employment taxes taxes on goods and services and a range of other taxes in Salem County New Jersey.

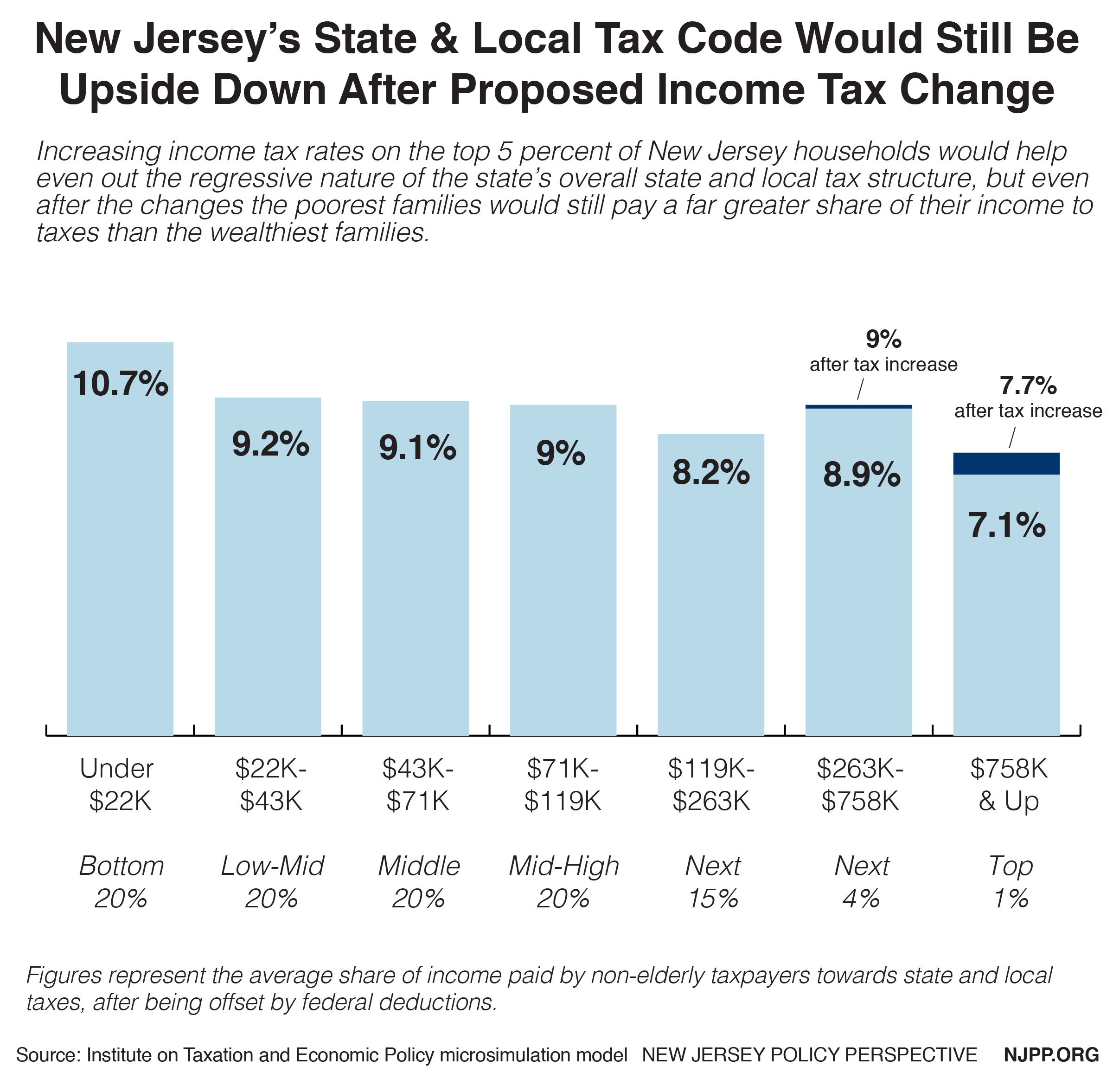

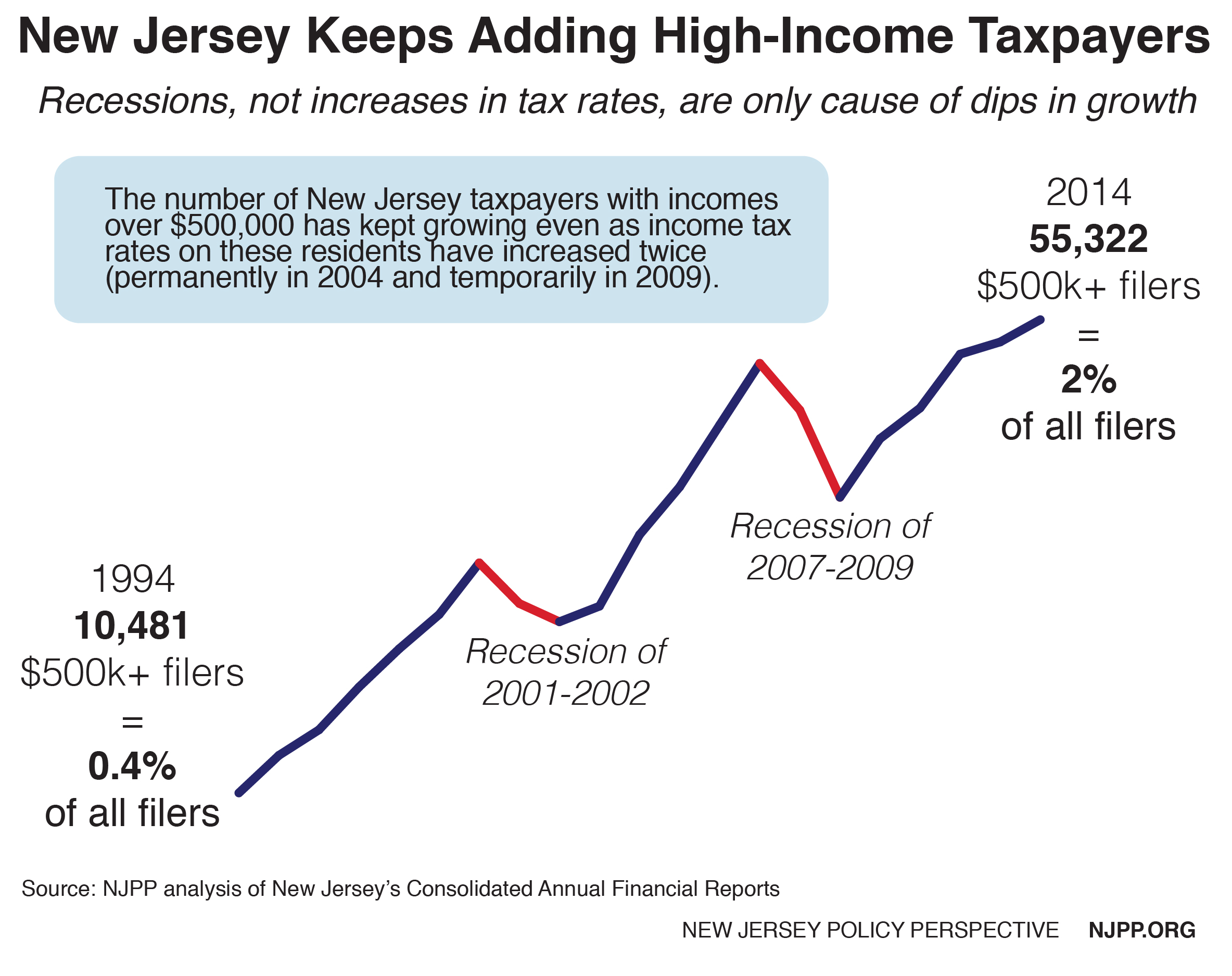

Reforming New Jersey S Income Tax Would Help Build Shared Prosperity New Jersey Policy Perspective

Reforming New Jersey S Income Tax Would Help Build Shared Prosperity New Jersey Policy Perspective

NJ Division of Taxation Property.

Property tax history new jersey. Property taxes are calculated based on the total assessed value of the property land value improvements value - exemptions divided by 100 and multiplied by the tax rate. Generate Reports Mailing Labels - Maps Include. All real property is assessed according to the same standard of value except for qualified agricultural or horticultural land.

They are maintained by the county property tax assessors and the county clerks as well as the State of New Jerseys Department of the Treasury Division of Taxation. Browse Filter and Export the data to Microsoft Excel. About one third of the Citys annual budget is funded through property taxes.

The State of NJ site may contain optional links information services andor content from other websites operated by third parties that are provided as a convenience such as Googleâ Translate. In 1670 a levy of one half penny per acre of land was imposed for the support of the colonial government. Homeowners including owners of mobile homes located in mobile home parks age 65 or older or receiving Federal Social Security disability benefits who paid property taxes on their principal residence in New Jersey either directly or through mobile home park site fees.

The standard measure of property value is true value or market value that is what a willing knowledgeable buyer would pay a. Mercer County Property Records are real estate documents that contain information related to real property in Mercer County New Jersey. Please be advised that the State of New Jersey does not allow the Tax Collector to acknowledge postmarks.

609-292-7974 or 609-292-7975 Fax. New Jerseys real property tax is an ad valorem tax or a tax according to value. Property records are updated on a weekly basis.

The tax rate is set and certified by the Hudson County Board of Taxation. PLEASE BE ADVISED collection of payments for property taxes in the State of New Jersey. Taxes are due February 1st May 1st August 1st and November 1st.

Applicants must be New Jersey residents for at least the past 10 years and lived in the. Up to 38 cash back Property Records New Jerseys property records are kept on a state and a localcounty basis. And four years later.

Find Salem County Tax Records. View tax assessment records for free. State of New Jersey Government NJ Taxes.

Public Property Records provide information on homes land or commercial properties including titles mortgages property deeds and a range of other documents. Search By Property Location Required fields are indicated with an asterisk Property - Tax Year 2021 2020 2019 2018 2017 2016 2015 2014 2013 2012 2011. NJ Property Tax Records Search Search - NJ Tax Maps Property Records Ownership Assessment Data Real Estate Info Sales History Comparable Properties.

In 1682 with the establishment of counties the property tax became the primary source of funding for local government. Your Ultimate NJ Property Records Source. Property tax bills are mailed once a year in July and contain four 4 quarterly payments.

These records can include Salem County property tax assessments and assessment challenges appraisals and income taxes. The amount of the tax is annually determined each year in every municipality to provide sufficient revenues to meet the budgeted expenditures of municipalities counties and school districts. Tax Zoning Flood Aerial GIS and more.

Therefore taxes must be received in this office on or before the 10th. Until the middle of the 19th Century property taxes were levied on real estate and certain personal property at arbitrary rates within certain limits referred to as certainties The Public Laws of 1851 brought to New Jersey the goals of uniform assessments based on actual value and a general property tax This meant that all property classes were to be treated the same for the purpose of taxation. The Tax Assessors Office is responsible for placing valuations on all real property throughout the city and makes sure the tax burden is equally distributed among the property owners.

Christopher Hackett CTA Office Hours Wednesday Evenings 530 pm to 8 pm 609 823 2731 extension 103 FAX 609 823 - 1781. The assessed value is determined by the Tax Assessor. NETR Online New Jersey Public Records Search New Jersey Records New Jersey Property Tax New Jersey Property Search New Jersey Assessor.

Tax Collector S Office City Of Englewood Nj

Tax Bill Breakdown City Of Woodbury

Reforming New Jersey S Income Tax Would Help Build Shared Prosperity New Jersey Policy Perspective

Reforming New Jersey S Income Tax Would Help Build Shared Prosperity New Jersey Policy Perspective

Historical New Jersey Tax Policy Information Ballotpedia

Historical New Jersey Tax Policy Information Ballotpedia

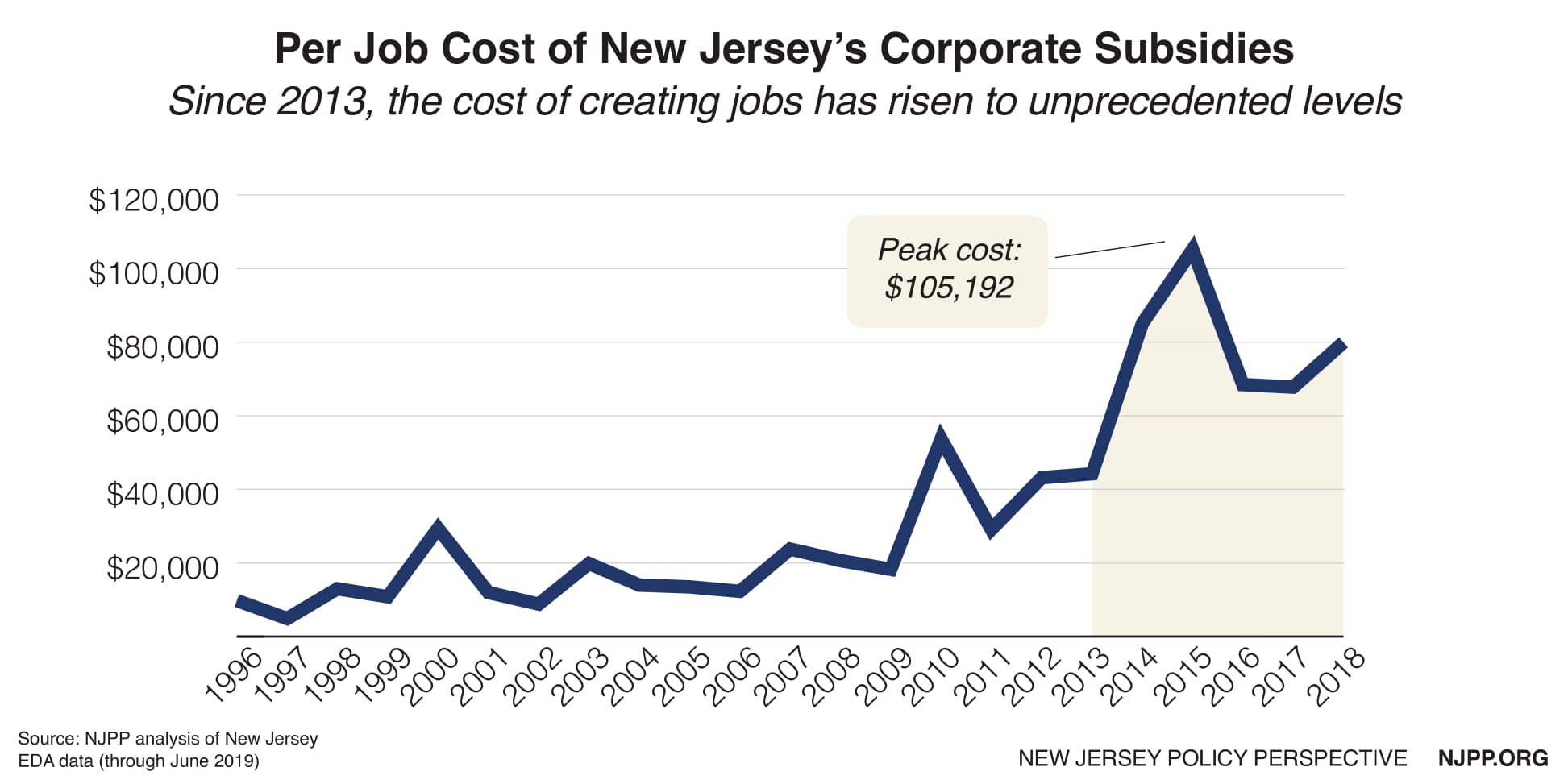

Reining In Corporate Tax Subsidies A Better Economic Development Playbook For New Jersey New Jersey Policy Perspective

Reining In Corporate Tax Subsidies A Better Economic Development Playbook For New Jersey New Jersey Policy Perspective

Future Facts Blog About Smart Growth And Sustainable Development New Jersey Future

Future Facts Blog About Smart Growth And Sustainable Development New Jersey Future

Interactive Map Where Nj S High Property Taxes Are Highest And Lowest Nj Spotlight News

Interactive Map Where Nj S High Property Taxes Are Highest And Lowest Nj Spotlight News

Reforming New Jersey S Income Tax Would Help Build Shared Prosperity New Jersey Policy Perspective

Reforming New Jersey S Income Tax Would Help Build Shared Prosperity New Jersey Policy Perspective

Bergen County Tax Rates For 2018 2019 Michael Shetler

Bergen County Tax Rates For 2018 2019 Michael Shetler

States With The Highest And Lowest Property Taxes Property Tax Tax States

States With The Highest And Lowest Property Taxes Property Tax Tax States

Reforming New Jersey S Income Tax Would Help Build Shared Prosperity New Jersey Policy Perspective

Reforming New Jersey S Income Tax Would Help Build Shared Prosperity New Jersey Policy Perspective

Property Tax Definition History Administration Rates Britannica

Property Tax Definition History Administration Rates Britannica

Nutley New Jersey Property Tax Calculator

Nutley New Jersey Property Tax Calculator

Tax Finance Dept Sparta Township New Jersey

Tax Finance Dept Sparta Township New Jersey

Suffolk County Property Tax Records Suffolk County Property Taxes Ny

Suffolk County Property Tax Records Suffolk County Property Taxes Ny

Official Website Of East Windsor Township New Jersey Tax Collector

Official Website Of East Windsor Township New Jersey Tax Collector

Future Facts Blog About Smart Growth And Sustainable Development New Jersey Future

Future Facts Blog About Smart Growth And Sustainable Development New Jersey Future

Reforming New Jersey S Income Tax Would Help Build Shared Prosperity New Jersey Policy Perspective

Reforming New Jersey S Income Tax Would Help Build Shared Prosperity New Jersey Policy Perspective

Nutley New Jersey Property Tax Calculator

Nutley New Jersey Property Tax Calculator

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home