How Do I File A Homestead Exemption In Alabama

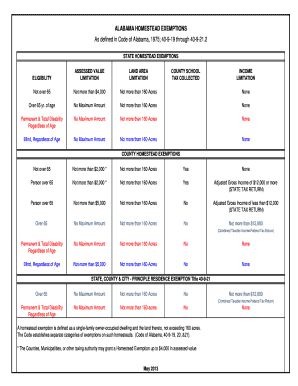

There are several different homestead exemptions but none. For more information regarding homesteads and Title 40-9-19 through 40-9-21 view the Code of Alabama 1975.

Now it is possible to print download or share the form.

/GettyImages-1254784260-b0ee3e20ca46463493b2682a26f133cd.jpg)

How do i file a homestead exemption in alabama. Homestead Exemptions The Limestone County Tax Assessor can provide you with an application form for the Limestone County homestead exemption which can provide a modest property tax break for properties which are used as the primary residence of their owners. Exemption applications other than the over-65 homestead exemption must be filed between January 1. Than 160 acres but not exempt from state taxes.

You must visit one of our office locations to sign an assessment sheet. If filing online please read on-line filing instructions carefully to determine eligibility. Youll need to determine what you qualify for and then apply for it.

You must make your initial application for a homestead exemption in person at the Revenue Commissioners Office. Real Property Exemptions - Effective July 12008 may apply at anytime prior to April 1st of effective year. If you own property in Alabama and meet some other requirements you may be eligible for a Homestead Exemption.

Deadline to apply is December 31st. Bring your deed or proof of ownership to any tax assessor location and ask to claim your homestead exemption. Copy of Deed with correct address legal description names.

You must own and occupy the property as your primary residential address. Any homestead granted may be adjusted rescinded or reinstated at any time by the local taxing authority granting such exemption as stated in 40-9-19c Code of Alabama. Applying for Homestead Exemption.

How to File for a Homestead Exemption on Your Home You must use the Districts application form. Press Done after you finish the blank. How do I apply for this exemption.

You must close and take ownership of the property before October 1. Proof of title less than 20 years old and proof that sales tax has been paid must be provided at time of assessingregistering. If filing online please read on-line filing instructions carefully to determine eligibility.

Homestead Exemption 2 is for residents of Alabama 65 years of age or older with an annual adjusted gross income of less than 12000 as reflected on the most recent State Income Tax Return. One can be granted a homestead exemption if the single-family residence is their primary residence on October 1 of the tax year for which the property owner is applying. Homestead exemption is a statutory exemption that must be timely claimed or lost.

A homestead exemption may be claimed if you own the manufactured home and live in it as your principle residence as of October 1st of the year you are applying for the exemption. You must own and occupy the property as your primary residential address. The key is making it a priority and getting it done on time.

Address the Support section or contact our Support team in case you have got any concerns. Additional exemptions might be available for farmland green space veterans or others. Please visit your local county office to apply for a homestead exemption.

Under Alabama State Tax Law only one Homestead Exemption is granted regardless of how much property is owned in the state. This exemption gives you a break on your property taxes but it isnt automatic. The owner who lives on the property must be the one to sign for the exemption Exemptions must be claimed by December 31 for next tax year.

You must show proof of ownership of the property. There are several different types of exemptions a home owner can claim in the State of Alabama. Proof of occupancy required.

Visit your local county office to apply for a homestead exemption. The deadline to file your homestead is December 31. Here are a few key things to remember.

The property owner may be entitled to a homestead exemption if he or she owns a single-family residence and occupies it as their primary residence on the first day of the tax year for which they are applying. You are entitled to only one homestead. Make use of the Sign Tool to add and create your electronic signature to signNow the Printable homestead exemption form alabama.

Visit the Houston County administrative building located in Dothan Alabama. There must be a signed assessment sheet. Proof of occupancy required.

Homestead Exemption Policy. The exemption is for the total assessed value of state taxes and up to 5000 in assessed value on their principal residence and 160 acres adjacent thereto. You must complete an assessment sheet and provide the Revenue Commissioner with your propertys tax parcel ID number and your supporting documentation.

To go to the Forms section to print a homestead exemption application form. It is a tax break a property owner may be entitled to if he or she owns a single-family residence and occupies it as their primary residence on the first day of the tax year for which they are applying. To receive any Exemptions you must apply in person at the Tax Assessors Office located at 2782 Marietta Hwy Suite 200 Canton GA 30114.

Documentation needed to claim homestead. Filing your Homestead Exemption in Alabama is easy. You must own and occupy the property.

To receive Homestead Exemptions IIIIIIV taxpayer must file and sign the assessment each year and bring federal and.

Why Is Closing By December 31 So Important For The Florida Homestead Exemption Usda Loan Pro

Why Is Closing By December 31 So Important For The Florida Homestead Exemption Usda Loan Pro

Alabama Homestead Exemptions Wedowee Lake Lands Realty

Homestead Exemption Rules Changing

Homestead Exemption Rules Changing

/GettyImages-1254784260-b0ee3e20ca46463493b2682a26f133cd.jpg) What Is A Homestead Tax Exemption

What Is A Homestead Tax Exemption

Your 2019 Guide To Filing Your Homestead Exemption Bhgre Homecity

Your 2019 Guide To Filing Your Homestead Exemption Bhgre Homecity

Order Approving Distribution And Authorizing Discharge Of Guardian Guardianship Probate Financial Information

Order Approving Distribution And Authorizing Discharge Of Guardian Guardianship Probate Financial Information

Palm Beach Market Focus December 2020 Palmbeachdecember2020 Palmbeach In 2021 Beach Palm Beach Palm Beach County

Palm Beach Market Focus December 2020 Palmbeachdecember2020 Palmbeach In 2021 Beach Palm Beach Palm Beach County

Alabama Homestead Exemption Fill Out And Sign Printable Pdf Template Signnow

Alabama Homestead Exemption Fill Out And Sign Printable Pdf Template Signnow

/gettyimages-1197184592-2048x2048-22e8a8e779514a43a8347a0b583c1813.jpg) Property Tax Exemptions For Seniors

Property Tax Exemptions For Seniors

Home Mortgage Information When And Why Should You File A Homestead Exemption

Home Mortgage Information When And Why Should You File A Homestead Exemption

Types Of Homestead Exemptions In Alabama South Oak

Amendment 3 Ratified December 15 1791 Gives Rights To General Populous Of The Us Rights You Are Not Legally Obli American Revolution Acting Revolution

Amendment 3 Ratified December 15 1791 Gives Rights To General Populous Of The Us Rights You Are Not Legally Obli American Revolution Acting Revolution

What Is A Homestead Exemption And How Does It Work Lendingtree

What Is A Homestead Exemption And How Does It Work Lendingtree

Just A Reminder It Is That Time Of Year To File Your Homestead Exemption Here Is The Information Hope You Have A G Selling House Just A Reminder Homesteading

Just A Reminder It Is That Time Of Year To File Your Homestead Exemption Here Is The Information Hope You Have A G Selling House Just A Reminder Homesteading

What Is The Alabama Homestead Exemption Davis Bingham Hudson Buckner P C

What Is The Alabama Homestead Exemption Davis Bingham Hudson Buckner P C

Delaware Small Estate Affidavit Form Estates Delaware Small

Delaware Small Estate Affidavit Form Estates Delaware Small

Just A Reminder It Is That Time Of Year To File Your Homestead Exemption Here Is The Information Hope You Have A G Selling House Just A Reminder Homesteading

Just A Reminder It Is That Time Of Year To File Your Homestead Exemption Here Is The Information Hope You Have A G Selling House Just A Reminder Homesteading

Amendment Cover Sheet North Dakota How To Apply Cover

Amendment Cover Sheet North Dakota How To Apply Cover

What Is Form W 4 Tax Forms Rental Agreement Templates Irs

What Is Form W 4 Tax Forms Rental Agreement Templates Irs

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home