Property Tax Rate Denton County

Please feel free to call us or visit any one of our 6 locations for personal service. Mary and Jim Horn Government Center.

The 10 Safest Places To Live In Atlanta Home Buying Mortgage Mortgage Rates

The 10 Safest Places To Live In Atlanta Home Buying Mortgage Mortgage Rates

Ave Ln or Dr.

Property tax rate denton county. 179 rows county tax rate. Beginning with tax year 2018 the Texas Comptroller of Pulbic Accounts changed the format of local government ID numbers. Search Property Tax Records by account number owner name and more.

Do not enter street type or direction such as. Here is the link for all the information from the Denton County Appraisal Distric. 50 rows Property Tax Rate Comparisons around North Texas.

Districts are included in this list if any part of the district is within the county. The median property tax in Denton County Texas is 3822 per year for a home worth the median value of 178300. Appraisal Districts update tax rate information in October of each year.

Skip to Main Content Public Notice Disaster Declaration Related to COVID-19 Read the Declaration Executive Order GA-34 Relating to Opening of Texas in Response to COVID-19 Disaster Read On. Denton County has one of the highest median property taxes in the United States and is ranked 77th of the 3143 counties in order of median property taxes. If youre still in sticker shock.

We hope that you will find this website a useful tool. Denton TX 76201-4168 Phone Directory. We hope the new site is more manageable and convenient for the citizens of Denton County.

Property Tax Estimator Property Tax Estimator. State law automatically places a tax lien on the property on January 1 of each year to ensure that taxes are paid. A person is not relieved of the obligation because he no longer owns the property.

Enter the street number followed by a space and the street name. School district property tax data for 2019 are preliminary. Ownership and exemptions will be updated as they are applied.

Calculate an estimate of your property taxes. Each individual taxing unit is responsible for calculating the. The county is providing this table of property tax rate information as a service to the residents of the county.

Skip to Main Content. Posted in Community How-to Property Tax. The median property tax also known as real estate tax in Denton County is 382200 per year based on a median home value of 17830000 and a median effective property tax rate of 214.

Welcome to the NEW Denton Central Appraisal District website. Property Tax General Information PDF Resources Forms. The move allows those who qualify to.

This is the actual property address. The Denton Central Appraisal District shows from 2019-2020 the Denton City Council voted for an increase of 286 percent while Denton County commissioners delivered a 143 percent hike. The person who owns or acquires property on or after January 1 of the tax year is personally liable for the tax.

Tax rates are reported based on the new District ID. This site is made available as a convenience to our customers. Tax Year 2019.

Taxpayer Rights Remedies. Denton County approved May 14 a property tax limitation for seniors and people with disabilities that is effective immediately. Denton County collects on average 214 of a propertys assessed fair market value as property tax.

COM CitiesISD Total City ISD County Argyle-Argyle ISD 2021878 0378193 1418700 0224985 Argyle-Denton ISD 2010778 0378193 1407600 0. We offer online payment options for property taxes and motor vehicle registration renewals. Compared to 2013 the countys property tax bill for its average homeowner is 227 percent higher and the citys is 398 percent higher.

Hours Monday through Friday except holidays. 972-434-8835 Phones answered between the hours of 8 am to 4 pm. After getting your property tax estimate Id like to give you some tips to help you out in protesting.

Tax Year 2020. Welcome to the Denton County Tax Office. Denton County Property Tax Rates Here are the updated tax rates in Denton County for 2019-2020 as approved by the tax entities.

Section 3207 Texas Property Tax. 2021 Values will be updated when notices are mailed out in May. One of the fantastic things about.

Equestrian Estate For Sale In Parker County Texas 91 Beautiful Acres Just Minutes South Of Weatherford Previ Equestrian Estate Horse Facility Horse Property

Equestrian Estate For Sale In Parker County Texas 91 Beautiful Acres Just Minutes South Of Weatherford Previ Equestrian Estate Horse Facility Horse Property

Get Your Food Truck Tasting On At Hub Streat At 1212 E 14th St In Plano Staylocal Inlocal Inlocalrealestate Planotx Foodtru Stay Local Plano Food Truck

Get Your Food Truck Tasting On At Hub Streat At 1212 E 14th St In Plano Staylocal Inlocal Inlocalrealestate Planotx Foodtru Stay Local Plano Food Truck

Just A Reminder It Is That Time Of Year To File Your Homestead Exemption Here Is The Information Hope You Have A G Selling House Just A Reminder Homesteading

Just A Reminder It Is That Time Of Year To File Your Homestead Exemption Here Is The Information Hope You Have A G Selling House Just A Reminder Homesteading

Monroe Pearson Holiday Styled Shoot With Allen Tsai Photography Rent My Dust Sweetheart Table Wedding Christmas Bride Industrial Wedding Venues

Monroe Pearson Holiday Styled Shoot With Allen Tsai Photography Rent My Dust Sweetheart Table Wedding Christmas Bride Industrial Wedding Venues

Equestrian Estate For Sale In Denton County Texas Beautiful Equestrian Estate In Desirable Location Gated Entrance Opens To Long Treelined Driveway Of Estab In 2021

Equestrian Estate For Sale In Denton County Texas Beautiful Equestrian Estate In Desirable Location Gated Entrance Opens To Long Treelined Driveway Of Estab In 2021

Rate Calculator Lawyers Title Dfw Title Insurance Title Lawyer

Rate Calculator Lawyers Title Dfw Title Insurance Title Lawyer

480 Terry Lane Heath Rockwall County Texas Horse Property Equestrian Estate Gorgeous View

480 Terry Lane Heath Rockwall County Texas Horse Property Equestrian Estate Gorgeous View

Accounting Jobs Accountant Cpa S Accounts Payable Accounts Receivable Sr Tax Specialist More At Www Hhstaffingse Accounting Jobs Cpa Accounting Tax Prep

Accounting Jobs Accountant Cpa S Accounts Payable Accounts Receivable Sr Tax Specialist More At Www Hhstaffingse Accounting Jobs Cpa Accounting Tax Prep

Lawyers Title Southlake Southlake Tx Title Insurance Escrow Title Insurance Escrow Southlake

Lawyers Title Southlake Southlake Tx Title Insurance Escrow Title Insurance Escrow Southlake

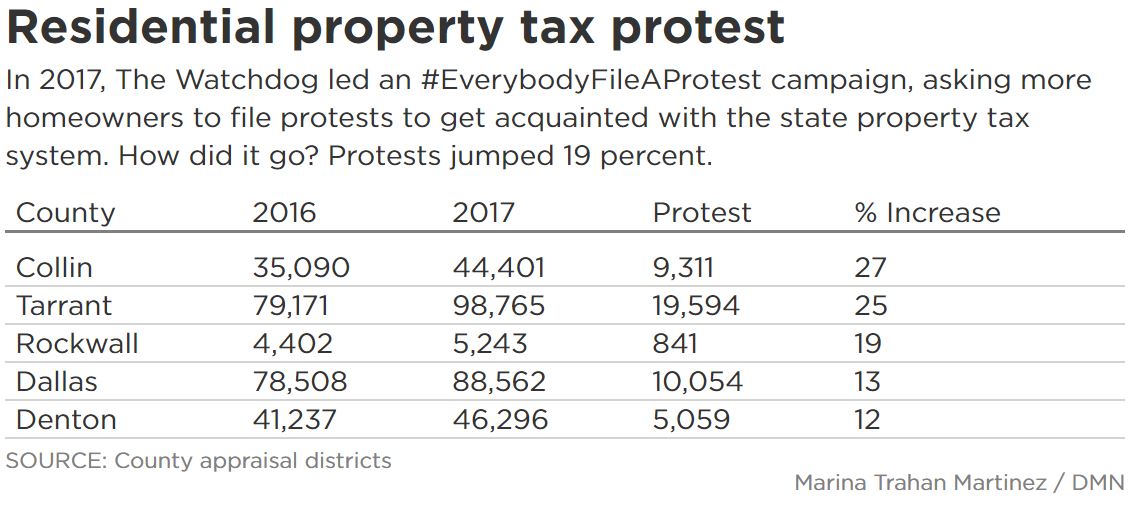

Watchdog Here Are 2014 S Top Consumer Tips To Save You Aggravation Property Tax How To Introduce Yourself Face Cream

Watchdog Here Are 2014 S Top Consumer Tips To Save You Aggravation Property Tax How To Introduce Yourself Face Cream

Sealing Flagstone Dallas Sealing Pavers Stone Deck Rock Tile

Sealing Flagstone Dallas Sealing Pavers Stone Deck Rock Tile

Where Do Texas Homeowners Pay The Highest Property Taxes Texas Scorecard

Where Do Texas Homeowners Pay The Highest Property Taxes Texas Scorecard

Keller Williams Modern Kitchen Open Single Story Homes Wood Laminate

Keller Williams Modern Kitchen Open Single Story Homes Wood Laminate

Is Opendoor Worth Considering When Selling Your Home In Dallas Dallas Realtor Dallas Real Estate Real Estate Marketing

Is Opendoor Worth Considering When Selling Your Home In Dallas Dallas Realtor Dallas Real Estate Real Estate Marketing

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home