Does A Property Tax Lien Affect Your Credit Score

Noand neither does an income tax lien. Statutory liens can be detrimental to your credit as they stay listed for seven years.

How To Improve Your Credit Score To Get Approved For An Apartment Propertynest

How To Improve Your Credit Score To Get Approved For An Apartment Propertynest

Lenders can discover tax liens through public records searches when considering applications for mortgages or other loans.

Does a property tax lien affect your credit score. Theyre considered to be one of the most negative credit report entries and can damage your credit score similar to bankruptcy or foreclosure. All negative information including the HOA lien affects your credit score. Tax liens can seriously affect your credit but thankfully the Consumer Financial Protection Bureau has decided to remove all tax liens from credit reports which will raise many peoples scores.

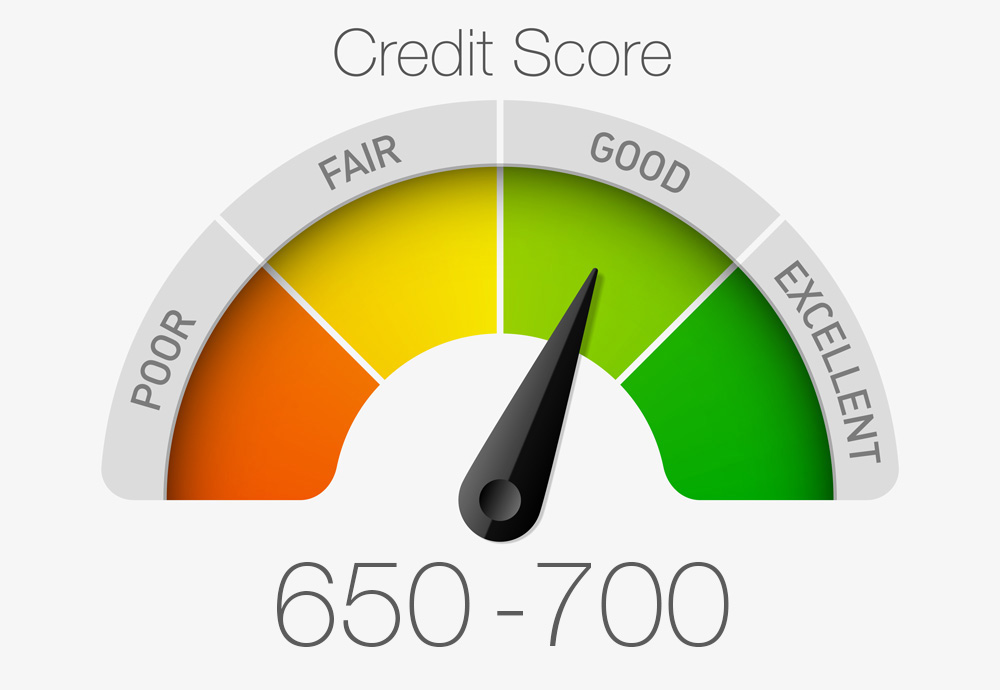

While FICO didnt specify the credit score impact of a tax lien bankruptcies and foreclosures can cause your credit rating to plummet. In the past your IRS debt may have appeared on your credit report if the IRS filed a Notice of Federal Tax Lien against you. A tax lien entry on your credit report can keep you from getting approved for future loans credit cards apartment rentals or even a job.

A tax lien is placed by the government when income estate or property taxes owed are not paid. Because the credit reporting bureaus dont give out their formula for calculating credit scores there is no way to know exactly how badly your score will drop in the face of a lien. Do Delinquent Property Taxes Affect Credit.

Tax liens used to be treated similarly to other negative public record items in FICOs formula. So like tax liens property liens dont impact your credit score because they dont show on your credit report. Tax liens or outstanding debt you owe to the IRS no longer appear on your credit reportsand that means they cant impact your credit scores.

A paid lien could have remained on your credit report for up to seven years after it was released and an unpaid lien for up to 10 years after it was originally filed. There was a time when tax liens could turn your credit score upside down. Starting in 2018 the three major credit bureaus removed tax liens from consumer credit reports.

Liens can severely affect your credit negatively. However lenders may still search public records for tax liens. However this doesnt mean you are off the hook.

Does a property tax lien affect your credit score. The damage was along the same lines as bankruptcy or even foreclosure. Tax Liens and Credit Scores Tax liens and tax levies are no longer public record.

Tax Liens Removed From Credit Reports Tax liens used to appear on your credit reports maintained by the three national credit bureaus Experian TransUnion and Equifax. It can take a great deal of time to pay off your tax debts and eventually improve your credit score. If a credit report registers a tax lien it can plummet your score by 100 points or more.

The creditor files for a property lien in court so the public record appears on your credit report. If you fail to pay your property taxes and the creditor attaches a lien on your home it will lower your credit score regardless of whether you. A public record like a lien has a negative effect on your credit score and may also affect whether or not a lender extends credit to you.

A lien entitles the IRS to take whatever unpaid taxes you owe plus penalties and interest from the proceeds of the sale of your property. A creditor may place a lien against your personal property such as your house or car. The extent of credit score damage depends on whether the homeowners association had been reporting your account as unpaid for several months before placing the lien.

A property lien can also include a judgment lien on property someone owns. Federal and state tax liens no longer appear on your credit. There was a time when property tax liens could significantly affect a credit score.

In fact the lien was considered similar to bankruptcy or foreclosure. Thanks to a joint credit reporting bureau decision made in 2018 they wont go on your credit report either. However take into consideration all the criteria the bureaus compile to get your score.

Even paid liens can stay on your credit score for up to seven years. This happens in a civil court case when someone loses a case and owes money for items such as credit card debt child support or unpaid medical bills. And when a tax lien did hit a persons credit it could prevent approval for credit cards jobs housing or even loans.

Tax liens havent appeared on credit reports since 2018 so they cannot lower your credit scores but tax liens can still damage your credit.

How Does A Short Sale Affect Your Credit

How Does A Short Sale Affect Your Credit

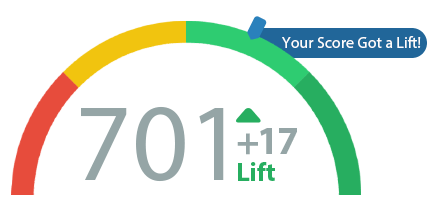

How Tax Liens Affect Your Credit Score May Change Best Tax Relief Company Is

How Tax Liens Affect Your Credit Score May Change Best Tax Relief Company Is

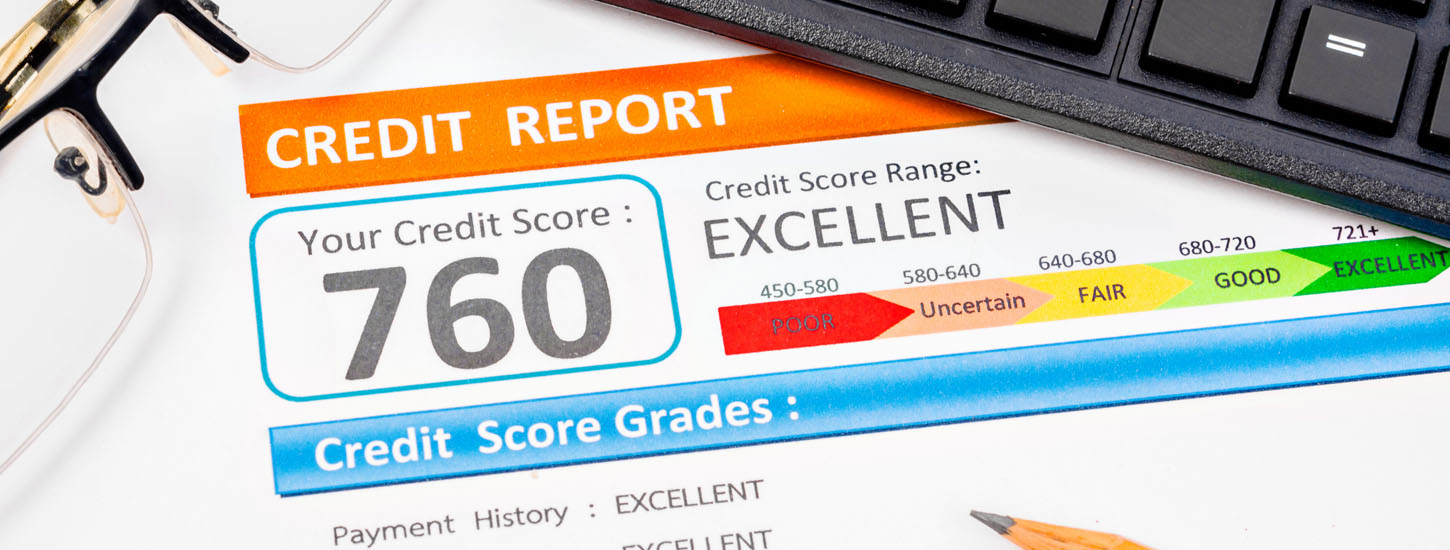

What Credit Score Is Needed To Buy A House In 2020 Lexington Law

What Credit Score Is Needed To Buy A House In 2020 Lexington Law

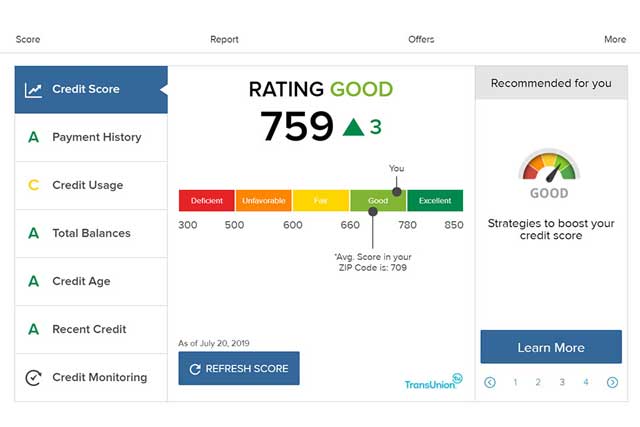

What You Need To Know About Credit Scores Eidls And Ppp Loans Workest

What You Need To Know About Credit Scores Eidls And Ppp Loans Workest

How To Refinance With Bad Credit Credit Com

What Credit Score Is Needed To Buy A House In 2020 Lexington Law

What Credit Score Is Needed To Buy A House In 2020 Lexington Law

8 Things You Should Know About Credit Reports And Scores Federal Employee Education Assistance Fund

8 Things You Should Know About Credit Reports And Scores Federal Employee Education Assistance Fund

10 Common Credit Traps Of The Wealthy Aspiriant Wealth Management

10 Common Credit Traps Of The Wealthy Aspiriant Wealth Management

What Is Your Credit Score How Does It Work And Why Is It Important

What Is Your Credit Score How Does It Work And Why Is It Important

Does Car Insurance Affect Your Credit Credit Score Infographic Car Insurance Bad Credit Score

Does Car Insurance Affect Your Credit Credit Score Infographic Car Insurance Bad Credit Score

Does Irs Debt Show On Your Credit Report H R Block

Does Irs Debt Show On Your Credit Report H R Block

How Does Medical Debt Affect Your Credit Score

How Does Medical Debt Affect Your Credit Score

How To Remove Tax Liens From Your Credit Report Updated For 2021

How To Remove Tax Liens From Your Credit Report Updated For 2021

5 Factors That Make Up Your Credit Score The Richardson Team

5 Factors That Make Up Your Credit Score The Richardson Team

How Does Negative Info Affect My Credit Report

How Does Negative Info Affect My Credit Report

6 Surprising Things That Won T Hurt Your Credit Score Creditcards Com

6 Surprising Things That Won T Hurt Your Credit Score Creditcards Com

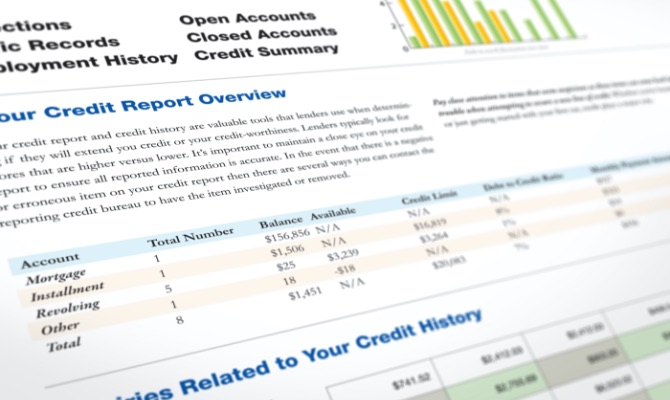

Understanding Your Credit Report Lgfcu Personal Finance

Understanding Your Credit Report Lgfcu Personal Finance

How To Improve Your Credit Score Increase Credit Score

How To Improve Your Credit Score Increase Credit Score

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home