Riverside County Property Tax Questions

Prospective purchasers are advised that some liens bonds or other assessments which are levied by agencies or offices other than the Treasurer-Tax Collector may still be outstanding after the tax sale. Property Tax Frequently Asked Questions.

New Homes For Sale In Porter Ranch California New Luxury Home Community Coming Soon To La Beacon At Hillcrest Antici Luxury Homes Hillcrest Porter Ranch

New Homes For Sale In Porter Ranch California New Luxury Home Community Coming Soon To La Beacon At Hillcrest Antici Luxury Homes Hillcrest Porter Ranch

Since property tax is calculated as a percentage of the assessed home value lowering the taxable value of the home means youll be paying less in taxes each year.

Riverside county property tax questions. The offices of the Assessor Treasurer-Tax Collector Auditor-Controller and Clerk of the Board have prepared this site to introduce taxpayers to the organizations that handle the property tax process in Riverside County. Property records requests for Burlington County NJ Looking up property owners by name and address Burlington County property tax bills and payments. The State of California passed the supplemental assessment law in 1983 to provide additional funding primarily for schools.

The telephone number is 951 955-3900 or 877 748-2689 for those taxpayers in the 951 and 760 area codes. You may contact the Riverside Township Tax Collector for questions about. Effective March 22 2021 the Treasurer-Tax Collectors downtown Riverside office located on the 1st floor of the County Administrative Center will be open by appointment only.

The county offices of the Assessor Auditor-Controller and Treasurer-Tax Collector created a website to assist the public with general information concerning property taxes. OFFICE OF THE TREASURER-TAX COLLECTOR RIVERSIDE COUNTY CALIFORNIA. Welcome to the Riverside County Property Tax Portal.

The assessment appeals process is administered by the Clerk of the Board. The county most of the countys incorporated cities school districts and all other taxing agencies located in the county including special districts eg flood control districts sanitation districts. Additionally the City of Riverside has enacted the Real Property Transfer Tax Ordinance and charges an additional tax of 055 for each 50000 or fractional part thereof.

We STRONGLY encourage taxpayers to make their tax payments using either our online payment system make. Property Tax Portal Property Tax Payments - Search. Whether making your request by letter phone or in person you will need to provide the PIN number which you can find on a previous tax bill or the address or legal description of the property.

Riverside CA 92501 Telephone. Secured - The purpose of a Secured tax sale is to return tax defaulted property back to the tax roll collect unpaid taxes and convey title to the purchaserProperties become subject to the County Tax Collectors power to sell because of a default in the payment of property taxes for five or more years. The Riverside County Tax Collector is a state mandated function that is governed by the California Revenue Taxation Code Government Code and the Code of Civil Procedures.

Temecula Wine Country Tourism Marketing District Assessment. The Treasurer Tax Collector is committed to offering payment options to the public in the safest way possible. Searches and payment options are available for the following.

Short Term Vacation Rentals. 951 955-3802 Is there a centralized location to obtain property tax information. To visit this site click here.

Published Notice to Taxpayers. Property taxes are collected by the county although they are governed by California State LawThe Tax Collector of Riverside County collects taxes on behalf of the following entities. Property Taxes No Mortgage 385479800.

Property Taxes Mortgage 1331867200. The Tax Collector is responsible for the billing and collection of secured unsecured supplemental transient occupancy tax as well as various other special assessments. In order to be eligible for this exemption properties must be a primary residence.

The supplemental tax bill is sent directly to you by the Treasurer Tax Collector rather than to your mortgage company as may be the case with the regular property tax bill. Mobilehome Tax Clearance Certificates. To be eligible the property sold must be within the State of California and the property purchased must be within Riverside County.

Please be advised that if for any reason you are unable to make your tax payment in an automated fashion over the phone or. To file for an assessment appeal you must timely complete an Assessment Appeal Application form BOE-305-AHThe form may be obtained by contacting the Riverside County Clerk of the Board or by visiting their website. Riverside County Property Tax Collections Total Riverside County California.

Riverside County Assessor-County Clerk-Recorder Vision Statement To uphold and protect public trust through extraordinary public service careful stewardship of public funds transparency and accessibility employee empowerment innovation collaboration effectiveness and leadership in local government. Riverside Countys Homeowners Exemption reduces the taxable value of a qualifying home by 7000. It is our hope that this directory will assist in locating the site.

Tax Cycle Calendar and Important Dates to Remember. For further information or claim forms please contact the Office of the Assessor at 951 955-6200 or 1 800 746-1544 within the 951 and 760 area codes.

The Cook County Property Tax System Cook County Assessor S Office

Let S Not Isolate Ourselves Let S Connect Have You Tried A Video Chat Via Facebook Messenger Give Me A Video Chatting How To Memorize Things Have You Tried

Let S Not Isolate Ourselves Let S Connect Have You Tried A Video Chat Via Facebook Messenger Give Me A Video Chatting How To Memorize Things Have You Tried

Affidavit Of No Lien Form Template Download At Businessofficepro Templates Legal Forms Microsoft Word Templates

Affidavit Of No Lien Form Template Download At Businessofficepro Templates Legal Forms Microsoft Word Templates

Dean Hines Tax Attorney And Divorce Lawyer Now Offers Live Chat To Answer All Their Clients Questions Divorce Lawyers Tax Attorney Divorce Help

Dean Hines Tax Attorney And Divorce Lawyer Now Offers Live Chat To Answer All Their Clients Questions Divorce Lawyers Tax Attorney Divorce Help

Welcome To Montgomery County Ohio

Welcome To Montgomery County Ohio

Fhfa Extends Foreclosure Moratorium To End Of August Commercial Real Estate Tax Advisor Fannie Mae

Fhfa Extends Foreclosure Moratorium To End Of August Commercial Real Estate Tax Advisor Fannie Mae

Appealing Your Property Tax Assessment It Just Might Work Cfib

Appealing Your Property Tax Assessment It Just Might Work Cfib

Real Estate Investment Software Dealmachine For Real Estate Investing Real Estate Real Estate Investing Real Estate Postcards

Real Estate Investment Software Dealmachine For Real Estate Investing Real Estate Real Estate Investing Real Estate Postcards

Https Countytreasurer Org Linkclick Aspx Fileticket Ib1xaaysnei 3d Tabid 171 Portalid 0

Https Www Boe Ca Gov Proptaxes Pdf Lta14042 Pdf

Https Www Titleadvantage Com Mdocs Homeowners 20prop 20tax 20exemption 20all Pdf

What Is Bail Bond And How They Work Bail Work Infographic Bond

What Is Bail Bond And How They Work Bail Work Infographic Bond

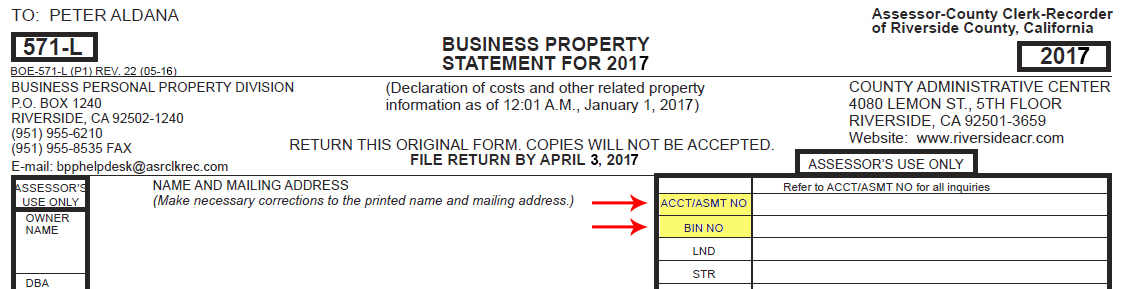

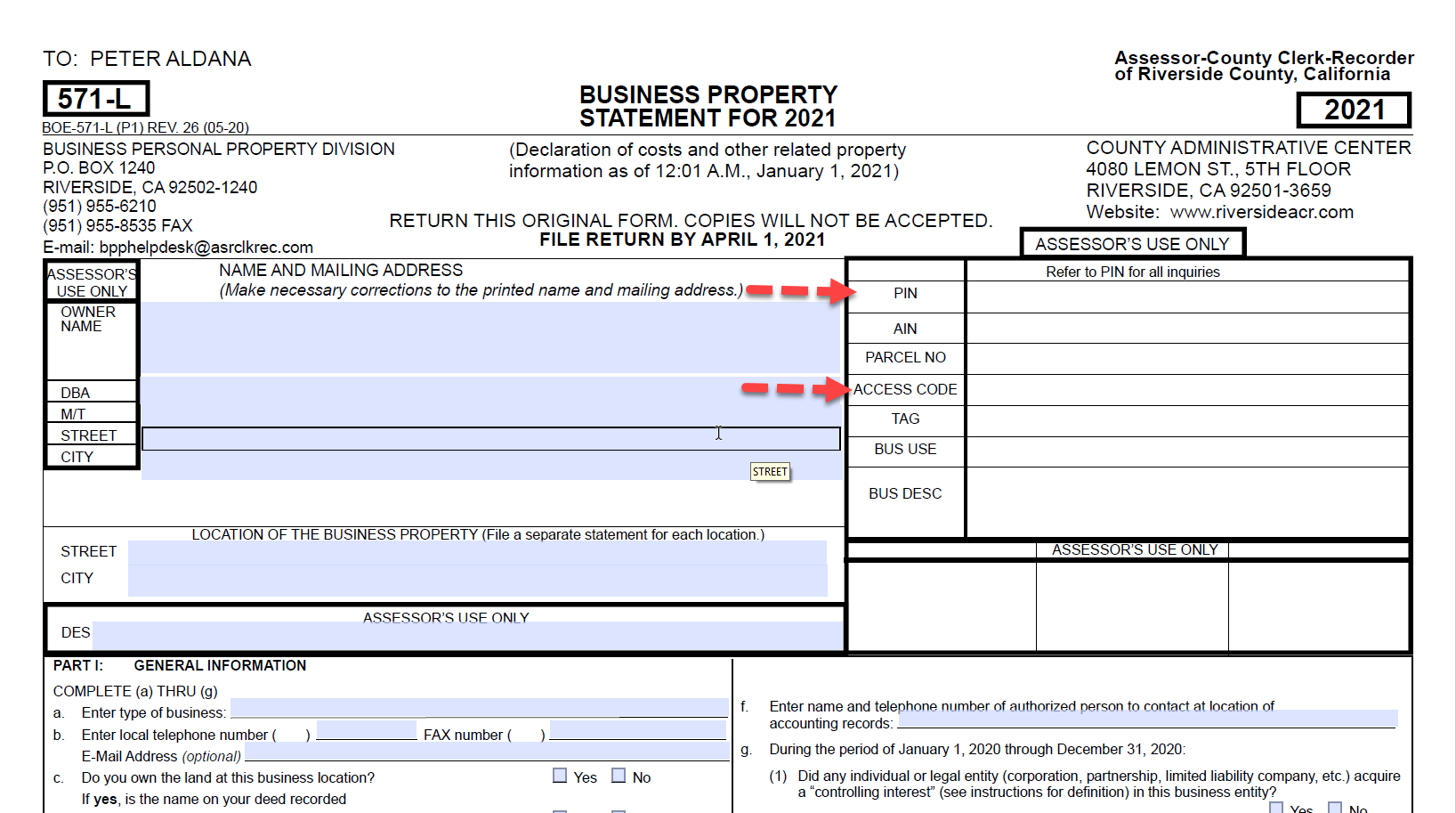

Riverside County Assessor County Clerk Recorder File Your Business Property Statement Online

Riverside County Assessor County Clerk Recorder File Your Business Property Statement Online

The Cook County Property Tax System Cook County Assessor S Office

How To Find The Best Cpa For Your Business Biggerpockets

How To Find The Best Cpa For Your Business Biggerpockets

Riverside County Assessor County Clerk Recorder Business Personal Property

Riverside County Assessor County Clerk Recorder Business Personal Property

Pin On Www Branchinvestigations Com

Pin On Www Branchinvestigations Com

Renting Vs Buying Being A Landlord Home Buying Real Estate Folder

Renting Vs Buying Being A Landlord Home Buying Real Estate Folder

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home