How To Calculate Property Tax Rate In Nj

While the exact property tax rate you will pay for your properties is set by the local tax assessor you can estimate your yearly property tax burden by choosing the state and county in which your property is located and entering the approximate. For example a millage rate of 10 means that for every 1000 of assessed value the property will be subject to 10 of property tax.

Property Tax Map Tax Foundation

Property Tax Map Tax Foundation

This converts to approximately 1 of the propertys assessed value.

How to calculate property tax rate in nj. The assessed value is determined by the Tax Assessor. 587 rows The General Tax Rate is used to calculate the tax assessed on a property. It is expressed as 1 per 100 of taxable assessed value.

This rate is used to compute the tax bill. Millage infers the amount of tax collected per thousand units of property worth. To arrive at the assessed value an.

This calculator can only provide you with a rough estimate of your tax liabilities based on the property taxes collected on similar homes in Bergen County. So if your home is worth 200000 and your property tax rate is. Tax Rate The tax rate is the tax levy divided by Ratables100 In other words.

Example General Tax Rate. The average effective property tax rate in New Jersey is 242 compared to the national average of 107. A towns general tax rate is calculated by dividing the total dollar amount it needs to raise to meet local budget expenses by the total assessed value of all its taxable property.

The General Tax Rate is a multiplier for use in determining the amount of tax levied upon each property. Property taxes are calculated based on the total assessed value of the property land value improvements value - exemptions divided by 100 and multiplied by the tax rate. New Jersey State Tax Quick Facts.

To determine your homes assessed value assessors multiple the actual value of your home by your local assessment percentage. Every locality uses a unique property tax assessment method. In our example since we owe a 1 property tax to the county 2 to the city and 3 to the school district we owe in total 1 2 3 6.

242 average effective rate. Tax Levy Ratables Tax Rate New Jersey practice is to calculate the rate per 100 of value. It is equal to.

The tax rate is set and certified by the Hudson County Board of Taxation. Last Updated on 1042019 Bergen County NJ Municipalities 2019 Property Tax Rate Allendale Borough 2297 Alpine Borough 0776 Bergenfield Borough 3238 Bogota Borough 3920 Carlstadt Borough 1922 Cliffside Park Borough 2438 Closter Borough 2226 Cresskill Borough 2399 Demarest Borough 2545 Dumont Borough 3594 East Rutherford Borough 1778. The calculator will then show you what the TAX ASSESSOR thinks your house is valued at in the Result of Assessment field below the Calculate button.

To figure out how property taxes are calculated on a home before you buy look up the most recent assessed value of the property most counties assess homes every other year and the current property tax ratethen do the math your assessed value x your property tax rate. The median property tax on a 48230000 house is 911547 in New Jersey. Property taxes are calculated by taking the mill rate and multiplying it by the assessed value of your property.

Find your residences assessed property value on the assessment notification mailed to you by your New Jersey certified local tax assessor. The median property tax on a 48230000 house is 506415 in the United States. Homeowners in New Jersey pay the highest property taxes of any state in the country.

The Garden State has a lot of things going for it but low taxes are not among its virtues. First fill in the value for your current NJ Real Estate Tax Assessment in the field below then select your County and City and press the Calculate button. PROPERTY TAX DUE DATES.

To estimate your real estate taxes you merely multiply your homes assessed value by the levy. Start by adding up the different tax rates to get one total property tax rate that youll need to pay. A home with a.

Your actual property tax burden will depend on the details and features of each individual property. The Property Tax Equation. How to Calculate Residential Property Tax Assessment in New Jersey.

An individuals property taxes are then calculated by multiplying that general tax rate by the assessed value of his particular property. Overview of New Jersey Taxes. Assessed Value 150000 x General Tax Rate.

The median property tax on a 48230000 house is 848848 in Bergen County. In fact rates in some areas are more than double the national average. 1050 cents per gallon of regular gasoline 1350 cents per gallon of diesel.

Bergen County Tax Rates For 2018 2019 Michael Shetler

Bergen County Tax Rates For 2018 2019 Michael Shetler

How To Appeal Property Taxes And Win Over The Appraiser We Did Nj Com

How To Appeal Property Taxes And Win Over The Appraiser We Did Nj Com

The Official Website Of The Borough Of Roselle Nj Tax Collector

The Official Website Of The Borough Of Roselle Nj Tax Collector

Do You Have To Pay A Vehicle Tax Here S Some Good News The Motley Fool

Do You Have To Pay A Vehicle Tax Here S Some Good News The Motley Fool

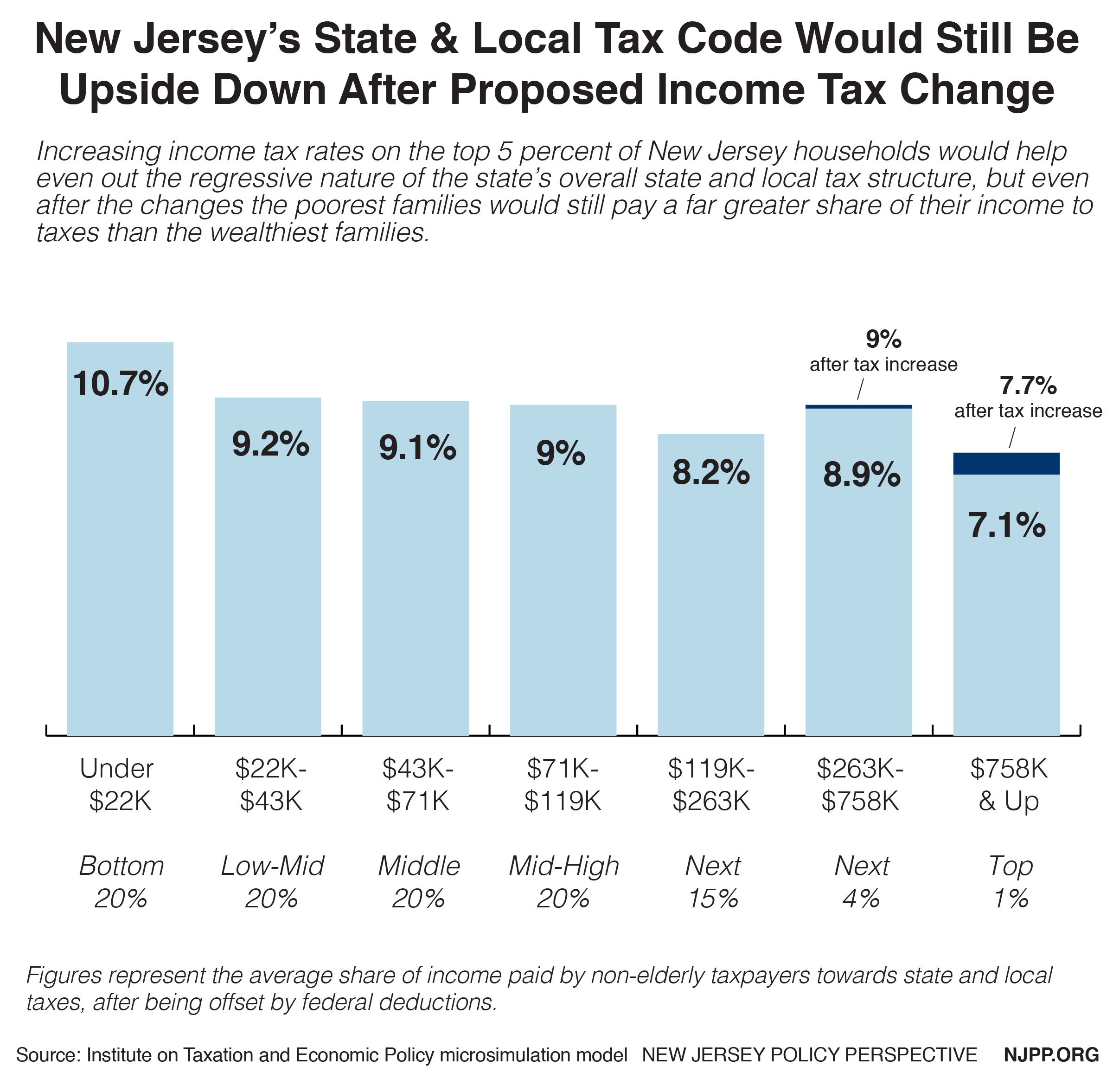

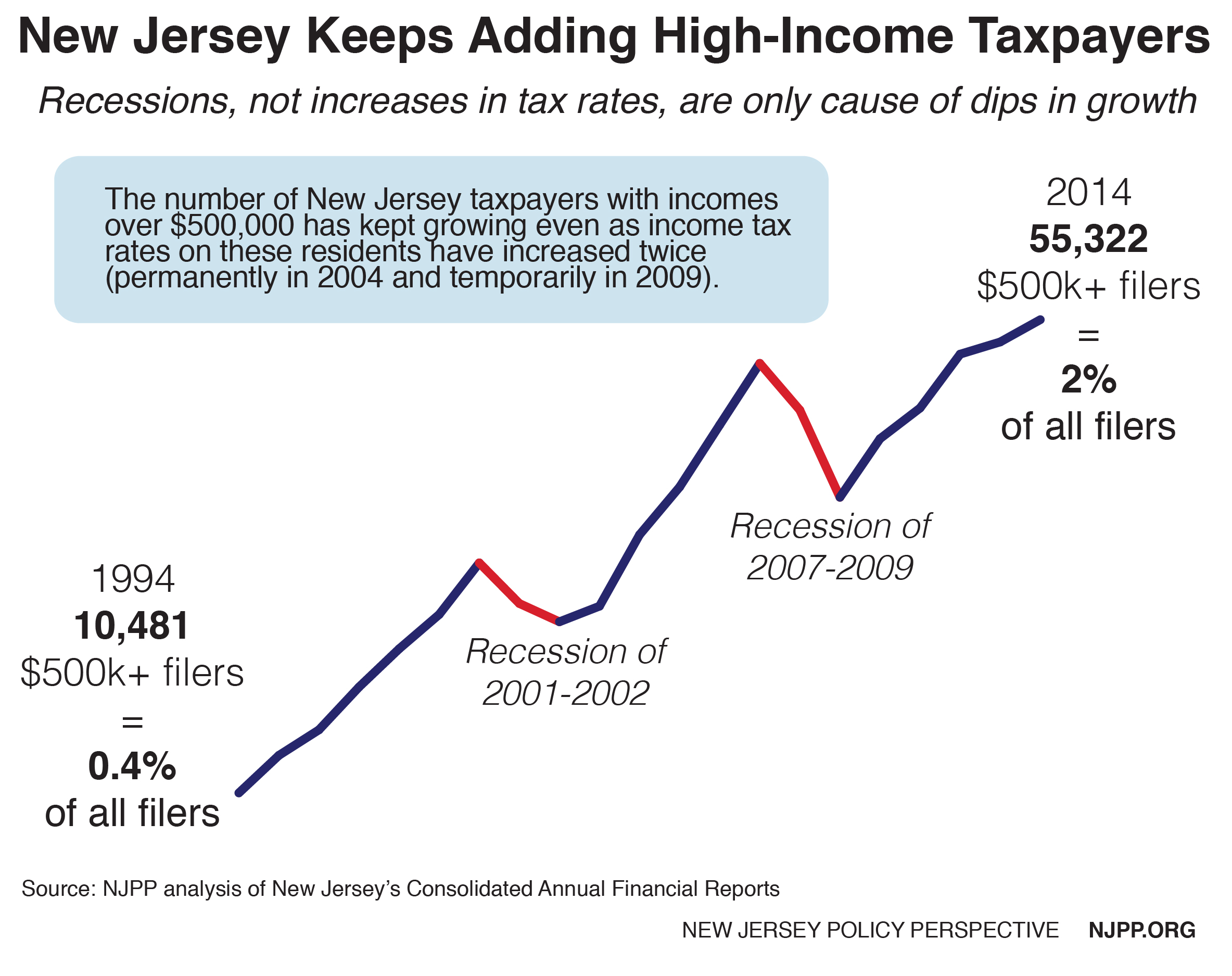

Reforming New Jersey S Income Tax Would Help Build Shared Prosperity New Jersey Policy Perspective

Reforming New Jersey S Income Tax Would Help Build Shared Prosperity New Jersey Policy Perspective

Reforming New Jersey S Income Tax Would Help Build Shared Prosperity New Jersey Policy Perspective

Reforming New Jersey S Income Tax Would Help Build Shared Prosperity New Jersey Policy Perspective

Understanding Your Property Tax Bill Department Of Taxes

Understanding Your Property Tax Bill Department Of Taxes

Reforming New Jersey S Income Tax Would Help Build Shared Prosperity New Jersey Policy Perspective

Reforming New Jersey S Income Tax Would Help Build Shared Prosperity New Jersey Policy Perspective

Reforming New Jersey S Income Tax Would Help Build Shared Prosperity New Jersey Policy Perspective

Reforming New Jersey S Income Tax Would Help Build Shared Prosperity New Jersey Policy Perspective

Bergen County Tax Rates For 2018 2019 Michael Shetler

Bergen County Tax Rates For 2018 2019 Michael Shetler

Nutley New Jersey Property Tax Calculator

Nutley New Jersey Property Tax Calculator

Nutley New Jersey Property Tax Calculator

Nutley New Jersey Property Tax Calculator

Best Cheap Car Insurance In New Jersey 2021 Forbes Advisor

Best Cheap Car Insurance In New Jersey 2021 Forbes Advisor

Historical New Jersey Tax Policy Information Ballotpedia

Historical New Jersey Tax Policy Information Ballotpedia

Bergen County Nj Property Tax Rates 2019 To 2020 201 455 Sell

Bergen County Nj Property Tax Rates 2019 To 2020 201 455 Sell

The Cost Of Living In New Jersey Smartasset

The Cost Of Living In New Jersey Smartasset

How Can You Lower Your Property Taxes In Nj Askin Hooker Llc

How Can You Lower Your Property Taxes In Nj Askin Hooker Llc

Reforming New Jersey S Income Tax Would Help Build Shared Prosperity New Jersey Policy Perspective

Reforming New Jersey S Income Tax Would Help Build Shared Prosperity New Jersey Policy Perspective

Tax Collector Manalapan Township

Labels: property

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home