What Is Property Tax In Kerala

Each land is allotted one survey number the tax should pay against that. 4000 is levied on buildings which are constructed on or after 141997 having a plinth area of 2787 sqm or more in addition to the one-time tax.

Types Of Property Investments In Kerala Transform Property Consulting Investment Property Property Investing

Types Of Property Investments In Kerala Transform Property Consulting Investment Property Property Investing

Are there rebates on property taxes.

What is property tax in kerala. Kerala just like all the states imposes road taxes as per the Kerala Motor Vehicles Taxation Act 1976. One time building tax is applicable for all buildings constructed on or after April 1 1973 as per the Kerala Building Tax Act 1975. As per the act no Vahan tax will be levied on the vehicle which is kept by a dealer or a manufacturer for trade.

Know your Property Tax. Content owned by Department of Revenue Kerala and Project implemented by State ITCell Revenue Department with IT support from NIC kerala Policies.

The Department of Commercial Taxes is the major source of revenue of the Government of Kerala accounting for 34th of its revenue. 9 rows In kerala different kinds of taxes are there. Property tax in Kerala needs to be paid only from April 1 2016.

Annual property tax Plinth area x Monthly rental value per sq ft x 12 x 017 030 depending on MRV and based on slab rate of taxation 10 per cent depreciation 8 per cent library cess Property tax in Kolkata. It depends on the area and type also for farm land tax is there and extra tax was there to give pension to Agriculture labours. The land taxes are paid to village offices of their area.

Number one free listing Kerala real estate web portal for buying and selling house plotsestates resorts commercial building lands flats low cost properties immediate. Kerala is no doubt one of the most beautiful states of India with a scenic view of the coast. In this article lets appear at how to pay online property tax in Kerala the use of Sanchaya platform.

Official Web Portal of Kerala Local Government Government of Kerala Owned by Local Self Government Department Developed by Information Kerala Mission Powered by Samveditha Ver 30. Thus a lot of factors need to be taken into account before one can determine the final value. Property tax is Land tax karam any one have land in Kerala should pay this tax to village office.

The land taxes are paid on the basis of area oneoccupies. Sanchaya a Online Property Tax Sanchaya is an e-governance platform used to alter income and license gadget in Kerala taxes. The municipal uses the funds collected as Property Tax to provide critical civic facilities and services.

22 hours agoCochin Corporation Property Tax Payment Guide Owners of residential properties in Kochi are liable to pay House Tax to the Kochi Municipal Corporation Cochin Corporation every year. A yearly luxury tax of Rs. The Kerala Motor Vehicles Taxation Act 1976 incorporates the laws relatable to the levy of road tax on motor vehicles passenger vehicles and goods carriage vehicles.

This period has now been revised as 1-4-2016. This tax is paid in the village office in the nam. The state government has revised the period from which property tax can be collected under the new tax regime.

Sanchaya an egovernance application software suite for Revenue and Licence System in local governments of Kerala. The tax imposed is based on the type of vehicle that you have. Designed and Developed by CMC Limited A TATA Enterprise Site best viewed in Microsoft Internet Explorer 60 in 1024x768 resolution.

At present tax based on plinth area is being collected from 1-4-2013. Yes depending on the type of property and its usage rebates can be applied for. For example if it is a place solely dedicated to.

Building owners can get their online Ownership Certificate from the Local Governments having e-payment facility. Property Tax Sanchaya. In that case the charges for the property tax Kerala value will vary.

Land Tax Plantation Tax Building Tax Luxury. Sanchaya online offerings are also used to gather property tax and constructing taxes online in Kerala taxes. The Department caters to 183000 traders through 431 offices including Check Posts across the State.

A Guide On Property Tax Property Tax Tax Refund Tax Consulting

A Guide On Property Tax Property Tax Tax Refund Tax Consulting

Icici Bank Limited India S Largest Private Sector Bank By Consolidated Assets In Association With Municipal Cor Property Tax Municipal Corporation Icici Bank

Icici Bank Limited India S Largest Private Sector Bank By Consolidated Assets In Association With Municipal Cor Property Tax Municipal Corporation Icici Bank

A Guide For Calculating And Paying Property Tax Online Income Tax Mortgage Payoff Accounting Services

A Guide For Calculating And Paying Property Tax Online Income Tax Mortgage Payoff Accounting Services

Property Tax In Delhi Circle Rate In Delhi Property In Delhi Property Advisor Property Agent Independent House Small House Front Design Kerala House Design

Property Tax In Delhi Circle Rate In Delhi Property In Delhi Property Advisor Property Agent Independent House Small House Front Design Kerala House Design

Kerala Property Registration Propertyregistration Legal Services Financial Decisions Limited Liability Partnership

Kerala Property Registration Propertyregistration Legal Services Financial Decisions Limited Liability Partnership

Here Arethe List List Of Documents Required For Home Loan In India Home Loans Loan Home

Here Arethe List List Of Documents Required For Home Loan In India Home Loans Loan Home

How To Apply For Marriageregistration In Kerala Marriage Registration Marriage Hindu Marriage Act

How To Apply For Marriageregistration In Kerala Marriage Registration Marriage Hindu Marriage Act

The Bahamas Government S Department Of Inland Revenue Is Embarking On Operation Enhancement Measures Designed To Facilitate A Mo Innovation Enhancement Awards

The Bahamas Government S Department Of Inland Revenue Is Embarking On Operation Enhancement Measures Designed To Facilitate A Mo Innovation Enhancement Awards

Property Tax In Delhi Circle Rate In Delhi Property In Delhi Property Advisor Property Agent Property Buye Real Estate Property Buyers Kerala House Design

Property Tax In Delhi Circle Rate In Delhi Property In Delhi Property Advisor Property Agent Property Buye Real Estate Property Buyers Kerala House Design

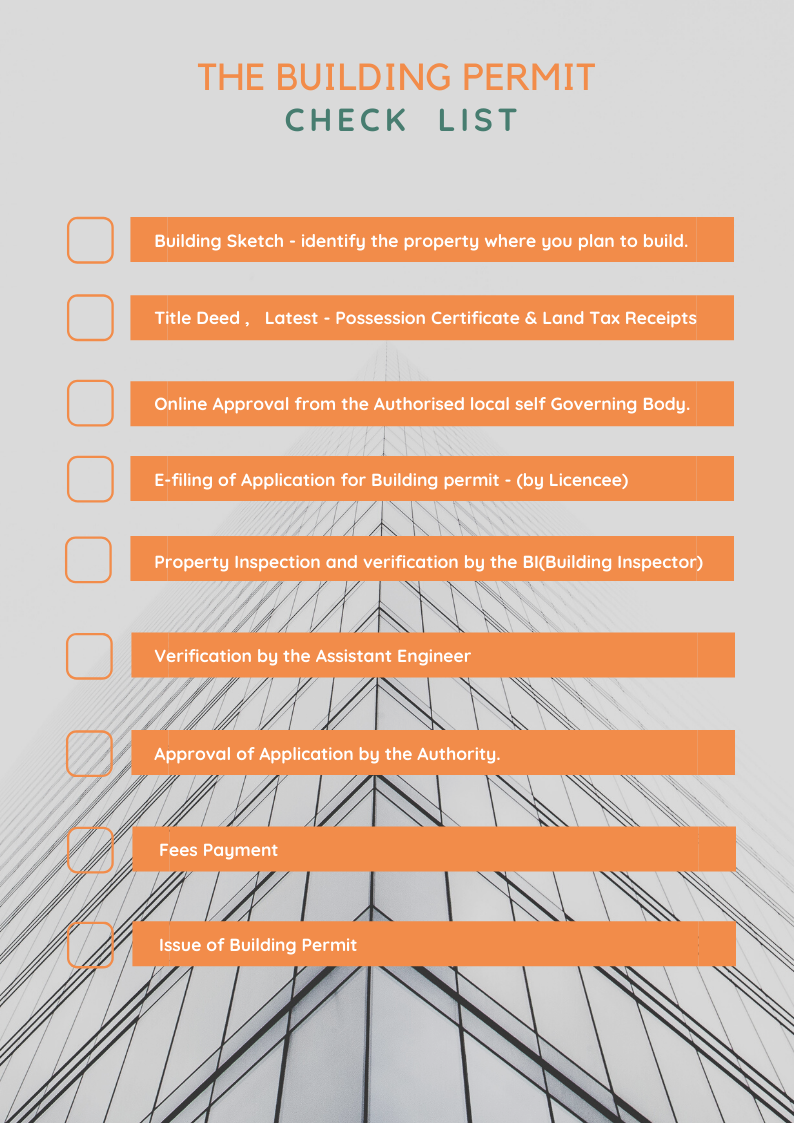

Kerala Building Permit Check List Check List For Print Out Building Renovation Constructio Building Permits Civil Engineering Companies Building Sketch

Kerala Building Permit Check List Check List For Print Out Building Renovation Constructio Building Permits Civil Engineering Companies Building Sketch

Videos Addressing Good Public Financial Management Pfmconnect Blog Financial Management Financial Public

Videos Addressing Good Public Financial Management Pfmconnect Blog Financial Management Financial Public

The Kerala Panchayat Raj Profession Tax Rules 1996 Professional Tax Registration Tax Rules Filing Taxes Tax

The Kerala Panchayat Raj Profession Tax Rules 1996 Professional Tax Registration Tax Rules Filing Taxes Tax

Real Estate Is A Great Investment It Provides Multiple Streams Of Income Read This Article To Find Out How How To Get Rich Real Estate Real Estate Investing

Real Estate Is A Great Investment It Provides Multiple Streams Of Income Read This Article To Find Out How How To Get Rich Real Estate Real Estate Investing

Did You Know In 2021 Real Estate Terms Did You Know Kerala

Did You Know In 2021 Real Estate Terms Did You Know Kerala

4 Tips For Choosing The Right Property For Investment Luxury Flats In Calicut Luxury Flats Property Choose The Right

4 Tips For Choosing The Right Property For Investment Luxury Flats In Calicut Luxury Flats Property Choose The Right

Income From House Property Ay 2018 19 Annual Value Of Let Out Property House Property Income Tax Refund

Income From House Property Ay 2018 19 Annual Value Of Let Out Property House Property Income Tax Refund

Kochi S Status As The Commercial Capital Of India S Kerala State Is Not Yet Reflected In The City Corporation S Revenue Mob Times Of India Revenue Property Tax

Kochi S Status As The Commercial Capital Of India S Kerala State Is Not Yet Reflected In The City Corporation S Revenue Mob Times Of India Revenue Property Tax

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home