Property Tax Rate Map Pennsylvania

In order to determine the tax bill your local tax assessors office takes into account the propertys assessed value the current assessment rate as well as any tax exemptions or abatements for that property. Use the interactive map to find.

Middle East Population 2018 Forced Labor Fertility Rate Middle East

Middle East Population 2018 Forced Labor Fertility Rate Middle East

You can compare the results using both of these methods with the property tax map.

Property tax rate map pennsylvania. Chester County collects the highest property tax in Pennsylvania levying an average of 419200 125 of median home value yearly in property taxes while Forest County has the lowest property tax in the state collecting an average tax of 86000 108 of median home value per year. Although there is a considerable amount of variance from county to county and school district to school district the median property tax paid in PA is 2223 on a home valued at 164700 the median home value statewide. In fiscal year 2016 property taxes comprised 315 percent of total state and local tax collections in the United States more than any other source of tax revenue.

Taxes as percentage of home value can be a more useful comparison of the true property tax burden in an area as any ranking using actual dollar amounts will be biased toward areas with high property values. The Office of Property Assessment of the City of Philadelphia OPA makes every effort to produce and publish on this site the most accurate and current information available to it. The owner of a 150000 home could pay anywhere from 1185 to 5445 in Pennsylvania school property taxes dependent upon which district the property is located.

Real estate property viewer for Cumberland County PA. Economic Development Planning 124 West Diamond Street PO Box 1208 Butler PA 16003-1208 Phone. The rates are expressed as millages ie the actual rates.

Fifth Floor Harrisburg PA 17108-1295. In that same year property taxes accounted for 46 percent of localities revenue from their own sources and 27 percent of overall local. Includes assessement information for each property.

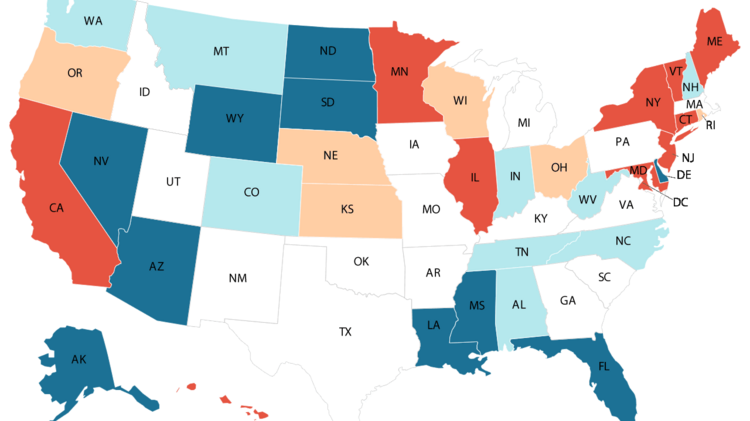

Todays map shows states rankings on the property tax component of the 2019 State Business Tax Climate IndexThe Indexs property tax component evaluates state and local taxes on real and personal property net worth and asset transfersThe property tax component accounts for 154 percent of each states overall Index score. Look Up Your Propertys Tax Assessment. In-depth Lackawanna County PA Property Tax Information.

This data is based on a 5-year study of median property tax rates on owner-occupied homes in Pennsylvania conducted from 2006 through 2010. Texas has 254 counties with median property taxes ranging from a high of 506600 in King County to a low of 28500 in Terrell CountyFor more details about the property tax rates in any of Texas counties choose the county from the interactive map or the list below. In order to determine the tax bill your local tax assessors office takes into account the propertys assessed value the current assessment rate as well as any tax exemptions or abatements for that property.

The county tax millage set by Perry County Council is currently 45625School tax millages are set by local school boards and municipal tax millages are set by individual municipalities. Jefferson County collects relatively high property taxes and is ranked in the top half of all counties in the United States by property tax collections. Property taxes matter to businesses for several reasons.

That works out to a median property tax rate of 135 percent. You are trying to view an interactive map of real estate properties in Cumberland County Pennsylvania. For more details about the property tax rates in any of Pennsylvanias counties choose the county from the interactive map or the list below.

68 rows To find detailed property tax statistics for any county in Pennsylvania click the countys name in the data table above. Dauphin County GIS Interactive Maps. What would you like to do.

Property taxes are an important tool to help finance state and local governments. Search for a specific property by parcel number PIN Search for one or more properties by name address and other criteria - -. Are Property Taxes and School Taxes the Same.

In-depth Chester County PA Property Tax Information. The exact property tax levied depends on the county in Pennsylvania the property is located in. The amount of property tax paid to each taxing body is calculated by multiplying the assessed value by the millage rate set by the taxing body.

The median property tax also known as real estate tax in Jefferson County is 111500 per year based on a median home value of 8010000 and a median effective property tax rate of 139 of property value. State Summary Tax Assessors Pennsylvania has 67 counties with median property taxes ranging from a high of 419200 in Chester County to a low of 86000 in Forest County. Use our free Pennsylvania property records tool to look up basic data about any property and calculate the approximate property tax due for that property based on the most recent assessment and local property tax statistics.

Our ownership records are based on deeds as recorded with the City of Philadelphia Department of Records DOR and we revise these records for currency as often as.

Maryland Named No 2 Least Tax Friendly State By Kiplinger Baltimore Business Journal

Maryland Named No 2 Least Tax Friendly State By Kiplinger Baltimore Business Journal

This Map Makes It Easy To Compare Your Property Tax Change To Your Neighbors On Top Of Philly News

This Map Makes It Easy To Compare Your Property Tax Change To Your Neighbors On Top Of Philly News

Property Tax Assessment See If You Re Paying Too Much

Property Tax Assessment See If You Re Paying Too Much

This Map Makes It Easy To Compare Your Property Tax Change To Your Neighbors On Top Of Philly News

This Map Makes It Easy To Compare Your Property Tax Change To Your Neighbors On Top Of Philly News

How School Funding S Reliance On Property Taxes Fails Children Npr

Delaware Pennsylvania Pennsylvania Map Delaware

Delaware Pennsylvania Pennsylvania Map Delaware

These Are The Most Affordable States In America States In America Map Best Places To Retire

These Are The Most Affordable States In America States In America Map Best Places To Retire

Learn About The Pennsylvania Dot S Car Registration Steps Forms And Fees Apply For A New Pa Vehicle Registration Renew Your E Registration How To Apply Car

Learn About The Pennsylvania Dot S Car Registration Steps Forms And Fees Apply For A New Pa Vehicle Registration Renew Your E Registration How To Apply Car

Preussen Die Vier Grosseltern Meiner Mutter Sind Alle Im Neunzehnten Jahrhundert Aus Diesem Gebiet Preussens Das Heute I Map European History Vintage World Maps

Preussen Die Vier Grosseltern Meiner Mutter Sind Alle Im Neunzehnten Jahrhundert Aus Diesem Gebiet Preussens Das Heute I Map European History Vintage World Maps

States With Highest And Lowest Sales Tax Rates

States With Highest And Lowest Sales Tax Rates

1000 Maps Infographics Posts Social Security Benefits Social Security State Tax

1000 Maps Infographics Posts Social Security Benefits Social Security State Tax

Image Result For U S National Map Of Mosquito Population Map Mosquito Magnet Mosquito

Image Result For U S National Map Of Mosquito Population Map Mosquito Magnet Mosquito

Pennsylvania Is One Of The Top Ten Tax Friendly States To Retirees Retirement Advice Retirement Retirement Planning

Pennsylvania Is One Of The Top Ten Tax Friendly States To Retirees Retirement Advice Retirement Retirement Planning

Rentometer Average Rent Near 2706 Snowbird Terrace Silver Spring Maryland 20906 3 Bedroom Rent Finding Apartments Rental

Rentometer Average Rent Near 2706 Snowbird Terrace Silver Spring Maryland 20906 3 Bedroom Rent Finding Apartments Rental

Coronavirus Map Which States Are Seeing The Most Job Losses Due To The Pandemic

Coronavirus Map Which States Are Seeing The Most Job Losses Due To The Pandemic

Labels: pennsylvania, property, rate

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home