Property Tax Sale Columbia Sc

Citizens can look up properties and receive tax estimates by accessing the Property Value and Tax Estimate Inquiry page. No tax payments will be taken in the Delinquent Tax Office on the day of the sale.

Richland County South Carolina.

Property tax sale columbia sc. This is a tax lien listing. It is not a property for sale. Online Property Value and Tax Estimate.

Lexington County makes no warranty representation or guaranty as to the content sequence accuracy timeliness or completeness of any of the database information provided herein. The South Carolina capital gains rate is 7 of the gain on the money collected at closing. 312 Tendrill Ct Columbia SC 29210.

Single Family Home Tax Lien. Delinquent Tax Sale begins at 1000 am. The defaulting taxpayer any grantee from the owner or any mortgage or judgment creditor may within twelve months from the date of the delinquent tax sale redeem each item of real estate by paying the delinquent taxes assessments penalties and cost together with interest as provided in Section 12-51-90 B of the Code of Laws of South Carolina as amended and required defaulting taxpayers to pay three 3 percents of the whole amount of the delinquent tax sale.

Property Tax - Data Search This website is a public resource of general information. These buyers bid for an interest rate on the taxes owed and the right to collect back that money plus an interest payment from the property owner. The delinquent tax sale is an open auction held on the first Monday in October and is the forced collection of real property taxes in accordance with South Carolina State Statute 12-51-50.

Approximately two-thirds of county-levied property taxes are used to support public education. All real or personal property owned by anyone listed on the SCDORs State Tax Lien Registry is subject to the lien. Learn to buy tax liens in Columbia SC.

2020 Hampton Street POBox 192 Columbia SC 29201. State tax liens are now issued and satisfied with the SCDOR not county offices. Here the user will find real property values property descriptions links to maps and the ability to receive tax estimates.

The current lien balance on the State Tax Lien Registry includes payments made toward the debt and additional penalty and interest accrued. 3 bed 15 bath 1290 sqft. In fact the rate of return on property tax liens investments in Columbia SC can be anywhere between 15 and 25 interest.

Real and personal property are subject to the tax. The county has the authority to cancel the tax sale any time before the tax deed on real estate or bill of sale on a mobile home is issued. At a location to be determined.

The purchaser of property at a tax sale acquires the title without warranty and buys at his own risk. The property owner must complete all items on the Application property identification number and legal description of property as it appears on the Current Tax Notice. However South Carolina also has a 44 exclusion from the capital gains flowing from the 1040 federal return effectively reducing the state tax to 392.

The officer charged with the duty to sell real property and mobile or manufactured housing for nonpayment of ad valorem property taxes shall submit a bid on behalf of the forfeited land commission equal to the amount of all unpaid property taxes penalties assessments including but not limited to assessments owed to a special taxing district established pursuant to Section 4-9-30 Chapter 19. Investing in tax liens in Columbia SC is one of the least publicized but safest ways to make money in real estate. Search 1000s of Homes for Sale in Columbia SC Downtown Columbia SC Real Estate Lake Murray Real Estate and Lexington SC Real Estate.

There are currently 56 tax lien-related investment opportunities in Columbia SC including tax lien foreclosure properties that are either available for sale or worth pursuing. A lien was recorded on this property by the creditor on 2020-06-23 for unpaid CountyCity delinquent taxes. The property owner must sign and date application and return in person or via mail to the Columbia County Tax Collectors Office or fill it out online here.

Extra copies of the Lexington Chronicle will be sent out to Chapin Cayce Gaston Irmo Pelion Swansea and West Columbia to allow greater coverage throughout Lexington County. The 2020 delinquent tax sale will be held on October 5 2020 at the Buckwalter Recreation Center. Property tax is administered and collected by local governments with assistance from the SCDOR.

Free Pictures Maps Video and Information. In South Carolina you get twelve months after the sale date to redeem. The relatively high interest rate makes tax.

See All 1 See Map. Multiple Lot Discount - May 1 2020 or 60 Days After. The county is not liable for the quality or quantity of the property sold.

Home buyers and Investors buy the liens in Columbia SC at a tax lien auction or online auction. South Carolina has a capital gains tax on profits from real estate sales. Under South Carolina law you get a specific amount of time called a redemption period to pay off the tax debt called redeeming the property after the sale before the winning bidder from the auction gets title to your home.

808 Sims Ave Columbia Sc 29205 Realtor Com

808 Sims Ave Columbia Sc 29205 Realtor Com

407 Lydgate Dr Columbia Sc 29210 Realtor Com

407 Lydgate Dr Columbia Sc 29210 Realtor Com

Columbia Sc Foreclosures Foreclosed Homes For Sale 182 Homes Zillow

Columbia Sc Foreclosures Foreclosed Homes For Sale 182 Homes Zillow

325 Pine Ridge Dr West Columbia Sc 29172 Realtor Com

325 Pine Ridge Dr West Columbia Sc 29172 Realtor Com

Columbia Sc Mobile Manufactured Homes For Sale Realtor Com

Columbia Sc Mobile Manufactured Homes For Sale Realtor Com

1562 Sq Ft For Sale In West Columbia Sc Land Century Cheap Houses For Sale Cheap Houses Old Houses For Sale

1562 Sq Ft For Sale In West Columbia Sc Land Century Cheap Houses For Sale Cheap Houses Old Houses For Sale

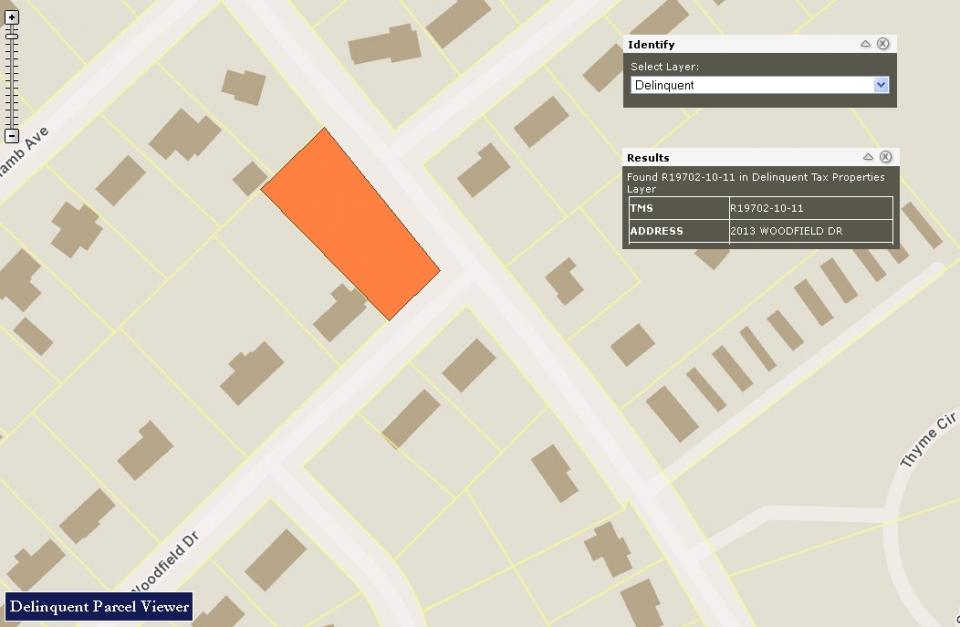

Delinquent Properties Richland County Gis

Delinquent Properties Richland County Gis

521 Congaree Ave Columbia Sc 29205 Realtor Com

521 Congaree Ave Columbia Sc 29205 Realtor Com

Investment Property Columbia Real Estate 43 Homes For Sale Zillow

Investment Property Columbia Real Estate 43 Homes For Sale Zillow

6465 Bridgewood Rd Columbia Sc 29206 Realtor Com

6465 Bridgewood Rd Columbia Sc 29206 Realtor Com

6457 Goldbranch Rd Columbia Sc 29206 Realtor Com

6457 Goldbranch Rd Columbia Sc 29206 Realtor Com

230 Spring Valley Rd Columbia Sc 29223 Realtor Com

230 Spring Valley Rd Columbia Sc 29223 Realtor Com

Sc Real Estate South Carolina Homes For Sale Zillow

Sc Real Estate South Carolina Homes For Sale Zillow

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home