Property Tax Rates In North Carolina By County

The next revaluation cycle was in 2015. Property Tax is only imposed by County and local governments.

Easyknock South Carolina Property Tax Rate A Complete Guide

Easyknock South Carolina Property Tax Rate A Complete Guide

Overview of Wake County NC Taxes.

Property tax rates in north carolina by county. ELDERLY AND PERMANENTLY DISABLED EXCLUSION DISABLED VETERANS EXCLUSION CIRCUIT BREAKER DEFERMENT PROGRAM AND BUILDERS. Statistical Abstract 2004 - Part II. The countys average effective property tax rate is 118 which comes in as the fourth-highest rate of any North Carolina county.

If you own a home in Wake County North Carolina paying property taxes isnt something you can avoid. 101 rows To find detailed property tax statistics for any county in North Carolina click the countys name in the data table above. This rate includes any state county city and local sales taxes.

Registered motor vehicle taxes are due at the time of vehicle registration renewal and are paid to the North Carolina DMV. In Beaufort County the rates are as follows. Nash County Tax Administrator.

New Hanover County collects relatively high property taxes and is ranked in the top half of all counties in the United States by property tax collections. Box 788 Statesville NC 28687 Phone. This is an easy to read property tax chart for Wake County Durham County Orange County Raleigh Cary Morrisville Apex Holly Springs Fuquay Varina Wake Forest Garner Clayton Angier Rolesville and Zebulon North Carolina.

2019 Property Tax Rates Per 100 of Assessed Value. City of King Vehicle Fee 1000 City of Winston-Salem Vehicle Fee. 2020 rates included for use while preparing your income tax deduction.

The following property tax rates for are for 2010 and 2011 fiscal years. Welcome to the North Carolina Triangle and Capital home of Freedom Realty Firm. Union County Board of Commissioners used a four year revaluation cycle in 2004 and in 2008.

The exact property tax levied depends on the county in North Carolina the property is located in. Nashville North Carolina 27856. North Carolina property tax rates range from a low of 042 percent in Watauga County to a high of 122 percent in Durham County.

Summary Of State General Fund Revenue. Orange County collects the highest property tax in North Carolina levying an average of 282900 109 of median home value yearly in property taxes while Montgomery County has the lowest property tax in the state collecting an average tax of 49400 059 of median home value per year. Homeowners in Durham County pay some of the highest property taxes in the state.

Real and personal property tax payments are due September 1st and payable on or before January 5th of the following year without interest. This western North Carolina County has property tax rates well below the state average. The North Carolina General Statutes mandate that all real property land and buildings must be reappraised at least once every eight years.

Total General State Local and Transit Rates Tax Rates Effective 1012020 By 5-Digit Zip By Alphabetical City Historical Total General State Local and Transit Rate Tax Rates Tax Charts County Rates. 23 rows Iredell County Government Center PO. 6 Things Every Homeowner Should Know About Property Taxes North Carolina Estate and Inheritance Taxes North Carolina doesnt charge an estate tax or an inheritance tax at the state level.

The latest sales tax rate for Hendersonville NC. The median property tax also known as real estate tax in New Hanover County is 139400 per year based on a median home value of 22780000 and a median effective property tax rate of 061 of property value. Orange County collects the highest property tax in North Carolina levying an average of 282900 109 of median home value yearly in property taxes while Montgomery County has the lowest property tax in the state collecting an average tax of 49400 059 of median home value per year.

Taxes And North Carolina Gross State Product. Fortunately North Carolinas property taxes are generally fairly low. LATE LISTING PENALTIES WILL BE IMPOSED AS REQUIRED BY LAW.

Residents of Wake County have an average effective property tax rate of 088 and the median annual property tax payment is 2327. This data is based on a 5-year study of median property tax rates on owner-occupied homes in North Carolina conducted from 2006 through 2010. County Property Tax Rates and Reappraisal Schedules County Property Tax Rates for the Last Five Years County and Municipal Property Tax Rates and Year of Most Recent Reappraisal County and Municipal Effective.

The Cost Of Living In North Carolina Smartasset Living In North Carolina Cost Of Living North Carolina

The Cost Of Living In North Carolina Smartasset Living In North Carolina Cost Of Living North Carolina

Hill S Gastonia Gaston County N C City Directory 1934 Gaston County Gastonia North Carolina History

Hill S Gastonia Gaston County N C City Directory 1934 Gaston County Gastonia North Carolina History

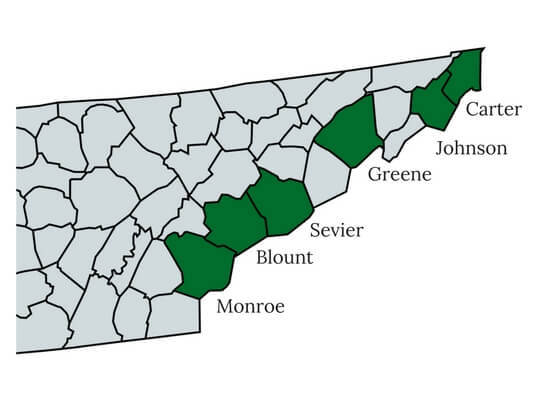

The Tennessee Counties With The Lowest Property Tax Rates

The Tennessee Counties With The Lowest Property Tax Rates

Pin On Personal Injury Lawyer Attorney

Pin On Personal Injury Lawyer Attorney

County Budget And Tax Survey North Carolina Association Of County Commissioners North Carolina Association Of County Commissioners

County Budget And Tax Survey North Carolina Association Of County Commissioners North Carolina Association Of County Commissioners

Are There Any States With No Property Tax In 2020 Free Investor Guide Property Tax States Small Towns Usa

Are There Any States With No Property Tax In 2020 Free Investor Guide Property Tax States Small Towns Usa

Carteret County Adopts Fy2020 21 Budget With 2 Cent Tax Increase News Carolinacoastonline Com

Carteret County Adopts Fy2020 21 Budget With 2 Cent Tax Increase News Carolinacoastonline Com

States With The Highest And Lowest Property Taxes Property Tax Tax States

States With The Highest And Lowest Property Taxes Property Tax Tax States

Oakland County Bonus Tax Breaks When Selling Your Home Http Homes2moveyou Com Oakland County Bonus Tax Breaks Selli Homeowner Taxes Property Tax Estate Tax

Oakland County Bonus Tax Breaks When Selling Your Home Http Homes2moveyou Com Oakland County Bonus Tax Breaks Selli Homeowner Taxes Property Tax Estate Tax

New Hampshire Property Tax Calculator Smartasset

New Hampshire Property Tax Calculator Smartasset

Wake County Nc Property Tax Calculator Smartasset

Wake County Nc Property Tax Calculator Smartasset

The Tennessee Counties With The Lowest Property Tax Rates

The Tennessee Counties With The Lowest Property Tax Rates

Pin On Facepost Posts You Are Linked To Resources

Pin On Facepost Posts You Are Linked To Resources

2018 Property Tax Rates Mecklenburg Union Counties Property Tax Union County Mecklenburg County

2018 Property Tax Rates Mecklenburg Union Counties Property Tax Union County Mecklenburg County

North Carolina Income Tax Calculator Smartasset

North Carolina Income Tax Calculator Smartasset

Are There Any States With No Property Tax In 2020 Free Investor Guide Property Tax States Small Towns Usa

Are There Any States With No Property Tax In 2020 Free Investor Guide Property Tax States Small Towns Usa

Labels: carolina

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home