Property Tax Rate Olmsted Falls Ohio

Property Tax Estimator Use this tool to estimate the current level of full year property taxes based on your opinion 2020 value associated with your property. To Property records Search.

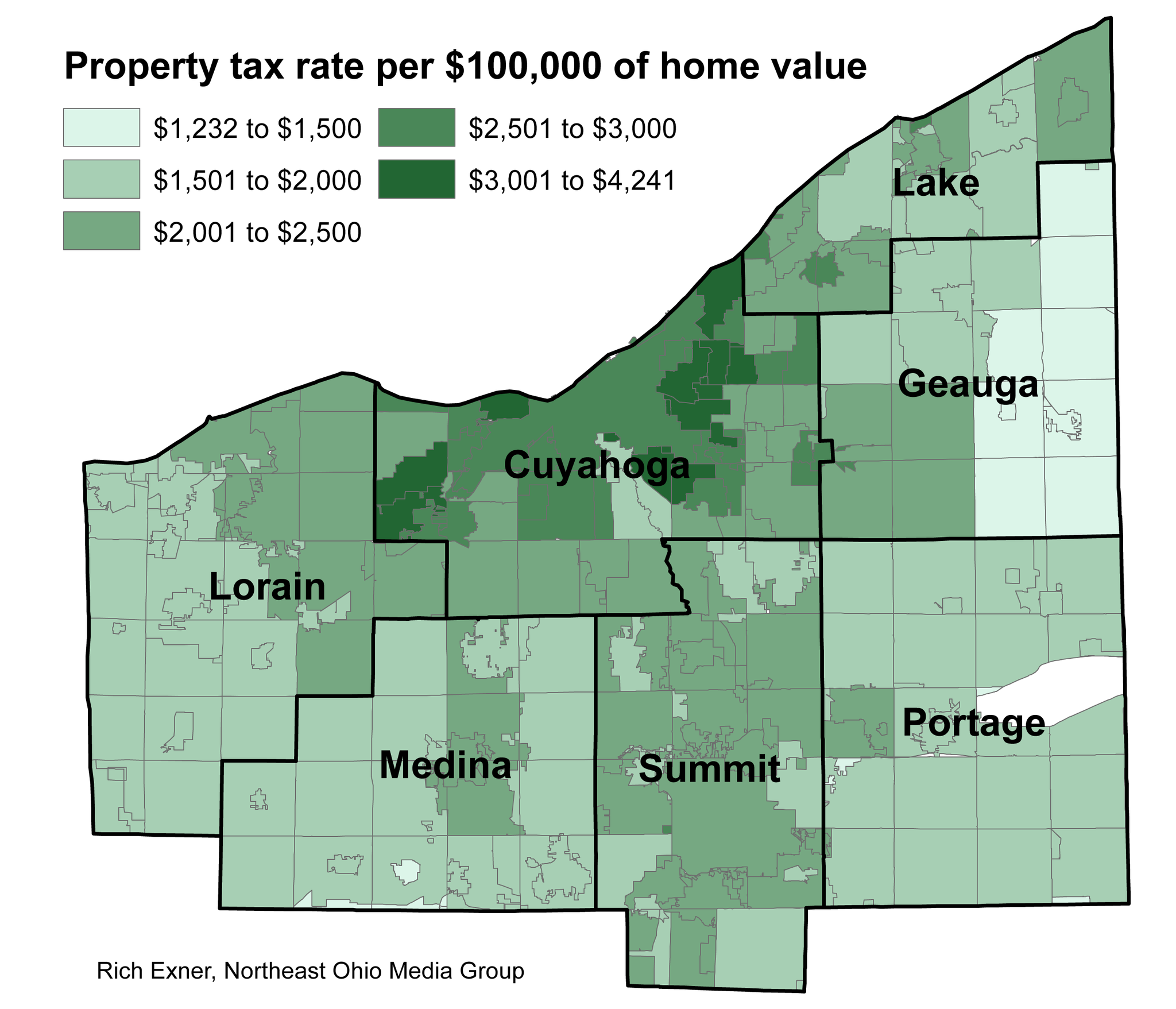

These Cuyahoga County Places Have Ohio S 6 Highest Property Tax Rates That S Rich Recap Cleveland Com

These Cuyahoga County Places Have Ohio S 6 Highest Property Tax Rates That S Rich Recap Cleveland Com

31150 Rates of Taxation for Tax Year 2020 Due in 2021 Rates are expressed in dollars and cents on each one thousand dollars of tax value.

Property tax rate olmsted falls ohio. 280-99-999 - - FULL VOTED 2011 TAX RATE. Homeowners in the Buckeye State pay property tax rates that are higher than the national average but lower than those of several other Midwestern states. If the tax rate is 1400 and the home value is 250000 the property tax would be 1400 x 2500001000 or 3500.

By proceeding to use this. The tax year 2019 is payable in year 2020. Tax Rates for Olmsted township OH.

14830 mills RESIDENTIAL TAX RATES Tax reduction factor. The current income tax rate for the City of Olmsted Falls is 15 imposed on earned income consisting of wages salaries commissions and other compensation as well as net profit of business attributable to activities in the municipality. German 201 Irish 114 American 77 Polish 74 Italian 71 English 60.

Federal income taxes are not included Property Tax Rate. Berea Olmsted Falls 32. How to pay your local income tax.

For a more detailed explanation of County Property Tax Rates call the County Treasurer at 216 443-7400. If you have information concerning property taxes and county services please visit. Briarpatch Drive Bronson Road Brook Road Brookside Drive Central Park Boulevard Chandlers Lane Charney Circle Clark Street Cliffside Circle Columbia Road.

Your actual property tax may be more or less than the value calculated in the estimator. The average effective property tax rate in Ohio is 148 which ranks as the 13th-highest in the US. This site provides access to the Assessment and Tax office property records database in Olmsted County Minnesota.

The City of North Olmsted utilizes RITA for local income tax billing and collection. A simple percentage used to estimate total property taxes for a home. You can access public records by search by street address Parcel ID or various other methods.

Use our free directory to instantly connect with verified Property Tax attorneys. 1 to Cuyahoga County and 38 is used to help fund the Metroparks and library. North Olmsted North Olmsted 10054.

775 The total of all sales taxes for an area including state county and local taxes. Tax as a Percentage of Market for owner occupied properties only. 261-01-001 and ends with.

OLMSTED TOWNSHIP STATE TAX CODE. From Date Thru Date Tax Rate Credit Factor Tax Credit Credit Rate Credit Limit 01012015. A tax credit of up to 75 is allowed for tax paid to other cities.

To assist taxpayers in the County all late penalty dates for property taxes due in 2020 were extended until December 31 2020. 0387582 Effective tax rate on bill. However tax rates vary significantly between Ohio counties and cities.

In combination with other local taxes that make up the total bill the overall tax rates are up about 355 per 100000 in Fairview Park 336 in Euclid 332 in Olmsted Falls 327 South. Moreland Hills Orange. COVID-19 property tax hardship relief.

Compare the best Property Tax lawyers near Olmsted Falls OH today. Search by Address Real Property Search Advanced Search Condo and Subdivision Search Map Search. 1540 The property tax rate shown here is the rate per 1000 of home value.

Residents of North Olmsted 18 years of age or older are taxed 2 of their gross earned income. Property Tax Rate. Annual tax as a percentage of the market value of the property is also provided.

81 rows Moreland Hills Chagrin Falls. 1540 The property tax rate shown here is the rate per 1000 of home value. 687 The total of all income taxes for an area including state county and local taxes.

Real property tax dollars are distributed as follows 706 to the school district 105 to the City of Olmsted Falls 15. 9082 Effective tax rate after rollbacks. This is the effective tax rate.

This tax should be deducted through the taxpayers pay if employer is in North Olmsted. Olmsted Falls Olmsted Falls 2400. Olmsted County is aware of the serious impacts of COVID-19 in our local area and across the US.

26635 Sprague Road Olmsted Falls Oh 44138 Mls Id 4263839 Progressive Urban Real Estate

26635 Sprague Road Olmsted Falls Oh 44138 Mls Id 4263839 Progressive Urban Real Estate

Find Out Where Your City Or Township Ranks For Property Tax Rates In Greater Cleveland Akron Area Cleveland Com

Find Out Where Your City Or Township Ranks For Property Tax Rates In Greater Cleveland Akron Area Cleveland Com

25705 Cook Rd Olmsted Falls Oh 44138 Zillow

25705 Cook Rd Olmsted Falls Oh 44138 Zillow

9130 Devonshire Drive Olmsted Falls Oh 44138 Mls Id 4258514 Cutler Real Estate

9130 Devonshire Drive Olmsted Falls Oh 44138 Mls Id 4258514 Cutler Real Estate

9180 Columbia Rd Olmsted Falls Oh 44138 Zillow

9180 Columbia Rd Olmsted Falls Oh 44138 Zillow

24544 Nobottom Road Olmsted Falls Oh 44138 Mls Id 4254937 Cutler Real Estate

24544 Nobottom Road Olmsted Falls Oh 44138 Mls Id 4254937 Cutler Real Estate

24835 W Northwood Dr Olmsted Falls Oh 44138 Zillow

24835 W Northwood Dr Olmsted Falls Oh 44138 Zillow

Find Out Where Your City Or Township Ranks For Property Tax Rates In Greater Cleveland Akron Area Cleveland Com

Find Out Where Your City Or Township Ranks For Property Tax Rates In Greater Cleveland Akron Area Cleveland Com

8878 Holly Lane 43 Olmsted Falls Oh 44138 Mls 4255824 Howard Hanna

8878 Holly Lane 43 Olmsted Falls Oh 44138 Mls 4255824 Howard Hanna

7826 Brookside Drive Olmsted Falls Oh 44138 Mls 4069880 Howard Hanna

7826 Brookside Drive Olmsted Falls Oh 44138 Mls 4069880 Howard Hanna

6394 Fitch Road Olmsted Township Oh 44138 Mls Id 4239368 Cutler Real Estate

6394 Fitch Road Olmsted Township Oh 44138 Mls Id 4239368 Cutler Real Estate

27381 Bagley Rd Olmsted Twp Oh 44138 Zillow

27381 Bagley Rd Olmsted Twp Oh 44138 Zillow

Https Www Reveretitle Com Wp Content Uploads 2020 03 Cuyahoga County 2019 Payable 2020 Tax Rates Revere Ind Pdf

The Ultimate Guide To Grading Cleveland Neighborhoods Cleveland The Neighbourhood Area Map

The Ultimate Guide To Grading Cleveland Neighborhoods Cleveland The Neighbourhood Area Map

Property Tax Rates For 2015 Up For Most In Greater Cleveland Akron Database Cleveland Com

Property Tax Rates For 2015 Up For Most In Greater Cleveland Akron Database Cleveland Com

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home