How To Become Farm Tax Exempt In Illinois

View up to date information on Illinois Covid-19 vaccine plan and vaccination eligibility from the State of Illinois Coronavirus Response Site Budget Address Reminder The Governors Budget address will be given at 12pm today. Into the construction repair or renovation of on-farm facilities exempt under the provision of KRS 139480.

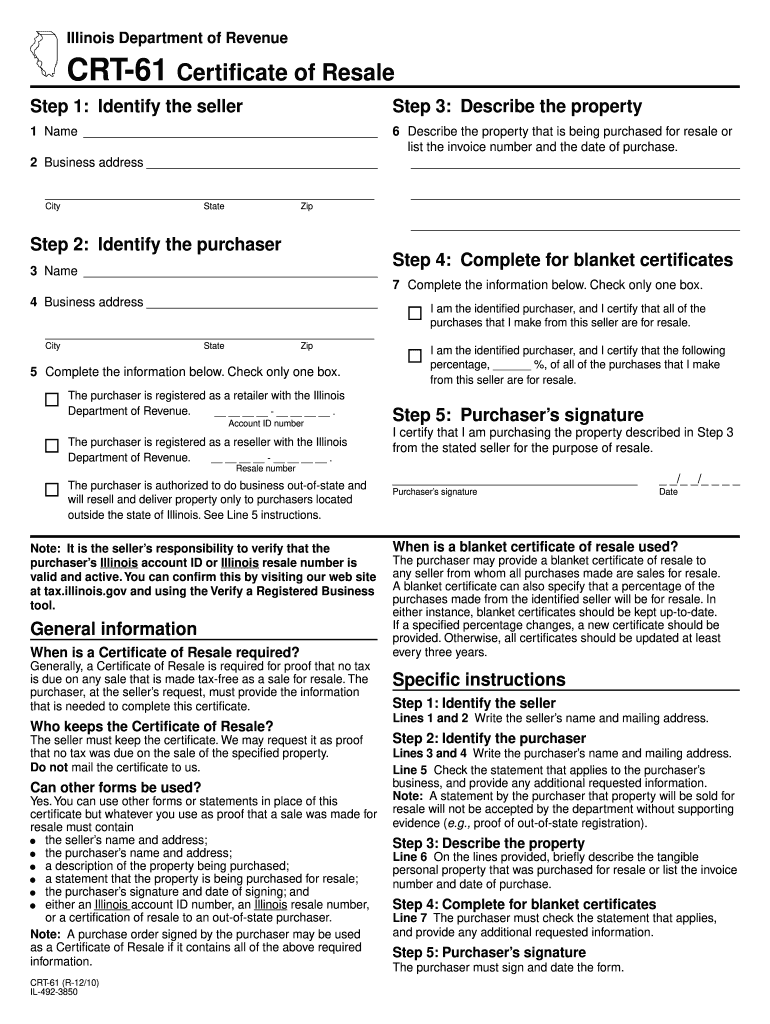

Il Dor Crt 61 2011 2021 Fill Out Tax Template Online Us Legal Forms

Il Dor Crt 61 2011 2021 Fill Out Tax Template Online Us Legal Forms

The activities of agricultural and horticultural organizations involve raising livestock forestry cultivating land raising and harvesting crops or aquatic resources cultivating useful or ornamental plants and similar pursuits.

How to become farm tax exempt in illinois. Doing them will help you establish that you are a farmer to be able to get an agricultural sales tax exemption. In the early 1980s Illinois passed the 86 Illinois Administration Code 130305 exempting machinery personal machinery that is moveable from the State of Illinois sales tax. Exempt from sales tax but some equipment they buy may be exempt.

The required attachments are listed on that form. Revenue Form 51A159 On-Farm Facilities Certificate of Exemption for Materials Machinery and Equipment must be used for such purchases. You may however have to renew your application for a farm assessment each year depending on your local tax assessors rules and on state requirements.

To explain this we must first know the history of this subject. The state of Illinois provides several forms to be used when you wish to purchase tax-exempt items. You must include the AgTimber Number on the agricultural exemption certificate PDF or the timber exemption certificate PDF when buying qualifying items.

You dont necessarily have to do the work yourself to claim the exemption for your property. For more information see PTAX-1004 Illinois Property Tax System. Name _____ Address _____ Number and street.

In the early 1980s Illinois passed the 86 Illinois Administration Code 130305 exempting machinery personal machinery that is moveable from the State of Illinois sales tax. Once you have followed the steps outlined on this page you will need to determine what type of tax-exempt status you want. ST-587 Equipment Exemption Certificate is used to substantiate an exempt purchase of machinery and equipment used for manufacturing production agriculture or coal and aggregate mining.

To explain this we must first know the history of this subject. Comprehensive Tax Course Offers 60 CPE credits. What Is the Illinois Agricultural Property Tax Exemption.

AgTimber Number Expiration Dates. However getting a farm number is NOT the same as getting agricultural tax exemption. To claim a tax exemption on qualifying items you must apply for an agricultural and timber registration number AgTimber Number from the Comptroller.

Homestead and Small Farm Tax Deductions. Requirements for Exemption - AgriculturalHorticultural Organization. With a paperback tax guide soon showed that this very same individual was entitled to several previously undreamed of exemptions.

Comprehensive Tax Preparer Training. You will need to present this certificate to the vendor from whom you are making the exempt purchase - it is up to the vendor to verify that you are indeed qualified to make a tax-exempt purchase. For this purpose aquatic resources include only animal or vegetable life but not mineral resources.

A state may allow farms to. Effective July 1 2019 the manufacturing machinery and equipment exemption includes production related tangible personal property. Registering for a farm number filing your Schedule F and getting an agricultural land valuation all establish you and your farm.

A farm building is assessed at one-third of the value that it contributes to the farms productivityFarm home sites and farm dwellings are assessed at one-third of their market value. In some states these types of property tax relief programs may be in the form of a tax freeze or rebate. As of January 31 the IRS requires that Form 1023 applications for recognition of exemption be submitted electronically online at wwwpaygov.

The agricultural property tax exemption in Illinois is not technically an exemption such as the senior citizen or the person with disabilities exemptions where a portion of your homes assessed value is exempt from tax payments. Identify the seller The seller must keep this certificate. States provide a wide array of tax benefits for farms with the most common being exemptions from sales use or property taxes.

Farmland is assessed based on its ability to produce income its agricultural economic value. Enough in fact to. Course total of 20 chapters 4 modules 5 chapters per module.

The required attachments are listed on that form. Farmers are not exempt from sales tax but some equipment they buy may be exempt. Federal and state agencies should complete Form PTAX-300-FS Application for FederalState Agency Property Tax Exemption.

Illinois Department of Revenue ST-587 Exemption Certificate for Manufacturing Production Agriculture and Coal and Aggregate Mining Step 1. Religious organizations should complete Form PTAX-300-R Application for Religious Property Tax Exemption. The University of Illinois Tax School is pleased to partner with The Income Tax School ITS to provide our customers with an online solution for comprehensive tax training.

How To Get A Sales Tax Exemption Certificate In Wisconsin Startingyourbusiness Com

How To Get A Sales Tax Exemption Certificate In Wisconsin Startingyourbusiness Com

Https Www Dupageco Org Community Services Senior Services Docs Awd Directory 49869

Printable Illinois Sales Tax Exemption Certificates

Printable Illinois Sales Tax Exemption Certificates

Https Www2 Illinois Gov Rev Research Legalinformation Hearings Pt Documents Pt 11 01 Pdf

Sales Tax Exemption For Building Materials Used In State Construction Projects

Sales Tax Exemption For Building Materials Used In State Construction Projects

Http Newillinoisfarmers Org Pdf 032015taxes Pdf

Https Www2 Illinois Gov Rev Forms Sales Documents Sales St 1 X Pdf

How To Get A Sales Tax Exemption Certificate In Arkansas Startingyourbusiness Com

How To Get A Sales Tax Exemption Certificate In Arkansas Startingyourbusiness Com

Https Www2 Illinois Gov Rev Research Legalinformation Regs Documents Part130 130 340 Pdf

How Do I File For Tax Exempt Status In Illinois James C Provenza Associates Pc

How Do I File For Tax Exempt Status In Illinois James C Provenza Associates Pc

How To Get A Sales Tax Exemption Certificate In Iowa Startingyourbusiness Com

How To Get A Sales Tax Exemption Certificate In Iowa Startingyourbusiness Com

Https Www2 Illinois Gov Rev Forms Reg Documents Stax 1 Pdf

Https Www2 Illinois Gov Rev Research Legalinformation Hearings St Documents St00 7 Pdf

Http Newillinoisfarmers Org Pdf 032015taxes Pdf

How To Get A Sales Tax Exemption Certificate In Missouri Startingyourbusiness Com

How To Get A Sales Tax Exemption Certificate In Missouri Startingyourbusiness Com

How To Get An Exemption Certificate In Pennsylvania Startingyourbusiness Com

How To Get An Exemption Certificate In Pennsylvania Startingyourbusiness Com

Http Www Midwestapplication Com Files Il 20tax 20exempt 20form 20st 587 Pdf

Https Www2 Illinois Gov Rev Research Publications Compliancealerts Documents Ca 2016 02 Pdf

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home