Homestead Property Tax Florida Amendment

Increased Portability Period To Transfer Accrued Benefit Placed By. Portability for homestead exemptions has proved important for.

Everybody Is For Amendment 2 Omcar Ocala Marion County Association Of Realtors

Limitations On Homestead Property Tax Assessments.

Homestead property tax florida amendment. The Florida homestead exemption is an exemption that can reduce the taxable value of your home by as much as 50000. Under the Florida Constitution every Florida homeowner can receive a homestead exemption up to 50000. In the budget analysis for the amendment the Revenue Estimating Conference estimated that the amendment if approved would reduce local property taxes by 18 million beginning in fiscal year.

Amendment 5 would extend the time frame from two tax years to three tax years for property owners to transfer or port all or part of their homestead assessment difference to a new homestead anywhere in Florida. 25000 applies to all property taxes including school district taxes. Amendment 5 was introduced by state Representative Rick Roth backed by Americans for Tax Reform and passed with a unanimous vote in both chambers of Floridas legislature in this years session.

When someone owns property and makes it his or her permanent residence or the permanent residence of his or her dependent the property owner may be eligible to receive a homestead exemption that would decrease the propertys taxable value by as much as 50000. The first 25000 in property value is exempt from all property taxes including school district taxes. For Palm Beach County Amendment 5 could potentially apply to any of the 330000 current property owners with homestead exemptions.

The amendment changes the code so senior. The original intent was to decrease taxes on homesteaded properties in Florida by placing caps on the appraised value on homes and land. The additional exemption up to 25000 applies to the assessed value between 50000 and 75000 and only to non-school taxes.

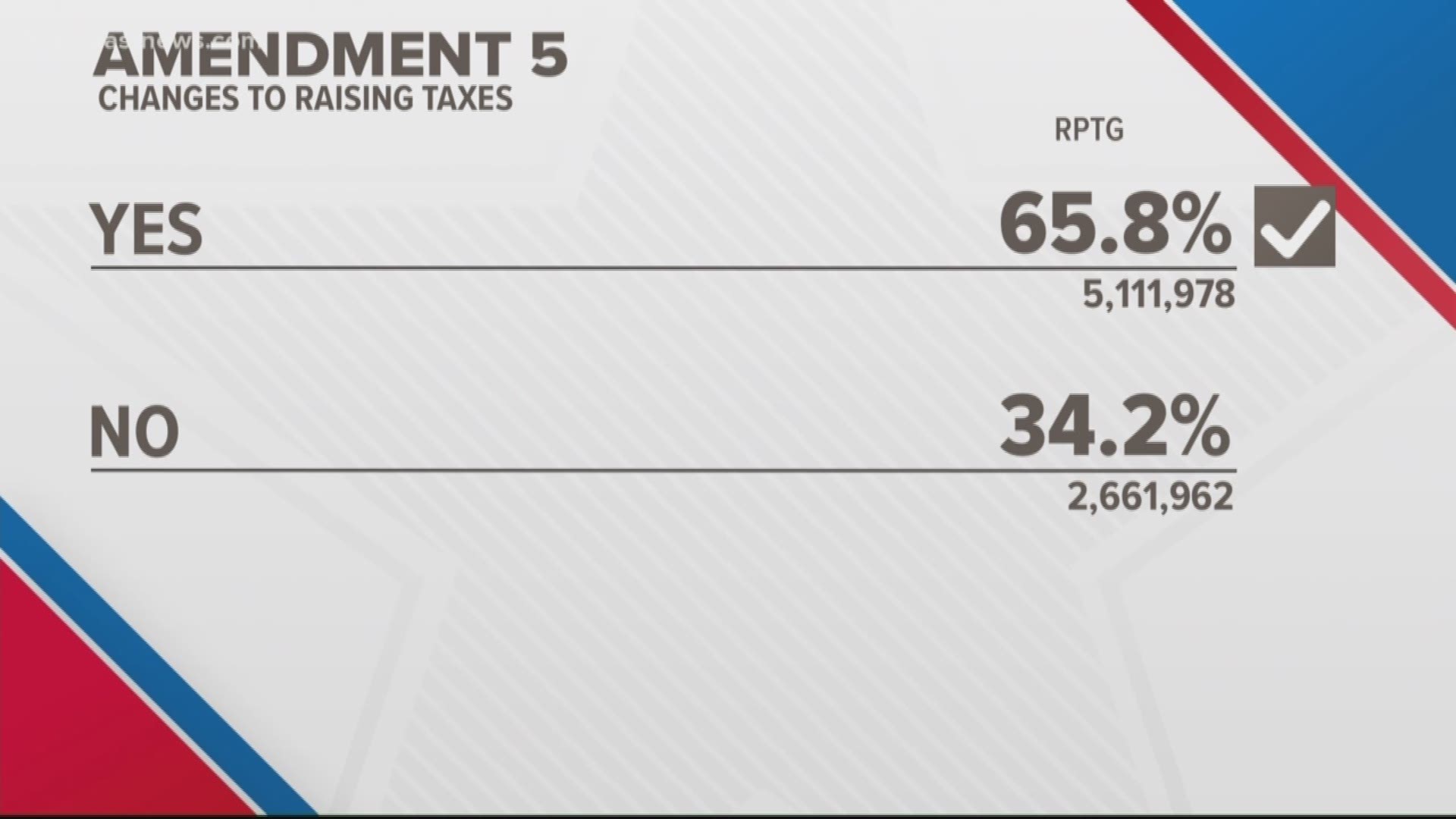

LAKE MARY Fla- Florida voters passed Amendment 5 which was placed on the ballot by the Florida Legislature extends the window of time that Florida homeowners have to. Proposing an amendment to the State Constitution effective January 1 2021 to increase from 2 years to 3 years the period of time during which accrued Save-Our-Homes benefits may be transferred from a prior homestead to a. Its offered based on your homes assessed value and offers exemptions within certain value limits.

This exemption qualifies the home for the Save Our Homes assessment limitation. WFLA The Florida Property Tax Exemptions for Senior Citizens Amendment or Amendment 5 will change Floridas current homestead tax exemption language. Florida Legislature HJR 369 Ballot Summary.

In Florida homeowners can qualify for a homestead exemption on their primary residence known as the Save Our Homes benefit reducing the taxable value of a home as much as 50000 saving about. The application for homestead exemption Form DR-. The 1992 Save Our Homes Amendment places a cap on the increases of the assessed value of a homesteaded residence in Florida.

Florida voted on an amendment to the state constitution this November that would increase the period of time a Homestead property tax benefit can be transferred to a. It didnt do that. The additional 25000 exemption is available for non-school taxes and applies only to the assessed value between 50000 and 75000.

See section 196031 Florida Statutes Homestead Property Tax Exemption.

Amendments 5 And 6 On Florida S Ballot Focus On Florida Property Taxes The Independent Florida Alligator

Amendments 5 And 6 On Florida S Ballot Focus On Florida Property Taxes The Independent Florida Alligator

Save Our Homes Amendment And Its Effects Orange County Property Appraiser

Save Our Homes Amendment And Its Effects Orange County Property Appraiser

What Are These Florida Amendments All About Nonpartisan Analysis From The League Of Women Voters Palm Coast Observer

What Are These Florida Amendments All About Nonpartisan Analysis From The League Of Women Voters Palm Coast Observer

Https Www Ctsfl Us Index Htm Files Website 20faq Pdf

Election Results Which Florida Amendments Passed Failed And What It Means For You Firstcoastnews Com

Election Results Which Florida Amendments Passed Failed And What It Means For You Firstcoastnews Com

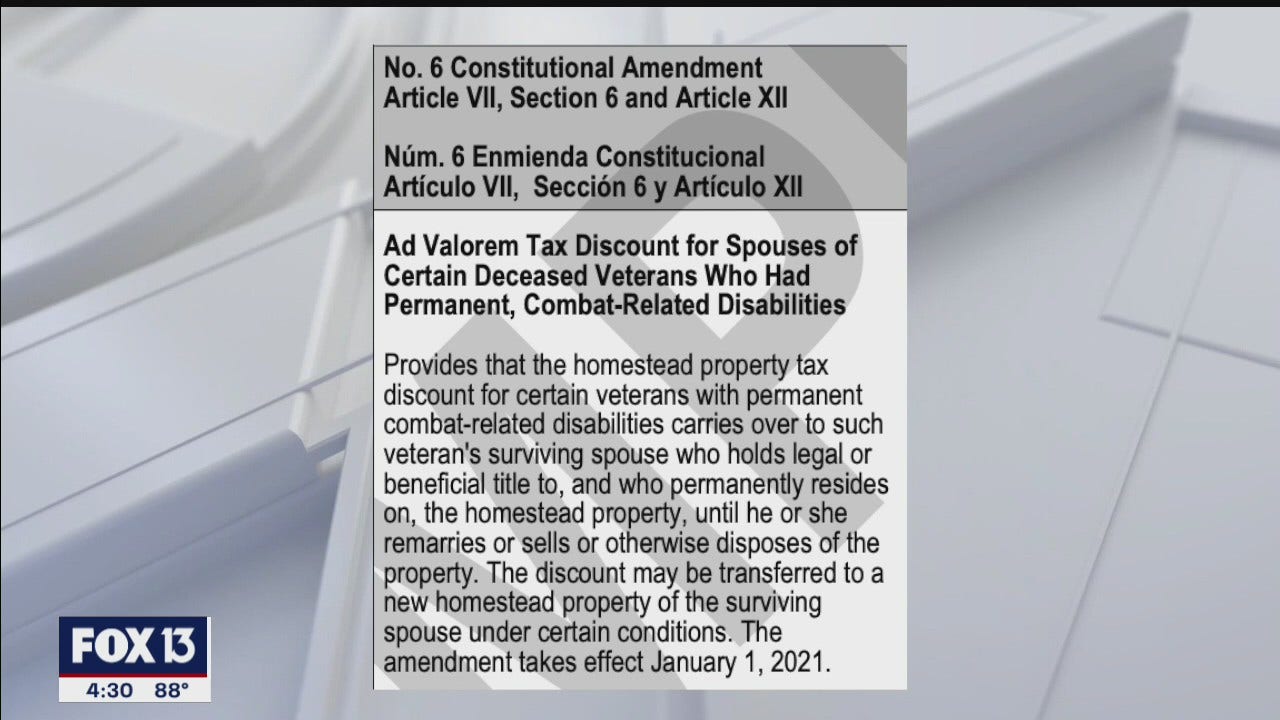

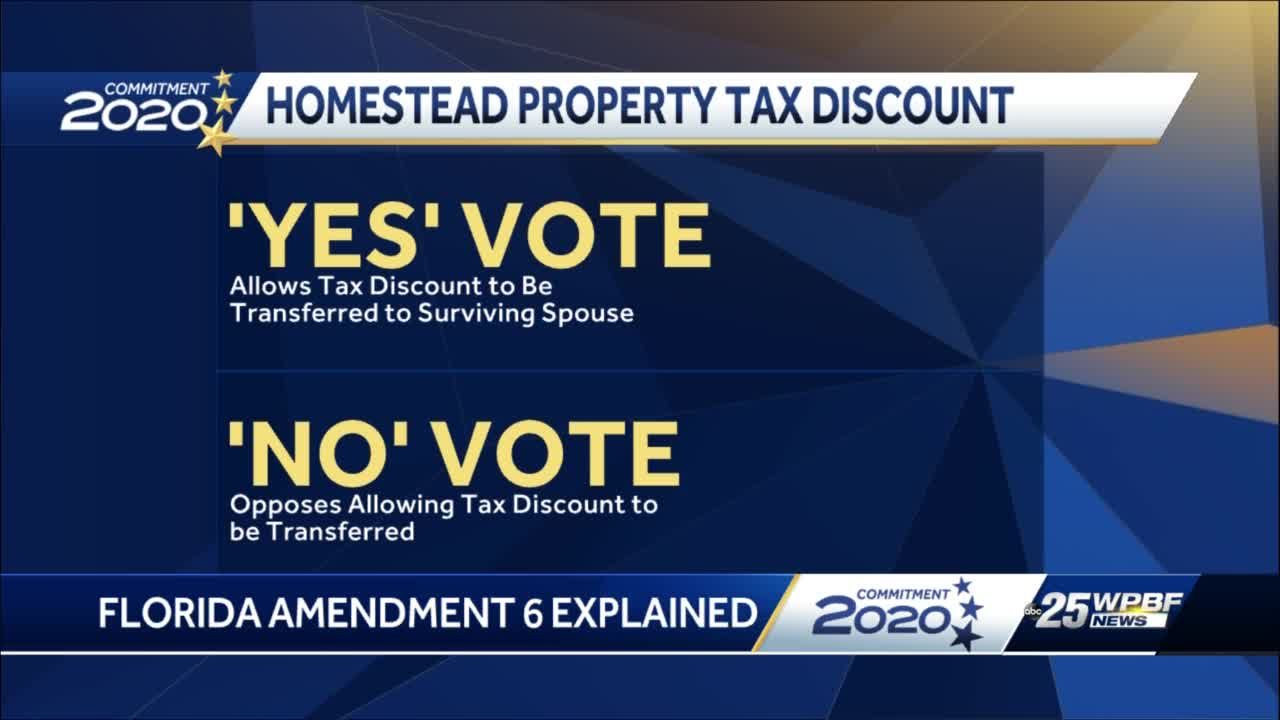

What To Know About Florida S Amendment 6 Transfer Of Veteran Benefits To Surviving Spouses

What To Know About Florida S Amendment 6 Transfer Of Veteran Benefits To Surviving Spouses

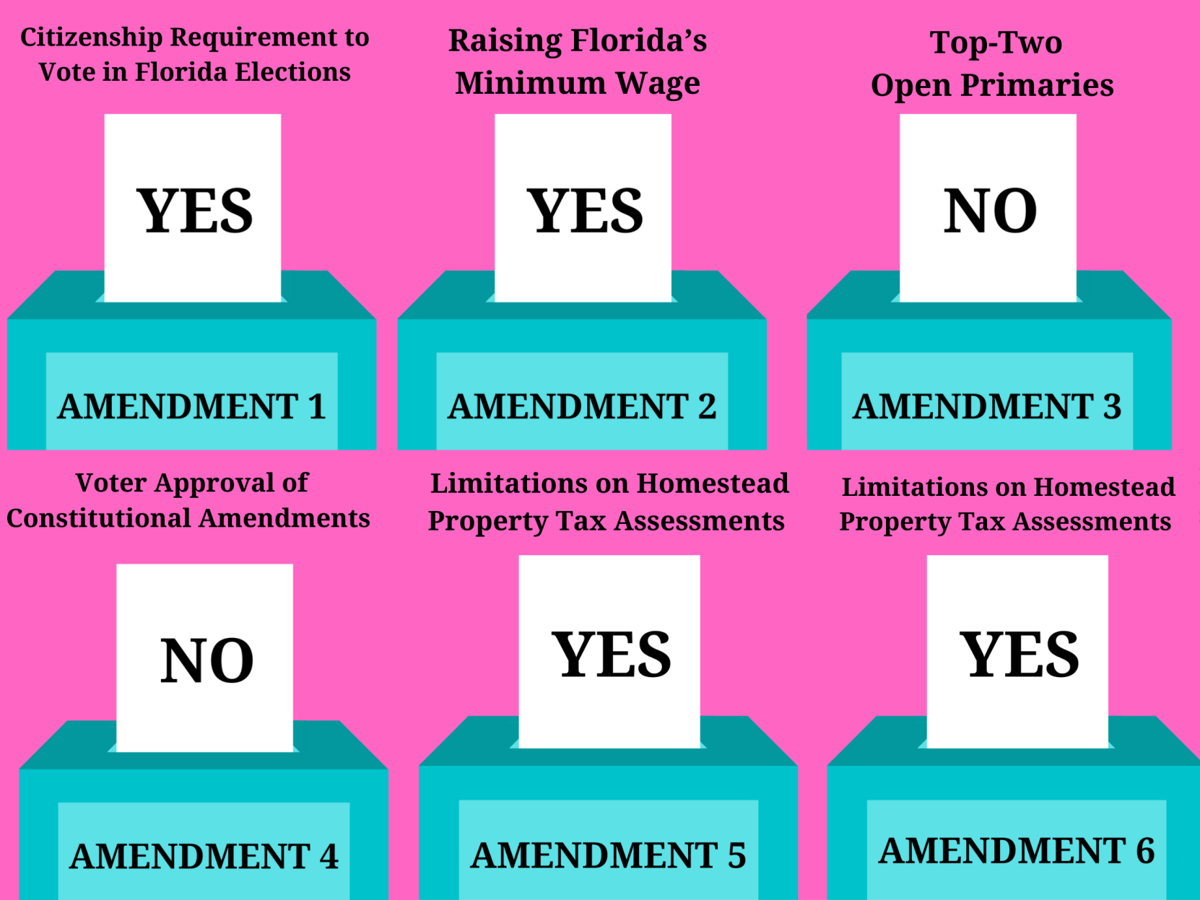

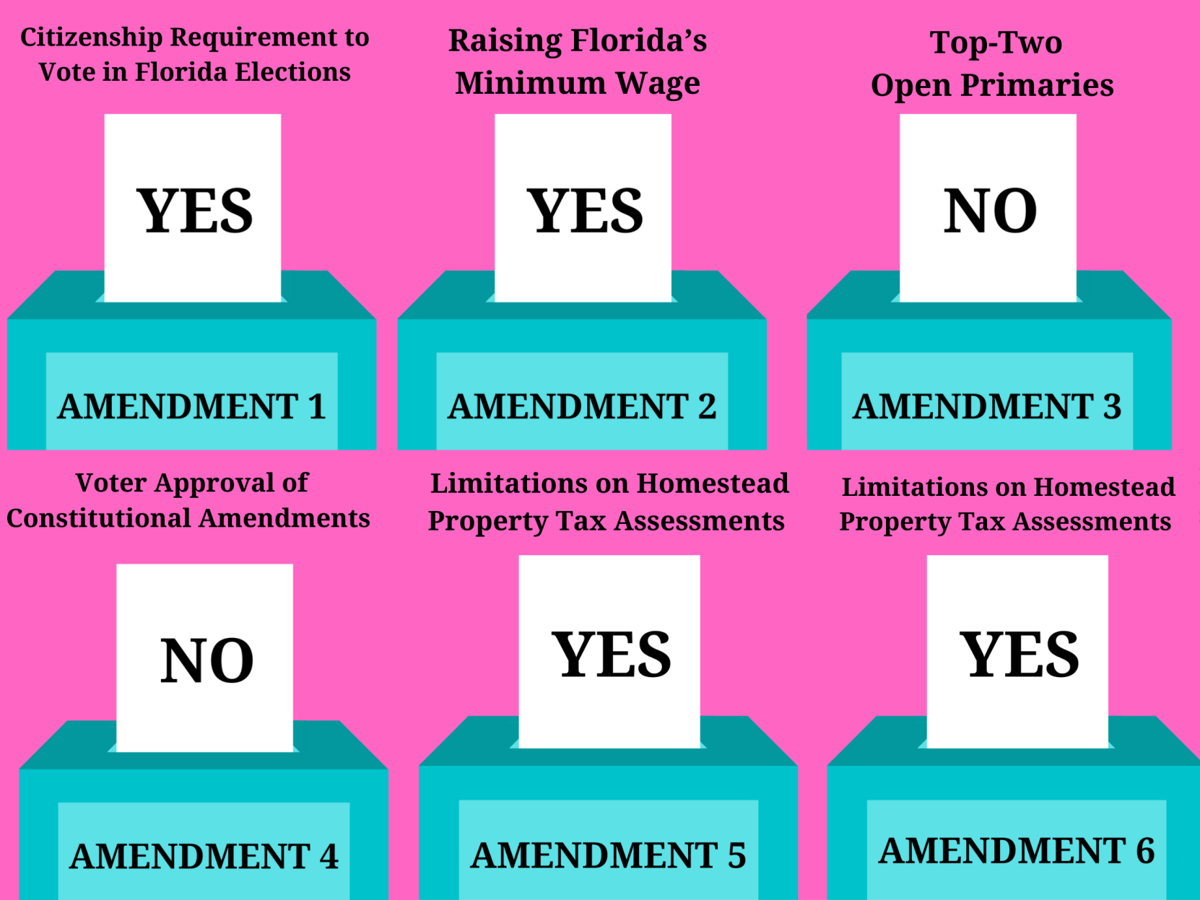

What Are The Florida Amendments To Vote On In 2020 Firstcoastnews Com

What Are The Florida Amendments To Vote On In 2020 Firstcoastnews Com

Understanding Your Vote Naples Florida Weekly

Understanding Your Vote Naples Florida Weekly

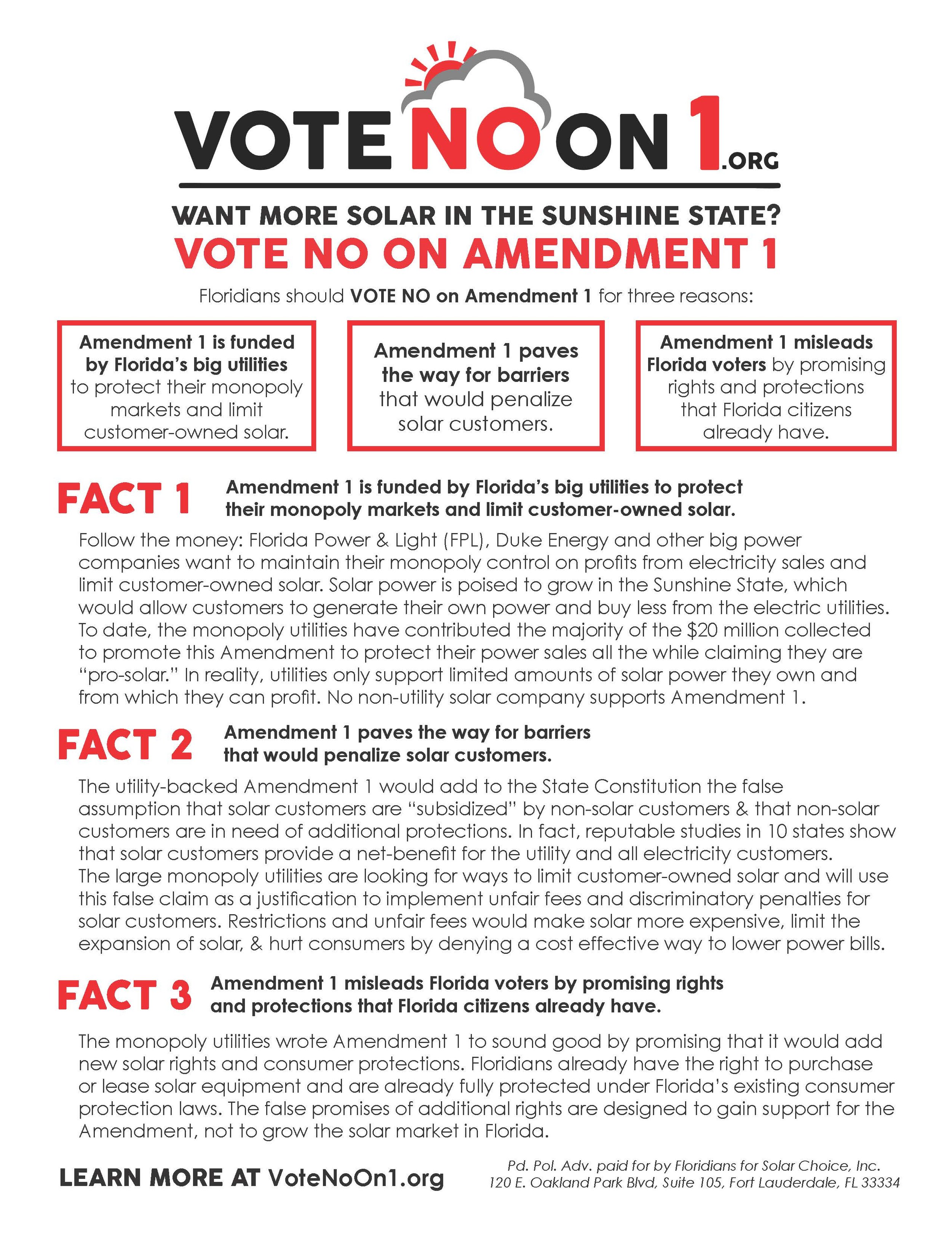

Florida Taxwatch Recommendations On Proposed 2020 Amendments To State Constitution Fernandina Observer

Florida Taxwatch Recommendations On Proposed 2020 Amendments To State Constitution Fernandina Observer

Florida Taxwatch Recommendations On Proposed 2020 Amendments To State Constitution Fernandina Observer

Florida Taxwatch Recommendations On Proposed 2020 Amendments To State Constitution Fernandina Observer

Florida Amendments16ge The League Of Women Voters Of Miami Dade

Florida Amendments16ge The League Of Women Voters Of Miami Dade

Florida Voters Approve Amendment 4 10 Others Wusf Public Media

Florida Voters Approve Amendment 4 10 Others Wusf Public Media

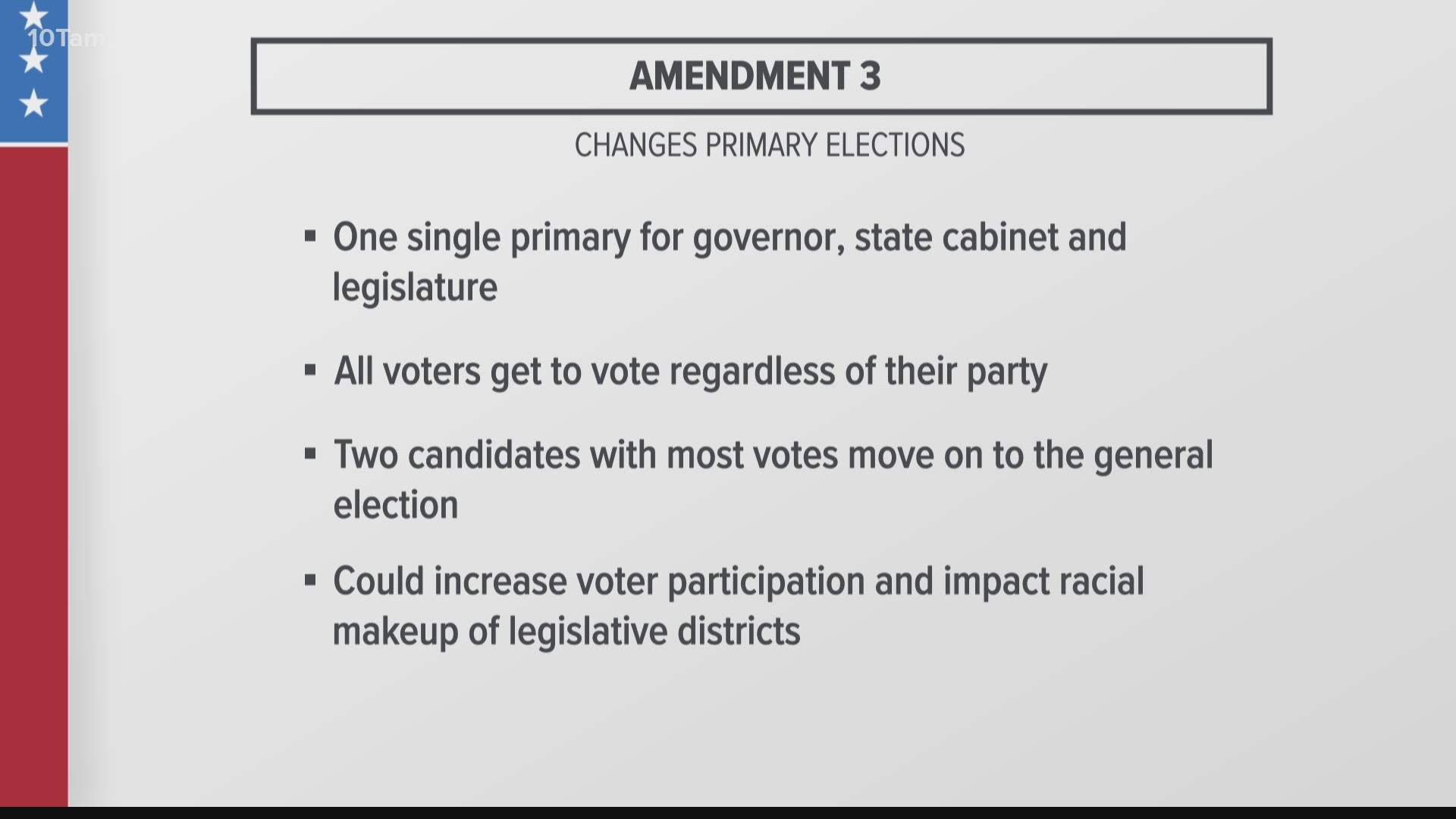

Six Florida Constitutional Amendments Appear On This Year S Ballot 2020 Amendments Chronicleonline Com

Six Florida Constitutional Amendments Appear On This Year S Ballot 2020 Amendments Chronicleonline Com

Florida Amendment 6 Passes With 90 Of Vote

Florida Amendment 6 Passes With 90 Of Vote

4 Florida Amendments Pass 2 Do Not News Theonlinecurrent Com

4 Florida Amendments Pass 2 Do Not News Theonlinecurrent Com

Florida Amendments 2020 Watch For These 6 On The Ballot 10tv Com

Florida Amendments 2020 Watch For These 6 On The Ballot 10tv Com

What Statewide Ballot Measures Will Florida Voters Decide On November 3 Ballotpedia News

What Statewide Ballot Measures Will Florida Voters Decide On November 3 Ballotpedia News

:strip_exif(true):strip_icc(true):no_upscale(true):quality(65):fill(FFF)/cloudfront-us-east-1.images.arcpublishing.com/gmg/EGM63XNN2BHYPFOKMCOJGLRZKQ.jpg) What To Know About Florida S Amendment 5 Extend Homestead Exemption Transfer Period

What To Know About Florida S Amendment 5 Extend Homestead Exemption Transfer Period

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home