Property Investment Yield Calculation Formula

To calculate take the Annual rental income Weekly rent x 52 weeks and divide by the Property value. 5000 100000 005 x 100 5.

How To Calculate The Debt Yield

How To Calculate The Debt Yield

This means that the right to receive 1 per annum for 4 years at 8 is worth 33121.

Property investment yield calculation formula. Calculating the PropertyCapital Value. Purchase price 100000. Capital Value 25 Million.

Equity multiple cash on cash return and internal rate of return are just a few of the metrics used to calculate investment yield on a commercial real estate property. 12 x 892 pcm the UK average as of January 2017 10704. In the simplest form the average yield calculation equals the investments annual income divided by the cost of acquisition.

Gross Yield Theres obviously a significant distinction between these two terms. Monthly rental return 775 Investment 180000. You then multiply this by 100 to give you the percentage.

22518 divided by the property value of 300000 equals a rental yield of 75 percent. To calculate the net rental yield subtract the annual expenses from the annual rent and divide this result by the total cost of the investment property. Property value 600000 and expected rent 500 a week.

And that figure is then divided by 216750 the average. Leveraged Yield Formula The formula to calculate how much leverage yield as an investor you can garner when you rent out your property can be represented by this generic formula L. This is less than 4 because of the time value of money and risk.

Rental Yield example 2. Net Rental Yield Investment Property Calculator. Its the annual rental income divided by the purchase price.

So if the annual rent you expect to make on a property is. An income of 27360 minus the cost of 4842 works out to 22518 in rental income after expenses. Calculating the gross yield.

How to Calculate Rental Yield The Formula The formula. Moving on investors should also be aware that property yield figures can also be manipulated to show alternative capital values that more accurately reflect the investment risk. Making a calculation.

HOW TO CALCULATE GROSS YIELD. Because ROI is a profitability. Monthly rental return 600 Investment 150000.

Annual rental income 5000. Put another way it will take 33121 years for the income to equal the capital value. This investment property calculator works out the net rental yield.

Capital Value 150000 6 x 100. Rental Yield example 1. Then multiply this number by 100.

The average yield on an investment is related to another important. Gross rental yield Annual rental income weekly rent x 52 purchase price or market value x 100. Yield 6.

Lets take the above mentioned example. Now lets say that it cost you 300000 to purchase the property. The gross yield simply means how much ROI you will make before any expenses are deducted.

Many Metrics One Investment Yield. Annual rent property value x 100. Calculate the rental yield of a property using this rental yield calculator from Ian Ritchie Real Estate.

This equals about 72 5757 8000 with XYZ Residential and is called the AFFO yield. In order to create a successful investment in commercial real estate the best route is to thoroughly evaluate the property. Gross rental yield requires two values the annual rental income and the cost of the property.

Cap Rate Net Operating Income x 100 or Market Value Operating Income x 100 Market Value Cap Rate NOI x 100 MV NOI x 100 MV Cap Rate. 600 12 7200 7200 150000 0048 0048 100 48 yield. Covenant Strength its Effect on Property Yield.

Calculating your gross yield. Its calculated by this simple formula. Net rental yield is a much better gauge of potential returns than the gross rental yield.

To calculate gross rental yield simply divide the annual rent by the total cost or value and multiply by 100. A useful exercise takes the reciprocal of the price-to-AFFO multiple or 1 PriceAFFO AFFOPrice. 26000 500 x 52 weeks annual rental income 600000 property value x 100.

Also called Brokers Yield. Calculating the gross yield of a property is pretty simple. It takes into account the costs of buying and the monthly running costs so is far more accurate.

Calculate your annual expenses by adding up a years worth of the investment property repair costs property taxes landlord insurance property management and real estate agent fees. YP 1- 073503008. The Formula for ROI To calculate the profit or gain on any investment first take the total return on the investment and subtract the original cost of the investment.

This simple equation will help you figure out the gross yield of an investment property. Mrr monthly rental return i investment.

Capital Gains Yield Cgy Formula Calculation Example And Guide

Capital Gains Yield Cgy Formula Calculation Example And Guide

3 Ways To Work Out A Rental Yield Wikihow

3 Ways To Work Out A Rental Yield Wikihow

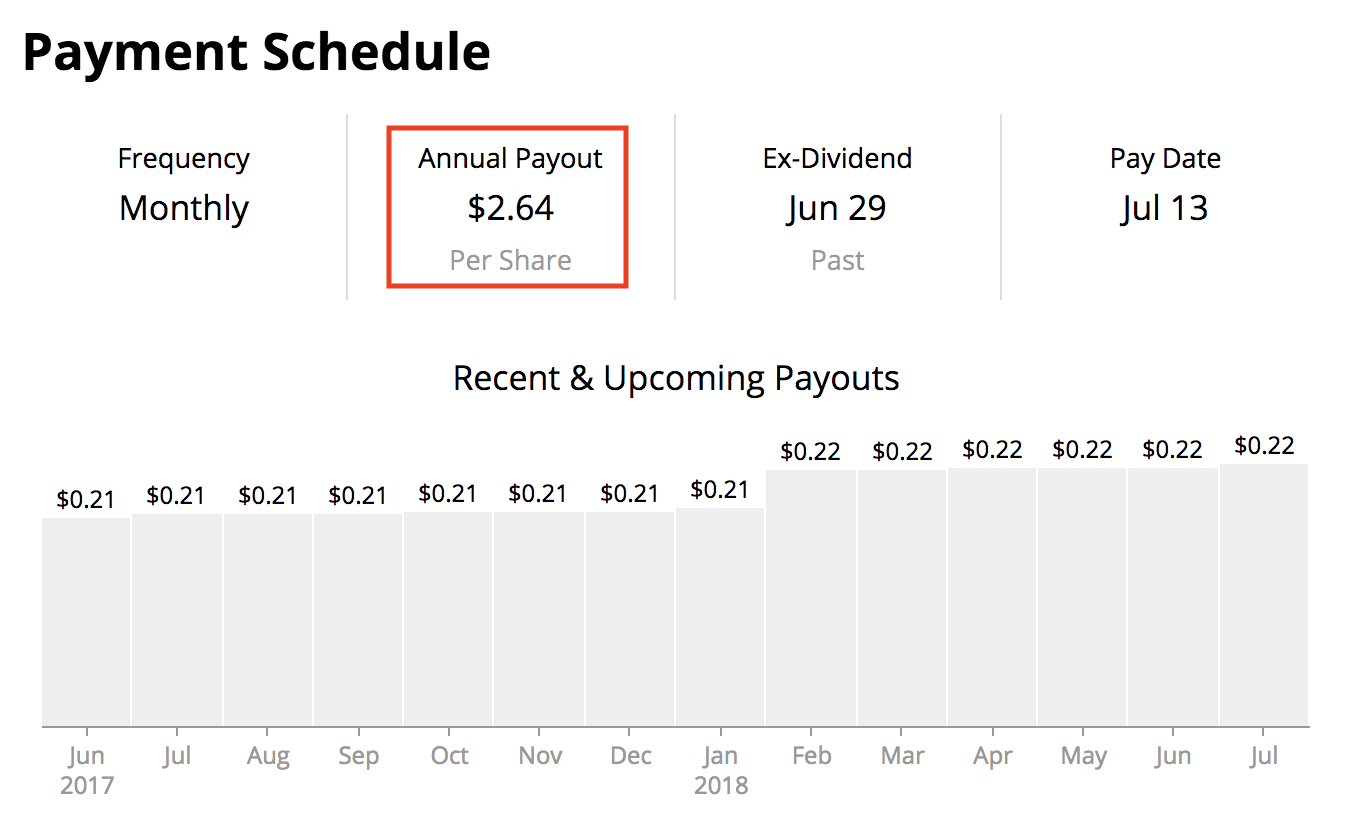

Yield On Cost How To Calculate And Apply It Intelligent Income By Simply Safe Dividends

Yield On Cost How To Calculate And Apply It Intelligent Income By Simply Safe Dividends

Calculating Returns For A Rental Property Xelplus Leila Gharani

Calculating Returns For A Rental Property Xelplus Leila Gharani

Yield Definition Overview Examples And Percentage Yield Formula

Yield Definition Overview Examples And Percentage Yield Formula

What Is Yield And Why Is It Important Performance Property Data

What Is Yield And Why Is It Important Performance Property Data

3 Ways To Work Out A Rental Yield Wikihow

3 Ways To Work Out A Rental Yield Wikihow

/dotdash_Final_How_to_Assess_a_Real_Estate_Investment_Trust_REIT_Nov_2020-01-d11e2a73dcd74c80b629e0f3068f85d8.jpg) How To Assess A Real Estate Investment Trust Reit

How To Assess A Real Estate Investment Trust Reit

How To Calculate The Debt Yield

How To Calculate The Debt Yield

3 Ways To Work Out A Rental Yield Wikihow

3 Ways To Work Out A Rental Yield Wikihow

Free Rental Yield Calculator By Landlord Vision

Free Rental Yield Calculator By Landlord Vision

All Risks Yield Overview How To Calculate Good Vs Bad Ary

All Risks Yield Overview How To Calculate Good Vs Bad Ary

3 Ways To Work Out A Rental Yield Wikihow

3 Ways To Work Out A Rental Yield Wikihow

Property Yield Calculating Property Yields Return On Investment

Property Yield Calculating Property Yields Return On Investment

Calculating Returns For A Rental Property Xelplus Leila Gharani

Calculating Returns For A Rental Property Xelplus Leila Gharani

3 Ways To Work Out A Rental Yield Wikihow

3 Ways To Work Out A Rental Yield Wikihow

Labels: formula, investment, property, yield

:max_bytes(150000):strip_icc()/dotdash_Final_Current_Yield_Oct_2020-01-7b25f37332ff434f9bc3794782fe38fe.jpg)

/dotdash_Final_Current_Yield_Oct_2020-01-7b25f37332ff434f9bc3794782fe38fe.jpg)

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home