Divorce And Property Held In Trust Nz

The property in the trust will be treated as the settlors own property which in turn can potentially be categorised as relationship property. If during the relationship a trust provided for both parties in some manner but after the divorce one party ceases to be supported then it is possible that a claim can be made against the trust to recompense for the lack.

:max_bytes(150000):strip_icc()/GettyImages-175427818-0fb82c7ceb554879adec94d4cff86548.jpg) How To Set Up A Trust Fund In Australia

How To Set Up A Trust Fund In Australia

Advertise with NZME.

Divorce and property held in trust nz. Financial trusts are one of the most complicated aspects of property division during divorce. However these two people often hold property in a. They can arise in many circumstances and in divorce proceedings when spouses are unable to agree how their assets should be divided and how their housing and other needs are to be met the Court may have to decide how a trust should be treated.

It reduces the opportunity for the Family Court to get its hands on your money. The Law Commission has previously estimated there may be anything between 300000 to 500000 trusts in New Zealand1 In the 2013 Census 148 per cent of households reported that their home was held on trust. Settle relationship property for the childrens benefit.

Property held by a Trust generally falls outside of the Act as Trust owned property is neither separate nor relationship property. Trusts are invalid if they fail to comply with any one of a number of formal requirements such as if the settlor fails to sign the trust. This means the court may.

Illusory trust An illusory trust is when a trust is declared to not exist because the settlor is able to control the trust entirely for hisher benefit. Mr Duffys Trust was set up prior to the relationship and owned a number of assets both in New Zealand and overseas. Property Division in a Divorce Affects Property Held in Trust.

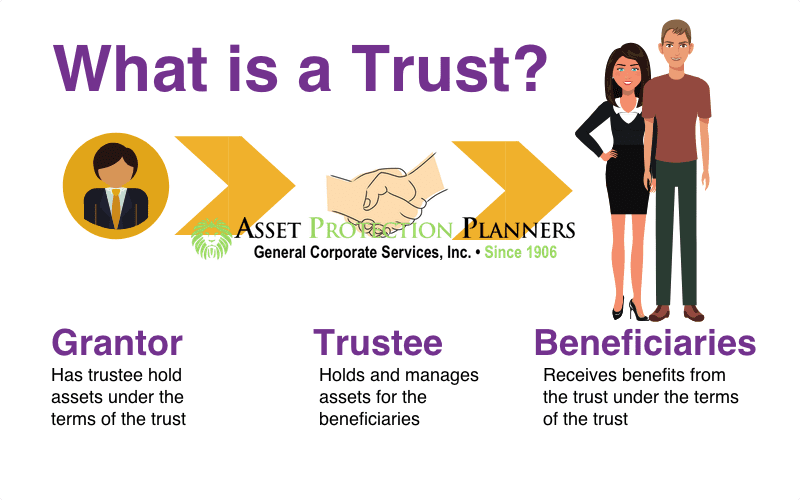

When you go through a divorce you must analyze all of your assets including property held in trust or corpus. The Divorce Protection Trust seeks to delay or stop capital and income going to the beneficiary who is suffering a divorce or separation. A trust is a relationship where the property is held by one party for the benefit of the other.

The parties were in a relationship for 12 years. The use of trusts in New Zealand 204 New Zealand has one of the highest numbers of trusts in the world as a proportion of its population. This is why many people choose to set up a Trust before embarking on a second or new marriagerelationship as this structure was a means of protection for property acquired prior to the.

The interest claimed must be by virtue of the PRA. If a divorce involves a trust a spouse may argue that the trust is invalid or a sham or that the placement of assets made by the other spouse into the trust should be reversed. Because the assets in the trust continue to be owned by the trust they cannot be accessed in the divorce.

In either case its your separate property generally not divisible in divorce so your spouse would have no right to it although this can vary a little by state law. The key to protecting marital assets in a divorce is to create an irrevocable trust. When a couple separates relationship property is normally split equally between them including the home they live in.

What the future may hold for separating couples with a trust When a marriage civil union or de facto relationship breaks down the couple will usually divide their property according to the Property Relationships Act 1976 the PRA. The Family Court must make sure any dependent children are looked after when it divides relationship property. The buyers deposit will be held in a lawyers or real estate agents trust account.

Trusts In divorce proceedings are an increasingly common issue in family law cases. There are a number of situations where one partners separate property will become relationship property and which therefore form exceptions to sections 9 and 10 above. In this case Ms Vervoort brought applications against her ex de facto partner and the trustees of his Trust the William Duffy Family Trust.

Separate Property that becomes Relationship Property. Section 42 of the PRA can be used to protect land which is held in trust. The Family Law Act gives the Family Court power over third parties.

Placing it in a trust would have the same effect as signing a premarital agreement in which your spouse concedes that shes not entitled to your separate property except your spouse must sign that agreement for it to be valid. These are as follows. Section 42 allows a person who claims an interest in the land whether held in trust or not to lodge a notice on the title.

Even the terms of the trust can have an effect. When the property is sold again when all trustees are happy with the price and conditions all the trustees must sign the sale and purchase agreement. Alternatively a trust can be set up in your Will for the benefit of your beneficiary and their family rather than a gift directly to the beneficiary.

See also the Federal Court case in the West Point collapse. If a spouse established a revocable trust and funded it with assets that were marital property regardless of whos name is on the title then it would be considered marital property. Property acquired by an inheritance by succession by gift or as a beneficiary under a Family Trust.

Trusts can be used for asset protection gifting tax sheltering protection from creditors and more. Succession Law in New Zealand. Postpone selling or handing over relationship property if it would cause undue hardship for the person who has day-to-day care of the children.

The notice acts as a stop sign and prevents the land being sold or otherwise dealt with. Assets that are not owned or controlled by a spouse cannot be subject to division in a divorce. That being said a trust can become an issue in a divorce if it was funded with marital property.

After settlement the trusts assets register should be updated to.

Pin On But Registered Ielts And Toefl Certificates Without Taking Exams

Pin On But Registered Ielts And Toefl Certificates Without Taking Exams

Partnership Agreement Template Word New 10 Limited Partnership Agreement Templates Pdf Word Agreement Statement Template Job Resume Template

Partnership Agreement Template Word New 10 Limited Partnership Agreement Templates Pdf Word Agreement Statement Template Job Resume Template

What Is A Family Trust Legalzoom Com

What Is A Family Trust Legalzoom Com

Land Trusts For Asset Protection And Home Privacy

Land Trusts For Asset Protection And Home Privacy

Advantages And Disadvantages Of Family Trusts Ioof

Advantages And Disadvantages Of Family Trusts Ioof

How To Choose A Name For Your Trust Legalzoom Com

How To Choose A Name For Your Trust Legalzoom Com

Do Trusts Protect Assets From Divorce Steps Law

Free Living Trust Forms Sample Living Trust Form Template 10 Samples Examples Revocable Living Trust Living Trust Doctors Note Template

Free Living Trust Forms Sample Living Trust Form Template 10 Samples Examples Revocable Living Trust Living Trust Doctors Note Template

How To Avoid Estate Taxes With A Trust

How To Avoid Estate Taxes With A Trust

Are Trust Assets Marital Or Separate Property In Divorce Divorce Attorney Ny

Are Trust Assets Marital Or Separate Property In Divorce Divorce Attorney Ny

Free Revocable Living Trust Forms Pdf Word Eforms

Free Revocable Living Trust Forms Pdf Word Eforms

Free Trustagreement Form Printable Real Estate Forms Legal Forms Real Estate Forms Reference Letter

Free Trustagreement Form Printable Real Estate Forms Legal Forms Real Estate Forms Reference Letter

Trust And Foundation Compared Side By Side Which Is Best

Trust And Foundation Compared Side By Side Which Is Best

Free Revocable Living Trust Forms Pdf Word Eforms

Free Revocable Living Trust Forms Pdf Word Eforms

How Does A Mortgage Work With A Living Trust Vaksman Khalfin Lawyers

How Does A Mortgage Work With A Living Trust Vaksman Khalfin Lawyers

Https Www Aldavlaw Com Blog Trust Funds Held Hostage Can My Trustee Force Me To Sign A Release Before Making A Trust Distribution

Land Trusts For Asset Protection And Home Privacy

Land Trusts For Asset Protection And Home Privacy

:max_bytes(150000):strip_icc()/dotdash_Final_Trust_Aug_2020-01-6b0686cb892a40589605baeeef79a183.jpg)

/dotdash_Final_Trust_Aug_2020-01-6b0686cb892a40589605baeeef79a183.jpg)

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home