Property Tax Bill Wake County

Requests should include the tax account number if available the name on the bill and a description of the property. A taxpayer may appeal the value situs or taxability of the property within.

Wake County Nc Property Tax Calculator Smartasset

Wake County Nc Property Tax Calculator Smartasset

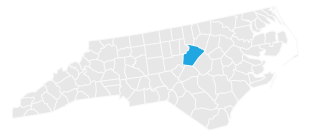

The Wake County Department of Tax Administration appraises real estate and personal property within the county as well as generating and collecting the tax bills.

Property tax bill wake county. The tax rate for the district that I live in within Wake county is an additional 25 cents per. The department also collects gross receipts taxes. Pay Tax Bill Online.

Wake County makes no warranties express or implied concerning the accuracy completeness reliability or suitability of. Millage rates for three of the largest North Carolina counties have been proposed for the 2020 tax year with notable changes for Wake County which underwent a substantial reassessment this year. Find important information on the departments listing and appraisal methods tax relief and deferment programs exempt property.

Wake County Tax Administration. Statements for Real Estate Business and Personal Property Taxes. The 2016 county tax rate for Wake county was set by July 1 2016 at 615.

The median home value in Wake County is 265800 with a median property tax payment of 2327. The Wake County Department of Tax Administration appraises real estate and personal property within the county as well as generating and collecting the tax bills. If making an advance payment also write Prepayment in this area.

If you submit a partial payment a balance due statement will. The department also collects gross receipts taxes. This data is subject to change daily.

Pay a Property Tax Bill. Wake County property tax dollars are used to cover the cost of various expenses. This means property will be appraised at 6150 cents per 100 value.

II Durham NC 27701 Phone. Wake County makes no warranties express or implied concerning the accuracy completeness reliability or suitability of. This data is subject to change daily.

My house market value as of the last reappraisal was 200000. Property tax in North. The property records and tax bill data provided herein represent information as it currently exists in the Wake County collection system.

Property that was to be listed as of January 1 2016 would be subject to this tax rate. Outlined below are the latest in proposed 2020 millage rates for Wake. To obtain a statement of property taxes paid for your vehicle call the NC DMV at 919-814-1779 or e-mail your request to their service center.

SEE Detailed property tax report for 305 E Hillside Dr Wake County NC. Pay your property tax bill online. The property records and tax bill data provided herein represent information as it currently exists in the Wake County collection system.

They are not based on a calendar year. Requests should include the tax account number if available the name on the bill and a description of the property. Property taxes not paid in full by January 5 following billing are assessed an interest charge of 2 for the month of January and an additional ¾ of 1 each month thereafter.

If you have the tax account number s you would like to pay please select your method of payment. Raleigh NC 27602 Important. A bill issued in July 2020 would cover the period of July 1 2020 through June 30 2021 Property taxes not paid in full by January 5 following billing are assessed an interest charge of 2 for the month of January and an additional 34 of 1 each month thereafter.

Annual tax bills are calculated for the fiscal taxing period of July 1 through June 30. Always write the account numbers you wish to pay in the memo section on your check. Wake County Tax Administration.

The property records and tax bill data provided herein represent information as it currently exists in the Wake County collection system. Find important information on the departments listing and appraisal methods tax relief and deferment programs exempt property. Property taxes across the state are technically due September 1 but are not considered delinquent unless paid after January 5 2021.

Timothy Dwane Brinson Tax Administrator 201 East Main Street 3rd Floor. That makes the countys average effective property tax rate 088. Select this option to search tax bills and locate your account number s To file and pay Wake County Gross Receipts Tax go to File Online.

10 Things You Need To Know About Your Property Tax Bill Entertainment Life The Columbus Dispatch Columbus Oh

10 Things You Need To Know About Your Property Tax Bill Entertainment Life The Columbus Dispatch Columbus Oh

Business Name Search Instructions Wake County Government

Business Name Search Instructions Wake County Government

![]() Tax Rates Fees Wake County Government

Tax Rates Fees Wake County Government

Data Files Statistics And Reports Wake County Government

Data Files Statistics And Reports Wake County Government

Data Files Statistics And Reports Wake County Government

Revaluation And Property Taxes In Wake County And Beyond John Locke Foundation John Locke Foundation

Revaluation And Property Taxes In Wake County And Beyond John Locke Foundation John Locke Foundation

My Land Is Worth What 2020 Wake County Real Property Tax Reappraisals And Homeowner Rights Forrest Firm

My Land Is Worth What 2020 Wake County Real Property Tax Reappraisals And Homeowner Rights Forrest Firm

What Will Raleigh S Affordable Housing Bond Do Indy Week

What Will Raleigh S Affordable Housing Bond Do Indy Week

September 2020 Monthly Dollar Value Of Real Estate Activity Was The Highest Of 2020 Wake County Government

September 2020 Monthly Dollar Value Of Real Estate Activity Was The Highest Of 2020 Wake County Government

My Land Is Worth What 2020 Wake County Real Property Tax Reappraisals And Homeowner Rights Forrest Firm

My Land Is Worth What 2020 Wake County Real Property Tax Reappraisals And Homeowner Rights Forrest Firm

Business Name Search Instructions Wake County Government

Business Name Search Instructions Wake County Government

How To Find Out If Your Wake County Property Tax Is Going Up Abc11 Raleigh Durham

How To Find Out If Your Wake County Property Tax Is Going Up Abc11 Raleigh Durham

Wake County Nc Property Tax Calculator Smartasset

Wake County Nc Property Tax Calculator Smartasset

Wake County Nc Property Tax Calculator Smartasset

Wake County Nc Property Tax Calculator Smartasset

Wake County Nc Property Tax Calculator Smartasset

Wake County Nc Property Tax Calculator Smartasset

Wake County N C Approves 10 Percent Tax Increase Ke Andrews

Wake County N C Approves 10 Percent Tax Increase Ke Andrews

It S Really Ridiculous Wake Residents Sound Off On New Tax Assessments Abc11 Raleigh Durham

It S Really Ridiculous Wake Residents Sound Off On New Tax Assessments Abc11 Raleigh Durham

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home