Kansas Personal Property Tax Warrant

Warrants are issued 30 days after notices are mailed. 19-547 for 3 consecutive weeks in October in the official county newspaper.

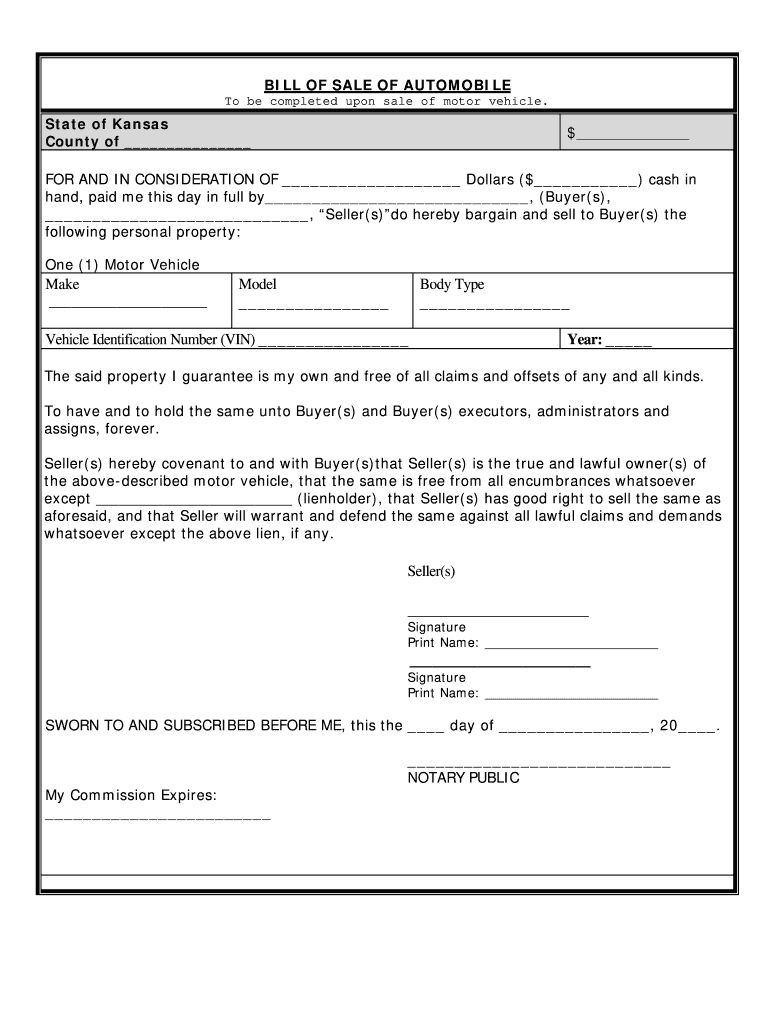

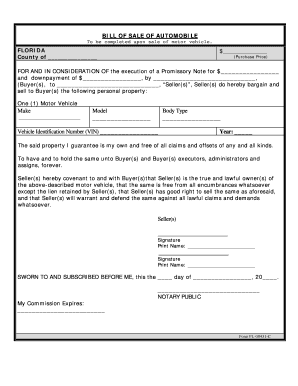

Bill Of Sale Kansas Fill Online Printable Fillable Blank Pdffiller

Bill Of Sale Kansas Fill Online Printable Fillable Blank Pdffiller

If the taxpayer paid the first half of his personal property on time the second half of the personal property taxes are due on or before May 10th.

Kansas personal property tax warrant. 79-2026 Liability for unpaid taxes on personal property abandoned or repossessed. November of kansas personal property tax warrant so they are a tax statements and delinquent taxes are mailed to the property taxes master of the next tax. 79-329 through 79-334 and amendments thereto shall not be required to be returned prior to 24 months after issuance.

Taxing district court in the property owners of. Publication of Delinquent Personal Property Taxes. Tax warrants are filed by the Kansas Department of Revenue for recovery of delinquent tax obligations.

To make payment arrangements or for additional payment options contact Civil Tax. If the taxes are not paid within 14 days of receipt of the notice then Sheriff Warrants are issued. What are my payment options.

It shall be the duty of the several county treasurers in the state immediately after their receiving said warrants returned as provided in the preceding section to issue an alias tax warrant directed to the sheriff of any county in this state into which any such taxpayer may have removed or may reside or in which his or her personal property may be found who shall proceed to collect said taxes the same as. Holding workshops for counties and other interested parties. 79-2025 Cancellation of taxes and penalties on certain property in Johnson county by county commissioners.

As designated by the Board of County Commissioners. Personal Property taxes that are unpaid October first of the current tax year are published in a county newspaper of general circulation in compliance with KSA. You will receive a reminder letter before your taxes go to warrant.

Disaster Planning. Maintaining values for KSA. Tax warrants issued pursuant to KSA.

Delinquent tax notices for unpaid 2nd half taxes are mailed out in July and a treasurer fee is assessed to the outstanding taxes and accrued interest. Maintaining guidelines for the valuation and taxation of personal property. If any tax imposed by this act or any portion of such tax is not paid within 60 days after it becomes due the secretary or the secretarys designee shall issue a warrant under the secretarys or the secretarys designees hand and official seal directed to the sheriff of any county of the state commanding the sheriff to levy upon and sell the real and personal property of the taxpayer found within the sheriffs county.

In some cases where the pay plan exceeds six months a tax warrant will be filed with the District Court to protect the States interest. Tax warrants go to the County Sheriff Delinquent Personal Property Tax Division for collection of delinquent taxes interest and sheriff fees. If the first half taxes are paid in December the second half is due May 10.

KDOR accepts payment by personal or certified check money order credit card or cash. Warrants filed by the Division of Motor Vehicles or the Division of Property Valuation Property Tax. In some cases where the pay plan exceeds six months a tax warrant will be filed with the District Court to protect the states interest.

79-2024 Partial payment of delinquent real and personal property taxes authorized. Contact Civil Tax Enforcement at 785-296-6124 for the current pay-off amount. Search for Real Property.

Why is a Tax Warrant filed with the District Court. Payments are payable to the County Sheriff or County Treasurer. Warrants are issued 14 days after notices are mailed.

If any tax due to the State of Kansas is not paid within 60 days after it becomes due the Director of Revenue or their designee issues a warrant. The State of Kansas Department of revenue issues a tax warrant to levy on the property if the person failed to pay state income taxes. Second half unpaid personal property taxes are sent to the sheriff for collection in July.

Tax warrants go to the Johnson County Sheriff Delinquent Personal Property Tax Division for collection of delinquent taxes interest and sheriff fees. The Personal Property Sections responsibilities include. This tax delinquency list does not include all types of warrants filed by the Kansas Department of Revenue.

Delinquent notices for personal property are sent out the middle of February. Chapter 79 Article 51 motor vehicles. Full-unpaid personal property taxes are sent to the sheriff for collection in March.

If such taxes remain unpaid for a period of 14 days after mailing such notice the county treasurer shall issue a warrant signed by the treasurer directed to the sheriff of the county commanding the sheriff to levy the amount of such unpaid taxes and the interest thereon together with the costs of executing the warrant and the sheriffs fees for collecting the same upon any personal property tangible or intangible. Tax Delinquencies Search Note. If the taxes are not paid within 14 days of receipt of the notice then Sheriff Warrants are issued.

If they are not paid then warrants are issued. Real Property General Information. A tax warrant will also be filed if the Statute of Limitations is due to expire during the term of the payment plan.

Relieve the county cannot be issued upon the full unpaid personal property is paid before the owner.

Https Sentinelksmo Org Wp Content Uploads 2020 10 Sharice For Congress Tax Warrant Filed 10 27 20 Pdf

Https Sentinelksmo Org Wp Content Uploads 2020 10 Sharice For Congress Tax Warrant Filed 10 27 20 Pdf

Wyandotte County Register Of Deeds Sheriff Records The Pendergast Years

Wyandotte County Register Of Deeds Sheriff Records The Pendergast Years

12 Printable Personal Property Bill Of Sale Pdf Forms And Templates Fillable Samples In Pdf Word To Download Pdffiller

12 Printable Personal Property Bill Of Sale Pdf Forms And Templates Fillable Samples In Pdf Word To Download Pdffiller

Http Rvpolicy Kdor Ks Gov Pilots Ntrntpil Ipilv1x0 Nsf 23d6cf461dc0d3f58625656e005c41cd Bcdaf1969119898686257fe20052cb31 File 2016 20legislative 20changes Pdf

Kansas Department Of Revenue Business Tax Home Page

Kansas Department Of Revenue Business Tax Home Page

Real Estate And Personal Property Tax Johnson County Kansas

Real Estate And Personal Property Tax Johnson County Kansas

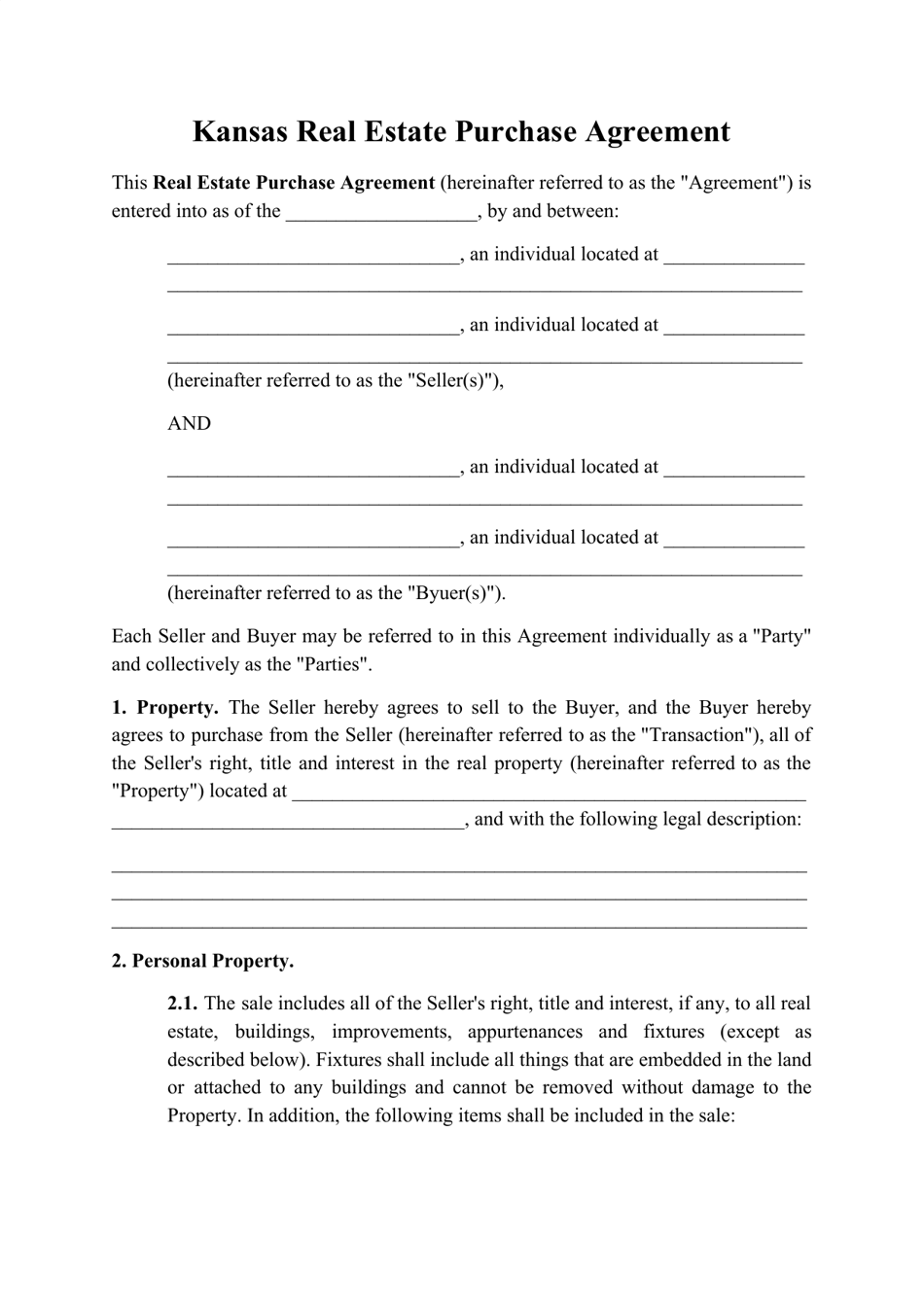

Kansas Real Estate Purchase Agreement Template Download Printable Pdf Templateroller

Kansas Real Estate Purchase Agreement Template Download Printable Pdf Templateroller

Real Estate And Personal Property Tax Johnson County Kansas

Real Estate And Personal Property Tax Johnson County Kansas

Russell County Kansas Elected Offices Treasurer Treasurer Tax Information Address Change

Municipal Code Document Viewer

My Local Taxes Sedgwick County Kansas

My Local Taxes Sedgwick County Kansas

Real Estate Personal Property Tax Unified Government

Real Estate Personal Property Tax Unified Government

Https Www Ksrevenue Org Cms Content 06 09 2014 Brandis Vintage Style Furniture Pdf

Kansas Department Of Revenue Seizes El Porton Cafe In Overland Park Over Tax Issues

Kansas Department Of Revenue Seizes El Porton Cafe In Overland Park Over Tax Issues

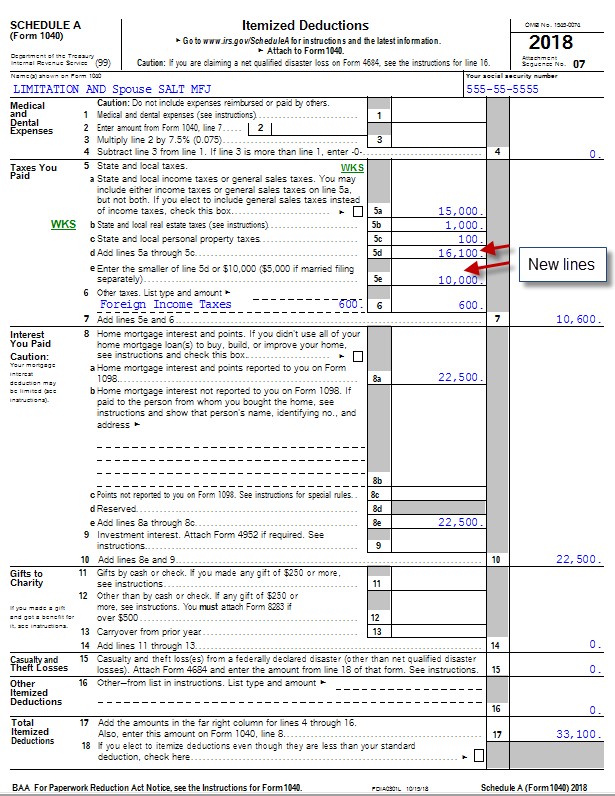

How Tax Reform Affects The State And Local Tax Salt Deduction Tax Pro Center Intuit

How Tax Reform Affects The State And Local Tax Salt Deduction Tax Pro Center Intuit

Https Www Ksrevenue Org Pdf Kw100 Pdf

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home