Franklin County Property Tax Bill

All you need at your finger tips. NOTICE TO DELINQUENT TAX PAYERS.

Secured Property Taxes Treasurer Tax Collector

Secured Property Taxes Treasurer Tax Collector

If you no longer escrow or do not receive your bill by April 15th please contact the Treasurers Office at treasurerfranklincountyingov.

Franklin county property tax bill. John Smith Street Address Ex. Delinquent tax refers to a tax that is unpaid after the payment due date. 355 West Main St.

Welcome to Franklin County Online Tax Payment Bill Search. You can search and pay Franklin County taxes online or you can pay your taxes over the phone by calling 1-888-272-9829. Please be advised that the City of Franklin web portal displays delinquent prior year taxes.

Statements are mailed one time with a Spring A coupon and Fall B coupon. If total tax remains unpaid for four years the property being taxed becomes subject to tax foreclosure suit by the County. Payments for property taxes.

The GISMapping department serves as a clearinghouse and central distributor of geographic information for Franklin County. You can viewprint your property tax bill information via the Citys Property Tax Web Portal request the bill from the seller or contact the Treasury Office at 425-4770 to get the necessary property tax information. The Tax Office is charged with collecting all current and delinquent taxes on this property.

Jeanette Gagnier - Director Address. The Franklin County Treasurers Office disclaims any responsibility or liability for any direct or indirect damages resulting from the use of this data. FRANKLIN COUNTY TREASURERS OFFICE.

Tax bill payments are due either in full by January 31st or in installments with 50 due January 31st 25 due March 31st and 25 due on May 31st. You will receive your statement in the mail towards the end of March. Real Estate Tax Sale.

Suite 251 Malone NY 12953 Phone. The Franklin County Collector of Revenue is responsible for the collection and distribution of current and delinquent taxes for the county and 64 other taxing entities within Franklin County. 518-481-1504 or 518-481-1502 front desk Fax.

That display is correct only until July 31st of the year following billing. 2019 pay 2020 property taxes are due May 11 2020 and November 10 2020. View an Example Taxcard.

Real Property Tax Service - Department 10 About the Department. PROPERTY TAX INFORMATION NEW. In addition to collecting taxes for real and personal property the Collector also collects levee railroad and utility taxes along with issuing merchants and manufacturers.

Tax Rates Due Dates. Property tax information last updated. Proposed legislation would cap property tax hikes at 5 annually for eligible Ohio homeowners hit hard by increase as property values soar.

Enter the search criteria below to locate a tax bill and click the Search button. April 16 2021 You may begin by choosing a search method below. The property values are determined by the Franklin County Property Valuation Administrator.

Franklin County Real Property Tax Services Contact. The Franklin County Tax Office is responsible for listing appraising and assessing all real estate personal property and registered motor vehicles within Franklin County. Fast safe and convenient.

The Franklin County Treasurer makes every effort to produce and publish the most current and accurate information possible. New application provides a simple search by your parcel owner name or property address. 123 Main Parcel ID Ex.

Property tax bills are mailed in October of each year. The Franklin County auditors office estimates the bill will impact about 260000 homeowners in Franklin County alone and even more Ohioans across the state. Pay taxes online Your payment will be considered accepted and paid on the submitted date.

Please be advised payments will be applied to your oldest tax bills first regardless of web site tax bills. Tax bill payments are accepted as soon as tax bills. Franklin County recognizes the many financial and personal impacts of the current COVID-19 emergency and we are committed to helping every tax payer in Franklin County during this.

A 2 discount is available if the bill is paid by November 30th. Craig says the legislation comes. Find our most popular services right here.

Property taxes paid after December 31st will be subject to a 10 penalty. The Tax Office. The County assumes no responsibility for errors in the information and does not guarantee that the.

When are tax bill payments due and accepted. Tax bills are due by December 31st. Search for a Property Search by.

The property then can be sold at public auction. Tax bill payments are due either in full by January 31st or in installments with 50 due January 31st 25 due March 31st and 25 due on May 31st. The divisions duties include the collection of delinquent taxes and working with property owners account holders tax lien purchasers and other interested parties with tax related issues.

Real estate taxes are due either in half or full on or before December 20th with the 2nd half being due on or before May 10th the following year. However it may take 2-4 business days for processing.

Are You A Milk Cow For The Government International Man Tax Freedom Day Is The Day Of The Year That The Average Person H Milk Cow Freedom Day Guest Posting

Are You A Milk Cow For The Government International Man Tax Freedom Day Is The Day Of The Year That The Average Person H Milk Cow Freedom Day Guest Posting

Property Taxes Waterford Wi Official Website

To The Left Of The Sonntag Bldg Is The Franklin House Later Named Lincoln Hotel Alton Il Alton Franklin Homes Madison County

To The Left Of The Sonntag Bldg Is The Franklin House Later Named Lincoln Hotel Alton Il Alton Franklin Homes Madison County

Just In Time For O C Property Taxes A New App For That Property Tax Sign Company Free Sign

Just In Time For O C Property Taxes A New App For That Property Tax Sign Company Free Sign

Tallahatchie County Mississippi 1911 Map Rand Mcnally Sumner Charleston Webb Tutwiler Albin Swan Lake Glendora Ti Map Mississippi My Family History

Tallahatchie County Mississippi 1911 Map Rand Mcnally Sumner Charleston Webb Tutwiler Albin Swan Lake Glendora Ti Map Mississippi My Family History

10 Things You Need To Know About Your Property Tax Bill Entertainment Life The Columbus Dispatch Columbus Oh

10 Things You Need To Know About Your Property Tax Bill Entertainment Life The Columbus Dispatch Columbus Oh

1909 Tax Bill Floyd County In New Albany In For Mary Snider Floyd County West Baden Springs New Albany

1909 Tax Bill Floyd County In New Albany In For Mary Snider Floyd County West Baden Springs New Albany

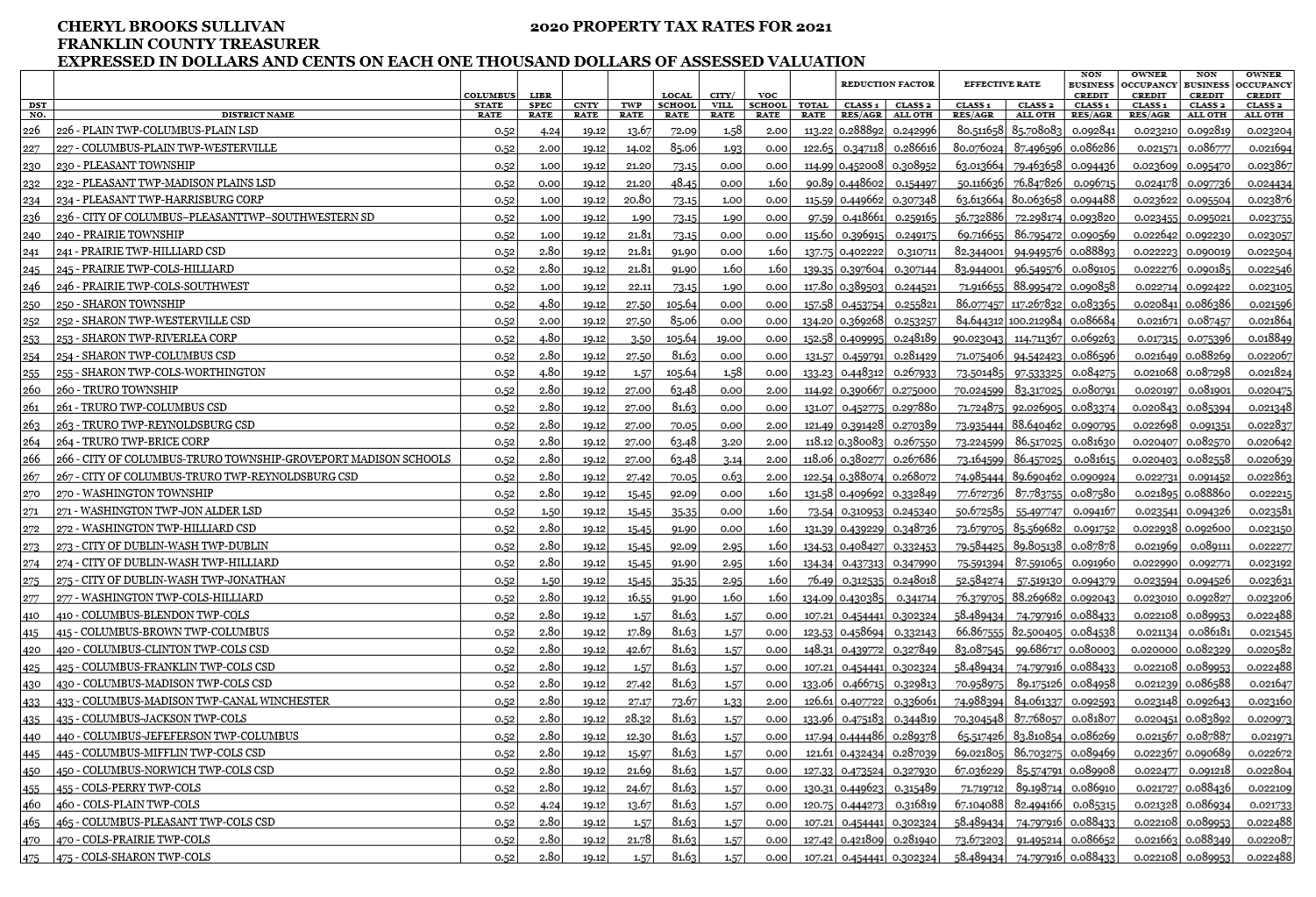

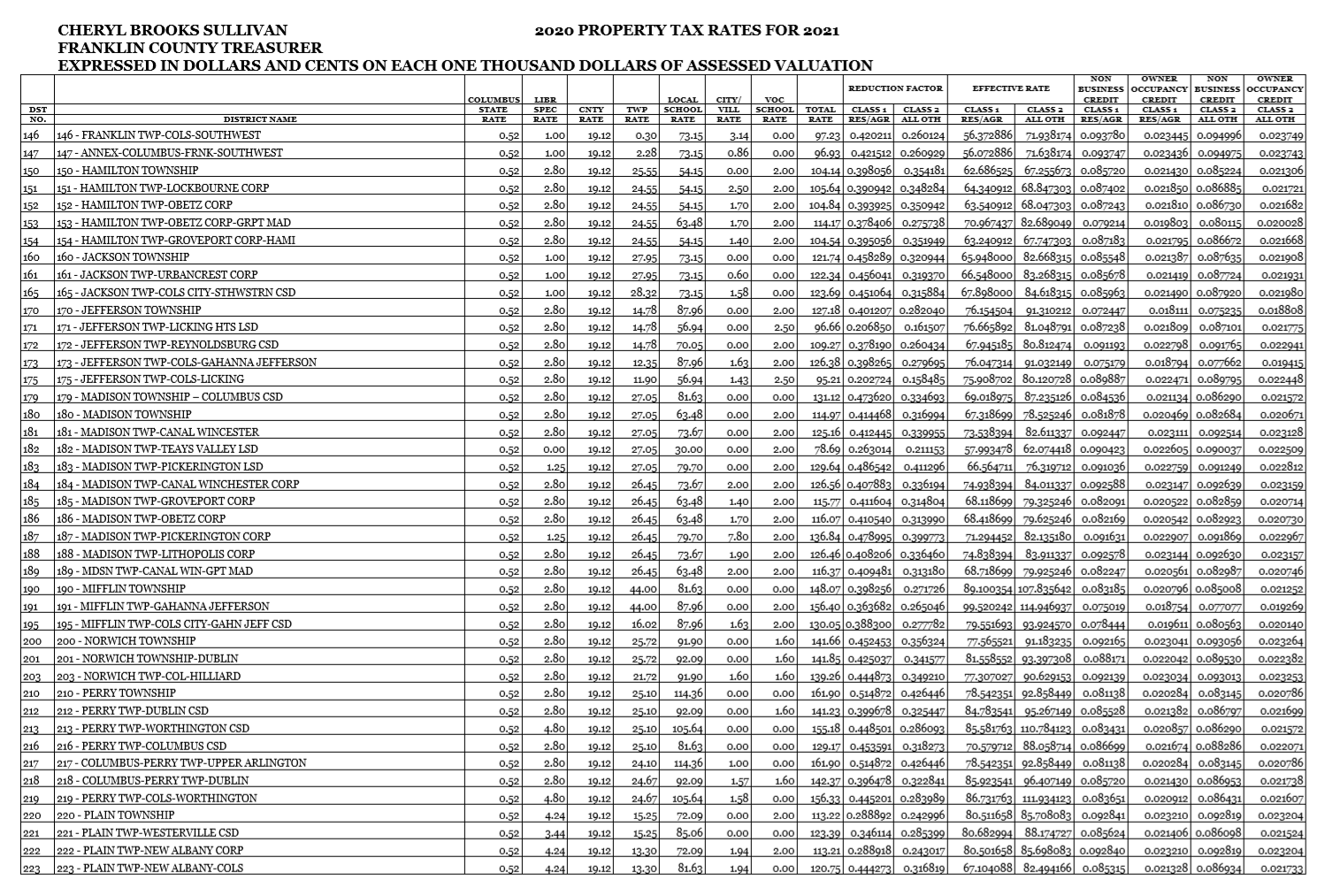

Franklin County Treasurer Tax Rates

Franklin County Treasurer Tax Rates

Why Is My Property Tax Bill Higher I Thought Monroe County Cut Taxes

Real Estate Is The Safest Investment In The World Safe Investments Real Estate Buyers Home Buying Process

Real Estate Is The Safest Investment In The World Safe Investments Real Estate Buyers Home Buying Process

Franklin County Treasurer Tax Rates

Franklin County Treasurer Tax Rates

40 What Is A Tax Receipt For Donations Ts4b Fundraising Donations West High School Receipt

40 What Is A Tax Receipt For Donations Ts4b Fundraising Donations West High School Receipt

Nj Counties With The Highest Lowest Property Taxes Property Tax Tax County

Nj Counties With The Highest Lowest Property Taxes Property Tax Tax County

Get Our Example Of Interior Design Purchase Order Template Purchase Order Template Templates Purchase Order

Get Our Example Of Interior Design Purchase Order Template Purchase Order Template Templates Purchase Order

Franklin County Treasurer Tax Rates

Franklin County Treasurer Tax Rates

Why Is My Property Tax Bill Higher I Thought Monroe County Cut Taxes

Why Is My Property Tax Bill Higher I Thought Monroe County Cut Taxes

Think Your Property Tax Bill Is Too High If So Here S How To File A Formal Complaint With The County Auditor To Dispute Your Property Tax Dispute Assessment

Think Your Property Tax Bill Is Too High If So Here S How To File A Formal Complaint With The County Auditor To Dispute Your Property Tax Dispute Assessment

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home