Property Tax Records In Maricopa County Az

Maricopa County Assessors Office. Maricopa County Assessor Purpose.

Maricopa County Assessor S Office

Maricopa County Assessor S Office

Visit the Maricopa County Treasurers Office for information on reading and understanding your tax bill.

Property tax records in maricopa county az. The Maricopa County Assessors Office is open to serve you by phone email and by appointment only at this. Maricopa County AZ Property Tax Search by Address. How does the City calculate its property tax rate.

Annually the tax rate is calculated based on the tax levy for each taxing. The Assessor annually notices and administers over 18 million real and personal property parcelsaccounts with full cash value of more than 6075 billion in 2020. The number is composed of the book map and parcel number as defined by the Maricopa County Assessors Office.

Certain types of Tax Records are available to the general public while some Tax Records are only available by making a Freedom of Information Act FOIA request to access public records. Maricopa Treasurer 602 506 - 8511. Your property tax bill lists each agencys tax rate and the exact amount that each agency receives.

Maricopa Recorder 602 506 - 3535. Maricopa Assessor 602 506 - 3406. According to the Office of the Maricopa County Assessor this is the physical location of the property being represented by this bill.

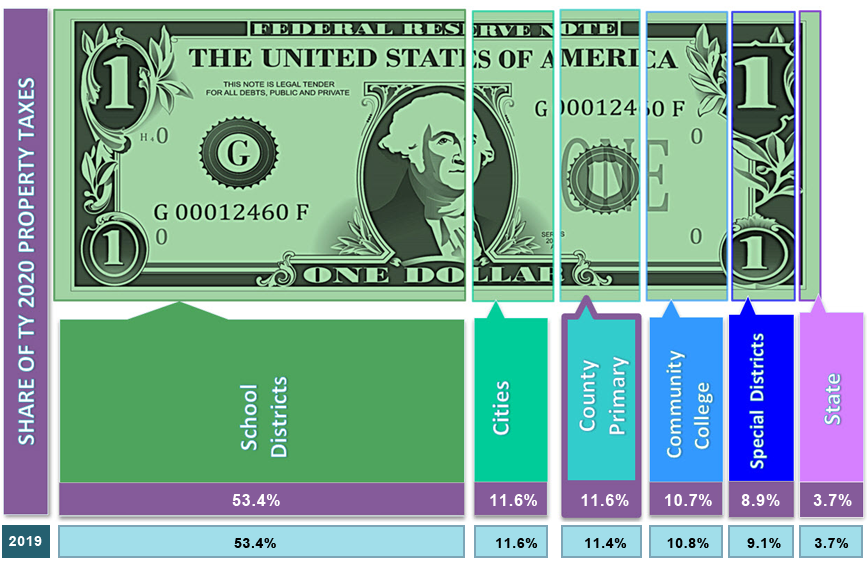

Interactive map of parcels in Maricopa County. Annually cities school districts special taxing districts and Maricopa County establish their own tax levy or the amount of taxes that will be billed. Learn about Tax Records including.

Delinquent and Unsold Parcels. Arizona is ranked 874th of the 3143 counties in the United States in order of the median amount of property taxes collected. Maricopa NETR Mapping and GIS.

The Maricopa County Treasurers Office is to provide billing collection investment and disbursement of public monies to special taxing districts the county and school districts for the taxpayers of Maricopa County so the taxpayer can be confident in the accuracy and accountability of their tax dollars. Eddie Cook Maricopa County Assessors Office. It is important to note that this program does not freeze your property TAXES it freezes the taxable portion of your property VALUE.

See what the tax bill is for any Maricopa County AZ property by simply typing its address into a search bar. See Maricopa County AZ tax rates tax exemptions for any property the tax assessment history for the past years and more. The Assessor annually notices and administers over 18 million real and personal property parcelsaccounts with full cash value of.

Contact the county treasurer where. Historic Aerials 480 967 - 6752. Where to get free Tax Records online.

How to challenge property tax. For property located in Maricopa County only. Go to Data Online.

The Assessors duty is to locate identify and equitably assess all property in Maricopa County. The chart below is based on average property taxes paid by Goodyear residents. Go to Data Online.

These records can include Maricopa County property tax assessments and assessment challenges appraisals and income taxes. Annually the Maricopa County Assessor determines the Full Cash and Limited Property values used to determine the assessed values on the tax bill calculations. The Business Personal Property Unit assists in the assessment of this type of property.

Forms Library AgricultureLand Appeals Business Personal Property Common Area Forms Historic Property Tax Reclassification Mobile Homes Organizational Exemptions Personal Exemptions Residential Property Valuation Relief Programs. Business Personal Property can include assets such as tables desks Computers machinery. In-depth Property Tax Information.

Maricopa County collects on average 059 of a propertys assessed fair market value as property tax. To freeze application year Limited Property Value of a Primary Residence owned by seniors based on income age and residency. Go to Data Online.

Maricopa Mapping GIS. Go to Data Online. 20 rows Property taxes are paid to the county treasurers office.

The median property tax in Maricopa County Arizona is 1418 per year for a home worth the median value of 238600. How to search for Maricopa County property Tax Records.

Taxes Maricopa County Assessor S Office

Taxes Maricopa County Assessor S Office

Maricopa County Assessor S Office

Maricopa County Assessor S Office

Dominic S Fago Was Involved In Stolen Securities In Scottsdale And May Have Been An Mobster Fago Was Once Fined 500 For G Crime Family Organized Crime Crime

Dominic S Fago Was Involved In Stolen Securities In Scottsdale And May Have Been An Mobster Fago Was Once Fined 500 For G Crime Family Organized Crime Crime

Real Estate Contract Real Estate Contract Real Estate Buying Selling Real Estate

Real Estate Contract Real Estate Contract Real Estate Buying Selling Real Estate

Maricopa County Az Property Tax Bill Search Maricopa County Property Tax Search

Maricopa County Az Property Tax Bill Search Maricopa County Property Tax Search

Maricopa County Treasurer S Letter Meant As Farewell Not Politics

Maricopa County Treasurer S Letter Meant As Farewell Not Politics

Maricopa County Assessor S Office

Maricopa County Assessor S Office

Life Home Enewsletter W Recipe 12 December 2016 Sellers Home Selling Tips Home Buying Recipes

Life Home Enewsletter W Recipe 12 December 2016 Sellers Home Selling Tips Home Buying Recipes

1443 Dartmouth Ave Baltimore Md 21234 Zillow Paradise Valley Valley Mansions

1443 Dartmouth Ave Baltimore Md 21234 Zillow Paradise Valley Valley Mansions

Clyde Dinnell Was An Involved In Land And Securities Fraud Clyde Was Sentenced To 18 Months In Prison And Fined Organized Crime Superior Court Maricopa County

Clyde Dinnell Was An Involved In Land And Securities Fraud Clyde Was Sentenced To 18 Months In Prison And Fined Organized Crime Superior Court Maricopa County

Chuckie English Chicago Outfit Chicago Mobster

Chuckie English Chicago Outfit Chicago Mobster

The Future Of Housing Rises In Phoenix Residential Real Estate House Flippers Vacation Home

The Future Of Housing Rises In Phoenix Residential Real Estate House Flippers Vacation Home

Arizona 1945 Joe Bonanno And His Son Salvatore Bill Bonanno Mafia Gangster Gangster Crime Family

Arizona 1945 Joe Bonanno And His Son Salvatore Bill Bonanno Mafia Gangster Gangster Crime Family

Joseph Bonanno Sr Tucson Police Investigate A Bombing At The Home Of Joe Bonanno In Tucson In 1968 Two Sticks Of D Joseph Bonanno Al Capone Organized Crime

Joseph Bonanno Sr Tucson Police Investigate A Bombing At The Home Of Joe Bonanno In Tucson In 1968 Two Sticks Of D Joseph Bonanno Al Capone Organized Crime

Keyglee Franchising Real Estate Investing Investing Real Estate

Keyglee Franchising Real Estate Investing Investing Real Estate

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home