How To Check My Property Tax Bill Online

Five months elapse before real property owners can be penalized for non-payment of taxes. The Senior Citizen Real Estate Tax Deferral Program.

Search Unsecured Property Taxes

Search Unsecured Property Taxes

The payment amount.

How to check my property tax bill online. ITS THE BEST WAY. You do not need to request a duplicate bill. You will receive a Property Tax Bill if you pay the taxes yourself and have a balance.

Property Tax Appeal Board Refunds. Real Estate Tax Payment PAMS offers customers an easy and secure way to view print and pay their Real Estate Tax bills online. If a bank or mortgage company pays your property taxes they will receive your property tax bill.

Current year is available between October 1 and June 30 only. Your banks ABA routing number from your check Your checking account number. Go to your cart check out and pay your bill.

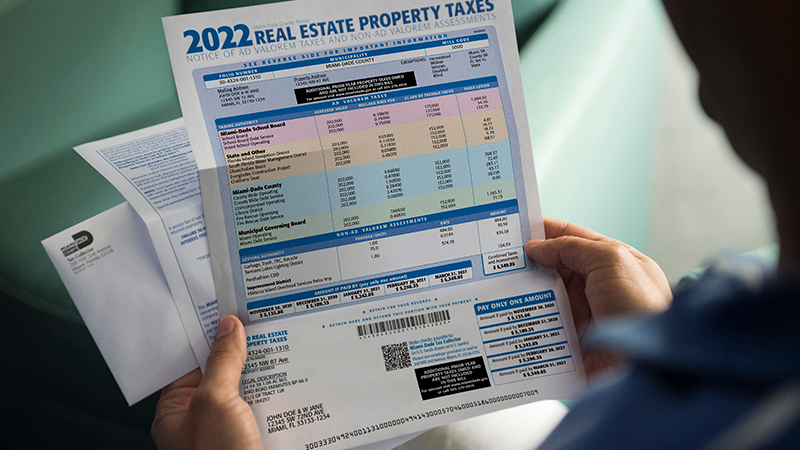

Florida Statute 197162 offers taxpayers a discount paying their taxes early. The information on the bill can also help you determine whether your assessment is accurate. Payment plan details if you have one.

To pay by e-Check you must have the following information. Digital copies of select notices from the IRS. Key information from your most recent tax return.

To locate the amount of your Secured Property Taxes click the following link How much are my property taxes. IMPORTANT - Property Tax Payments We are not accepting in-person property tax payments at this time. And enter your Assessors Identification Number.

The amount you owe updated for the current calendar day. PAMS in partnership with Invoice Cloud accepts ACHelectronic check electronic fund transfer from your checking or savings account and creditdebit card payments of bills. The Tax Office accepts e-checks credit cards and debit cards for online payment of property taxes.

Create or view your account. Bills are generally mailed and posted on our website about a month before your taxes are due. Statements of vehicle property taxes paid to the NC DMV at the time of registration are not available on the Countys web site.

When searching for a current secured defaulted supplemental or escape bill please search either by the parcel number or the current mailing address. Your Economic Impact Payments if any. When searching for an unsecured bill for businesses boats airplanes etc please search by the 4-digit year and 6-digit bill number.

Property Tax Information Using the tax bill search you can browse billing and payment information for real estate personal business and motor vehicle accounts and select accounts to pay online. Each eCheck transaction is limited to 99999999. We encourage everyone to use other payment methods such as online eCheck and creditdebit card payments telephone creditdebit card payments or mail in your payment.

There is no cost to you for electronic check eCheck payments. Your payment history and any scheduled or pending payments. You can select property tax records to view andor make payment on-line by credit card or automatic deduction from your bank account as appropriate.

For Unsecured Property Tax Bills each PIN. As a reminder there is no cost for e-Check payments online. Services for Seniors Exemptions.

You will need to use a Personal Identification Number PIN which is printed on both Secured and Unsecured Property Tax Bills. Your balance details by year. ENTER ONE OF THE FOLLOWING TO VIEW PROPERTY TAX RECORDS.

Your telephone number. You can always download and print a copy of your Property Tax Bill on this web site. You can access this new web site by clicking the link below or by directing your browser to.

This website provides current year and delinquent secured tax information. Property tax bills and receipts contain a lot of helpful information for taxpayers. All tax payments are due before April 1 at which time the taxes become delinquent and additional charges will apply.

If you have further questions please contact our office at 951955-3900 or e-mail your questions to. Search for your bill using parcelbill number mailing address or unsecured bill number. Receive your bill by email.

Your check number. For Secured Property Tax Bills each PIN is unique for each Assessors Identification Number AIN. It offers premium security and ease of use.

Tax notices are mailed on or before November 1 of each year. Request tax deferral for seniors military. Your Secured Property Tax Bill contains your Assessors Identification Number AIN and Personal Identification Number PIN which you will need to complete the transaction.

Paying by e-check is free fast and easy. Beyond the amount of taxes you owe the bills indicate where your taxes are going and how much more is being collected by your local governments each year. Use this convenient online service to view details about your tax bill upcoming due dates balances and more.

Your property tax account number. Search your property tax history. If you lost the original bill and are making a payment you can pay electronically or print out and send in the online copy with your tax payment.

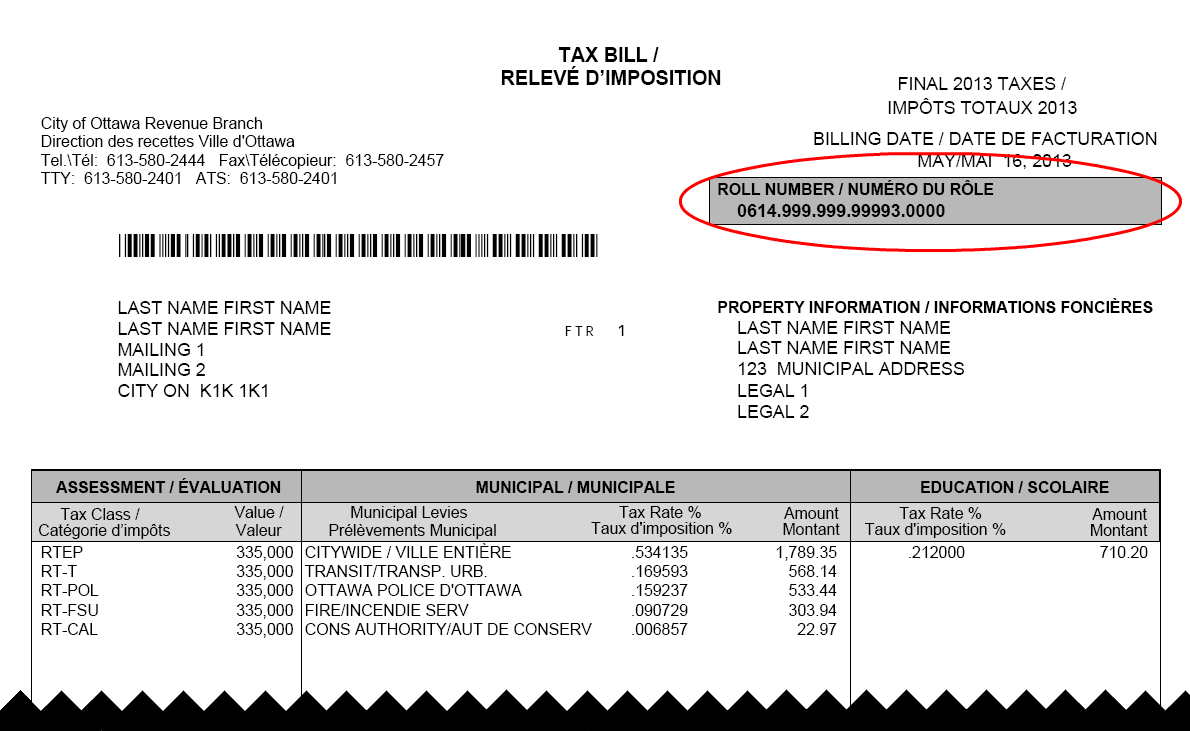

What S My Property S Tax Identification Number

What S My Property S Tax Identification Number

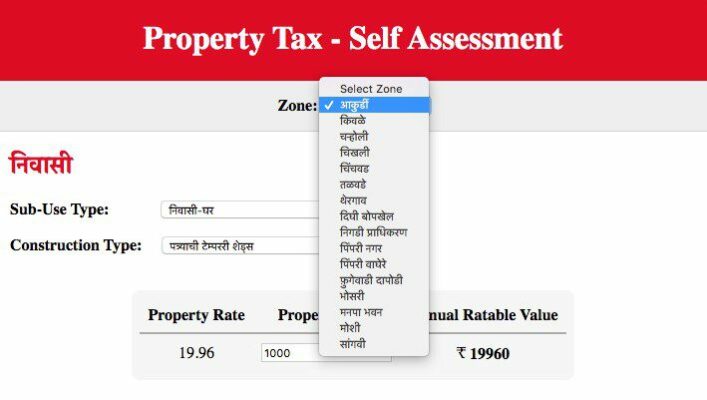

Property Tax Chennai Online Calculator And Payment Guide

Property Tax Chennai Online Calculator And Payment Guide

Pay Your Tax Bill City Of Ottawa

Pay Your Tax Bill City Of Ottawa

Current Payment Status Lake County Il

Pay Your Property Tax Bill Online

Pay Your Property Tax Bill Online

Secured Property Taxes Treasurer Tax Collector

Secured Property Taxes Treasurer Tax Collector

What S My Property S Tax Identification Number

What S My Property S Tax Identification Number

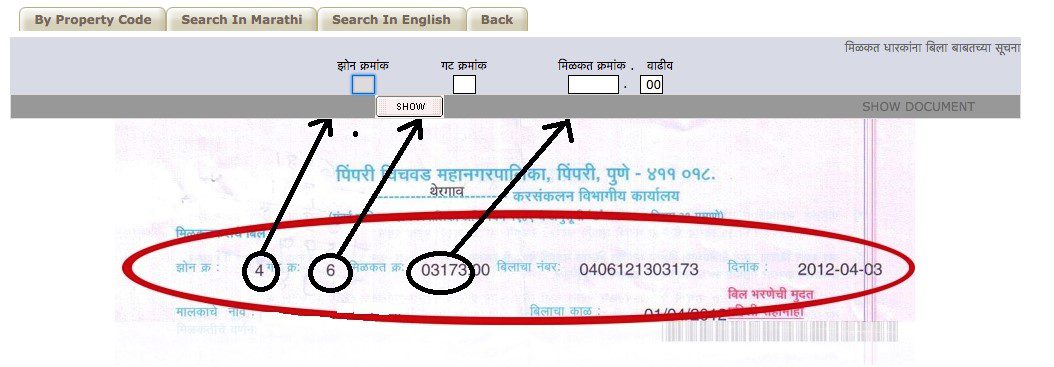

Pay Pcmc Property Tax Online A Step By Step Guide

Pay Pcmc Property Tax Online A Step By Step Guide

Understanding Your Property Tax Bill Department Of Taxes

Understanding Your Property Tax Bill Department Of Taxes

Understanding Your Property Tax Bill Department Of Taxes

Understanding Your Property Tax Bill Department Of Taxes

Property Tax Chennai Online Calculator And Payment Guide

Property Tax Chennai Online Calculator And Payment Guide

Clay County Mo Collector And Assessor S Offices Claycountymo Tax

Clay County Mo Collector And Assessor S Offices Claycountymo Tax

What S My Property S Tax Identification Number

What S My Property S Tax Identification Number

Property Tax Chennai Online Calculator And Payment Guide

Property Tax Chennai Online Calculator And Payment Guide

Pay Pcmc Property Tax Online A Step By Step Guide

Pay Pcmc Property Tax Online A Step By Step Guide

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home