How Do You Qualify For Homestead Exemption In Sc

You will need to provide proof of your eligibility. To be eligible a taxpayer must be 65 years of age or older as of Dec.

2018 Guide To Maine Home Solar Incentives Rebates And Tax Credits Tax Credits Incentive West Virginia

2018 Guide To Maine Home Solar Incentives Rebates And Tax Credits Tax Credits Incentive West Virginia

It must be your primary residence 2.

How do you qualify for homestead exemption in sc. As of December 31 preceding the tax year of the exemption I was 65 years of age or was declared totally and. Where do I apply. Was a legal resident of South Carolina for one calendar Year.

I hold complete fee simple title or life estate to my primary residence. Was 65 years of age. As of December 31 preceding the tax year of the exemption you were a legal resident of South Carolina for.

The South Carolina Homestead Exemption allows eligible taxpayers to be tax exempt on the first 50000 of assessed value on their primary residence. You may qualify if you are one of the following. If you are unable to go to the Auditors Office you may authorize someone to make application for you.

As of December 31 preceding the tax year of the exemption I. Age 65 on or before December 31 preceding the tax year in which you wish to claim the exemption. As of December 31 preceding the tax year of the exemption you were a legal resident of South Carolina for one calendar year.

31 of the previous tax year or 100 percent totally and permanently disabled or legally blind. Now you probably want know how to qualify. As of December 31 preceding the tax year of the exemption I was a legal resident of South Carolina for one year.

If you are applying due to age bring your birth certificate. Most property tax exemptions are found in South Carolina Code Section 12-37-220. Details on the Homestead Exemption Program.

If you qualify the Homestead Exemption Program can reduce your real property tax bill. Where do I apply. If youre having problems with or questions about this website please email the Countys Webmaster.

What documents do I need. Do I qualify for the Homestead Exemption. A legal resident of South Carolina for at least one year on or before December 31 of the year prior to the exemption.

In 1972 the SC. You hold complete fee simple title to your primary legal residence or life estate to your primary legal residence or you. You must also be one of the following.

The Homestead Exemption Program exempts 50000 from the value of your legal residence for property tax purposes. I hold complete fee simple title or life estate to my primary residence. You must apply for the Homestead Exemption at your County Auditors Office.

Real Estate taxation is a year in arrears meaning to be exempt for the current year you must be the owner of record and your effective date of disability must be on or before 1231 of the previous year. You hold complete fee simple title or life estate to your primary residence. You may qualify if.

General Assembly passed the Homestead Exemption Law which provides real estate property tax relief for South Carolinians who are age 65 and over totally and permanently disabled or legally blind. You must be a legal resident of South Carolina for at least one year 3. As of December 31 preceding the tax year of the exemption I.

65 years of age. Do I qualify for the Homestead Exemption. You hold complete fee simple title or life estate to your primary residence.

A homestead exemption is a legal mandate that shields a homeowner from the loss of his or her home usually due to the death of a home-owning spouse a. Applicants Must Be a legal resident of South Carolina for at least one year on or before December 31 preceding the year for which the exemption is claimed. If I move do I qualify for the Homestead Exemption Yes an exemption is granted on the new residence if you continue to meet the following requirements.

You must apply for the Homestead Exemption at your County Auditors office. To be eligible a. If you are unable to go to the Auditors office you may authorize someone to apply for you.

As of December 31 preceding the tax year of the exemption you were a legal resident of South Carolina for one calendar. The South Carolina Homestead Exemption allows eligible taxpayers to be tax exempt on the first 50000 of assessed value on their primary residence. Be at least 65 years old be declared disabled by state or federal agency or be legally blind.

The exemption excludes the first 50000 from the fair market value of your legal residence. To qualify for the Homestead Exemption you hold complete fee simple title to your primary legal residence or life estate to your primary legal residence or you are the beneficiary of a trust that holds title to your primary legal residence.

South Carolina Launches No Cost Solar Program Solar Panels Solar Solar House

South Carolina Launches No Cost Solar Program Solar Panels Solar Solar House

Https Www Newberrycounty Net Sites Default Files Uploads Departments Auditor Id 1618 Pdf

What The Interest Rate Increase Means For Homebuyers Fairway Interest Rates Mortgage Interest Rates Home Buying

What The Interest Rate Increase Means For Homebuyers Fairway Interest Rates Mortgage Interest Rates Home Buying

Your 2019 Guide To Filing Your Homestead Exemption Bhgre Homecity

Your 2019 Guide To Filing Your Homestead Exemption Bhgre Homecity

What Is A Homestead Exemption And How Does It Work Lendingtree

What Is A Homestead Exemption And How Does It Work Lendingtree

How To Apply For A Homestead Exemption Howstuffworks

How To Apply For A Homestead Exemption Howstuffworks

Https Www Aikencountysc Gov Reference Tau Homestead Pdf

Ten Tips To Prevent A Barn Fire Homesteading Best Barns Barn

Ten Tips To Prevent A Barn Fire Homesteading Best Barns Barn

Https Dor Sc Gov Resources Site Lawandpolicy Advisory 20opinions Rr97 18 Pdf

6 Things To Know About Homestead Exemptions Newhomesource

6 Things To Know About Homestead Exemptions Newhomesource

What The Interest Rate Increase Means For Homebuyers Fairway Interest Rates Mortgage Interest Rates Home Buying

What The Interest Rate Increase Means For Homebuyers Fairway Interest Rates Mortgage Interest Rates Home Buying

Best Map Of Sandestin And 30a Beaches Map Of Scenic 30a And South Walton Florida 30a In 2021 Map Of Florida Beaches 30a Beach Map Of Florida

Best Map Of Sandestin And 30a Beaches Map Of Scenic 30a And South Walton Florida 30a In 2021 Map Of Florida Beaches 30a Beach Map Of Florida

40 Projects For Building Your Backyard Homestead A Hands On Step By Step Sustainable Living Guide Walmart Backyard Farming Urban Chicken Farming Backyard

40 Projects For Building Your Backyard Homestead A Hands On Step By Step Sustainable Living Guide Walmart Backyard Farming Urban Chicken Farming Backyard

How Capital Gains Tax Works Capital Gains Tax Capital Gain Federal Income Tax

How Capital Gains Tax Works Capital Gains Tax Capital Gain Federal Income Tax

This Video Discusses The Homestead Exemption Laws You Can View More Videos About What Do You Need To Know Abou Texas Real Estate Real Estate Studying Library

This Video Discusses The Homestead Exemption Laws You Can View More Videos About What Do You Need To Know Abou Texas Real Estate Real Estate Studying Library

What Is Homestead Exemption James Gay S Blog Banksouth Mortgage

What Is Homestead Exemption James Gay S Blog Banksouth Mortgage

How To File For Florida Homestead Exemption Tampa Bay Title

How To File For Florida Homestead Exemption Tampa Bay Title

Barndominium Combination Barn And Condominium Barndominium Floor Plans Barndominium Barndominium Plans

Barndominium Combination Barn And Condominium Barndominium Floor Plans Barndominium Barndominium Plans

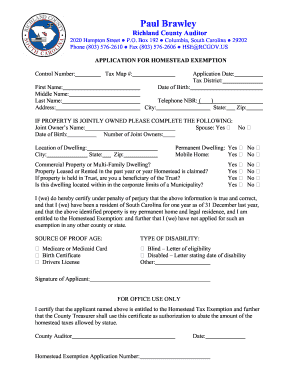

Homestead Exemption Fill Out And Sign Printable Pdf Template Signnow

Homestead Exemption Fill Out And Sign Printable Pdf Template Signnow

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home