Yearly Property Tax New York

New Jersey has the highest property tax rate at 22 percent followed by Illinois Texas Vermont and Connecticut. NYCs Property Tax Fiscal Year is July 1 to June 30.

Property Tax Map Reforming Government

Property Tax Map Reforming Government

New York property tax rates are set by local governments and they therefore vary by location.

Yearly property tax new york. About 129 million New York taxpayers are estimated to be eligible to receive the income tax credit. School districts are the largest users of the property tax. Estimate the propertys market value.

A propertys annual property tax bill is calculated by multiplying the taxable value with the tax rate. Property tax forms Exemption applications must be filed with your local assessors office. The Department of Finance determines the market value differently depending on they type of property you own.

Because the property burned down after Taxable Status Date your 2011 assessment was based on your property. After a county-wide reassessment with more than half of homeowners taxes. Of that 62 percent.

NYC is a trademark and service mark of the City of New York. Property taxes are determined by individual counties and municipalities and vary widely across the country. Annual Property Tax Report.

You may need to report this information on your 2020 federal income tax return. Bills are generally mailed and posted on our website about a month before your taxes are due. Class 4 - 10537.

In other words credits are based on the amount of property taxes paid in excess of 6 percent of an eligible taxpayers federal adjusted gross income. Your home burned down on March 15 2011 leaving only a vacant lot. Property Records ACRIS Deed Fraud Alert.

Get Form 1099-G for tax refunds. NYC is a trademark and service mark of the City of New York. Property Bills Payments.

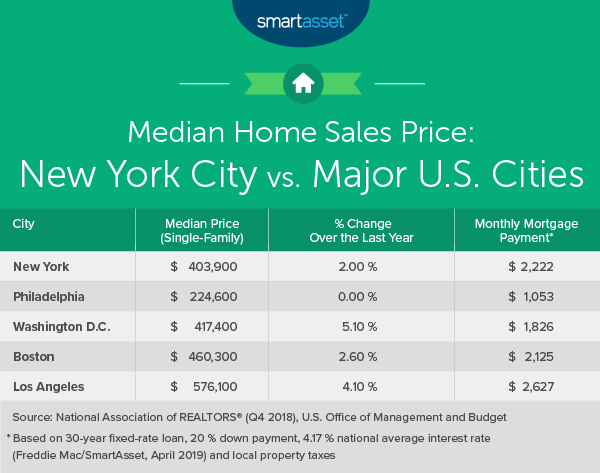

Class 3 - 12536. The average effective property tax rate in the Big Apple is just 088 more than half the statewide average rate of 169. Property tax rates imposed by school districts tend to be the highest at an average of 1764 per each 1000 in assessed value as of 2019.

The median property tax in New York is 375500 per year for a home worth the median value of 30600000. The information is listed by categories such as borough tax class and type of building. Where the property tax goes.

These reports provide property tax data such as market and assessed values exemptions and abatements. CBSNewYork Property taxes are front and center in Nassau County. Data and Lot Information.

In fact many New York counties outside of New York City have rates exceeding 250 which is more than double the national average of 107. Counties in New York collect an average of 123 of a propertys assesed fair market value as property tax per year. Finance mails property tax bills four times a year.

See our Municipal Profiles for your local assessors mailing address. Multiply the estimated market value by the level of assessmentî which is 6 Tax Class 1 or 45 all other classes. In New York City property tax rates are actually fairly low.

New York has the seventh highest tax rate at 168 percent. Your September 2011 school taxes and January 2012 towncounty taxes are based on the value of the vacant lot. If you received an income tax refund from us for tax year 2019 view and print New York States Form 1099-G on our website.

In fiscal years ending in 2009 local governments and school districts outside of New York City levied 2887 billion in property taxes. For Class 1 Properties and. Unlike many states there is no personal property tax in New York.

Some states have notoriously high property tax rates New Jersey Illinois and New Hampshire are all up there while other states are known for their low property tax rates Louisiana Hawaii and Alabama for example. Visit Department of Labor for your unemployment Form 1099-G. You either pay your property taxes two or four times a year depending on the propertys assessed value.

Property Tax Rates for Tax Year 2020. Property Tax Bills. Rather than taxing items such as jewelry and vehicles only real property is taxed.

Class 1 - 21167. Class 2 - 12473.

Santa Clara County Ca Property Tax Calculator Smartasset

Santa Clara County Ca Property Tax Calculator Smartasset

New Mexico Property Tax Calculator Smartasset

New Mexico Property Tax Calculator Smartasset

Property Tax Map Tax Foundation

Property Tax Map Tax Foundation

Cook County Il Property Tax Calculator Smartasset

Cook County Il Property Tax Calculator Smartasset

Nyc Mortgage Recording Tax Of 1 8 To 1 925 2021 Hauseit

Nyc Mortgage Recording Tax Of 1 8 To 1 925 2021 Hauseit

Nyc Mansion Tax Calculator For Buyers Interactive Hauseit

Nyc Mansion Tax Calculator For Buyers Interactive Hauseit

Nyc Mansion Tax Calculator For Buyers Interactive Hauseit

Nyc Mansion Tax Calculator For Buyers Interactive Hauseit

Easyknock South Carolina Property Tax Rate A Complete Guide

Easyknock South Carolina Property Tax Rate A Complete Guide

What Is The True Cost Of Living In New York City Smartasset

What Is The True Cost Of Living In New York City Smartasset

Nyc Mansion Tax Of 1 To 3 9 2021 Overview And Faq Hauseit

Nyc Mansion Tax Of 1 To 3 9 2021 Overview And Faq Hauseit

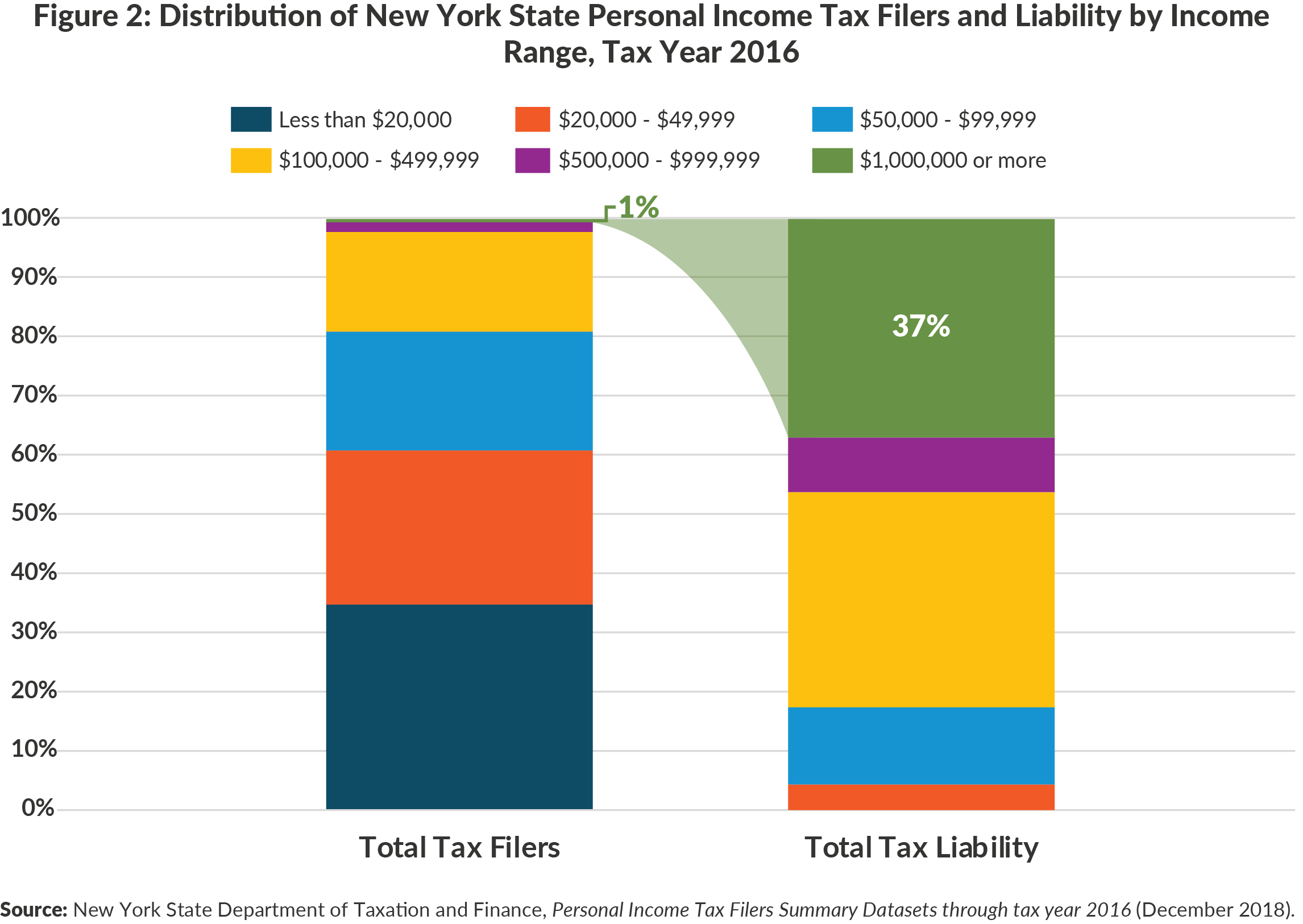

Personal Income Tax Revenues In New York State And City Cbcny

Personal Income Tax Revenues In New York State And City Cbcny

The Results Are In The Mansion Tax Has New York City Real Estate Sales Plummeting

The Results Are In The Mansion Tax Has New York City Real Estate Sales Plummeting

Annual State Of The City S Economy And Finances Office Of The New York City Comptroller Scott M Stringer

Annual State Of The City S Economy And Finances Office Of The New York City Comptroller Scott M Stringer

King County Wa Property Tax Calculator Smartasset

King County Wa Property Tax Calculator Smartasset

New Hampshire Property Tax Calculator Smartasset

New Hampshire Property Tax Calculator Smartasset

Property Taxes How Does Your County Compare Cnnmoney Com

Property Taxes How Does Your County Compare Cnnmoney Com

How Does The Deduction For State And Local Taxes Work Tax Policy Center

How Does The Deduction For State And Local Taxes Work Tax Policy Center

Nyc Mansion Tax Calculator For Buyers Interactive Hauseit

Nyc Mansion Tax Calculator For Buyers Interactive Hauseit

Local New York Property Taxes Ranked By Empire Center Empire Center For Public Policy

Local New York Property Taxes Ranked By Empire Center Empire Center For Public Policy

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home