How To Apply For Homestead Exemption In Pasco County

Mandatory for online filing Social. The second 25000 is to be applied to the value between 50000 and 75000 and does not include school taxes.

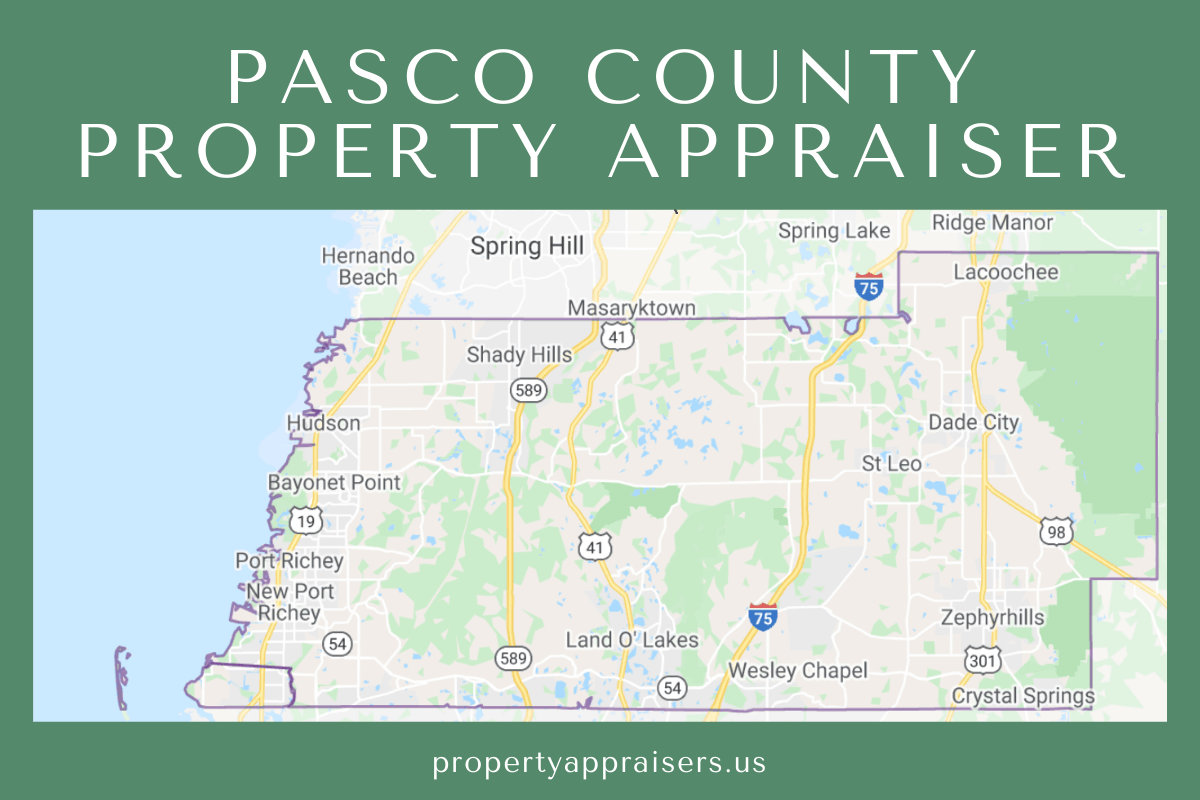

Pasco County Property Appraiser How To Check Your Property S Value

Pasco County Property Appraiser How To Check Your Property S Value

Signature property appraiser or deputy Date Entered by Date.

How to apply for homestead exemption in pasco county. If You are a Pasco County Resident you can visit New port Richey Office 727-847-8151 or. The second 25000 excludes school board taxes and applies to. Is there a lien on my property.

This requirement extends to all ownership changes including title changes and pertains to the exclusive property. To make application for Homestead exemption you must own and occupy your home prior to January 1st of the year in which are eligible to apply. What is the interest rate on the deferred amount.

The homeowner must apply for an exemption for the new property as well. 2500000 of your exemption does not exempt it from school taxes. If a homes assessed value is 75000 or more the owner would receive the full 50000 exemption benefit.

Valid Florida Issued Drivers License or Identification Card. Florida Voters ID if you vote Immigration documents if not a US. The year application is made shall be entitled to an exemption from all taxation except nonad valorem - taxes up to the assessed valuation of 25000.

Property owners with Homestead Exemption and an accumulated SOH Cap can apply to transfer or Port the SOH Cap value up to 500000 to a new homestead property. This application is known as the Transfer of Homestead Assessment Difference and the annual deadline to file for this benefit and any other property tax exemption is March 1st. Social Security numbers for your spouse and any owner who resides on the property.

Contact your local property appraiser if you have questions about your exemption. Must be a permanent resident of the State of Florida. The first 25000 of this exemption applies to all taxing authorities.

Homestead Save our Homes and other exemptions - English Homestead Save our Homes and other exemptions - Español. The standard homestead exemption is not the only potential way for homeowners to reduce their tax burden. In order to receive the benefit of the homestead exemption widow or widower exemption and all disability exemptions an initial application for the specific exemption must be filed with the Property.

If you have a mobile home you will need your title or registration to the mobile home and the deed to the real estate. When qualifying for the Homestead Exemption you will need the following documents for all property owners applying. Neither you nor your spouse may receive a residency-required exemption in any other state.

Owner should provide the address of the property tax bill or deedtitle. First-time Homestead Exemption applicants and persons applying for the Homestead. How do you apply.

Documents should reflect the address of your homesteaded property. Apply for a Homestead Exemption. The first 25000 is entirely exempt.

File By Mail We are pleased to offer you the convenience of filing by mail for your Homestead exemption. Youll go to the property appraisers office and sign an application showing your ownership and further swearing that you are a resident of the state of Florida show them your Florida drivers license. The interest rate is equal to the semiannually compounded rate of.

Its on the assessed value between 5000000 and 7500000. To apply for this deferral you must submit Form DR-570 to the tax collector by March 31 the year after the assessment. DOR sends pre-printed Homestead Exemption Applications applications to the county assessors.

Agricultural Classification Tangible Personal Property. Please read the following requirements carefully. Homestead Exemption Application for Senior Citizens Disabled Persons and Surviving Spouses Real property and manufactured or mobile homes.

In Cook County an application must be filed with the County Assessor along with a valuation complaint. In order to receive the benefit of the homestead exemption widow or widower exemption and all disability exemptions an initial application for the specific exemption must be filed with the Property Appraisers Office. FL Stat 196011 11.

File the signed application for exemption with the county property appraiser. Florida Drivers License or Florida ID if you do not drive. The Homestead Improvement Exemption may be granted automatically or a Form PTAX-323 Application for Homestead Improvement Exemption may be required by the Chief County Assessment Office.

It is the applicants responsibility to secure the application and required. You can visit your County Appraisers office in your Local Court House to File Your Exemption. HOW DO I QUALIFY.

File with the county auditor on or before December 31. Homestead Exemption Timeline v January. We are currently accepting timely 2022 exemption applications.

County assessors make the applications available and mail the pre-printed applications to prior-year applicants. The property appraiser has a duty to put a tax lien on your property if you received a homestead exemption.

Equestrian Estate For Sale In Pasco County Florida Escape The Hectic Corporate World And Come Home To The Co Resort Style Pool Custom Pools Custom Fireplace

Equestrian Estate For Sale In Pasco County Florida Escape The Hectic Corporate World And Come Home To The Co Resort Style Pool Custom Pools Custom Fireplace

Pasco County Property Appraiser How To Check Your Property S Value

Pasco County Property Appraiser How To Check Your Property S Value

Faqs Pasco County Property Appraiser

Faqs Pasco County Property Appraiser

Receipt Receipt Pasco County How To Apply

Receipt Receipt Pasco County How To Apply

Pasco County Florida Property Search And Interactive Gis Map

Pasco County Florida Property Search And Interactive Gis Map

Fillable Online Dr 501t Pasco County Property Appraiser Pascogovcom Fax Email Print Pdffiller

Fillable Online Dr 501t Pasco County Property Appraiser Pascogovcom Fax Email Print Pdffiller

Https Www Pascocountyfl Net Documentcenter View 55757 Section 2 Financial Structure Policy And Process

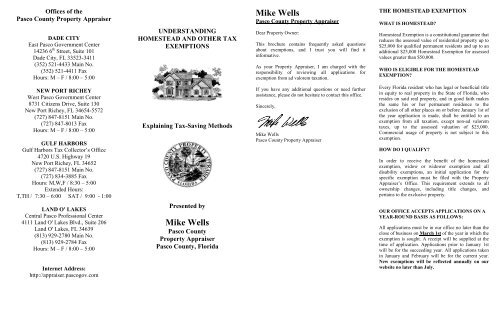

Offices Of The Pasco County Property Appraiser

Offices Of The Pasco County Property Appraiser

Pasco County Florida Va Home Loan Info Va Hlc

Pasco County Florida Va Home Loan Info Va Hlc

Pasco County Fl Recently Sold Homes

Pasco County Property Appraiser How To Check Your Property S Value

Pasco County Property Appraiser How To Check Your Property S Value

Https Www Pascocountyfl Net Documentcenter View 55757 Section 2 Financial Structure Policy And Process

Https Www Pascocountyfl Net Documentcenter View 55757 Section 2 Financial Structure Policy And Process

Viewing Sinkhole Properties Pasco County Property Appraiser

Viewing Sinkhole Properties Pasco County Property Appraiser

Https Www Pascocountyfl Net Documentcenter View 55761 Section 6 Appendix

Welcome Pasco County Property Appraiser

Welcome Pasco County Property Appraiser

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home