Toll Tax Exemption For Armed Forces Personnel

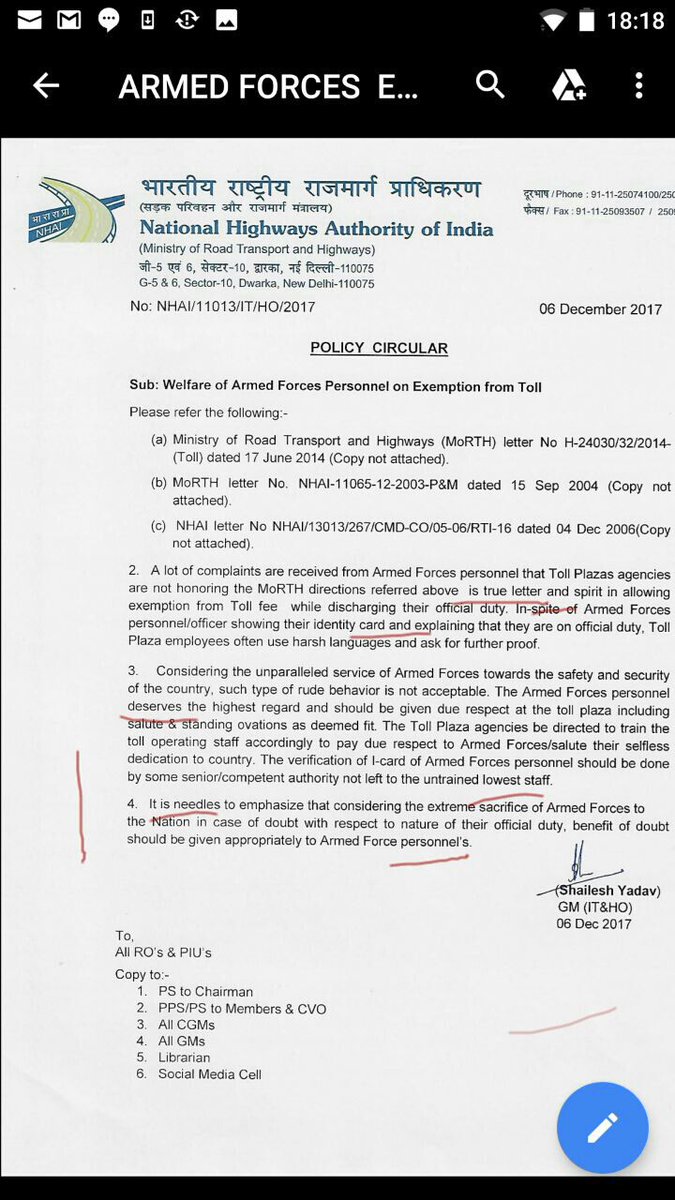

Toll Tax Exemption for Serving Defence Personnel NHAI Policy Letter 6 December 2017 The Armed Forces personnel deserves the highest regard and should be given due respect at the toll plaza including salute standing ovations as deemed fit Welfare of Armed Forces Personnel on Exemption from Toll National Highways Authority of India. Iii An Executive Magistrate.

Telangana Ex Servicemen Welfare Association Exemption From Toll Tax To Ex Servicemen

Telangana Ex Servicemen Welfare Association Exemption From Toll Tax To Ex Servicemen

2Ex servicemen are not exempted from paying Toll Tax.

Toll tax exemption for armed forces personnel. The NHAI clarification dated December 16 2019 says exemption under the Indian Toll Army and Air Force Act 1901 is available to the persons who are on duty and does not pertain to. Here is your Set of Toll Tax-exemption 202021 A Transporting and corresponding Here is your Set of Toll Tax-exemption 2020-21. Total property tax exemption for 100 disabled veterans and their surviving spouses.

Therefore it is explained there is no supply of exemption to person accessibility to any road user except which provided in the extant N-H charge Rules. Download the application form for exempted FASTag from the Dashboard. An insurance organization title insurance company or title insurance agent authorized to engage in insurance business in Texas now required to pay an annual tax under Chapter 4 or 9 Insurance Code measured by its gross premium receipts is exempt from franchise tax.

Click on the Upload Form and follow the process below. Log in to the IHMCL web portal with your Username and Password. To facilitate mass evacuations the policy also includes toll exemptions for the general public in the event of a declared emergency or natural disaster.

Thus normal documents for Leave or Duty and Identity should suffice to support entitlement. I the Ministry of Defense including those which are eligible for exemption in accordance with the provisions of the Indian Toll Army and Air Force Act 1901 and rules made there under as extended to Navy also. Veterans with 10 - 90 VA disability can get a reduction of their homes assessed value from 5000 -.

3Ex- servicemen Gallantry award winners are exempted to pay toll tax only on National Highways. Referring to an earlier memorandum dated June 17 2014 it stated that exemption under Indian Toll Army and Air Force Act 1901 from payment. Reproduced below is a self-explanatory letter sent to the Army Navy and the Air Force by me on the issue -TOLL TAX EXEMPTION GRANTED TO PRIVATE VEHICLES OF DEFENCE PERSONNEL ON DELHI-GURGAON EXPRESSWAY Sir.

Further as per MORTH OM dated 17062014 it has been clarified that exemption under Indian Toll Army and Air Force Act 1901 from payment of user fee is available to the persons who. Clear instructions have now been issued regaring toll exemption to defence personnel and their private vehicles on the Delhi-Gurgaon Expressway. Save as hereinafter otherwise provided in Rule 3 where exemption from the payment of tolls is claimed under the Indian Tolls Army and Air Force Act 1901 II of 1901 in respect of any person or body of persons or any property a pass in the Form annexed shall be presented on the.

The exemption is available only to serving armed forces personnel whether moving in government transport or their private vehicles. All defense personal are exempted from paying toll tax fee as per section 3 of Army and Airforce Act 1901 Tollswhether they are on duty or not and it extented to even hired vehicle ie. You dont need to be gazetted defense personnel to be exempted from paying tolls.

Ii The Central and Sate armed forces in uniform including Para military forces and police. Taxi or personal vehicle. Is provided on state highways and national highways.

Pl make the above blog complete and total as an authority for all. Toll exemption for Central Armed ForcesParamilitary eg. There is another blog which says that all defence personnelex-servicemen and thier families are exempted from paying toll tax on national highways.

Section 3a of the Indian Tolls Army Air Force Act 1901 provides toll exemption to all personnel of the Regular Forces without the requirement of being On Duty whereas Section 3 b provides toll exemption to Territorial Army and NCC personnel when on duty. All serving Armed Forces persons are Exempted from paying Toll tax under TOLL TAXES Exemption to Army Airforce Act 1901. 1Serving Officers are exempted from Toll Tax on duty off duty in uniform without uniform even in private vehicles.

2 Exemption of toll tax is extended to Para Military Forces is extended if they are on I official duty ii travelling in Mechanical Vehicle and iii in Uniform. Clarification is issued that Besides those on duty those Proceeding or Returning from Duty are also Exempted from Toll Tax. Select the exempted category listed on the above table.

With the revised toll exemption policy all state toll roads have the same policy for law enforcement and emergency vehicles. The President of India. Quoting the letter from Ex-servicemen welfare deptt and NHAIThanks.

The Vice President of India. I the Ministry of Defence including those which are eligible for exemption in accordance with the provisions of the Indian Toll Army and Air Force Act 1901 and rules made there under as extended to Navy also. Ex-servicemen are not exempted from paying toll tax on national highways.

Army Welfare Fund Archives Staffnews

Army Welfare Fund Archives Staffnews

What Are The Best Ways To Bypass The Toll Charges In India Quora

What Are The Best Ways To Bypass The Toll Charges In India Quora

India Of My Dreams Exemption From Nhai Toll Tax Letter Just Received From Mod

India Of My Dreams Exemption From Nhai Toll Tax Letter Just Received From Mod

What Are The Best Ways To Bypass The Toll Charges In India Quora

Exemption From Toll Tax For Army Personnel Terafiq

Exemption From Toll Tax For Army Personnel Terafiq

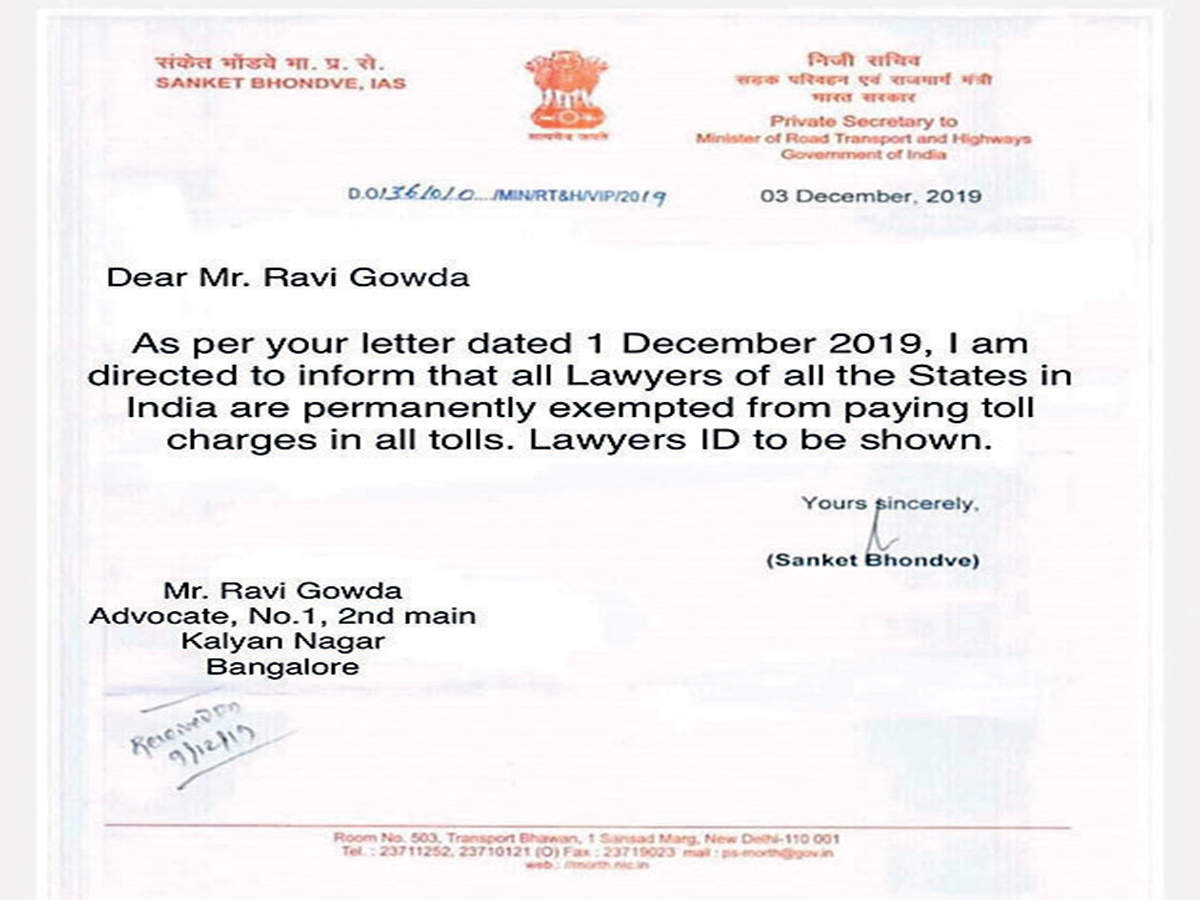

Are Lawyers Really Exempted From Paying At Toll Plazas Here S The Truth The New Indian Express

Are Lawyers Really Exempted From Paying At Toll Plazas Here S The Truth The New Indian Express

Fake News Buster Lawyers Aren T Exempted From Paying Toll Tax

Fake News Buster Lawyers Aren T Exempted From Paying Toll Tax

Is An Army Personnel Exempted From Toll Tax While He Is Travelling In A Personal Vehicle And Produces His Identity Card Quora

Mukul En Twitter In All The Circulars Which Nhai Is Issuing In 2019 They Are Making A Reference To Their June 2014 Circular However They Are Yet To Cancel Their This Circular Of

Mukul En Twitter In All The Circulars Which Nhai Is Issuing In 2019 They Are Making A Reference To Their June 2014 Circular However They Are Yet To Cancel Their This Circular Of

Is There A Rule To Not Pay A Toll Tax When You Stay Near The Toll Quora

Is There A Rule To Not Pay A Toll Tax When You Stay Near The Toll Quora

Ex Servicemen Welfare Update Toll Tax Exemption To Armed Forces Personnel

Ex Servicemen Welfare Update Toll Tax Exemption To Armed Forces Personnel

Mukul On Twitter See The Latest Orders Received From Nhai On Toll Issue For Armed Forces Personnel

Mukul On Twitter See The Latest Orders Received From Nhai On Toll Issue For Armed Forces Personnel

Ram Hari Sharma On Twitter Singhnavdeep Ji Salute For Fighting For Disabled Armed Forces Personnel There Is A Letter Of Nhai Is Floating Now Can You Update Regarding A Letter Written To

Ram Hari Sharma On Twitter Singhnavdeep Ji Salute For Fighting For Disabled Armed Forces Personnel There Is A Letter Of Nhai Is Floating Now Can You Update Regarding A Letter Written To

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home