Property Taxes In Lorain Ohio

The Lorain County Tax Assessor is the local official who is responsible for assessing the taxable value of all properties within Lorain County and may establish the amount of tax due on that property based on the fair market value appraisal. Counties in Ohio collect an average of 136 of a propertys assesed fair market value as property tax per year.

Another Round Of Housing Demolitions Coming For Lorain County Ohio Morningjournal Com

Another Round Of Housing Demolitions Coming For Lorain County Ohio Morningjournal Com

Youll have access to basic tax information property characteristics maps images and sketches.

Property taxes in lorain ohio. Lorain County Auditor to distribute 18 million from real estate assessment fund- Morning Journal County agencies schools to receive part of 18 million return- Morning Journal Pictured above is Auditor Craig Snodgrass with North Ridgeville resident Roberta Benedict discussing the recent changes to the Homestead Exemption at the North. Effective January 1 2017 tax credit allowed is 20 given for taxes paid to other cities. The median property tax on a 14740000 house is 200464.

Click here to access the Lorain County Real Estate Records. The average effective property tax rate in Ohio is 148 which ranks as the 13th-highest in the US. Craig Snodgrass CPA CGFM Lorain County Auditor.

Makes it easy to pay Ohio property taxes using your favorite debit or credit card. Theres nothing better than knowing your Ohio property tax. Prior to January 1 2017 tax credit is 100 up to 25.

Lorains tax rate is 25 effective January 1 2013 Tax Credit. The Lorain County Clerk of Courts offers the ability for you to make payments online with a credit card. In order to determine the tax bill your local tax assessors office takes into account the propertys assessed value the current assessment rate as well as any tax exemptions or abatements for that property.

The median property tax in Ohio is 183600 per year for a home worth the median value of 13460000. The median property tax on a 14740000 house is 198990 in Lorain County. NOTICE TO TAXPAYERS OF FORTHCOMING PUBLICATION OF DELINQUENT TAX LIST.

Property Taxes No Mortgage 74749900. You may even earn rewards points from your card. Property Taxes Mortgage 168920800.

Lorain County Property Tax Collections Total Lorain County Ohio. NOTICE IS HEREBY GIVEN by the County Auditor of Lorain County Ohio as required by Section 572103 of the Revised Code of Ohio the Delinquent Land Tax List will be published in a newspaper of general circulation in Lorain County. In-depth Lorain County OH Property Tax Information.

If you need to find your propertys most recent tax assessment or the actual property tax due on your property contact the Lorain County Tax Appraisers office. Its fast easy secure and your payment is processed immediately. Ohio is ranked number twenty two out of the fifty states in.

Declaration of Estimated Tax. The median property tax also known as real estate tax in Lorain County is 199100 per year based on a median home value of 14740000 and a median effective property tax rate of 135 of property value. Property tax rates in Ohio are higher than the national average which is currently 107.

Craig Snodgrass CPA CGFM Lorain County Auditor. Online bill pay is only available on closed Criminal and Domestic Relations cases that are not in a collections status. Publication of Delinquent Tax List.

Lorain County collects on average 135 of a propertys assessed fair market value as. A simple percentage used to estimate total property taxes for a home. The median property tax in Lorain County Ohio is 1991 per year for a home worth the median value of 147400.

For a more detailed explanation of County Property Tax Rates call the County Treasurer at 440. Lorain County Real Estate Property Records Access. The tax year 2019 is payable in year 2020.

Lorain County Assessors Office Services. 2019 Lorain County Residential Property Tax Rates Payable in 2020 Tax as a Percentage of Market for owner occupied properties only.

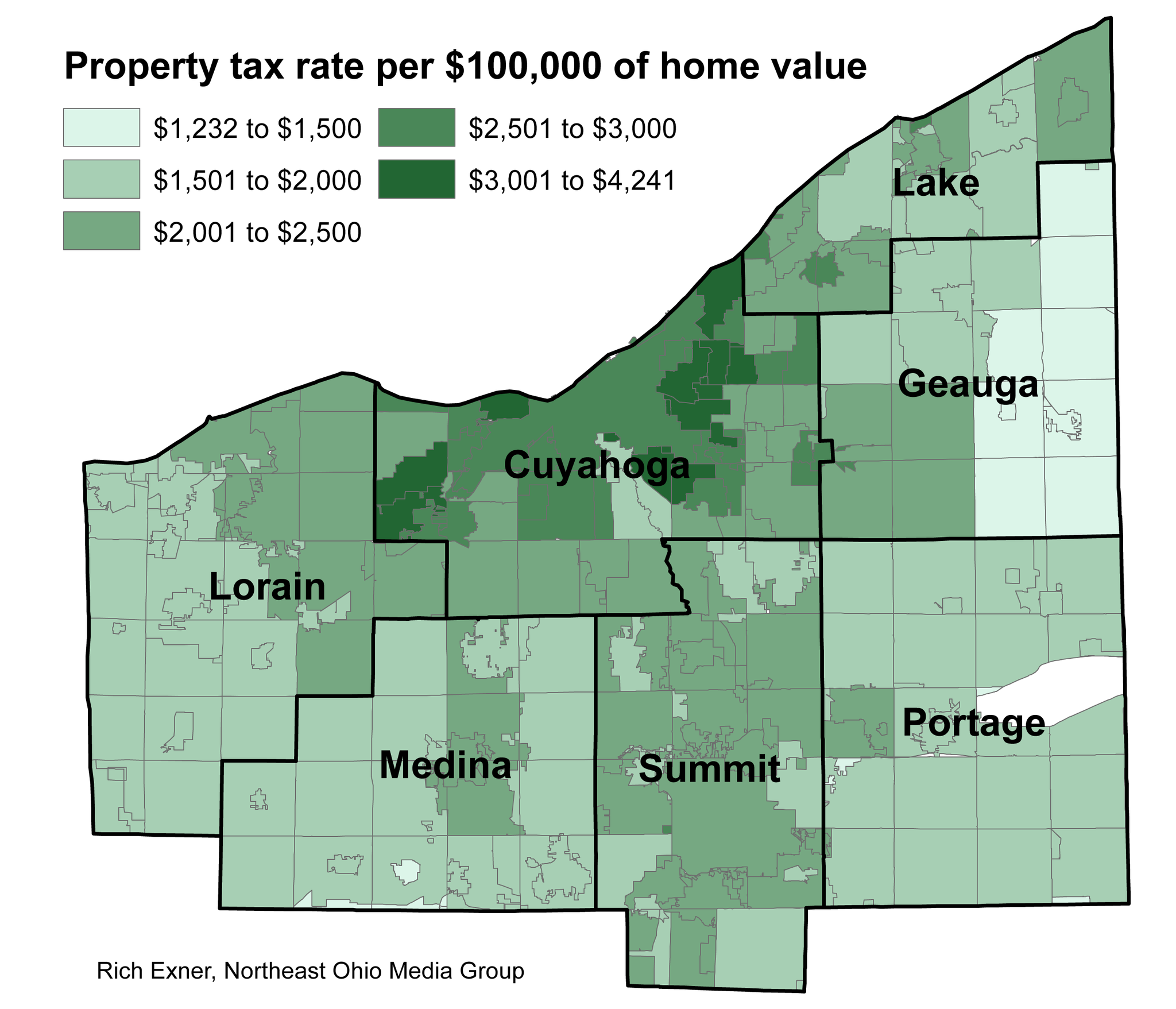

Greater Cleveland S Wide Spread In Property Tax Rates See Where Your Community Ranks Cleveland Com

Greater Cleveland S Wide Spread In Property Tax Rates See Where Your Community Ranks Cleveland Com

704 Osborn Ave Lorain Oh 44052 Realtor Com

704 Osborn Ave Lorain Oh 44052 Realtor Com

These 8 Lorain County Property Owners Owe At Least 100 000 In Property Taxes Ohio Morningjournal Com

These 8 Lorain County Property Owners Owe At Least 100 000 In Property Taxes Ohio Morningjournal Com

Map 1900 To 1999 Ohio Lorain County Library Of Congress

City Of Lorain Cra Map Lorain Oh

Lorain County Land Bank Lorain County Port Authority

Lorain Ohio Oh Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Lorain Ohio Oh Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

These 8 Lorain County Property Owners Owe At Least 100 000 In Property Taxes Ohio Morningjournal Com

These 8 Lorain County Property Owners Owe At Least 100 000 In Property Taxes Ohio Morningjournal Com

Lorain County Auditor S Staff Hit Streets For Property Revaluations Ohio Morningjournal Com

Lorain County Auditor S Staff Hit Streets For Property Revaluations Ohio Morningjournal Com

These 8 Lorain County Property Owners Owe At Least 100 000 In Property Taxes Ohio Morningjournal Com

These 8 Lorain County Property Owners Owe At Least 100 000 In Property Taxes Ohio Morningjournal Com

1132 W 30th St Lorain Oh 44052 Realtor Com

1132 W 30th St Lorain Oh 44052 Realtor Com

Property Tax Rates For 2015 Up For Most In Greater Cleveland Akron Database Cleveland Com

Property Tax Rates For 2015 Up For Most In Greater Cleveland Akron Database Cleveland Com

Lorain Ohio Oh Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Lorain Ohio Oh Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

These 8 Lorain County Property Owners Owe At Least 100 000 In Property Taxes Ohio Morningjournal Com

These 8 Lorain County Property Owners Owe At Least 100 000 In Property Taxes Ohio Morningjournal Com

.jpg)

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home