How Much Can Property Tax Go Up In One Year

Counties in Minnesota collect an average of 105 of a propertys assesed fair market value as property tax per year. Thus if the tax rate is raised to 150 per 100 the following year your property tax bill would increase to 1500.

Account Suspended Mortgage Interest Real Estate Infographic Mortgage Debt

Account Suspended Mortgage Interest Real Estate Infographic Mortgage Debt

Property taxes cant go up too much without voter approval.

How much can property tax go up in one year. The 10 limitation on a Texas homestead is effective January 1st of the tax year following the first tax year the owner qualifies the property for a homestead exemption. As stated in Tax Code Section 2323c the limitation takes effect Jan. And they tend to go up.

This compares well to the national average which currently sits at 107. The average effective property tax rate in California is 073. These two rules combine to keep Californias overall property taxes below the national average which in turn keeps your bills low.

According to ATTOM Data Solutions property taxes on single-family homes in 2018 totaled 30. Some people believe this to mean that market values for a residential homestead in Texas cannot be increased more than 10 in any one year. Applying for a Homestead exemption caps the maximum increase on taxes a residential property owner can receive since the latest reappraisal to 10.

New Yorks senior exemption is also pretty generous. The 35 increase is for the total property taxes levied by a county or city. Because the rates are determined county by county youll find a pretty large variance in property tax rates across the country from averages as high as 189 New Jersey to averages as low as 018 Louisiana.

Since Proposition 13 froze the statewide property tax rate at 1 percent plus a maximum of 2 percent per year between sales for inflation the rates do not vary much. In addition the tax rate is only one of two components affecting the tax bill. 100000100 1000 1000 x 100 1000.

These property tax rates can be raised or lowered every year. What Are Property Taxes. If the county received 10 mm in property taxes in 2019 the most they can receive in 2020 is 1035 MM for the existing properties.

To transfer the school district tax ceiling you may request a certificate from the chief appraiser in. For example the property tax on a vacant lot valued at 10000 is usually ten times as much as one valued at 1000 if located in the same taxing jurisdiction. The multiplier number is set by the Michigan State Tax Commission which has adopted the CPI which has maintained roughly 1 annually.

The 10 increase is cumulative. Minnesota is ranked number nineteen out of the fifty states in order of the average amount of property taxes collected. Your county officials value your property set your tax rates and collect your taxes.

Not only can they be expensive but they can fluctuate from year to year. The average tax bill in 2017 was 3400 3 percent higher than 2016 according to a recent report from Attom Data Solutions a property data company. Now for the bad news.

Property taxes are based on the value of the property. EHB 2242 changed the state school levy from a budget based system limited by the one percent growth to a 270 per 1000 market value rate based property tax for the 2018 2021 tax years. ESSB 6614 changed the rate based levy from 270 per 1000 market value.

And secondly it restricts increases in assessed value to 2 per year. It expires on Jan. Once a property is sold the taxable value resets back to the SEV which has no cap.

The median property tax in Minnesota is 209800 per year for a home worth the median value of 20040000. However special district voter-approved assessments add small percentages to their property taxes. The 10 increase in assessment is for an individual homestead.

Property taxes are local taxes. Its calculated at 50 percent of your homes appraised value meaning youre only paying half the usual taxes for your property. This means that the taxable value cannot increase more than the cap each year and the Taxable Value will never be more than the SEV.

1 of the tax year following the year in which the homeowner qualifies for the homestead exemption. 100000100 1000 1000 x 150 1500. Your property taxes are going up as well to just over 29000 from an average of about 16500 and youll only be able to deduct the first 10000 on your taxes.

Minnesotas median income is 67702 per year so the median yearly property tax. Under normal circumstances a new Texas law says a. 1 of the tax year following the year in which the property owners no longer.

Property taxessometimes referred to as millage taxesare a tax levied on property most typically real estate property by county governments. Therefore the maximum increase is 10 times the number of years since the property was last appraised. If you move to another home and the taxes on the new homestead would normally be 1000 in the first year the new tax ceiling would be 250 or 25 percent of 1000.

Just how much is too much is a matter of legal debate.

Image Result For U S National Map Of Property Taxes Property Tax History Lessons Historical Maps

Image Result For U S National Map Of Property Taxes Property Tax History Lessons Historical Maps

:max_bytes(150000):strip_icc()/getty-moneyhouse_1500_157590565-56a7269c5f9b58b7d0e757e3.jpg) How Property Taxes Are Calculated

How Property Taxes Are Calculated

Florida Property Tax H R Block

Florida Property Tax H R Block

What Is The Disability Property Tax Exemption Millionacres

What Is The Disability Property Tax Exemption Millionacres

States With The Highest And Lowest Property Taxes Property Tax Social Studies Worksheets States

States With The Highest And Lowest Property Taxes Property Tax Social Studies Worksheets States

Want To Invest In Real Estate But Not Sure Where To Start Here Are The 5 Biggest Rental Property Management Real Estate Investing Rental Property Investment

Want To Invest In Real Estate But Not Sure Where To Start Here Are The 5 Biggest Rental Property Management Real Estate Investing Rental Property Investment

6 Things Every Homeowner Should Know About Property Taxes Property Tax Homeowner Saving Money Frugal Living

6 Things Every Homeowner Should Know About Property Taxes Property Tax Homeowner Saving Money Frugal Living

/GettyImages-1042505068-d5c7b095f4704a5286a5cabcc25f4495.jpg) Your Property Tax Assessment What Does It Mean

Your Property Tax Assessment What Does It Mean

Long Island Index Infographic Property Tax Investment Property

Long Island Index Infographic Property Tax Investment Property

A Homestead Exemption Can Reduce The Amount Of Money You Pay In Property Taxes And Shield Some Of The Home S Va Property Tax Homesteading Real Estate Investing

A Homestead Exemption Can Reduce The Amount Of Money You Pay In Property Taxes And Shield Some Of The Home S Va Property Tax Homesteading Real Estate Investing

Oklahoma Property Tax Calculator Smartasset

Oklahoma Property Tax Calculator Smartasset

Single Family Rental Property Income Expense Tracker For Etsy In 2021 Being A Landlord Rental Property Management Rental Income

Single Family Rental Property Income Expense Tracker For Etsy In 2021 Being A Landlord Rental Property Management Rental Income

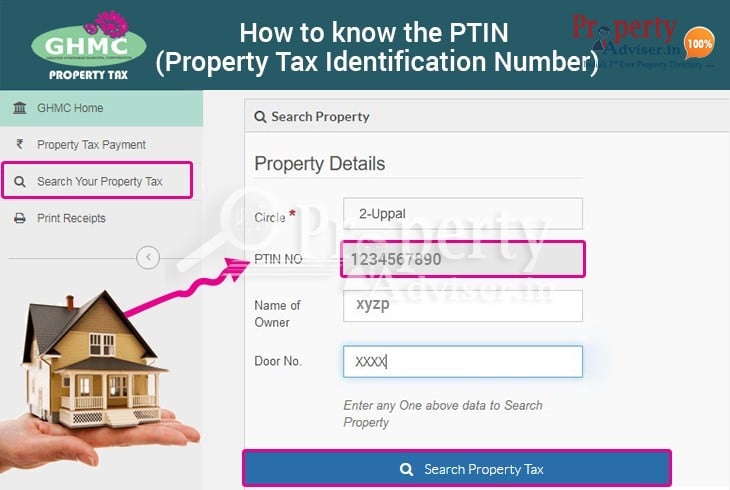

Now Get Your Ghmc Property Tax Search Details By Door Number In Hyderabad

Now Get Your Ghmc Property Tax Search Details By Door Number In Hyderabad

Northern Virginia Residential Property Tax Rates And Due Dates Smart Settlements

Northern Virginia Residential Property Tax Rates And Due Dates Smart Settlements

Property Tax Bills In King County Are Among The Nation S Highest And Growing Fast The Seattle Times Property Tax King County Bills

Property Tax Bills In King County Are Among The Nation S Highest And Growing Fast The Seattle Times Property Tax King County Bills

Thinking About Moving These States Have The Lowest Property Taxes Property Tax Estate Tax Tax

Thinking About Moving These States Have The Lowest Property Taxes Property Tax Estate Tax Tax

Property Tax Millage Property Tax Newtown Charts And Graphs

Property Tax Millage Property Tax Newtown Charts And Graphs

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home