Property Tax Reform New Jersey

New Jerseys recently adopted budget for the 2007 fiscal year represents an important milestone that could pave the way for fundamental reform of the states property tax system. 33 percent of average retail price per ounce for first nine months of legal sales.

Interactive Map Where Nj S High Property Taxes Are Highest And Lowest Nj Spotlight News

Interactive Map Where Nj S High Property Taxes Are Highest And Lowest Nj Spotlight News

He was the executive director of the State and Local Expenditure and Revenue Policy Commission and a member of the Education Funding Review Commission.

Property tax reform new jersey. Addback of Other States Taxes. The Legislature established four committees to address the issue of property tax reform. I just spoke on the house floor to support HR.

The report identified the following options among others for property tax reform as including limiting property taxes to a percentage of a households income and limiting future tax increases. TB-79R Nexus for Corporation Business Tax. Thats a 159 increase from 2019.

According to figures published online earlier this month by NJ 1015 FM radio the average New Jersey property-tax bill increased to 8767 in 2018. While New Jersey Gov. The property tax as it currently exists and is imposed permits certain exemptions rebates and abatements.

The committees have been given a November 15 deadline to present recommendations and findings to. New Jersey has been studying property tax reform for three decades since the establishment of the Tax Policy Committee under former Governor William T. The report of Governor Corzines Tax Reform Transition Policy Group suggested an interim step in increasing property tax rebates which would average 165 for renters 1320 for certain seniors with most taxpayers seeing modest rebates.

NJLM - Tax Reform in New Jersey. TAM2015-1R New Jersey Tax Treatment of Virtual Currency. This article draws from remarks made by the author at the Property Tax Reform.

Phil Murphy left speaks Attorney General Gurbir Grewal looks on after a bill signing ceremony last week in Berkeley Heights. An NJ Advance Media article about the bills passage noted soberly that the average property tax bill last year was 9112. One thing is clear no matter how the process ultimately works itself out to be successful the property tax must be reduced for a majority of New Jersey residents.

The property tax cap is the signature part of Christies property tax relief proposal. Joint Legislative Committee on Constitutional Reform and Citizens Property Tax Constitutional Convention It is the duty of the committee to review and formulate proposals that address property tax reform through amendments to the Constitution of the State of New Jersey. The budget resolved the states immediate fiscal crisis without fiscal gimmicks or an over-reliance on one-time revenues freeing state officials to focus on long-term reforms.

ORIGINS OF THE PROPERTY TAX IN NEW JERSEY Our property tax goes back to the earliest years of English rule. This constitutional amendment provides that an amount equal to the annual revenue derived from a tax rate of 05 imposed under the New Jersey Sales and Use Tax Act shall be annually dedicated in a special account in the Property Tax Relief Fund and. NJ with nations highest property taxes keeps up fight over federal tax law changes.

Tax Conformity to IRC 951A GILTI and IRC 250 FDII TB-84R Changes to the New Jersey Corporation Business Tax. Federal Tax Cuts and Jobs Act TCJA Opportunity Zones. New Jerseys phase-in schedule is.

5377 which will reinstate the State and Local Tax deduction and will save Fifth District tax filers 56 billion dollars each year. NEW JERSEY PROPERTY TAX the Long Road to Reform. New Jersey reached an unenviable milestone earlier this year as the average property tax bill hit 8353 the highest in the nation up more than 2 percent from the year before and up 10.

In 1670 a levy of one half penny per acre of land was imposed for the support. It would cap property tax increases at 2 percent a year for local governments but it includes certain. Henry A Coleman is the director of the Center for Government Services at Rutgers University.

The idea of a constitutional convention to reform property taxes was first raised in 2000 by then Sen. New Jerseys chief innovation is in ramping up its weight-based tax over time a simple enough reform that brings with it several significant benefits. New Jersey Connecticut and New York are suing the Internal Revenue Service for blocking a workaround to new state and local tax deduction limits.

Then 10 per ounce if average retail price per ounce is above 350.

Nj Property Tax Relief Program Updates Access Wealth

Nj Property Tax Relief Program Updates Access Wealth

Secondary Market Annuities Annuity Secondary Market Property Tax

Secondary Market Annuities Annuity Secondary Market Property Tax

New Jersey Tax Appeals Available Now Doctor Robert Appealing John

New Jersey Tax Appeals Available Now Doctor Robert Appealing John

How Can You Lower Your Property Taxes In Nj Askin Hooker Llc

How Can You Lower Your Property Taxes In Nj Askin Hooker Llc

Did Tax Reform Kill The Luxury Market Not So Far Luxury Beach House Real Estate Luxury Real Estate

Did Tax Reform Kill The Luxury Market Not So Far Luxury Beach House Real Estate Luxury Real Estate

Reduce Reliance On Local Property Taxes The Fourth Regional Plan

Jayson Bates On Twitter Real Estate Investor Real Estate Real Estate Investing

Jayson Bates On Twitter Real Estate Investor Real Estate Real Estate Investing

Guide To Central Pennsylvania Property Taxes Century 21 Core Partners

Guide To Central Pennsylvania Property Taxes Century 21 Core Partners

Earn 2 Credits Continue Professional Education Introduction To Protect Your Clients Be Prepared To Legal Marketing Local Marketing Professional Education

Earn 2 Credits Continue Professional Education Introduction To Protect Your Clients Be Prepared To Legal Marketing Local Marketing Professional Education

Property Tax Appeals Nj Reach Us Now Estate Tax Property Tax Doctor Robert

Property Tax Appeals Nj Reach Us Now Estate Tax Property Tax Doctor Robert

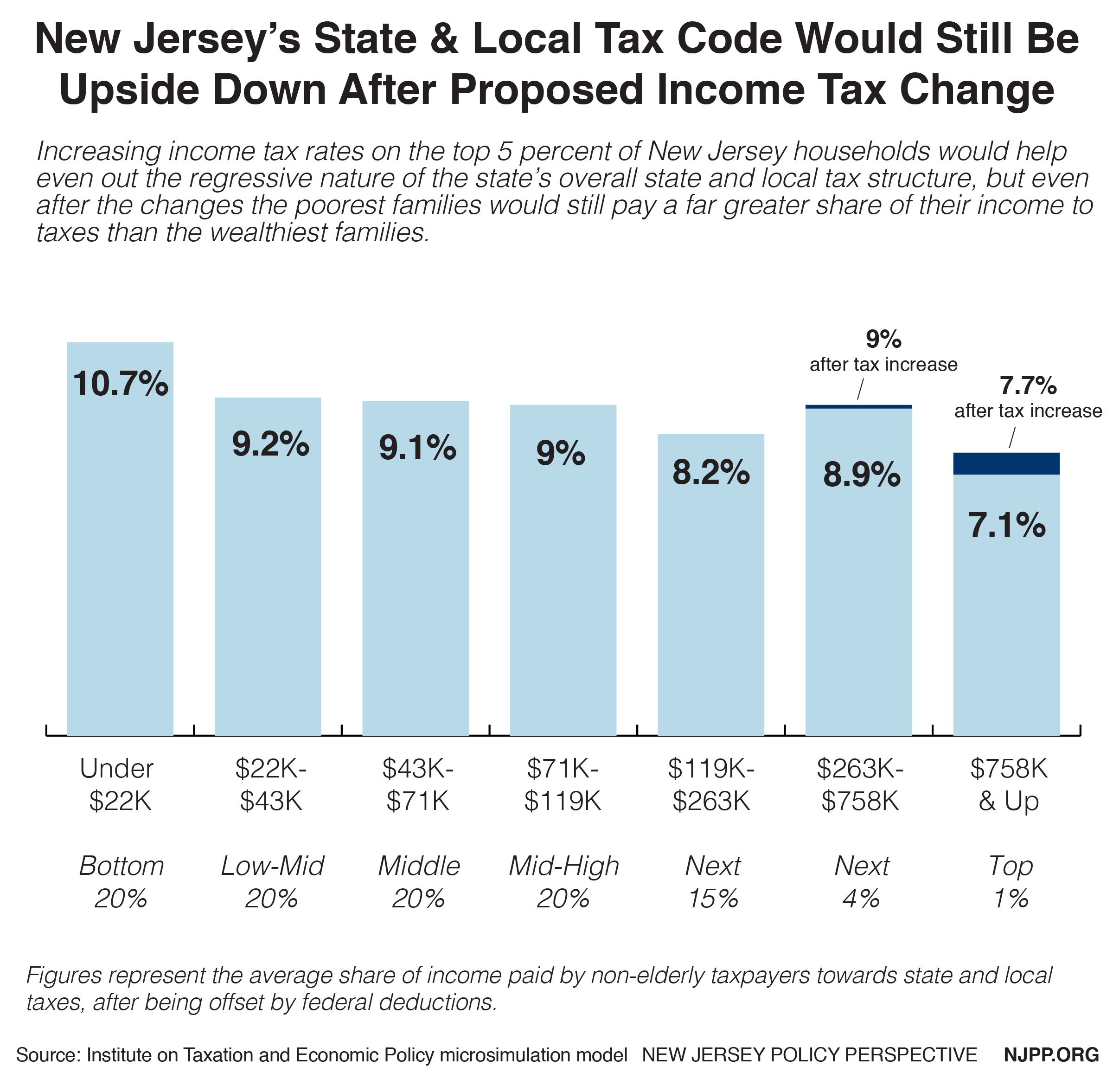

Reforming New Jersey S Income Tax Would Help Build Shared Prosperity New Jersey Policy Perspective

Reforming New Jersey S Income Tax Would Help Build Shared Prosperity New Jersey Policy Perspective

Filing Your Taxes Is An Important Civic Duty A Vital Part Of Keeping The Country Running Smoothly Video In 2021 Income Tax Tax Consulting Tax Refund

Filing Your Taxes Is An Important Civic Duty A Vital Part Of Keeping The Country Running Smoothly Video In 2021 Income Tax Tax Consulting Tax Refund

When You Contribute To A Roth 401 K The Contribution Won T Lower Your Taxable Income Today But When You Even Roth Required Minimum Distribution Contribution

When You Contribute To A Roth 401 K The Contribution Won T Lower Your Taxable Income Today But When You Even Roth Required Minimum Distribution Contribution

Reforming New Jersey S Income Tax Would Help Build Shared Prosperity New Jersey Policy Perspective

Reforming New Jersey S Income Tax Would Help Build Shared Prosperity New Jersey Policy Perspective

Tax Reform S 10k Property Tax Deduction Is Worthless Don T Mess With Taxes

N J Property Taxes Bounced Back In 2019 Whyy

N J Property Taxes Bounced Back In 2019 Whyy

Mortgage Help During Covid 19 Crisis But What About Property Taxes Nj Spotlight News

Mortgage Help During Covid 19 Crisis But What About Property Taxes Nj Spotlight News

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home