How To File Homestead Exemption In Hamilton County Indiana

Applications completed by December 31 will be effective for the current year and will reflect on the following years tax bill. The Mortgage Deduction Application must be completed and dated no later than December 31st.

Https Www Faegrebd Com Webfiles Tax 20appeals 20outline 20and 20flow 20chart 202013 Pdf

The Auditors office staff works closely with the Assessor and Treasurers office to complete these processes.

How to file homestead exemption in hamilton county indiana. Homestead Exemption Form Online. Your filing deadline is. If an individual mails this form and desires to have a file-stamped copy returned the individual must provide a self-addressed stamped envelope to the county auditors office.

Applications must be filed with the county in which the property exists on or before Jan. You must file an application to receive the homestead deductions. Deductions work by reducing the amount of assessed value subject to property taxation.

9 th St Suite L21. Recently the Hamilton County Auditors Office has partnered with a third party vendor Tax Management Associates TMA to assist with eliminating homestead fraud. If you also qualified for the homestead exemption for last year for real property or for this year for manufactured or mobile homes on the same property for which you are filing a current application but you did not file a current application for that year you may file.

Do you need to have your commercially used weighing and measuring devices tested and inspected. To locate your local officials please see httpwwwingovdlgf2440htm. For additional information regarding.

The forms required for filing for the deductions also can be found below. You may also visit the Department of Local Government Finance website for application forms and information. The title company sends this form to the county recorders office along with your deed.

We cannot process the Homestead deduction application until we receive the title. These include basic homestead exemptions as well as homestead exemptions for seniors low income homeowners surviving spouses of public safety and military. Indiana Property Tax Benefits.

It must be your primary residence and it must be residential and owner-occupied. Lake County Surveryors Office maintains official county maps and perpetually maintains original government survey section corners the basis for all property boundaries. Here you will be able to enterselect your property address which will then prefill the necessary information to the deduction form you have selected.

Tax Management Associates will be mailing letters to Hamilton County residence whose eligibility for the standard homestead deduction needs further clarification. The title may be submitted in person by mail at 1 E. The Hendricks County Auditors Office Provides the Following Services.

CLICK HERE TO FILE YOUR HOMESTEAD OR MORTGAGE DEDUCTION ONLINE. For example an application completed by December 31 2018 will be reflected on the 2019 tax bill. The State of Indiana has recently passed legislation IC 6-11-36-17 allowing the county auditor to back tax and add a.

The homeowner must also complete and date a Homestead Application by December 31st and file the application on or before January 5th. For properties closed after July 1 2008 new procedures require the title company to file for the Homestead Exemption using the Indiana State Sales Disclosure Form State Form 46201. Individuals and married couples are limited to one homestead standard deduction per homestead laws Indiana Code IC 6-11-12-31 and 6-11-209.

To learn more about property tax exemptions click HERE. Homestead Standard Deduction and Other Deductions. 102 Fort Wayne Indiana 46802 by email at acauditorallencountyus or by fax at 260-449-7679.

To qualify for the Indiana homestead exemption you must be living in the residence you wish to claim the exemption for. Boone County Auditors Office Website. Homestead exemptions are a form of property tax relief for homeowners.

Mortgage Exemption Form Online. STATE OF INDIANA Page 1 of 10 INDIANA GOVERNMENT CENTER NORTH 100 NORTH SENATE AVENUE N1058B INDIANAPOLIS IN 46204 PHONE 317 232-3777 FAX 317 974-1629 DEPARTMENT OF LOCAL GOVERNMENT FINANCE Frequently Asked Questions. Forms must be filed at the county auditors office in the county where the homestead is located.

Segregation of our duties is determined by law and designed for transparency and fairness. Please submit when filing either the Homestead Application Form 105A or the Homestead Addendum Application Form 105G Must be used by owners receiving Homestead or Owner-Occupancy Credits in Hamilton County who no longer reside in the property as their primary residence. This intuitive site will lead you through a series of steps necessary to successfully file your deduction application.

5 of the year before the year the property owner wishes to apply the deduction. Below are the addresses for Indianapolis-area counties to file in person or online. To file for the Homestead Deduction or another deduction contact your county auditor who can also advise if you have already filed.

Mortgages and homestead exemptions are filed with the County Auditor and will be applied to the following years taxes. To apply for the Indiana Homestead Property Tax Deduction an application must be filled out in a timely manner. Personal property deduction forms can be found by clicking HERE.

Fulton County homeowners can qualify for a variety of homestead exemptions offered through the Fulton County Tax Assessors office. November 1 2018. 3000 deducted from assessed value of property.

If you meet these requirements you can access the application as follows. County auditors are the best point of contact for questions regarding deductions and eligibility.

2016 Marion County Hamilton County Indiana Property Tax Exemption Information Homestead And Mortgage Interesting Indy

2016 Marion County Hamilton County Indiana Property Tax Exemption Information Homestead And Mortgage Interesting Indy

Auditor S Office Hamilton County In

Https Www Icemiller Com News Aickarenarland Pdf

Https Www Cityofnoblesville Org Egov Apps Document Center Egov View Item Id 8656 Doc 1599854761813

Property Tax Exemptions Dave Marusarz Deputy General Counsel

Property Tax Exemptions Dave Marusarz Deputy General Counsel

Auditor S Office Hamilton County In

Save Money By Filing For Your Homestead And Mortgage Exemptions

Save Money By Filing For Your Homestead And Mortgage Exemptions

Don T Forget To File Your Exemptions

Don T Forget To File Your Exemptions

Hamilton County Property Owners To Get Tax Delay

Hamilton County Property Owners To Get Tax Delay

Hamilton County Indiana Tax Assessor Property Search Hamilton County Tn Property Tax Search

Hamilton County Indiana Tax Assessor Property Search Hamilton County Tn Property Tax Search

Https Www Cityofnoblesville Org Egov Documents 1453222894 57126 Pdf

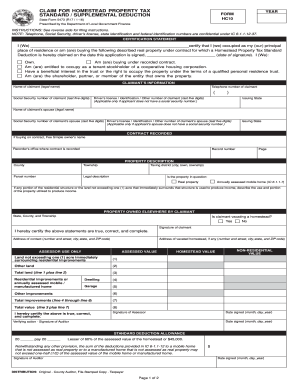

2020 Form In Dlgf Hc10 Fill Online Printable Fillable Blank Pdffiller

2020 Form In Dlgf Hc10 Fill Online Printable Fillable Blank Pdffiller

Auditor S Office Hamilton County In

Https Www Hamiltoncounty In Gov Archive Aspx Adid 94

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home