Can I Pay My Own Property Taxes With An Fha Loan

The first is paying it as part of your monthly mortgage payment the preferred method for most lenders. Typically the fee is 025 of the loan amount.

Fha Loans Complete Guide For First Time Homebuyers Credible

Fha Loans Complete Guide For First Time Homebuyers Credible

The Federal Housing Administration protects private lenders interests by reimbursing their losses if you fail to repay a home loan.

Can i pay my own property taxes with an fha loan. In this case you waive impounds which usually entails paying a fee such as125 or25 of the loan amount at closing. You dont have to do that because NerdWallet has summarized the Federal Housing Administration guidelines for you below. For example if your taxes are 4000.

From Fannie Maes Selling Guide sel013117. However FHA-backed loans do mandate that the lender escrow funds for the payment of taxes and insurances. FHA Loan Approval While it is possible to obtain an FHA loan if you owe taxes youll be required to go through the manual underwriting process.

Property taxes are the biggest item escrowed on FHA loans. You may find this is true for both state and federal taxes but FHA loan rules concentrate on federal taxes. First-time homebuyers can benefit from having their real estate property taxes paid with their home loan each month.

Certain restrictions come with having a mortgage insured by the Federal Housing Administration. The lender will divide your yearly tax payment by 12 to determine the monthly amount. FHA rules require lenders to set up and use an escrow account to pay your insurance and property taxes each year.

You can get approved for an FHA loan or a VA loan with back taxes but youll need to meet certain conditions first. You can own investment property and get an FHA loan for a. An FHA loan is insured by the government.

FHA stands for Federal Housing Administration. Lenders also generally agree to delete an escrow account once you have sufficient equity in the house because its in your self-interest to pay the taxes and insurance premiums. When in doubt reach out to your mortgage servicer to learn the specifics about cancelling MI on your specific loan type and to inquire.

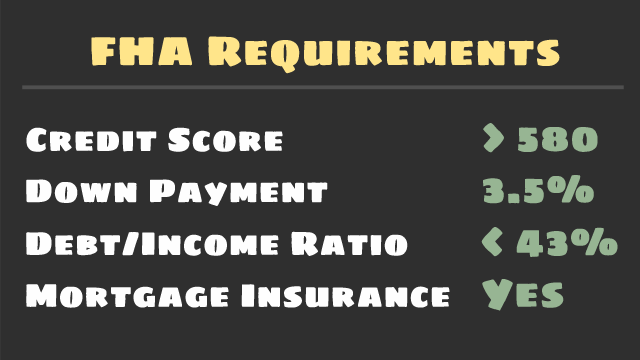

When it comes to taxes FHA loan rules emphasize the requirement to be in a satisfactory payment arrangement with the creditor and a minimum period of on-time payments for that arrangement. But it may cost you125 of the loan amount If youre the type that likes full control over your money you can always pay your property taxes and homeowners insurance yourself if the underlying loan allows for it. You can obtain an FHA-backed loan with a 35-percent down payment and flexible terms.

In addition most lenders charge a fee when you pay your own taxes and insurance or waive your reserve account. An essential cost of home ownership property taxes. But if you dont pay the taxes and insurance the lender can revoke its waiver.

There are two main ways to pay your property tax bill. Some come with past financial judgments some come with a bankruptcy or foreclosure in the past and still others may be applying for an FHA mortgage with a tax lien on their credit record. To determine how much property tax you pay each month lenders calculate your annual property tax burden and.

Basically the FHA says Go ahead lender loan these buyers some money. For example on a 250000 loan amount the fee is 62500 of additional cost. While private lenders who offer conventional loans are usually not required to do that the FHA requires all of its borrowers to pay taxes along with their monthly mortgage payments.

Because they are insuring the loan they expect the condition of the home to be to a certain standard. This applies to any FHA loans obtained after 2013. Can I Pay My Own Insurance If I Have an FHA Loan.

Its programs offer low- and moderate-income. The amount of money you spend on property taxes may or may not be offset by such deductions-it all depends on your specific situation but you can learn a lot by asking a real estate professional about how to help yourself at tax time by taking the right deductions allowed by law connected to your FHA mortgage and status as a property owner. Lenders often roll property taxes into borrowers monthly mortgage bills.

Escrow Waivers Fannie Mae advocates the establishment of an escrow account for the payment of taxes and insurance particularly for borrowers with blemished credit histories or first-time homeowners. Paying Taxes With a Mortgage. The second option is to pay it directly to your local tax office.

The first option is regarded by buyers and lenders as the better way to pay your property tax if you have a mortgage. For example if your down payment on a home purchased with an FHA loan was less than 10 you cannot cancel MI unless you refinance with a non-FHA loan. Not all borrowers come to the FHA loan or refinance loan process with the same types of credit history FICO scores or other financial qualifications.

We will help you out if they suck at paying you back. Obtain a copy of your tax bill from your municipality and submit it to the lender.

Fha Mortgage Loan Checklist Step By Step Process For Buying A Home Refiguide Org 2020

Fha Mortgage Loan Checklist Step By Step Process For Buying A Home Refiguide Org 2020

How To Get A Florida Fha Loan First Time Home Buyers Guide

How To Get A Florida Fha Loan First Time Home Buyers Guide

Thanks To Covid 19 Fha Mortgage Lending Gets Stricter

Thanks To Covid 19 Fha Mortgage Lending Gets Stricter

Kentucky Fha Loan Requirements For 2021 In 2021 Fha Loans Fha Mortgage Usda Loan

Kentucky Fha Loan Requirements For 2021 In 2021 Fha Loans Fha Mortgage Usda Loan

Relying On An Fha Loan Why Sellers May Not Be Thrilled Smartasset

Relying On An Fha Loan Why Sellers May Not Be Thrilled Smartasset

Your Guide To Fha Loan Requirements

Your Guide To Fha Loan Requirements

Fha Loan Down Payment Requirements And Guidelines

Fha Loan Down Payment Requirements And Guidelines

Fha Loans Everything You Need To Know The Truth About Mortgage

Fha Loans Everything You Need To Know The Truth About Mortgage

Fha Loan Requirements And Guidelines

Fha Loan Requirements And Guidelines

Florida Fha Loan Guidelines Dream Home Inspection

Florida Fha Loan Guidelines Dream Home Inspection

Fha Mortgage Rates Best Fha Home Loan Rates Programs

Fha Mortgage Rates Best Fha Home Loan Rates Programs

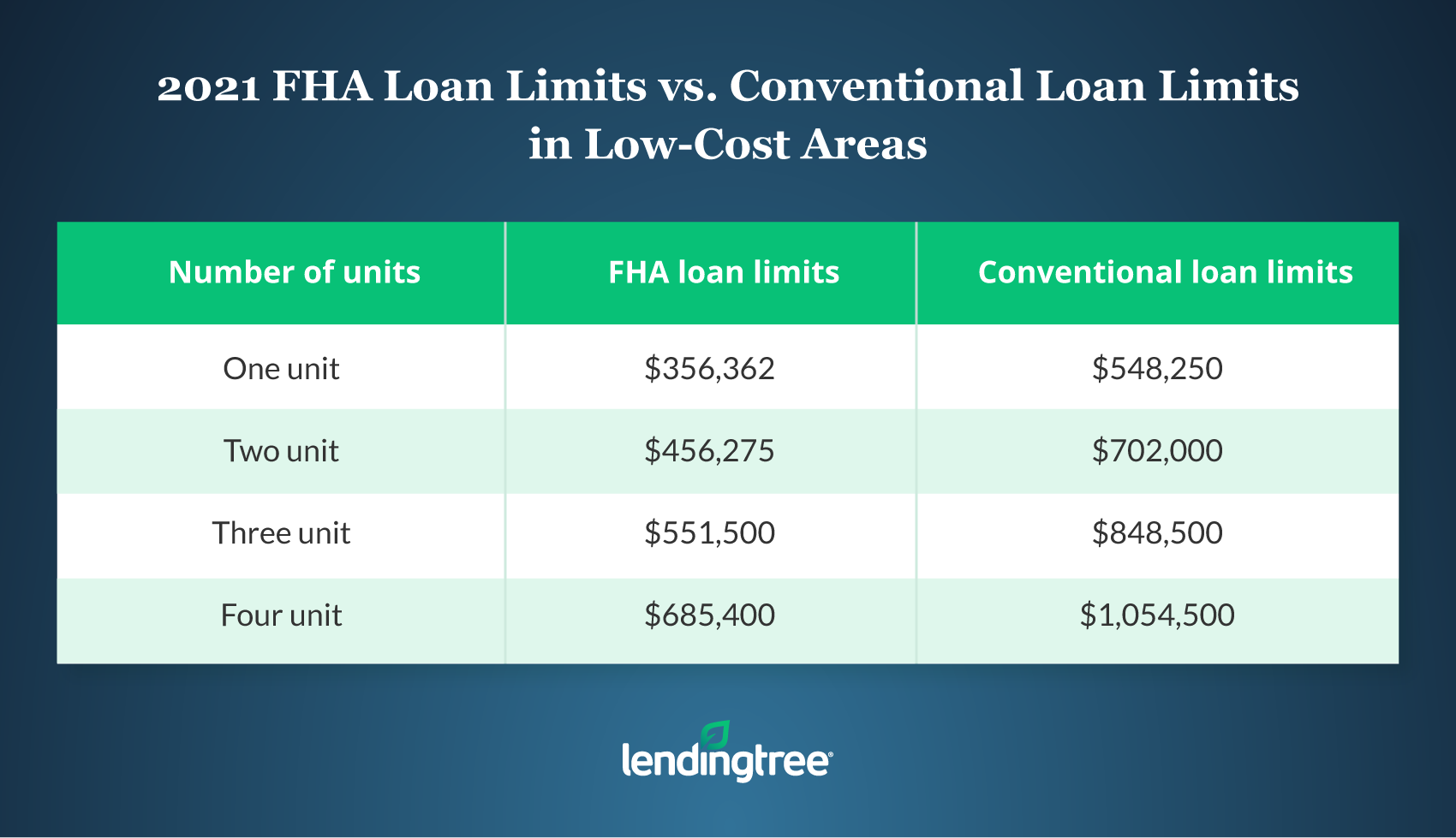

Fha Loan Limits In 2021 Lendingtree

Fha Loan Limits In 2021 Lendingtree

/text-sign-showing-hand-written-words-fha-home-loan-1179800155-9e745cb5bb5f49279651d7a9e76096ac.jpg) Federal Housing Administration Fha Loan Definition

Federal Housing Administration Fha Loan Definition

Fha Loans Everything You Need To Know The Truth About Mortgage

Fha Loans Everything You Need To Know The Truth About Mortgage

Fha Mortgage Loan Checklist Step By Step Process For Buying A Home Refiguide Org 2020

Fha Mortgage Loan Checklist Step By Step Process For Buying A Home Refiguide Org 2020

2021 Is An Escrow Account Required With Fha Loans Fha Co

Fha Loans Everything You Need To Know The Truth About Mortgage

Fha Loans Everything You Need To Know The Truth About Mortgage

Fha Loans Everything You Need To Know The Truth About Mortgage

Fha Loans Everything You Need To Know The Truth About Mortgage

Fha Mortgage Loan Checklist Step By Step Process For Buying A Home Refiguide Org 2020

Fha Mortgage Loan Checklist Step By Step Process For Buying A Home Refiguide Org 2020

Labels: taxes

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home