How To Apply For Homestead Tax Credit In Ohio

If you qualify for the homestead exemption for the firsttime this year for real property or for the firsttime next year for manufactured or mobile homes check the box for. Must provide proof of age and current residency by submitting a photocopy of a valid Ohio drivers license or State of Ohio ID card.

Real Property Tax Homestead Means Testing Department Of Taxation

Real Property Tax Homestead Means Testing Department Of Taxation

You should complete the Michigan Homestead Property Tax Credit Claim MI.

How to apply for homestead tax credit in ohio. 2 days agoApplying for a homestead tax program is the most effective way for homeowners to create tax savings. Application Based on Age An application to receive the homestead exemption is filed with the property valuation administrator of the county in which the property is located. Application of person who received homestead reduction for 2013 or for 2014 for manufactured or mobile homes.

As of 112014 the Homestead Exemption requires a means test. To file a Homestead application please return completed forms to the Auditors Office or you can file electronically online. You can also download the Application or the Veterans Application and mail it to our office at.

There is no application deadline. On the front of this form. Verify that you are eligible for a homestead exemption.

Your state and local government may offer this program in the form of a property tax credit. Find out your homes taxable value by subtracting the exemption from your homes assessed value. The form is available on the Department of Taxations website and is.

Be sure to select new user create an account to begin. If you are interested in filing a homestead exemption application call our office at 216 443- 7050. Senior and disabled applicants also have the option to.

You can obtain homestead applications and change of circumstances forms by contacting your county auditor. Form DTE 105G must accompany this application. In Ohio any person who is 65 years old or.

A home owner may receive a 25 reduction on their property tax bill as long as the owner lives in the home. If you are under 65 and disabled you also have to download Form DTE 105E. High St 21st Floor or visit the Auditors website and select the appropriate link to download an application.

The Homestead Exemption allows low-income senior citizens and permanently and totally disabled Ohioans to reduce their property tax bills by shielding some of the market value of their homes from taxation. To apply complete the application form DTE 105A Homestead Exemption Application Form for Senior Citizens Disabled Persons and Surviving Spouses then file it with your local county auditor. Once a property owner is approved for the credit he or she does not need to reapply each year thereafter.

Must complete and submit DTE Form 105H Addendum to the Homestead Exemption Application for Senior Citizens Disabled Persons and Surviving Spouses. If the application is based upon the age of the homeowner the property owner can provide proof of their age by presenting a birth certificate drivers license passport. Senior citizens and the permanently disabled are eligible to receive a Homestead Exemption reduction in real estate taxes.

DTE 105A 43669 KB. To qualify you must own and occupy your home as of January 1 of the year you apply for the reduction. Because of this re-application is required annually.

Must provide a copy of State of Ohio taxes 10401040A. Applications for the homestead exemption must be filed on or before December 31 in the tax year for which the credit is sought. A homeowner and spouse may only apply for.

If you are interested in filing a homestead exemption application call the Franklin County Auditors Office at 614-525-3240 visit the Auditors Office at 373 S. Visit the Ohio Department of Taxation website and download Form DTE 105A. To apply for the Homestead Exemption please fill out the application and mail it to our office at 231 Main Street Suite 1A Chardon Ohio 44024.

Applications may be filed with the County Auditor on. Check the box that indicates. The deadline for filing is.

If you also qualifiedfor the homesteadexemption. Must provide proof of current residency by submitting a photocopy of photo ID such as drivers license or State of Ohio ID card. Property owners who qualify due to agedisability are still subject to an income test.

Form DTE 105G must accompany this application. Must own your home or manufactured home as primary place of residence as of January 1 in year of application. Michigans homestead property tax credit is how the State of Michigan can help you pay some of your property taxes if you are a qualified Michigan homeowner or renter and meet the requirements.

Application of person who received the homestead reduction for 2006 that is greater than the reduction calculated under the current law.

Real Property Tax Homestead Means Testing Department Of Taxation

Real Property Tax Homestead Means Testing Department Of Taxation

Real Property Tax Homestead Means Testing Department Of Taxation

Real Property Tax Homestead Means Testing Department Of Taxation

Real Property Tax Homestead Means Testing Department Of Taxation

Real Property Tax Homestead Means Testing Department Of Taxation

Real Property Tax Homestead Means Testing Department Of Taxation

Real Property Tax Homestead Means Testing Department Of Taxation

Governor Mike Dewine Signs 2020 2021 Ohio Budget With Several Significant Tax Changes What To Look For Cohen Company

Wayne County Treasurer Your Tax Bill

Wayne County Treasurer Your Tax Bill

Richland County Ohio Homestead Exemption Form Fill Online Printable Fillable Blank Pdffiller

Richland County Ohio Homestead Exemption Form Fill Online Printable Fillable Blank Pdffiller

Real Property Tax Homestead Means Testing Department Of Taxation

Real Property Tax Homestead Means Testing Department Of Taxation

Stuff You Should Know Real Property Taxes In Ohio Waller Financial Planning Group

Stuff You Should Know Real Property Taxes In Ohio Waller Financial Planning Group

Real Property Tax Homestead Means Testing Department Of Taxation

Real Property Tax Homestead Means Testing Department Of Taxation

Real Property Tax Homestead Means Testing Department Of Taxation

Real Property Tax Homestead Means Testing Department Of Taxation

Not All Senior Citizens Still Qualify For Ohio Property Tax Discounts Homestead Savings Calculator Cleveland Com

Not All Senior Citizens Still Qualify For Ohio Property Tax Discounts Homestead Savings Calculator Cleveland Com

Find Tax Help Cuyahoga County Department Of Consumer Affairs

Find Tax Help Cuyahoga County Department Of Consumer Affairs

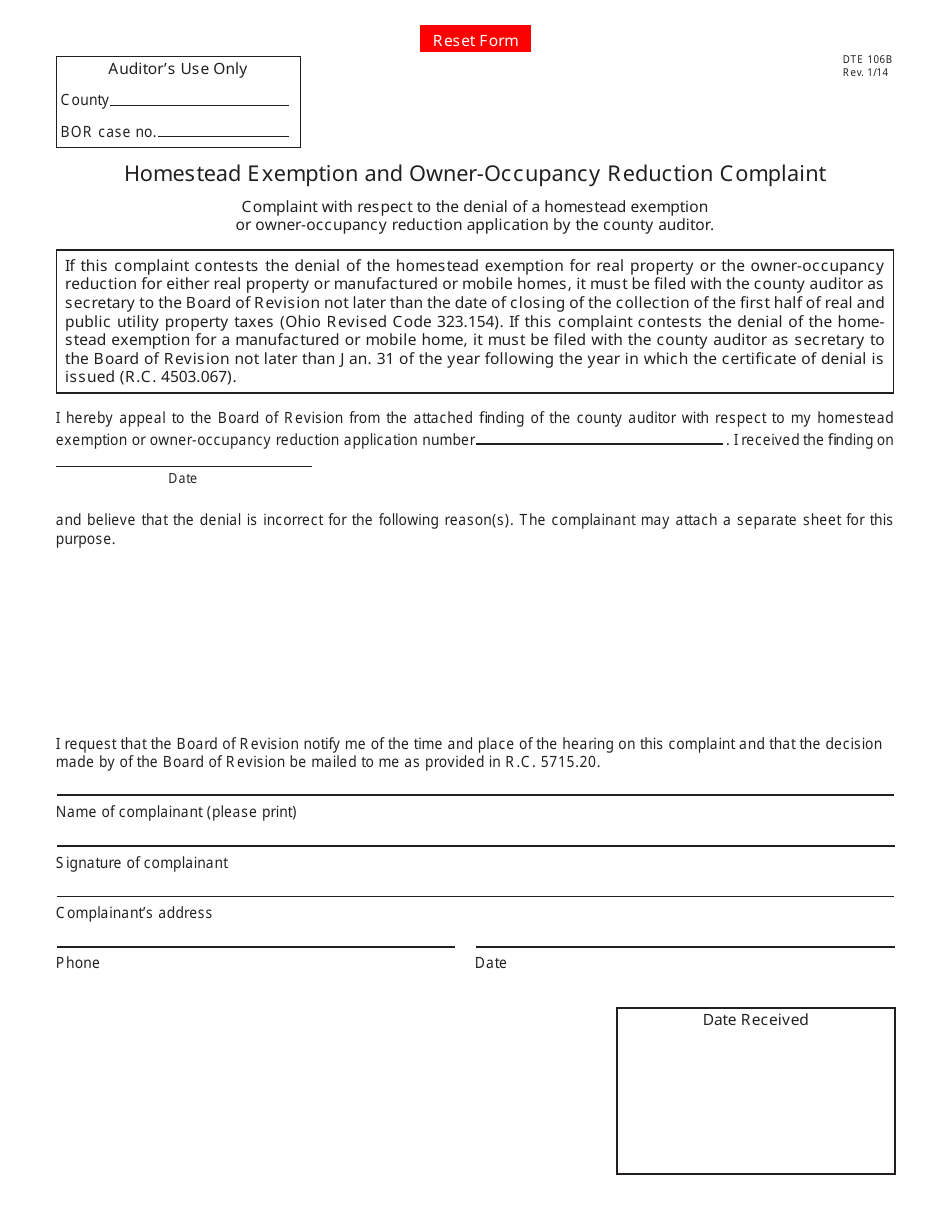

Form Dte106b Download Fillable Pdf Or Fill Online Homestead Exemption And Owner Occupancy Reduction Complaint Ohio Templateroller

Form Dte106b Download Fillable Pdf Or Fill Online Homestead Exemption And Owner Occupancy Reduction Complaint Ohio Templateroller

Real Property Tax Homestead Means Testing Department Of Taxation

Real Property Tax Homestead Means Testing Department Of Taxation

Real Property Tax Homestead Means Testing Department Of Taxation

Real Property Tax Homestead Means Testing Department Of Taxation

Labels: homestead

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home