Tarrant County Property Tax Abatement

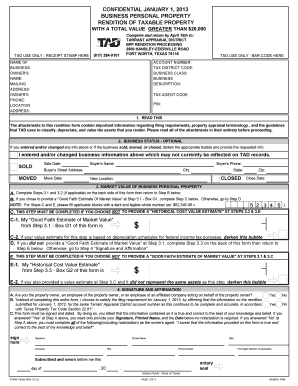

Account numbers can be found on your Tarrant County Tax Statement. Please contact the Appraisal District for.

Fort Worth TX 76196 PLAT FILING REQUIREMENTS.

Tarrant county property tax abatement. It is difficult to determine the total amount of property tax revenue lost to abatements and incentives. This is more than any other county in Ohio and the countys reliance on abatements has grown over time. Every effort is made to ensure that information provided is correct.

Delaware County collects the highest property tax in Ohio levying an average of 373200 148 of median home value yearly in property taxes while Monroe County has the lowest property tax in the state collecting an average tax of 69200 08 of. This does not include abatements of other taxes such as municipal income taxes or local sales taxes. The offer of incentives is tied to an analysis of the economic impact of the project on the community including the amount of investment in real and personal property.

TARRANT COUNTY TAX ABATEMENT POLICY TARRANT COUNTY POLICY PROCEDURES SUMMARY TARRANT COUNTY POLICY. Maximum length of abatement is 10 years. Minimum investment - New business.

Tarrant County provides the information contained in this web site as a public service. The scale must be no smaller than 1 200. Cuyahoga County calculated that county-wide the amount of taxes abated for local governments and schools came to nearly 964 million in 2016.

Get information about motor vehicle registration and title transactions. Click here for information. Municipality sets terms of abatement by agreement.

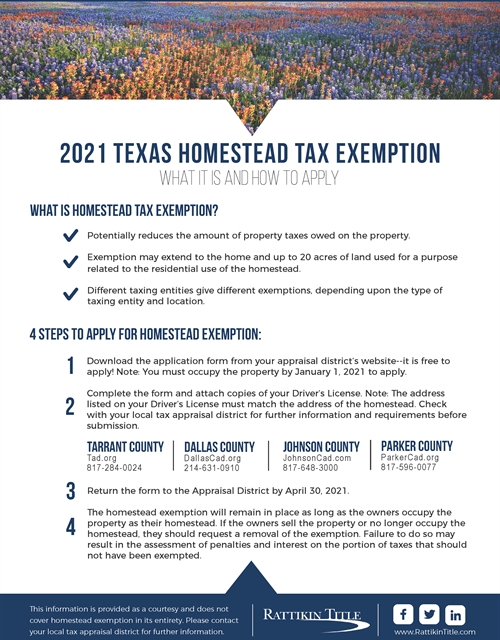

Other taxing entities may choose to participate at identical terms. Some important dates and deadlines to keep in mind are. As prescribed in Chapter 312 of the Texas Tax Code the Commissioners Court of Tarrant County considers each request for tax abatement on a case by case basis in accordance with the Countys Tax Abatement Policy.

The taxable value of abated property in Franklin County alone was over 32 billion in Tax Year 2017. Cuyahoga County Administrative Headquarters 2079 East Ninth Street Cleveland OH 44115 216 443-7400. Application for Tax AbatementReinvestment Zone.

Tax statements are mailed on or as soon as possible thereafter this date throughout the county to real and personal property owners. Pay your Tarrant County tax bill search for an account sign up for paperless billing see payment options and local Truth in Taxation information and more. WELCOME TO TARRANT COUNTY PROPERTY TAX DIVISION.

The Tarrant County Tax Office handles property tax billings and collections on behalf of the City. Enter owners last name followed by a space and the first name or initial. Real Property Tax Exemption and Remission County name Office Use Only County application number DTE application number Date received by county auditor Date received by DTE General Instructions Submit two copies of this application to the auditors office in the county where the property is located make a copy for your records.

In-depth Tarrant County TX Property Tax Information. Base or existing value may not be abated. Abatement on eligible real and fixed personal property.

In keeping with our Mission Statement we strive for excellence in all areas of property tax collections. The current collection period begins. Ownership changes address changes value information and exemptions.

Tarrant County residents can renew vehicle registration. Applicants Representative for contact regarding abatement request. However in any case where legal reliance on information contained in these pages is required the official records of Tarrant County.

If you do not know the account number try searching by owner name address or property location. Applicable to new construction and expansionsmodernization. The exact property tax levied depends on the county in Ohio the property is located in.

Plan for In-Person and Remote Contact with TAD for 2021 Appraisal Year. Penalty and interest charges begin to accrue on taxes for the. Anything smaller will not be accepted 3.

No abatement of inventories supplies etc. Maximum amount of abatement in 100 percent. All plats must be black line originals.

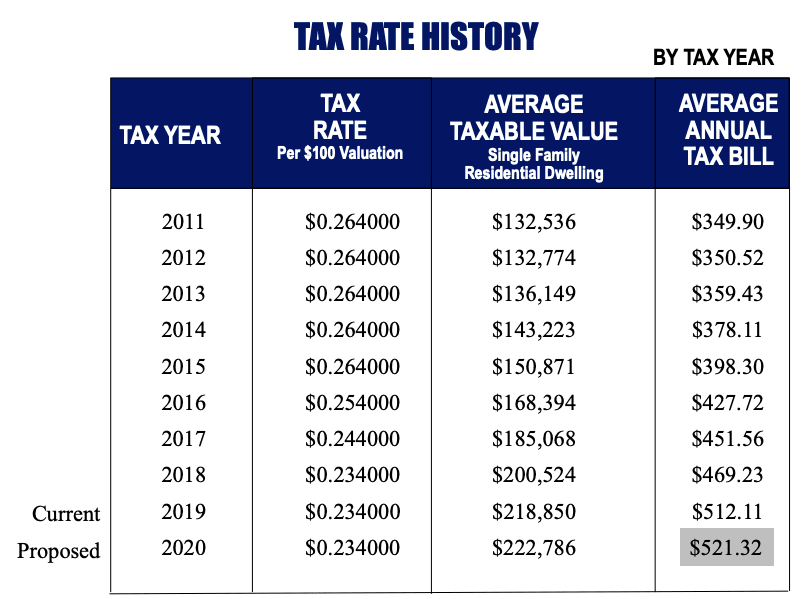

Tarrant County has the highest number of property tax accounts in the State of Texas. In order to determine the tax bill your local tax assessors office takes into account the propertys assessed value the current assessment rate as well as any tax exemptions or abatements for that property.

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home