Property Tax Abatement Columbus Ohio

Zillow has 8 homes for sale in Columbus OH matching Tax Abatement Until. Whats New for Tax Year 2020.

Individuals odx-share-caps Individual Income Tax.

Property tax abatement columbus ohio. Monday through Friday 900 am. Front Street 2nd Floor. It received a 15-year 99 percent reduction in property taxes through a CRA property tax abatement worth about 4 million in tax savings annually.

Front Street building to drop off tax. Property Tax Abatement in Ohio The city of Cleveland temporarily eliminates 100 of the increase in real estate tax of a property when the homeowners remodel or convert it into a two-family or multifamily home. Meanwhile the corporation will save more than 777 million.

The purpose of the CRA is to encourage revitalization of the existing housing and building stock and the construction of new structures. View listing photos review sales history and use our detailed real estate filters to find the perfect place. Front Street 8th Floor.

The tax credit is capped at 1000000 per taxpayer and per eligible dwelling. Headquarters for more information about the Ohio individual and school district income tax. Community Reinvestment Area - CRA ORC 373565 - An incentive used to encourage new construction and job growth.

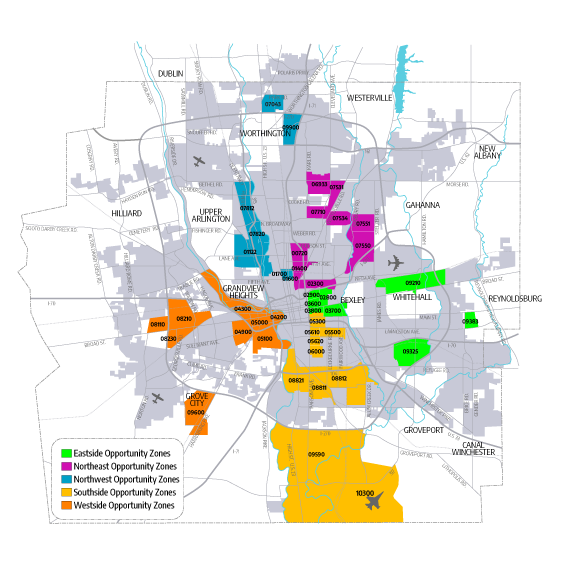

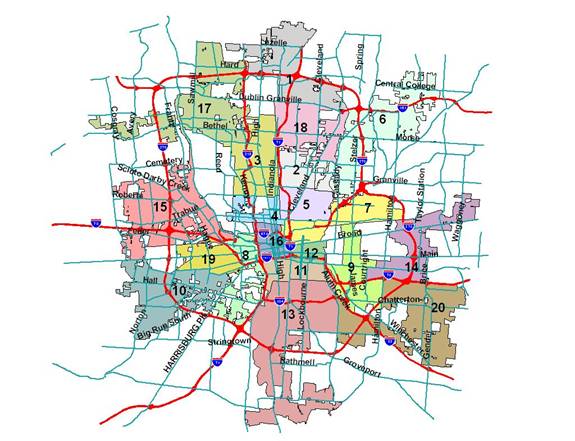

In response to a growing chorus of opposition to the existing tax abatement policy in which any new development in one of 16 designated neighborhoods is eligible for a. The abatement deal for software company CoverMyMeds will cost Columbus schools at least 37 million in property-tax revenue each year of the abatement for an estimated loss of more than 555 million over the full term of the deal. 100 15 year property tax abatements will be available for all projects including single family new construction and rehabilitation.

The same affordability requirements for multi-family projects from the Market Ready category applies to the Ready for Revitalization category. Property tax abatement is a tool which has been provided to counties townships and municipalities to promote economic development promote urban renewal and revitalization activities and encourage the retention and creation of jobs. 614 645-7193 Customer Service Hours.

Eligible businesses must invest in new building construction andor improvements to existing land and buildings. The CRA district allows the City of Columbus to negotiate exemptions on new property tax from investment for up to one hundred percent 100 for up to fifteen 15 years. 100 15 year property tax abatements will be available for all projects including single family new construction and rehabilitation.

Residential applicants will pick up an application CRA Form 1 when applying for a building permit. The Ohio Community Reinvestment Area program is an economic development tool administered by municipal and county government that provides real property tax exemptions for property owners who renovate existing or construct new buildings. CRA Tax Abatement Program.

One of the largest property tax abatements in Franklin County in the last 29 years went to the Nationwide Arena in the City of Columbus. Carlie Boos the executive director of the Affordable Housing Alliance of Central Ohio said fostering homeownership. Due to the COVID-19 pandemic the Division is currently closed to the public.

Front Street 3rd Floor. This is the State of Ohio Application for Real Property Tax Exemption and Remission More. For projects with four or more housing units an agreement must be entered into with the City in order to qualify for the abatement.

City of Columbus Income Tax Division 77 N. The Child Care Center Exemption credit allows qualifying centers to receive a partial property exemption based on qualifications set by the State. HOW DOES IT WORK.

Then you see developers get tax abatements for 10-15 years from city council. Tax Increment Finance - TIF ORC 570940 A TIF parcel pays full tax however a portion of the tax collected is sent to the municipality to pay for public infrastructure improvements made within the TIF area. Additional requirements for the lifetime of.

Community Reinvestment Areas are areas of land in which property owners can receive tax incentives for investing in real property. Taxpayers may use the secure drop box located in the lobby of the 77 N. Lead Abatement Credit Ohio Educator Deduction Schedules of Withholding and more.

614 6456675 FAX Code Enforcement Division. This suspension of tax property increase lasts for 15 years. Follow the link for form DTE 105J for additional information.

Beginning in 2020 the Ohio Lead Abatement Tax Credit Program provides a state income tax credit to Ohio property owners who incur qualifying lead abatement costs in connection with an eligible dwelling. Property Owners can earn affordability credits.

Https Www Columbus Gov Workarea Downloadasset Aspx Id 2147484112

Central Ohio Downtown Condominiums Condominiums Available Downtown Columbus Ohio

Http Supremecourt Ohio Gov Pdf Viewer Pdf Viewer Aspx Pdf 786766 Pdf

243 245 E Whittier St Columbus Oh 43206 489 000 4 Bed 3 Bath Whittier Zillow Columbus

243 245 E Whittier St Columbus Oh 43206 489 000 4 Bed 3 Bath Whittier Zillow Columbus

Columbus Her Realtors Ohio Real Estate Estate Finds Real Estate

Columbus Her Realtors Ohio Real Estate Estate Finds Real Estate

Https Www Columbus Gov Workarea Downloadasset Aspx Id 2147484112

Https Www Columbus Gov Workarea Downloadasset Aspx Id 2147484112

10 Things You Need To Know About Your Property Tax Bill Entertainment Life The Columbus Dispatch Columbus Oh

10 Things You Need To Know About Your Property Tax Bill Entertainment Life The Columbus Dispatch Columbus Oh

Columbus Ohio Expands On Emergency Scooter Restrictions

Greater Cols Antique Mall Columbus Landmarks

Greater Cols Antique Mall Columbus Landmarks

1725 Franklin Ave Columbus Oh 43205 315 000 4 Bed 3 5 Baths House Styles Zillow Columbus

1725 Franklin Ave Columbus Oh 43205 315 000 4 Bed 3 5 Baths House Styles Zillow Columbus

Luxurious Penthouse Style Living In Parks Edge Downtown Columbus Ohio This High Rise Corner Unit On The 10t Luxury High Rise High Rise Downtown Columbus Ohio

Luxurious Penthouse Style Living In Parks Edge Downtown Columbus Ohio This High Rise Corner Unit On The 10t Luxury High Rise High Rise Downtown Columbus Ohio

Open House In Gahanna School District This Sunday August 6 From 1 4 Pm 332 Muskingum Dr Columbus Ohio 43230 4 Bedrooms 2 Columbus House Styles Open House

Open House In Gahanna School District This Sunday August 6 From 1 4 Pm 332 Muskingum Dr Columbus Ohio 43230 4 Bedrooms 2 Columbus House Styles Open House

They Re All Friends Down There Developers Gave Over 440k To City Officials In 4 Years

They Re All Friends Down There Developers Gave Over 440k To City Officials In 4 Years

1089 S Champion Columbus Ohio Foreclosure 23 000 6 Bed 2 Bath Straight Up In The Hood Estate Finds Foreclosures Real Estate

1089 S Champion Columbus Ohio Foreclosure 23 000 6 Bed 2 Bath Straight Up In The Hood Estate Finds Foreclosures Real Estate

Franklin County Auditor Tax Reduction Programs

Franklin County Auditor Tax Reduction Programs

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home