Property Tax Rate Columbus Ohio

Taxpayers may use the secure drop box located in the lobby of the 77 N. The last countywide reappraisal in Franklin County was in 2017.

Delaware County Rents Most Affordable In Nation Delaware County Rent National

Delaware County Rents Most Affordable In Nation Delaware County Rent National

Ohio senator to propose bill capping annual property tax hikes at 5 for eligible homeowners.

Property tax rate columbus ohio. Front Street 2nd Floor. Zillow has 1 homes for sale in Columbus OH matching Columbus City Taxes. Delinquent tax refers to a tax that is unpaid after the payment due date.

The Franklin County Treasurer makes every effort to produce and publish the most current and accurate information possible. Columbus - 100000 x 148 148000. For more details about the property tax rates in any of Ohios counties choose the county from the interactive map or the list below.

A simple percentage used to estimate total property taxes for a property. To view all county data on one page see Ohio property tax by county. Owner Occupied Reduction Homeowners who occupy live in their primary place of residence may receive a reduction of up to 25 percent.

Multiply the market value of the property by the percentage listed for your taxing district. Payments by Electronic Check or CreditDebit Card. 123 Main Parcel ID Ex.

State Summary Tax Assessors. The State Department of Taxation Division of Tax Equalization helps ensure uniformity and fairness in property taxation through its oversight of the appraisal work conducted by each County. Whitehall - 100000 x 172 172000.

The tax applies to wages salaries and other compensation earned by the aforementioned parties. Search for a Property Search by. Taxes for a 100000 home in.

For a more specific estimate find the calculator for your county. The median property tax on a 13460000 house is 141330 in the United States. Rates range from 0-3 in Ohio.

Taxation of Real Property is Ohios oldest tax established in 1825 and is an ad valorem tax based on the value of the full market value of each property. On average the county has the third-highest property tax rate in Ohio with an average effective rate of 205. Counties in Ohio collect an average of 136 of a propertys assesed fair market value as property tax per year.

This estimator is based on median property tax values in all of Ohios counties which can vary widely. As property taxes increase with soaring property values a. The County assumes no responsibility for errors in the information and does not guarantee that the.

The median property tax on a 13460000 house is 183056 in Ohio. John Smith Street Address Ex. The rate is determined locally with a maximum rate of 1 without voter approval.

That is approximately 2029 per year if you own a house valued at 100000. City of Columbus Income Tax Division 77 N. View listing photos review sales history and use our detailed real estate filters to find the perfect place.

The average home price. Monday through Friday 900 am. Several options are available for paying your Ohio andor school district income tax.

The divisions duties include the collection of delinquent taxes and working with property owners account holders tax lien purchasers and other interested parties with tax related issues. 614 645-7193 Customer Service Hours. Home values in Columbus can be high.

Hilliard - 100000 x 208 208000. The real property tax is Ohios oldest tax. Due to the COVID-19 pandemic the Division is currently closed to the public.

If you have questions about how property taxes can affect your overall financial plans a financial advisor in Columbus can help you out. Ohio is ranked number twenty two out of the fifty states in order of the average amount of property taxes collected. Front Street building to drop.

States law requires a flat rate within a municipality. The median property tax in Ohio is 183600 per year for a home worth the median value of 13460000. The departments Tax Equalization Division helps ensure uniformity and fairness in property taxation through its oversight of the appraisal work of local county auditors.

For general payment questions call us toll-free at 1-800-282-1780 1-800-750-0750 for persons who use text telephones TTYs or adaptive telephone equipment. It has been an ad valorem tax meaning based on value since 1825. This is the State of Ohio Application for Real Property Tax Exemption and.

Ohio has 88 counties with median property taxes ranging from a high of 373200 in Delaware County to a low of 69200 in Monroe County. On average a person living in Columbus can expect to pay 2029 percent in property taxes each year. This program assists qualified surviving spouses by providing tax savings on real estate or manufactured home taxes.

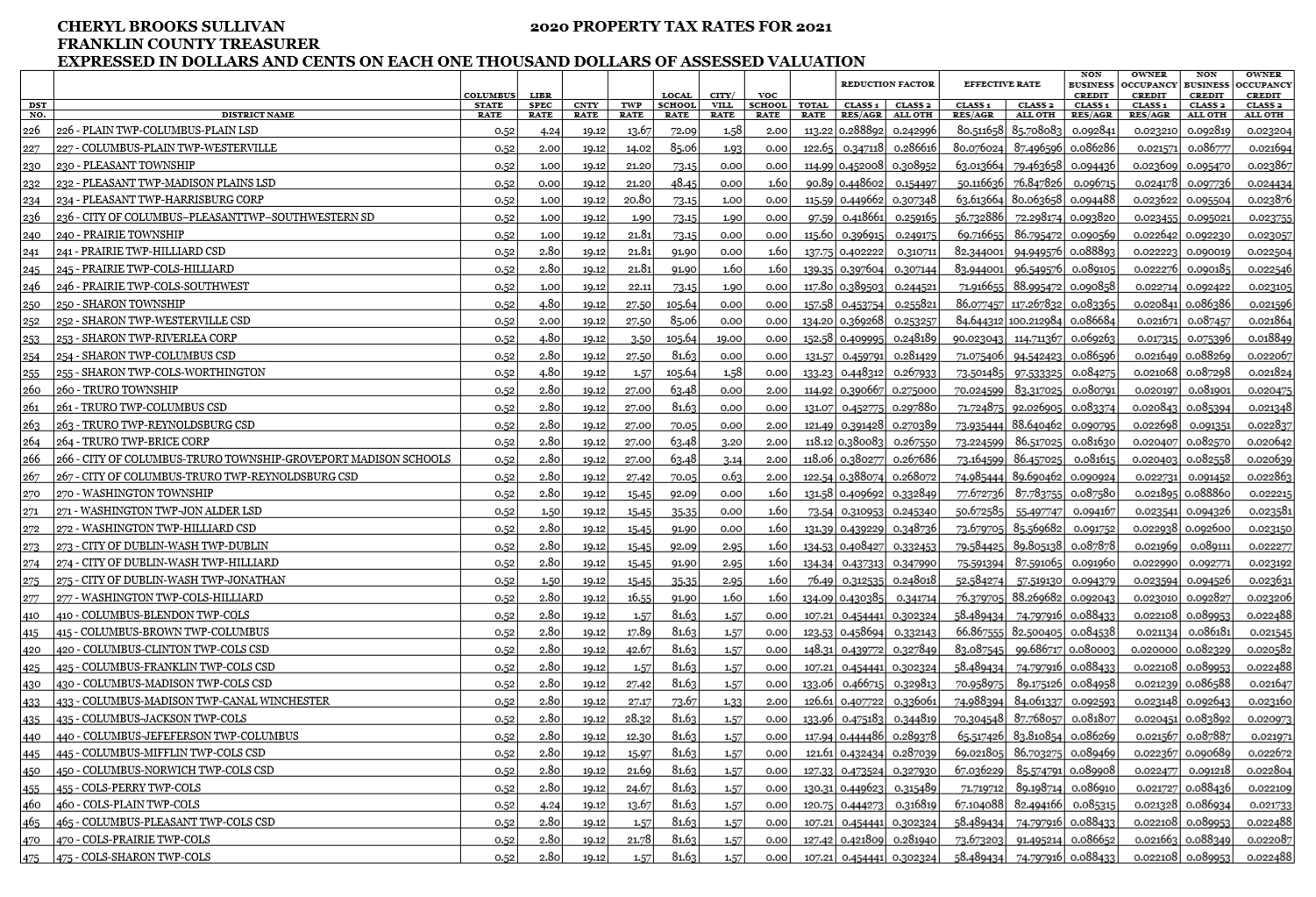

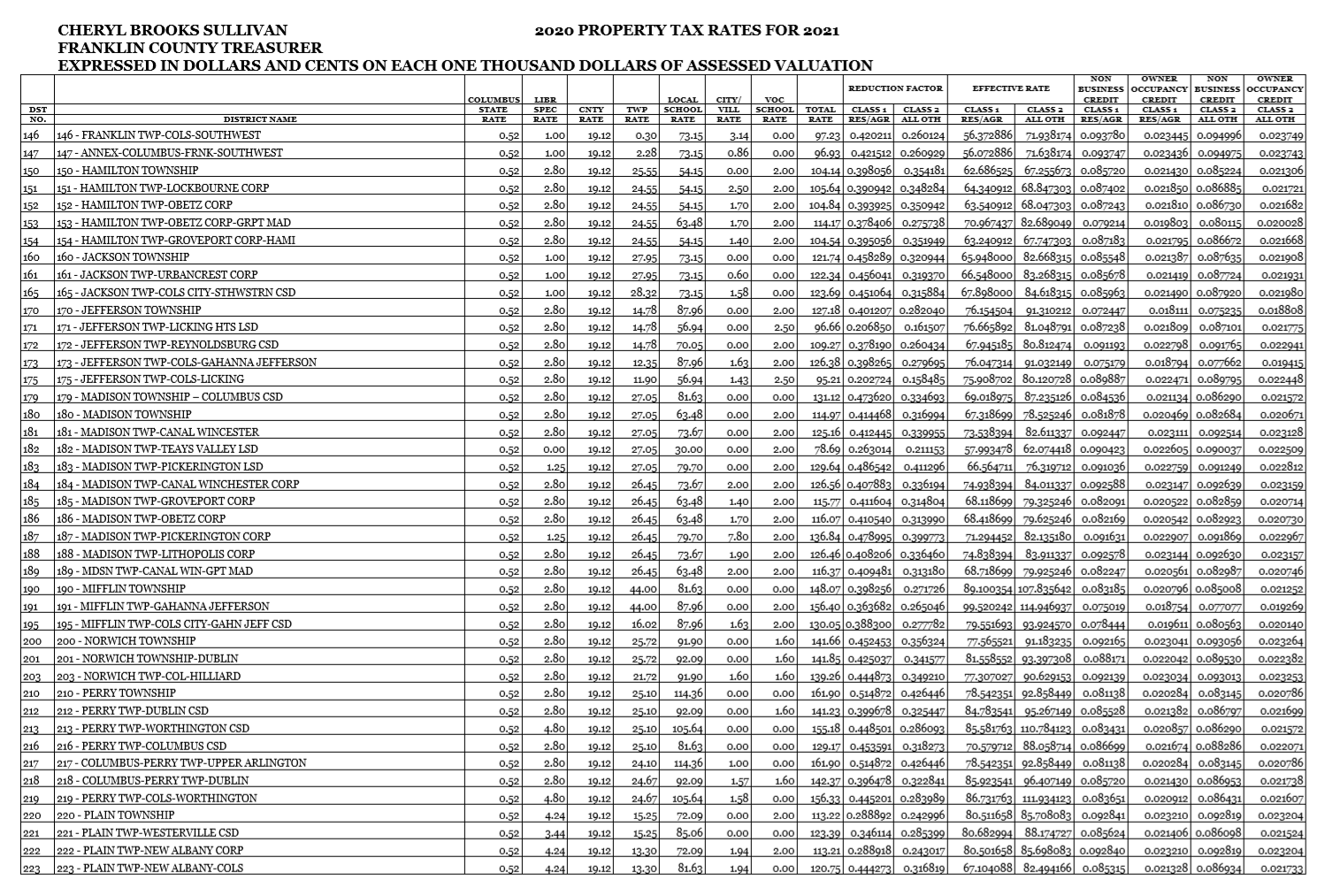

Franklin County Treasurer Tax Rates

Franklin County Treasurer Tax Rates

Find Out Where Your City Or Township Ranks For Property Tax Rates In Greater Cleveland Akron Area Cleveland Com

Find Out Where Your City Or Township Ranks For Property Tax Rates In Greater Cleveland Akron Area Cleveland Com

States With The Lowest Corporate Income Tax Rates Infographic Infographic History Geography Usa Map

States With The Lowest Corporate Income Tax Rates Infographic Infographic History Geography Usa Map

Jerome Village Ohio Dublin Ohio Union County Ohio Real Estate

Jerome Village Ohio Dublin Ohio Union County Ohio Real Estate

Franklin County Treasurer Tax Rates

Franklin County Treasurer Tax Rates

Stuff You Should Know Real Property Taxes In Ohio Waller Financial Planning Group

Stuff You Should Know Real Property Taxes In Ohio Waller Financial Planning Group

Ohio Property Tax Calculator Smartasset

Ohio Property Tax Calculator Smartasset

10 Things You Need To Know About Your Property Tax Bill Entertainment Life The Columbus Dispatch Columbus Oh

10 Things You Need To Know About Your Property Tax Bill Entertainment Life The Columbus Dispatch Columbus Oh

The Property Tax On My Eaton Ohio Home Is Increasing 14 Percent In 2018 I Knew The Rate Was Abnormal It S Roughly Twi Property Tax Preble County How To Plan

The Property Tax On My Eaton Ohio Home Is Increasing 14 Percent In 2018 I Knew The Rate Was Abnormal It S Roughly Twi Property Tax Preble County How To Plan

These Cuyahoga County Places Have Ohio S 6 Highest Property Tax Rates That S Rich Recap Cleveland Com

These Cuyahoga County Places Have Ohio S 6 Highest Property Tax Rates That S Rich Recap Cleveland Com

10 Things You Need To Know About Your Property Tax Bill Entertainment Life The Columbus Dispatch Columbus Oh

10 Things You Need To Know About Your Property Tax Bill Entertainment Life The Columbus Dispatch Columbus Oh

Franklin County Treasurer Tax Rates

Franklin County Treasurer Tax Rates

Find Out Where Your City Or Township Ranks For Property Tax Rates In Greater Cleveland Akron Area Cleveland Com

Usa County Of Orange California Property Tax Bill Template In Word Format Bill Template Property Tax Bills

Usa County Of Orange California Property Tax Bill Template In Word Format Bill Template Property Tax Bills

Easyknock The Guide To Georgia Property Tax Rates And Options

Easyknock The Guide To Georgia Property Tax Rates And Options

Find Out Where Your City Or Township Ranks For Property Tax Rates In Greater Cleveland Akron Area Cleveland Com

Ohio Homestead Exemption For Disabled Veterans Disabled Veterans Va Mortgage Loans Mortgage Loan Officer

Ohio Homestead Exemption For Disabled Veterans Disabled Veterans Va Mortgage Loans Mortgage Loan Officer

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home