Property Tax Office El Paso

915 212-0107 In Person. Due to pandemic currently closed for in-person services.

El Paso County Assessor Extends Deadline For Filing Personal Property Declarations Cheyenne Edition Gazette Com

El Paso County Assessor Extends Deadline For Filing Personal Property Declarations Cheyenne Edition Gazette Com

Wells Fargo Plaza 221 N.

Property tax office el paso. Registration Renewals License Plates and Registration Stickers. You may verify your current exemption status by using FIND ACCOUNT INFOfor your property. We hope you find the information contained here to be useful and interesting.

8907 Park St property location 8907 park then click Property Address leave blank all accounts with statements requested by fiduciary number 2066 Washington Mutual 2066 then click Fiduciary No leave blank all owners with a last name of Smith who live on Jackson Rd. Each portfolio may consist of one or more properties and includes pertinent tax information such as property location certified. City of El Paso Tax Office PO.

Am I getting all my exemptions. Garden of the Gods Road Suite 2300. This office will be located in West El Paso at 424 Executive Center Suite 120.

The City of El Paso collects property taxes on behalf of all the 38 units of government that levy a tax within El Paso County. Assessor Offices in El Paso TX are responsible for assessing the values of all taxable property within their jurisdictions. You may search the El Paso CAD appraisal.

Gonzalez is proud to announce the opening of our brand new County Tax Office. The hours of operation will be Monday through Friday 800 am. We invite you to pay your Property Taxes at the El Paso County Tax Office We have seven tax offices conveniently located throughout El Paso County Payments accepted mid October through Monday February 1 2021.

An exemption removes part of the value of your property from taxation and lowers your taxes. The district appraises property according to the Texas Property Tax Code and the Uniform Standards of Professional Appraisal Practices USPAP. El Paso County Tax Office.

Smith then click Owner Name Jackson then click Property Address. The Office of the Treasurer is responsible for the collection and distribution of property taxes in compliance with Colorado Statutes. We are one of the few large urban offices in Texas fully consolidated for purposes of property tax collection.

The El Paso County Tax Assessor-Collector Ruben P. A friendly reminder about the Property Tax Collection Season. Make your check or money order payable toEL PASO TAX ASSESSORCOLLECTORPO BOX 2992EL PASO TEXAS 79999-2992.

Assessors appraise values of all land and commercial property real property and business fixed asset personal property. Credit or debit card payment for other property types may be made by phoning our office 719. Unless otherwise noted all data refers to tax information for 2020.

Colorado Springs CO 80907. County tax assessor-collector offices provide most vehicle title and registration services including. About the El Paso Assessor Office.

The appraisal district s chief appraiser is hired by a board of directors. El Paso County Appraisal District operates property tax systems and is administered by a chief appraiser who undertakes annual property valuations. El Paso Central Appraisal District is responsible for appraising all real and business personal property within El Paso County.

For example if your home is valued at 100000 and you qualify for a 20000 exemption you pay taxes on your home as if it was worth only 80000. Property Tax Exemptions The El Paso Central Appraisal District EPCAD is the office responsible for processing and determining eligibility on applicable exemptions. Only real estate and mobile home taxes may be paid online.

Back to City of El Paso. You can pick up an exemption application at the Appraisal District located at 5801 Trowbridge El Paso TX 79925 in the Deeds Exemptions Department between 700 am and 600 pm Monday through Thursday and 800 am -. Please contact your county tax office or visit their Web site to find the office closest to you.

Our goal is to provide efficient and effective services for the taxpayers. Kansas Suite 300 Corner of Kansas Mills Monday through Friday 800 am. Real Estate Property Tax Search and Online Payments - El Paso County Treasurer PLEASE NOTE.

Cash personal checks cashiers checks and money orders. All amounts due include penalty interest and attorney fees when applicable. Our goal is to serve the citizens of El Paso County in the most timely cost-efficient and secure manner possible while treating you with courtesy and respect.

The local taxing units appoint the directors and fund the appraisal district according to a taxes-based formula. Box 2992 El Paso TX 79999-2992 Phone Information or Payments. You can create a portfolio if you want to group multiple tax accounts together for easier review and payment.

El Paso County Adjusts In Person Services Due To Covid 19 El Paso County Colorado

El Paso County Adjusts In Person Services Due To Covid 19 El Paso County Colorado

Property Tax Deadline Extended 24 Hours

Property Tax Deadline Extended 24 Hours

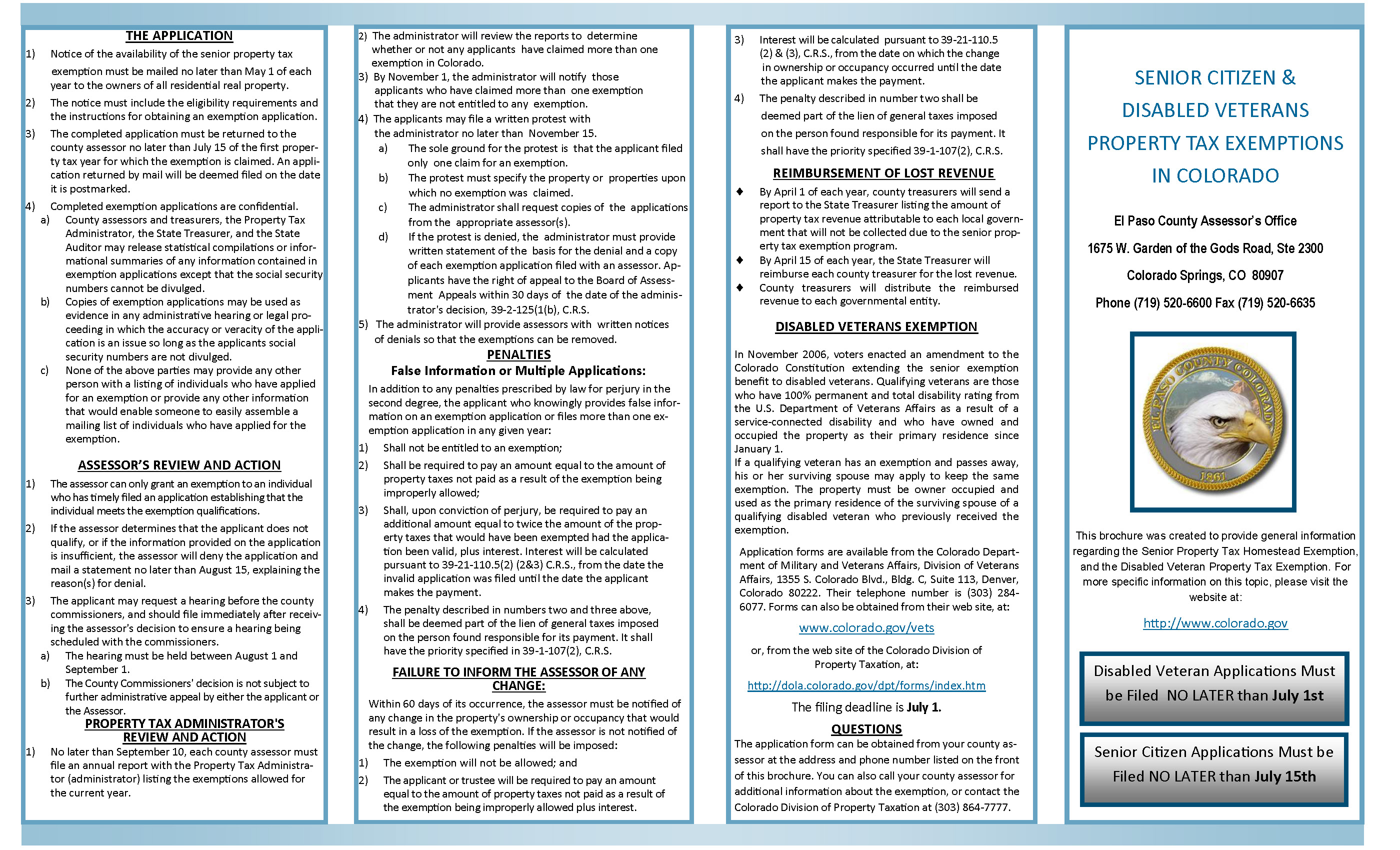

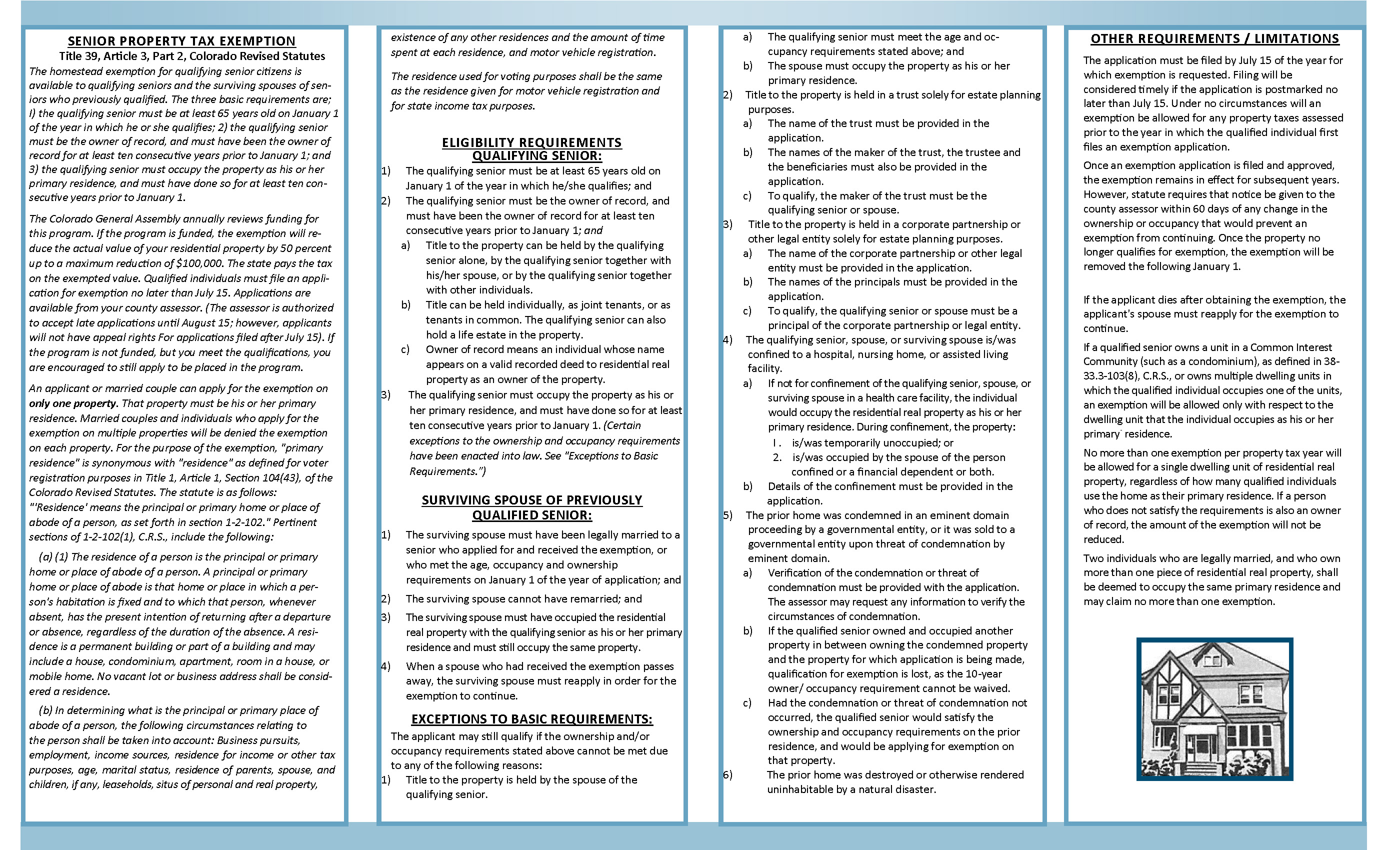

Senior Property Tax Exemption El Paso County Assessor

Senior Property Tax Exemption El Paso County Assessor

Senior Property Tax Exemption El Paso County Assessor

Senior Property Tax Exemption El Paso County Assessor

Https Assessor Elpasoco Com Wp Content Uploads Personal Property Brochure Pdf

I Was In Shock Higher Property Values Means Higher Taxes For El Paso County Homeowners

I Was In Shock Higher Property Values Means Higher Taxes For El Paso County Homeowners

Assessor Launches Enhanced Website El Paso County Colorado

Assessor Launches Enhanced Website El Paso County Colorado

Data Thousands Of El Paso Homes Have No Mortgage

Data Thousands Of El Paso Homes Have No Mortgage

Legal Notices For 7 12 20 Legals Elpasoinc Com

Legal Notices For 7 12 20 Legals Elpasoinc Com

Where To Pay Your Property Tax Bill In El Paso County Kfox

Where To Pay Your Property Tax Bill In El Paso County Kfox

El Paso Central Appraisal District Protests And Appeals

El Paso Central Appraisal District Protests And Appeals

Https Www Horizoncity Org Wp Content Uploads Town Of Horizon City Notice Of Proposed Tax Rate Final8994 Pdf

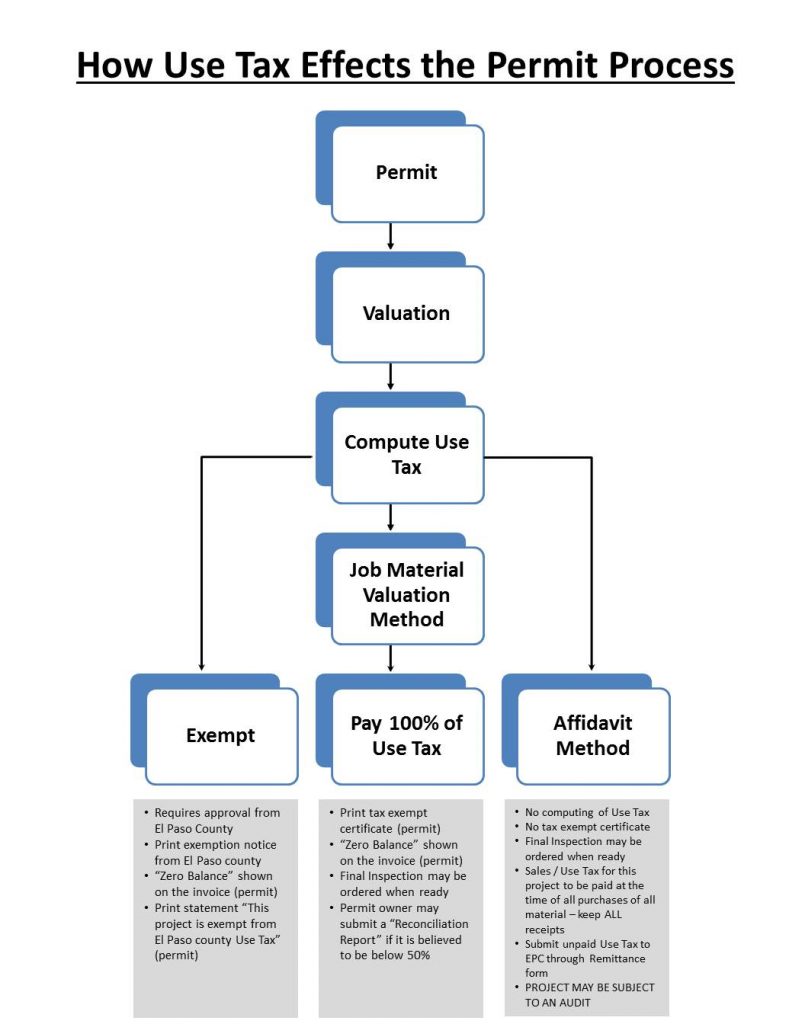

Sales And Use Tax El Paso County Administration

Sales And Use Tax El Paso County Administration

Senior Property Tax Exemption El Paso County Assessor

Senior Property Tax Exemption El Paso County Assessor

City Of El Paso Reminds Homeowner Of Property Tax Savings Kfox

City Of El Paso Reminds Homeowner Of Property Tax Savings Kfox

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home