North Carolina Rental Property Tax Laws

Private residences that are rented for fewer than 15 days in a calendar yearAccommodations directly purchased by the United States government or its agencies Filing short-term rental tax returns. No lessor of property merely by reason that he is to receive as rent or compensation for its use.

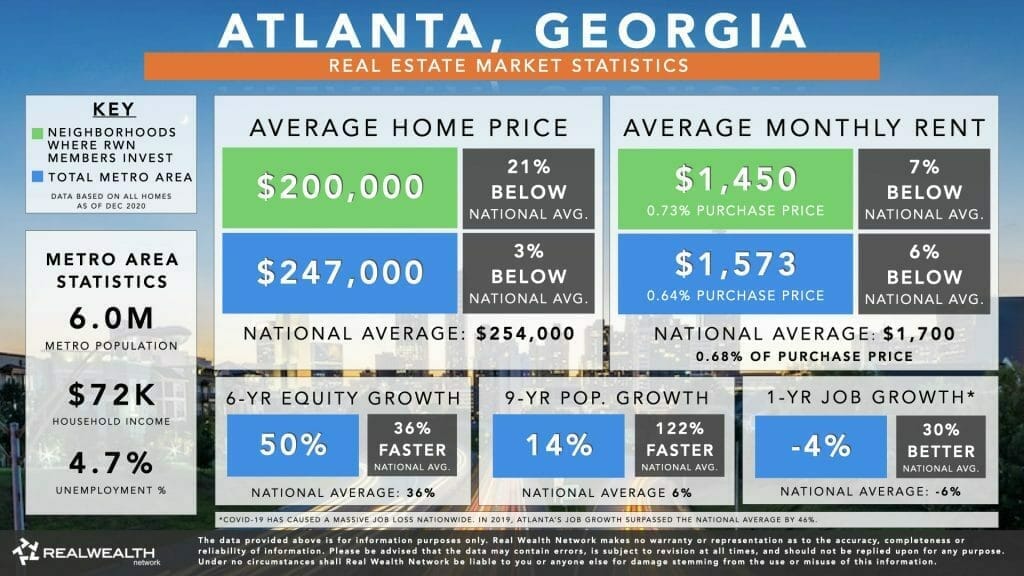

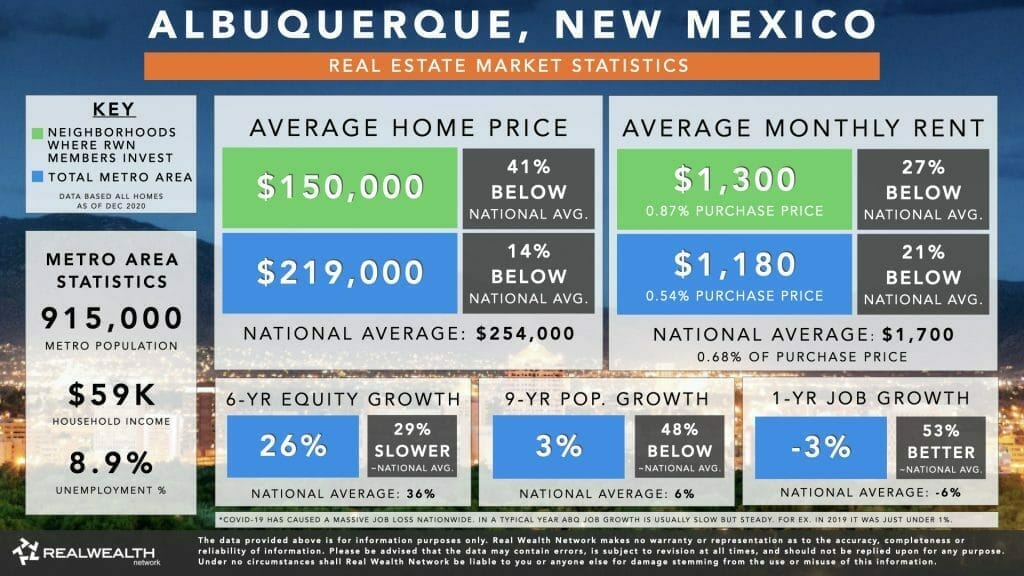

18 Best Places To Buy Rental Property In 2021 Cash Flow Appreciation

18 Best Places To Buy Rental Property In 2021 Cash Flow Appreciation

North Carolina landlords can raise tenants rent for whatever reason without prior notice.

North carolina rental property tax laws. If you do not meet one of the exceptions then the gain is taxable. North Carolina landlords may charge up to 15 of 5 of monthly rent in late. The gross receipts or gross proceeds derived from or the total amount agreed to be paid for the lease or rental within North Carolina of all kinds and types of tangible personal property not specifically exempt by statute are subject to sales and use tax at the same rate and maximum tax that is applicable to the retail sale of such property.

Senate Bill 483 was enacted into law and became effective on July 1 2019 as Session Law 2019-73. This is particularly significant as Raleigh is the state capital of North Carolina. North Carolina Property and Real Estate Laws.

Again you can use a selling rental property tax calculator to help you estimate the tax implications when selling rental property. North Carolina legislation currently prohibits rent control on both a state and local level. Gross receipts derived from the rental of an accommodation include the sales price of the rental of the accommodation.

There are specific rules for how much a landlord can collect as a deposit the reasons the landlord can make deductions from the deposit requirements for storing the deposit and when the landlord must return the deposit. The rate can range between 0 to 20 but most often falls within the 15 range. To learn more see a full list of taxable and tax-exempt items in North Carolina.

A A landlord or real estate broker shall not disburse prior to the occupancy of the property by the tenant an amount greater than fifty percent 50 of the total rent except as permitted pursuant to this subsection. Tenants in North Carolina are protected by landlord-tenant law when it comes to their security deposit. North Carolina state law limits how much a landlord can charge for a security deposit one- and one-half months rent for month-to-month rental agreements or two months if the rental term is longer that two months and landlords may apply an additional reasonable nonrefundable deposit for pets when it must be returned within 30 days after a tenant moves though if a landlords claim.

In North Carolina short-term rental hosts with properties that meet the following qualifications may be exempt from collecting and remitting state taxes. The gross receipts derived from the rental of an accommodation are subject to the general State and applicable local and transit rates of sales and use tax and any local occupancy tax imposed by a city county or special jurisdiction. Every operator of a business or individual furnishing a taxable accommodation in New Hanover County such as a hotel motel inn room rental tourist camp or other short-term rental is subject to charging a Room Occupancy Tax in accordance with North Carolina General Statute 153A-155 and 160A-215.

Lessor and lessee not partners. The waters surrounding proposed regulation of short-term rentals in Raleigh and other North Carolina municipalities got a little murkier last week as a seemingly simple bill passed both houses of the General Assembly and was signed by the Governor. Selling rental property tax expenses determines the basis of the rental property.

Wake County is a county in North Carolina. This page describes the taxability of leases and rentals in North Carolina including motor vehicles and tangible media property. Property and real estate laws typical concern things like landlord-tenant relations homestead protection from creditors and related matters.

Wake County is located near the center of North Carolina. While North Carolinas sales tax generally applies to most transactions certain items have special treatment in many states when it comes to sales taxes. A late fee cannot be imposed unless the tenant pays the rent five days or.

House Bill 1050 SL. Do I have to file. A landlord or real estate broker may disburse prior.

July 9 2019. Multiply the resulting percentage by 250K if single or 500K if MFJ. 2014-3 signed into law May 29 2014 by Governor McCrory provides that the gross receipts derived from the rental of a private residence cottage or similar accommodation listed with a real estate broker or agent where a person occupies or has the right to occupy such on or after June 1 2014 is subject to the 475 general State and applicable local and.

So long as a 30 days written notice is. NC General Statutes - Chapter 42 1 Chapter 42. Leases providing for monthly rent the fee cannot exceed 15 or 5 of the monthly rent whichever is greater.

Rent Increases Related Fees in North Carolina. For monthly payments the maximum late fee is fifteen dollars or five percent of the monthly rent. Do I put the profits from my rental property in the nonresident income allocations even though I have a depreciated negative amount from my federal return.

In North Carolina for example landlords must return a tenants security deposit within 30 days of the termination of the lease and limits the amount. Wake County real estate includes areas in Raleigh Chapel Hill and Durham all of which are cities located within Wake County. As a non-resident of North Carolina with rental property located in NC do I have to file a North Carolina state tax return if the NC Refund or Payment is 0.

You received income for the taxable year from North Carolina sources that was attributable to ownership of any interest in real or tangible personal property in the State or derived from a business trade profession or occupation carried on in North Carolina. Laws regulating the rental market protect both landlords and tenants. If you are a nonresident you must file if.

Yes rental property in NC would be NC-source income. In North Carolina landlords can only charge late fees if the rental payment is late five days or more. The pro-rata portion of the exclusion is calculated by dividing the number of days you both owned and occupied the property as your principal residence by 730 days ie.

Thus landlords can charge as much as they want for rent.

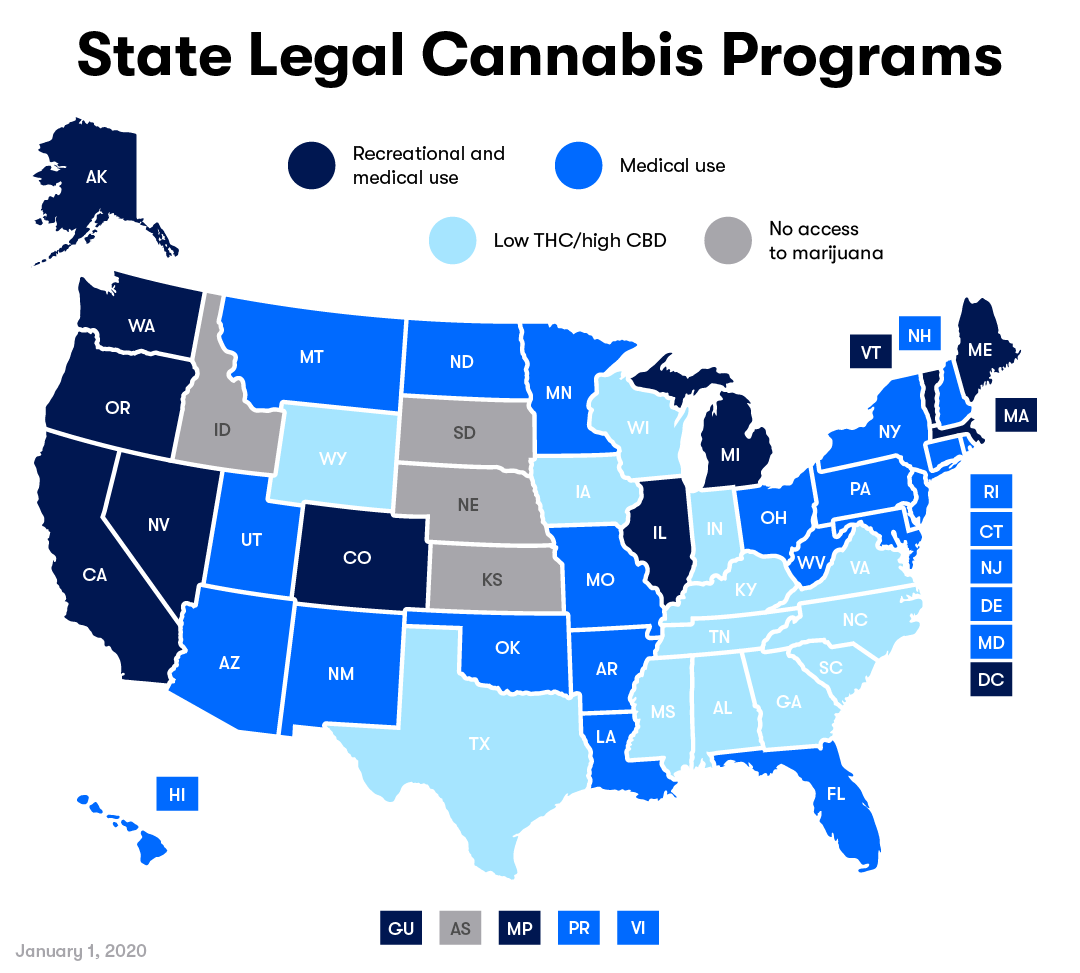

Marijuana And Rental Properties What Landlords And Property Managers Should Know Rentals Resource Center

Marijuana And Rental Properties What Landlords And Property Managers Should Know Rentals Resource Center

Should I Pay Off My Rental Property Mortgage Realwealth

Should I Pay Off My Rental Property Mortgage Realwealth

18 Best Places To Buy Rental Property In 2021 Cash Flow Appreciation

18 Best Places To Buy Rental Property In 2021 Cash Flow Appreciation

Should I Sell Our Rental Properties Retire By 40

Should I Sell Our Rental Properties Retire By 40

What To Do If A Tenant Dies In Your Rental Property Rentprep

What To Do If A Tenant Dies In Your Rental Property Rentprep

5 Great Things To Know About Rental Income And Taxes 1 800accountant

5 Great Things To Know About Rental Income And Taxes 1 800accountant

How To Sell Rental Property Without Paying Taxes

How To Sell Rental Property Without Paying Taxes

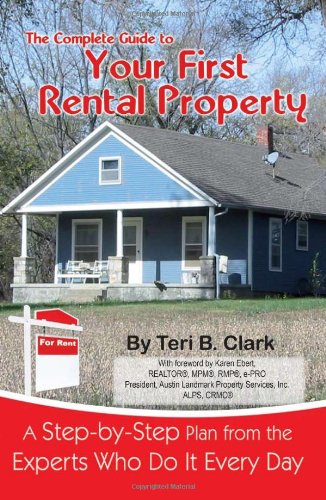

The Complete Guide To Your First Rental Property A Step By Step Plan From The Experts Who Do It Every Day Teri B Clark 9780910627986 Amazon Com Books

The Complete Guide To Your First Rental Property A Step By Step Plan From The Experts Who Do It Every Day Teri B Clark 9780910627986 Amazon Com Books

5 Reasons You Should Or Shouldn T Buy A Rental Property Mynd Management

5 Reasons You Should Or Shouldn T Buy A Rental Property Mynd Management

Renters Application Form Template Best Of Free South Carolina Rental Application Form Pdf Template Rental Application Real Estate Forms Application Form

Renters Application Form Template Best Of Free South Carolina Rental Application Form Pdf Template Rental Application Real Estate Forms Application Form

How To Buy A Rental Property With Little Money Down

How To Buy A Rental Property With Little Money Down

Rental Application Form Pdf Real Estate Forms Rental Application Real Estate Forms Application Form

Rental Application Form Pdf Real Estate Forms Rental Application Real Estate Forms Application Form

Policies For Short Term Rental Properties Under Review In The Woodlands Community Impact Newspaper

Policies For Short Term Rental Properties Under Review In The Woodlands Community Impact Newspaper

18 Best Places To Buy Rental Property In 2021 Cash Flow Appreciation

18 Best Places To Buy Rental Property In 2021 Cash Flow Appreciation

What Are The Tax Implications Of Selling A Rental Property Northern Virginia Property Managementnorthern Virginia Property Management

What Are The Tax Implications Of Selling A Rental Property Northern Virginia Property Managementnorthern Virginia Property Management

7 Reasons To Consider Buying An Investment Property Before First Home

7 Reasons To Consider Buying An Investment Property Before First Home

Llcs For Asset Protection For Nc Rental Property Owners Carolina Family Estate Planning

Llcs For Asset Protection For Nc Rental Property Owners Carolina Family Estate Planning

Rental Property Tax Deductions Property Tax Deduction

Rental Property Tax Deductions Property Tax Deduction

Rental Income And Expense Worksheet Propertymanagement Com

Rental Income And Expense Worksheet Propertymanagement Com

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home