Property Tax Pay Online Los Angeles

Hill Street Los Angeles CA 90012. To address the concerns of not being able to record intergenerational transfers before 2162021.

Evaluation Of The Property Tax Postponement Program

Evaluation Of The Property Tax Postponement Program

You can pay online by credit card or by electronic check from your checking or savings account.

Property tax pay online los angeles. The Assessors Identification Number AIN is a ten-digit number assigned by the Office of the Assessor to each piece of real property in Los Angeles County. Once you have entered the information click the Search button. Please call 213893-7935 or visit us at 225 N.

888 807-2111 Toll Free 213 974-8368. Property Tax Installment Plans. Estimate taxes for a recently purchased property.

500 West Temple Street Room 153. Each year business property statements which provide a basis for determining property assessments for fixtures and equipment are mailed by the Assessors Office to most commercial industrial and professional firms. Business Registration ApplicationsRegistration for Business Tax Registration Certificate BTRC.

You can pay your bill using checking account or creditdebit card. Secured Property Taxes 213 974-2111. A convenience fee of 25 will be charged for a credit card transaction.

Los Angeles County Auditor-Controller. Pay Your Property Taxes Online. Property Tax Payment History.

We are located on the first floor in Room 122. Last day to file an ASSESSMENT APPEAL APPLICATION for reduction of assessment made in regular period in Los Angeles County. You must submit a separate request for each property tax bill eg Annual Secured Property Tax Bill Supplemental Secured Property Tax Bill Unsecured Property Tax Bill etc.

You will need your Assessors Identification Number AIN to search and retrieve payment information. If you are unable to submit your request online you must contact our office at 213 974-2111 to complete your request. Delinquent Unsecured Tax information is only available by telephone or in person.

Enter your property address property ID or parcel number below. This ten-digit AIN is made up of a four-digit Map Book Number 1234 a three-digit Page Number 567 and a three-digit Parcel Number 890. The Office of the Los Angeles County Assessor will consider the execution and notarization date notarial execution on the document to.

If November 30 falls on a Saturday Sunday or a legal holiday an application is valid if either filed or postmarked by the next business day. We accept Visa MasterCard Discover and American Express. The first installment of real estate taxes is DUE DELINQUENT after 500 pm on December 10.

Property Tax Services Division. Your actual tax rates. Get started with Your Payment.

Nearly all of our taxpayer services are available on-line 24 hours 7 days a week and are listed below. Los Angeles CA 90012. Unsecured Taxes Payment Status.

The property tax portal gives taxpayers an overview and specific details about the property tax process in Los Angeles County. View and pay your Los Angeles County Secured Property Tax Bill online using this service. The Treasurer-Tax Collectors Office offers an online search to find the status of unsecured property tax payments.

Your parcel number is labeled as number 1 on your property tax bill. Visit Treasurer and Tax Collector website. New Property Owner Information.

You only need to enter one of the fields below to begin. No fee for an electronic check from your checking or savings account. Appealing decisions on your assessed value and subsequent tax bill.

Unsecured taxes are those that are not secured by real property. Businesses with personal property and fixtures that cost 100000 or more must file a business property.

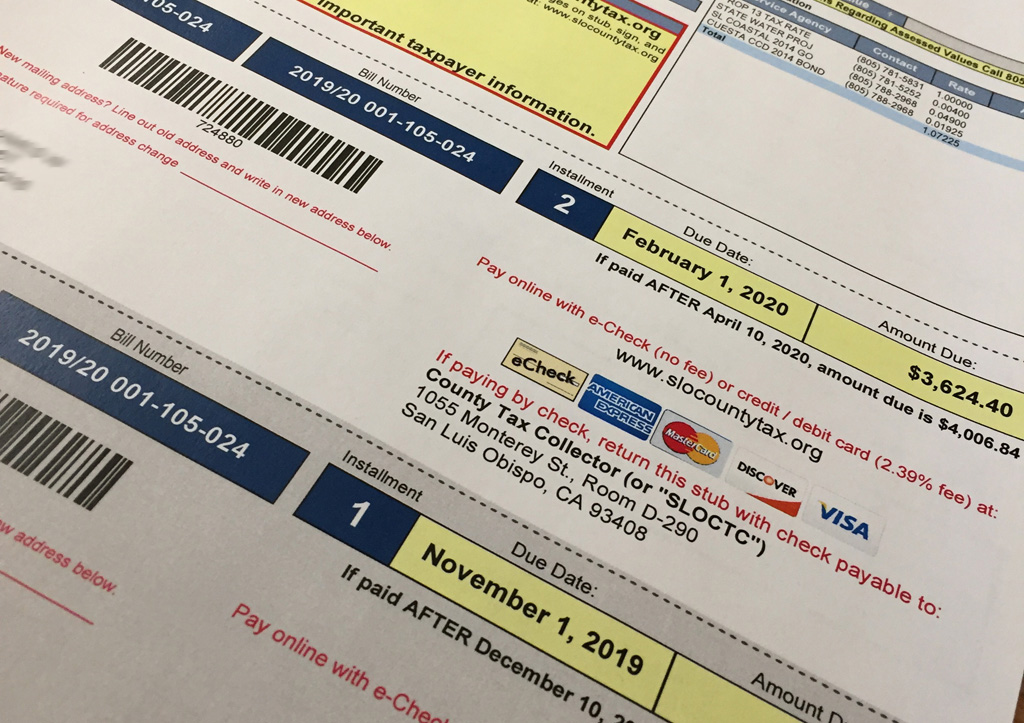

First Installment Payments For 2019 20 Secured Property Tax Bills Are Due November 1st County Of San Luis Obispo

First Installment Payments For 2019 20 Secured Property Tax Bills Are Due November 1st County Of San Luis Obispo

Contesting Your Property Value Los Angeles County Property Tax Portal

Contesting Your Property Value Los Angeles County Property Tax Portal

Property Taxes Overview Los Angeles County Office Of The Assessor

Property Taxes Overview Los Angeles County Office Of The Assessor

Property Taxes By State Why We Should All Embrace Higher Property Taxes

Property Taxes By State Why We Should All Embrace Higher Property Taxes

Secured Property Taxes Frequently Asked Questions Treasurer And Tax Collector

Secured Property Taxes Frequently Asked Questions Treasurer And Tax Collector

Supplemental Secured Property Tax Bill Los Angeles County Property Tax Portal

Supplemental Secured Property Tax Bill Los Angeles County Property Tax Portal

Overview Los Angeles County Property Tax Portal

Overview Los Angeles County Property Tax Portal

Statement Of Prior Year Taxes Los Angeles County Property Tax Portal

Statement Of Prior Year Taxes Los Angeles County Property Tax Portal

Unsecured Property Tax Los Angeles County Property Tax Portal

Unsecured Property Tax Los Angeles County Property Tax Portal

Los Angeles County Property Tax Records Los Angeles County Property Taxes Ca

Los Angeles County Property Tax Records Los Angeles County Property Taxes Ca

Annual Secured Property Tax Bill Los Angeles County Property Tax Portal

Annual Secured Property Tax Bill Los Angeles County Property Tax Portal

Adjusted Annual Property Tax Bill Los Angeles County Property Tax Portal

Adjusted Annual Property Tax Bill Los Angeles County Property Tax Portal

How To Read Your Property Tax Bill La County Property Tax Los Angeles Real Estate Tax

How To Read Your Property Tax Bill La County Property Tax Los Angeles Real Estate Tax

Adjusted Supplemental Property Tax Bill Los Angeles County Property Tax Portal

Adjusted Supplemental Property Tax Bill Los Angeles County Property Tax Portal

Notice Of Delinquency Los Angeles County Property Tax Portal

Notice Of Delinquency Los Angeles County Property Tax Portal

New Program Allows Taxpayers Pay Annual Property Taxes In Monthly Installments County Of San Luis Obispo

New Program Allows Taxpayers Pay Annual Property Taxes In Monthly Installments County Of San Luis Obispo

Pay Property Tax Bill Online County Of Los Angeles Papergov

Payment Activity Notice Los Angeles County Property Tax Portal

Payment Activity Notice Los Angeles County Property Tax Portal

Substitute Secured Property Tax Bill Los Angeles County Property Tax Portal

Substitute Secured Property Tax Bill Los Angeles County Property Tax Portal

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home