Capital Gains Tax Uk Property Non Resident

These are anti-avoidance rules to prevent people from leaving the UK to dispose of an asset just to avoid capital gains tax. Non-residents realising chargeable gains post 5 April 2019 will be taxed as follows.

Capital Gains Tax In The Uk For Property Property Walls

Capital Gains Tax In The Uk For Property Property Walls

The new rules apply to.

Capital gains tax uk property non resident. Capital Gains Tax CGT usually applies to taxpayers who live in the UK but special rules bring expats and other non-residents into the tax net if they make a profit from selling a home while living overseas. UK Personal Allowance for Non Residents Capital Gains Tax. The Finance Bill legislation published on 24 March includes significant additional detail on the operation of the new tax charge together with consequential changes to other capital gains tax CGT provisions.

From 6 April 2019 non-resident Capital Gains Tax covers indirect and direct disposals of all UK property or land. If you return to the UK however you would pay just like UK residents do. The capital gains tax charge on disposals of UK residential property by nonUK residents NRCGT - from 6 April 2015 will proceed.

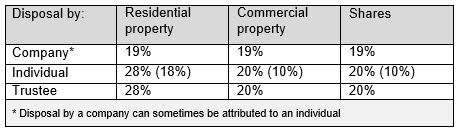

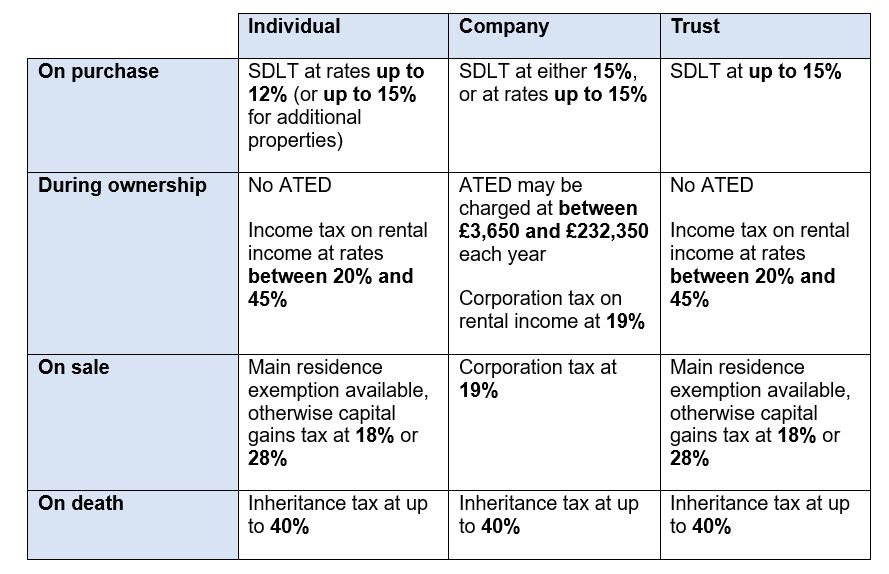

Non-resident companies will be subject to corporation tax at 19 17 from April 2020 Non-resident individuals disposing of non-residential property will be subject to capital gains tax at 10 or 20 depending on their marginal rate. For UK residential properties sold on or after 6 April 2020 Capital Gains Tax needs to be reported to HMRC and paid within 30 days of completion of a sale. We have created this Capital Gains Tax calculator for the tax year 202021 to help you understand how much capital gains tax you may have to pay if you sell or have sold your property or shares in the tax year 202021.

You need to submit a non-resident Capital Gains Tax return if youve sold or disposed of UK property or land up to 5 April 2020. 30-day capital gains tax payment warning. UK Capital Gains Tax rates In the UK Capital Gains Tax for residential property is charged at the rate of 28 where the total taxable gains and income are above the income tax basic rate band.

You dont pay Capital Gains Tax on UK assets that are not property unless you return to the UK within 5 years of leaving so long term expats dont have to worry about UK capital gains on their ETFs. From 6 April 2020 you need to report and pay your non-resident. If you are a non-resident of the UK you are subject to Capital Gains Tax rules if you sell a UK property or shares.

The most common forms of capital gains are the profits that you make when you sell something. As a non-resident you only pay tax on any gain made since 5 April 2015. From April 2019 the current exemption from capital gains tax for non-resident investors will be abolished.

If you are a non-resident who has sold or disposed of UK property or land then it is likely that you were required to submit a non-resident Capital Gains Tax return within 30 days of the date of. UK taxpayers must pay CGT when the sell or dispose of an asset anywhere in the world. For trustees and personal representatives of deceased persons the rate is 28.

In addition from April. You may get some tax relief. Non-resident companies from 6 April 2019 From 6 April 2019 Corporation Tax rather.

UK Residential Property - Capital Gains Tax for non-UK residents. From 6 April 2015 the CGT regime was extended to non-UK residents disposing of UK residential property. The amount you pay is lower than for property though.

Before the 6 th of April 2015 you were not taxed in the UK on gains made when you sold UK property if you were non-UK resident for five consecutive UK tax years. Below that limit the rate is 18. When you get tax relief In most cases you dont pay any tax for any tax years in which you your.

However if you are eligible for the personal allowance you only pay tax on capital gains above a certain level. Draft legislation in relation to these changes will be published in the 2018 Autumn Budget. For UK residential property any taxable gains must now be reported and paid to HMRC within 30 days of the completion of the sale.

If you are temporarily non-resident then in the year of your return to the UK any gains or losses realised during your period of non-residence including in an overseas part of a split year become chargeable to capital gains tax in the year of return. Rules governing the taxation of non-resident investors in UK property. Since that date if youre a British expat who owns property in the UK you have to pay CGT if you sell your property for a gain.

The NRCGT 2015 regime was repealed and replaced by a new NRCGT regime with effect from 6 April 2019. Typical examples include property shares business assets and possessions worth over 6000. This is known as the non-resident capital gains tax NRCGT 2015 regime also known as FA 2015 NRCGT or FA15 NRCGT.

Capital Gains Tax For Non Uk Residents Experts For Expats

Capital Gains Tax For Non Uk Residents Experts For Expats

Capital Gains Tax For Expats Experts For Expats

Capital Gains Tax For Expats Experts For Expats

How To Avoid Capital Gains Taxes When Selling Your House 2020

How To Avoid Capital Gains Taxes When Selling Your House 2020

Report And Pay Capital Gains Tax On Uk Property Non Residents Who Cannot Set Up A Government Gateway Account Chartered Institute Of Taxation

Report And Pay Capital Gains Tax On Uk Property Non Residents Who Cannot Set Up A Government Gateway Account Chartered Institute Of Taxation

Buying Residential Property In The Uk J P Morgan Private Bank

Buying Residential Property In The Uk J P Morgan Private Bank

Https Www Pwc Com M1 En Tax Documents Uk Tax Filing Requirements For Non Uk Residents Pdf

Https Www Pwc Com M1 En Tax Documents Private Business Publications Important Changes Affecting Non Residents Disposing Of Interests In Uk Property 2019 Pdf

Non Resident Capital Gains Tax Nrcgt On Uk Land Individuals Interaction With Other Tax Provisions Tax Guidance Tolley

Non Resident Capital Gains Tax Nrcgt On Uk Land Individuals Interaction With Other Tax Provisions Tax Guidance Tolley

Capital Gains Tax For Non Resident Owners Of Uk Property

Capital Gains Tax For Non Resident Owners Of Uk Property

Uk Residential Property Structures What Are My Options

Uk Residential Property Structures What Are My Options

Capital Gains Tax For Individuals Not Resident In The Uk Low Incomes Tax Reform Group

Capital Gains Tax For Individuals Not Resident In The Uk Low Incomes Tax Reform Group

Own A Property In Spain Learn About Non Resident Property Taxes

Own A Property In Spain Learn About Non Resident Property Taxes

Capital Gains Tax In The Uk For Property Property Walls

Capital Gains Tax In The Uk For Property Property Walls

Capital Gains Tax In The Uk For Property Property Walls

Capital Gains Tax For Individuals Not Resident In The Uk Low Incomes Tax Reform Group

Capital Gains Tax For Individuals Not Resident In The Uk Low Incomes Tax Reform Group

Main Residence Property Sale New Capital Gains Tax Implications Kirk Rice

Main Residence Property Sale New Capital Gains Tax Implications Kirk Rice

Private Residence Relief Capital Gains Tax Bdo

Private Residence Relief Capital Gains Tax Bdo

Guide To Capital Gains Tax Times Money Mentor

Guide To Capital Gains Tax Times Money Mentor

Capital Gains Tax In The Uk For Property Property Walls

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home