Property Tax Oregon By County

Property tax reports and statistics. Effective average tax rate.

Oregon Property Tax Important Dates Annual Calendar Ticor Northwest

In Grant County the average tax rate is 1425 per 1000 of assessed value but the average homeowner is taxed 1131 per 1000 of real market.

Property tax oregon by county. JACKSON COUNTY TAXATION OFFICE IS CLOSED TO THE PUBLIC The last Trimester Payment is due by May 17th Because the 15th falls on the weekend. We are a broad service organization mandated by the Oregon Constitution and Oregon law and collect revenue for 85 taxing jurisdictions including local governments schools and special districts that provide essential public services for the citizens of Lane County. Official Payments the service provider charges a service fee of 280 for credit card payments 119 for debit card payments or 060 for electronic.

For more details about the property tax rates in any of Oregons counties choose the county from the interactive map or the list below. The exact property tax levied depends on the county in Oregon the property is located in. The property tax system is one of the most important sources of revenue for more than 1200 local taxing districts in Oregon.

At that rate taxes on a home worth 150000 would be 1830 a year. Free Oregon Property Records Search. The first step towards understanding Oregons tax code is knowing the basics.

This western Oregon county has the second-highest average effective property tax rate in the state. As part of our commitment to provide citizens with efficient convenient service Marion County has partnered with Official Payments to offer payment of taxes and fees online or by telephone. Property tax is set by and paid to the county where your property is located.

For general tax questions please see Property Tax Questions. Based on population statistics Douglas County is ninth largest county in Oregon. Below we have highlighted a number of tax rates ranks and measures detailing Oregons income tax business tax sales tax and property tax systems.

County voters have a history of. 700 per 1000 of real market value for residential homes and land giving Josephine County the lowest property tax rate in the state. Linn Countys average effective property tax rate is 122.

1st Ave Ste 130 Hillsboro. 33 rows Oregon. Links to county websites take me to ORMAP.

Median property tax is 224100. Quick links 2019 Industrial property return 2019 Personal property return 2019 Real property return. Clackamas County collects the highest property tax in Oregon levying an average of 281400 085 of median home value yearly in property taxes while Gilliam County has the lowest property tax in the state collecting an average tax of 95600 096 of median home value per year.

How property taxes work in Oregon. A property tax exemption is a legislatively approved program that relieves qualified individuals or organizations from all or part of their property taxes. Property tax is set by and paid to the county where your property is located.

Personal property is taxable in the county where its located as of January 1 at 1 am. The Oregon law specifies the due dates for property taxes and no extensions have been offered at this time. This interactive table ranks Oregons counties by.

Property Taxes - Whats In It For Me. Oregon has 36 counties with median property taxes ranging from a high of 281400 in Clackamas County to a low of 95600 in Gilliam County. Exemptions can be either full or partial depending on the program requirements and the extent to which the property is used in a qualifying manner.

If you are looking for specific tax data relevant to your property please call our office at 503-846-8741. Make checks payable to Washington County Please do not paper-clip or staple check to payment stub Washington County Assessment Taxation 155 N. Property taxes rely on county assessment and taxation offices to value the property calculate and collect the tax and distribute the money to taxing districts.

Washington County Assessment Taxation 155 N First Avenue Suite 130 MS8 Hillsboro OR 97124 Pay Taxes Online. Property Tax Information Videos. First Avenue Suite 130 MS8 Hillsboro Oregon 97124.

Find Oregon residential property records including property owners sales transfer history deeds titles property taxes valuations land zoning records more. All personal property must be valued at 100 percent of its real market value unless otherwise exempt ORS 307020. Each states tax code is a multifaceted system with many moving parts and Oregon is no exception.

How does Oregon rank.

Oregon Revenue Online Https Oregonrevenueonline Freetaxfree Com Tax Refund Freetax Irs Irstax Wheresmyrefund Irs Taxes Tax Free Tax

Oregon Revenue Online Https Oregonrevenueonline Freetaxfree Com Tax Refund Freetax Irs Irstax Wheresmyrefund Irs Taxes Tax Free Tax

Property Tax Comparison By State For Cross State Businesses

Property Tax Comparison By State For Cross State Businesses

Santa Clara County Ca Property Tax Calculator Smartasset

Santa Clara County Ca Property Tax Calculator Smartasset

Oregon Property Tax Calculator Smartasset

Oregon Property Tax Calculator Smartasset

Oregon Property Tax Calculator Smartasset

Oregon Property Tax Calculator Smartasset

Image Result For U S National Map Of Property Taxes Property Tax History Lessons Historical Maps

Image Result For U S National Map Of Property Taxes Property Tax History Lessons Historical Maps

Pin On Facepost Posts You Are Linked To Resources

Pin On Facepost Posts You Are Linked To Resources

Ramsey County Mn Property Tax Calculator Smartasset

Ramsey County Mn Property Tax Calculator Smartasset

Equestrian Estate For Sale In Marion County Oregon Wow This Facility Generates Great Income And Grow Equestrian Estate Horse Property Equestrian Facilities

Equestrian Estate For Sale In Marion County Oregon Wow This Facility Generates Great Income And Grow Equestrian Estate Horse Property Equestrian Facilities

States With The Highest And Lowest Property Taxes Property Tax Tax States

States With The Highest And Lowest Property Taxes Property Tax Tax States

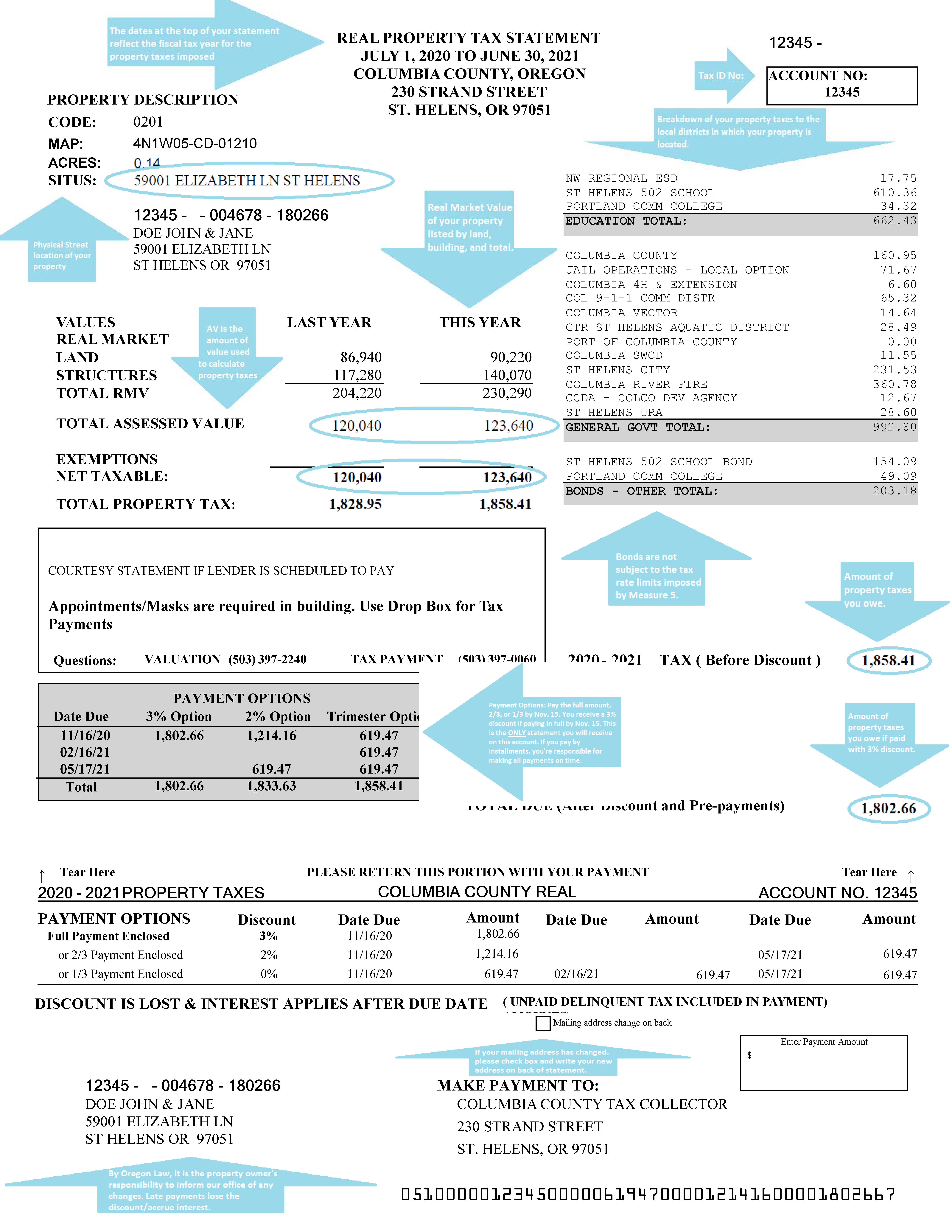

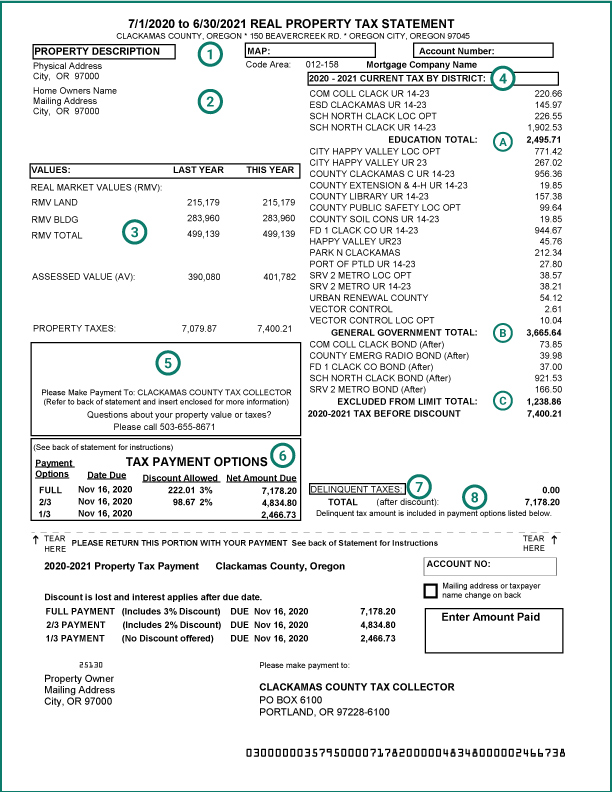

Columbia County Oregon Official Website Understanding Your Property Tax Statement

Columbia County Oregon Official Website Understanding Your Property Tax Statement

Understanding Your Property Tax Statement Clatsop County Oregon

Understanding Your Property Tax Statement Clatsop County Oregon

Nicholas County Kentucky Property Tax Lists 1800 1811 With Indexes To Deed Books A B 2 And C Property Tax Index Kentucky

Nicholas County Kentucky Property Tax Lists 1800 1811 With Indexes To Deed Books A B 2 And C Property Tax Index Kentucky

Equestrian Estate For Sale In Jackson County Oregon Nearly 15 Acres W 2 Tax Lots Zoned Efu Backed By 1000 Sunken Hot Tub Equestrian Estate Horse Property

Equestrian Estate For Sale In Jackson County Oregon Nearly 15 Acres W 2 Tax Lots Zoned Efu Backed By 1000 Sunken Hot Tub Equestrian Estate Horse Property

2020 S Tax Burden By State Business And Economics Smart Money State Tax

2020 S Tax Burden By State Business And Economics Smart Money State Tax

Understanding Your Property Tax Bill Clackamas County

Understanding Your Property Tax Bill Clackamas County

Chart 4 Louisiana Local Tax Burden By County Fy 2016 Jpg Burden Louisiana Tax

Chart 4 Louisiana Local Tax Burden By County Fy 2016 Jpg Burden Louisiana Tax

Washington County Or Property Tax Calculator Smartasset

Washington County Or Property Tax Calculator Smartasset

Are There Any States With No Property Tax In 2021 Free Investor Guide

Are There Any States With No Property Tax In 2021 Free Investor Guide

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home