How To Calculate Property Tax From Millage Rate In Florida

Each taxing authority sets their millage rate. Millage rates are typically expressed in mills with each mil acting as 11000 of 1000 of property value or 1 total.

Tax On Purchase And Sale Of Property Property Tax Tax Consulting Tax Payment

Tax On Purchase And Sale Of Property Property Tax Tax Consulting Tax Payment

This Tax Estimator does not consider any savings you may be eligible to Port from a previous homestead in Florida.

How to calculate property tax from millage rate in florida. X 021 Millage Rate 21 Mills per 1000 1575 Taxes Due. The taxable value is. Taxes due County General 750001000 75 51639 38729.

Figuring Florida property tax rates by county is a multipronged calculation that includes millage rates exemptions and something called just value. For example here is how to calculate real estate tax rates in Florida. Current Millage Rate.

The sale of a property will prompt the removal of all exemptions assessment caps and special classification belonging to the current owner. The millage rate is the amount of property tax charged per 1000 of taxable property value. Choose a tax districtcity from the drop down box enter a taxable value in the space provided then press the Estimate Taxes button.

Quick Reference - 2014 Estimated Millage Tax Rates. If you would like to get a more accurate property tax estimation choose the county your property is located in from the. The millage rate is a dollar amount per 1000 of a homes taxable property value.

110520 My Taxable Value from the example above x 227184 My Millage Rate from Chart 2510837 1000 251074 My 2009 Property Taxes. Past taxes are not a reliable projection of future taxes. Property taxes in Florida are implemented in millage rates.

Millage rates are expressed in tenths of a penny meaning one mill is 0001. Millage Rate This is the tax amount per 1000 of assessed property value. 750001000 75 176379 132284 Note.

What Exemptions are Available. Calculating Your Taxes. 75000 Taxable Value.

The millage rate is the amount per 1000 of assessed value thats levied in taxes. Florida property owners may pay a premium for seaside views but the responsibility of paying property tax falls to everyone even those who live inland without an ocean in sight. Divide 5 mills by 1000 to get 0005.

If your millage rate is 2049 then you are paying 2049 in taxes for every 1000 of taxable property value. To get a rough estimate of future taxes you can multiply your purchase price by the current millage rate in the tax district where the property is located. The millage rate is a rate established per 1000 of assessed taxable value.

Taxable Value1000 Total millage rate Example. Cities school districts and county departments in Miami-Dade and Broward Counties may set their own millage all of which are added up to determine the total millage rate. Upto 50000 Homestead Exemption.

If you live in a municipality you must add the applicable local millage rate to the total millage rate for the County. Millage is the tax rate used to calculate your ad valorem taxes. Vero Beach 790 mills.

So to convert millage rates to dollar rate amounts divide each mill rate by 1000. A number of different authorities including counties municipalities school boards and special districts can levy these taxes. Multiply your Taxable Value by your Millage Rate and divide by 1000.

The rate represents the amount a homeowner has to pay for every 1000 of a propertys assessed value. Formula to calculate taxes per taxing authority. Taxable Value1000 Millage rate Example.

25000 Senior Homestead Exemption. So if the millage rate for a property is 7 mills this implies that. Continuing with the example divide 10 mills by 1000 to get 001.

Delray Beach 1297 mills. For example on a 300000 home a millage rate of 0003 will equal 900 in taxes owed 0003 x 300000 assessed value 900. Palm Coast 2082 mills.

The results displayed are the estimated yearly taxes for the property using the last certified tax rate without exemptions or discounts. Millage rates are the tax rates used to calculate local property taxes. To find your millage rate go back to the Search box on the homepage and type in your name or owner name.

A property tax millage rate of 35 mills for example would mean property with a taxable value of 100000 would pay 350 in property taxes. Ad valorem property taxes are calculated by multiplying the taxable value of the property by the millage rate. The Tax Estimator allows you to calculate the estimated Ad Valorem taxes for a property located in Duval County.

The real property tax estimator will calculate the ad valorem portion of property taxes by multiplying the amount entered in Step 1 times the previous years adopted millage rates also known as the tax rate. A millage rate is one tenth of a percent which equates to 1 in taxes for every 1000 in home value. While the exact property tax rate you will pay will vary by county and is set by the local property tax assessor you can use the free Florida Property Tax Estimator Tool to calculate your approximate yearly property tax based on median property tax rates across Florida.

100000 Assessed Value of the Home - 25000 Basic Homestead Exemption. One mil equals 1 for every 1000 of taxable property value.

Property Tax Prorations Case Escrow

Property Tax Prorations Case Escrow

How Property Taxes Can Impact Your Mortgage Payment Property Tax Mortgage Marketing Mortgage Payment

How Property Taxes Can Impact Your Mortgage Payment Property Tax Mortgage Marketing Mortgage Payment

Homestead Tax Exemption Florida Orange County Erica Diaz Team Florida Real Estate Homesteading Property Tax

Homestead Tax Exemption Florida Orange County Erica Diaz Team Florida Real Estate Homesteading Property Tax

Florida Property Tax H R Block

Florida Property Tax H R Block

Millage Rate Sample Chart And Instructions

Millage Rate Sample Chart And Instructions

Secured Property Taxes Treasurer Tax Collector

Secured Property Taxes Treasurer Tax Collector

Real Estate Property Tax Constitutional Tax Collector

Real Estate Property Tax Constitutional Tax Collector

States With The Highest And Lowest Property Taxes Property Tax Social Studies Worksheets States

States With The Highest And Lowest Property Taxes Property Tax Social Studies Worksheets States

Real Estate Taxes City Of Palm Coast Florida

Real Estate Taxes City Of Palm Coast Florida

Florida Property Taxes Explained

Florida Property Taxes Explained

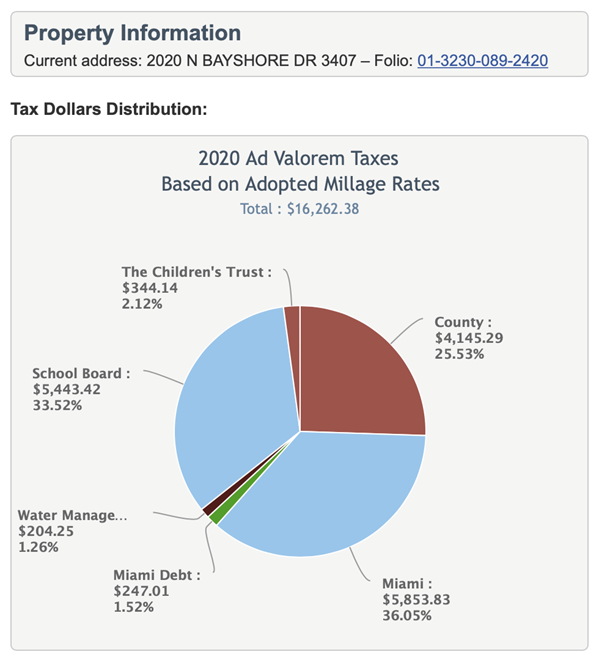

Where To Find The Lowest Property Taxes In Miami Condoblackbook Blog

Where To Find The Lowest Property Taxes In Miami Condoblackbook Blog

Minnesota Property Taxes By County 2015 Property Tax Tax Reduction Income Tax Return

Minnesota Property Taxes By County 2015 Property Tax Tax Reduction Income Tax Return

Greater Cleveland S Wide Spread In Property Tax Rates See Where Your Community Ranks Cleveland Com

Greater Cleveland S Wide Spread In Property Tax Rates See Where Your Community Ranks Cleveland Com

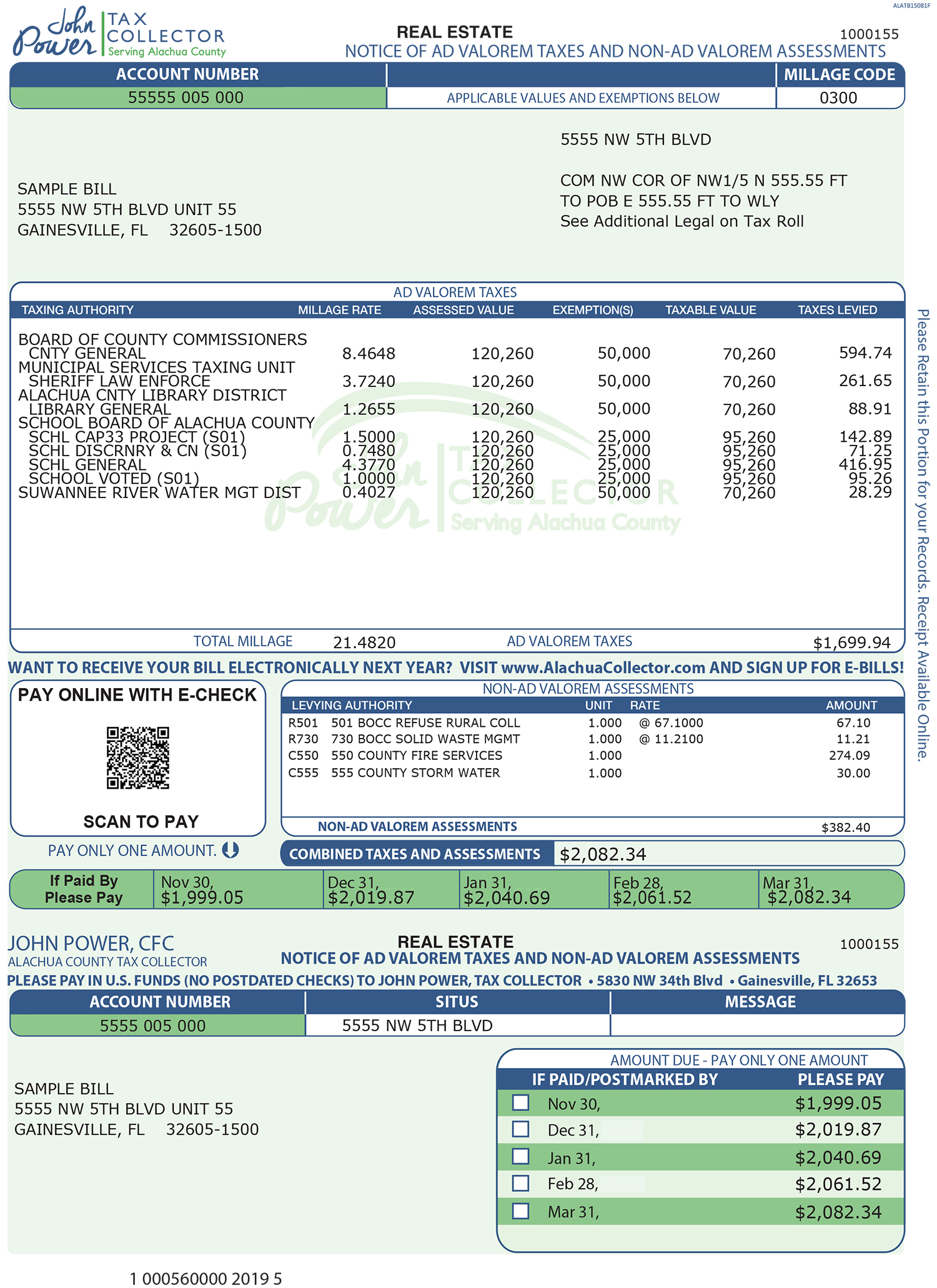

A Guide To Your Property Tax Bill Alachua County Tax Collector

A Guide To Your Property Tax Bill Alachua County Tax Collector

Secured Property Taxes Treasurer Tax Collector

Secured Property Taxes Treasurer Tax Collector

How To Calculate Property Taxes Real Estate Scorecard

How To Calculate Property Taxes Real Estate Scorecard

Millage Rate Sample Chart And Instructions

Millage Rate Sample Chart And Instructions

Appeal For Property Tax Appraisal How Do You Get Benefit Property Tax Tax Refund Types Of Taxes

Appeal For Property Tax Appraisal How Do You Get Benefit Property Tax Tax Refund Types Of Taxes

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home