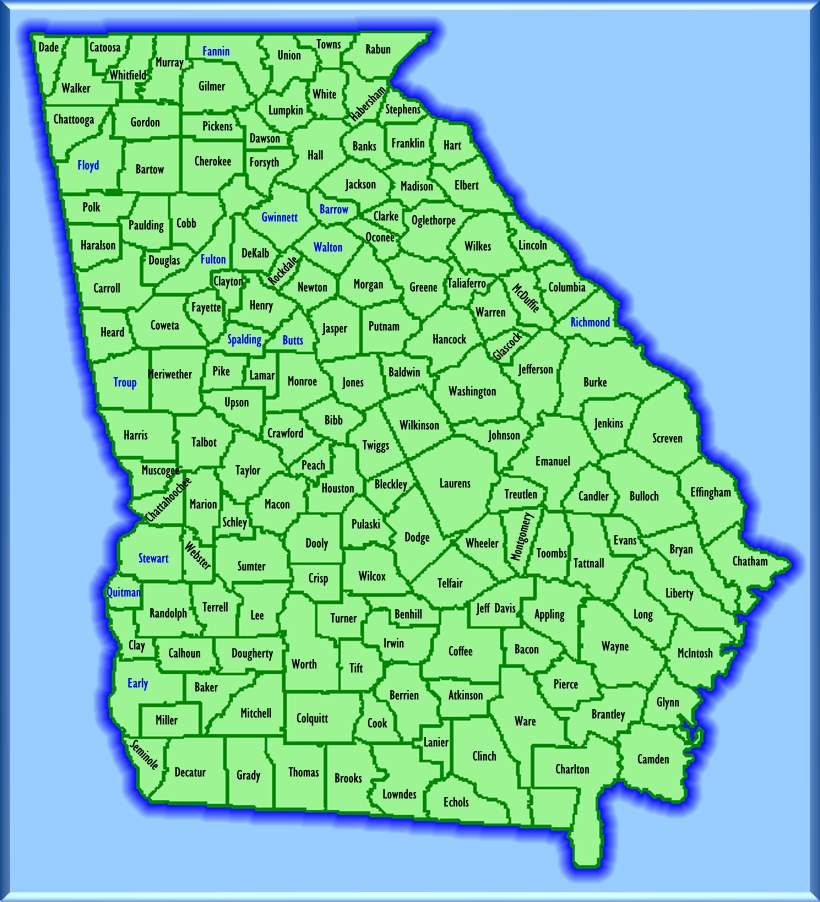

What Is The Property Tax Rate In Fulton County Ga

County and county school ad valorem taxes are collected by the county tax commissioner. These include basic homestead exemptions as well as homestead exemptions for seniors low income homeowners surviving spouses of public safety and military personnel killed in the line of duty and others.

Fort Lauderdale Property Tax Consultant Property Tax Consultant Property Tax Tax Consulting Fort Lauderdale

Fort Lauderdale Property Tax Consultant Property Tax Consultant Property Tax Tax Consulting Fort Lauderdale

Fulton County homeowners can qualify for a variety of homestead exemptions offered through the Fulton County Tax Assessors office.

What is the property tax rate in fulton county ga. Atlanta GA 30303. The median property tax also known as real estate tax in Fulton County is 273300 per year based on a median home value of 25310000 and a median effective property tax rate of 108 of property value. Infrastructure For All.

Read more about appraisal methodology. Tax Collections Lien Transfers Foreclosures. The Tax Commissioner takes the appraised value and the exemption status provided by the Board of Tax Assessors along with the millage rates set.

You can find out the property taxes for your property or. The median property tax on a 25310000 house is 210073. Georgia Property Taxes The average effective property tax rate is 091.

The Tax Commissioner takes the appraised value and the exemption status provided by the Board of Tax Assessors along with the millage rates set by the Board of Commissioners and other Governing Authorities to calculate taxes for each property and mails bills to owners at the addresses provided by the Board of Tax Assessors. The Supreme Court Ruling on TADs. Fair market value 300000 Assessed value 40 X 300000 120000 Millage rate 29235 Property tax 120000 X 292351000 3508.

The median property tax on a 25310000 house is 273348 in Fulton County. Property Taxes The Fulton County Tax Commissioner is responsible for collecting property taxes on behalf of Fulton County Government two school systems and some city governments. In Fulton County the median property tax payment is.

The exact property tax levied depends on the county in Georgia the property is located in. Fulton County collects on average 108 of a propertys assessed fair market value as property tax. Tax Allocation Districts in Fulton County.

Atlanta GA 30303. Elements of your Property Bill. Its important to keep in mind though that.

The Board of Assessors issues an annual notice of assessment for each property in Fulton County. Property owners can view their property assessment online. If you need to find your propertys most recent tax assessment or the actual property tax due on your property contact the Fulton County Tax Appraisers office.

Multiply that by the millage rate and divide by 1000. You also may visit the main office at 235 Peachtree Street Suite 1400 NE Atlanta. Even though the official due date for ad valorem tax payment is December 20th the local governing authority may adopt a resolution changing the official due date for tax payment to December 1st or November 15th or may implement installment billing with.

The Tax Commissioner takes the appraised value and the exemption status provided by the Board of Tax Assessors along with the millage rates set. Property Taxes The Fulton County Tax Commissioner is responsible for collecting property taxes on behalf of Fulton County Government two school systems and some city governments. Its important to keep in mind though that property taxes in Georgia vary greatly between locations.

160 rows The average effective property tax rate is 087. 775 Is this data incorrect The Fulton County Georgia sales tax is 775 consisting of 400 Georgia state sales tax and 375 Fulton County local sales taxesThe local sales tax consists of a 300 county sales tax and a 075 special district sales tax used to fund transportation districts local attractions etc. Yearly median tax in Fulton County The median property tax in Fulton County Georgia is 2733 per year for a home worth the median value of 253100.

Property taxes Read More Boards of equalization Read More. Fulton County Board of Tax Assessors Homestead and Return Division 235 Peachtree Street NE Suite 1100 Atlanta GA 30303. Ending tax on tags would be fairer to all.

Fulton County is committed to helping property owners understand their rights and responsibilities throughout the property tax process. Calculating property taxes for Fulton County. Fulton County Initiatives Fulton County Initiatives.

Fulton County collects the highest property tax in Georgia levying an average of 273300 108 of median home value yearly in property taxes while Warren County has the lowest property tax in the state collecting an average tax of 31400 051 of. The assessed value is 40 of the fair market value. Besides what is the property tax rate in Fulton County Georgia.

Where Are Lowest Property Taxes In North Texas Property Tax Tax Consulting Tax Payment

Where Are Lowest Property Taxes In North Texas Property Tax Tax Consulting Tax Payment

Dekalb County Ga Hallock Law Llc Property Tax Appeals

Dekalb County Ga Hallock Law Llc Property Tax Appeals

Property Tax Appeal Blog Cobb County Assessors

Property Tax Appeal Blog Cobb County Assessors

Rivermoore Park Bank Owned Homes Real Estate Home Inspector

Rivermoore Park Bank Owned Homes Real Estate Home Inspector

3940 Mcguire Way Nw Kennesaw Ga 30144 Mls 8595749 Zillow Real Estate Estate Homes Zillow

3940 Mcguire Way Nw Kennesaw Ga 30144 Mls 8595749 Zillow Real Estate Estate Homes Zillow

Saint Simons Island Real Estate Saint Simons Island Ga Homes For Sale Zillow St Simon Island Ga St Simons Island Real Estate

Saint Simons Island Real Estate Saint Simons Island Ga Homes For Sale Zillow St Simon Island Ga St Simons Island Real Estate

Georgia Property Tax Property Tax Resources

Georgia Property Tax Property Tax Resources

Atlanta Georgia Property Tax Calculator Fulton County Millage Rate Homestead Exemptions

Fulton County Property Tax Increase Information North Fulton Georgia

Fulton County Property Tax Increase Information North Fulton Georgia

Dekalb County Ga Hallock Law Llc Property Tax Appeals

Dekalb County Ga Hallock Law Llc Property Tax Appeals

Dekalb County Ga Hallock Law Llc Property Tax Appeals

Dekalb County Ga Hallock Law Llc Property Tax Appeals

Midway Real Estate Midway Ga Homes For Sale Zillow Real Estate Estate Homes Estates

Midway Real Estate Midway Ga Homes For Sale Zillow Real Estate Estate Homes Estates

Atlanta Georgia Property Tax Calculator Fulton County Millage Rate Homestead Exemptions

Property Tax Consultation Let Us Help Save You Money Property Tax Tax Home Ownership

Property Tax Consultation Let Us Help Save You Money Property Tax Tax Home Ownership

Atlanta Georgia Property Tax Calculator Fulton County Millage Rate Homestead Exemptions

Dunwoody Dekalb County Georgia Property Tax Calculator Millage Rate Homestead Exemptions

Dunwoody Dekalb County Georgia Property Tax Calculator Millage Rate Homestead Exemptions

Fulton County Property Tax Increase Information North Fulton Georgia

Fulton County Property Tax Increase Information North Fulton Georgia

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home