Vermont Property Tax Credit Calculator

Homestead Declaration AND Property Tax Credit. 2020 IN-152A Annualized VEP Calculator.

Mobile Credit Card Processing Mobile Merchant Account Credit Card Infographic Credit Card First Mobile Credit Card

Mobile Credit Card Processing Mobile Merchant Account Credit Card Infographic Credit Card First Mobile Credit Card

The City Charter has a revenue neutral provision that requires a portion of the tax rate to adjust equivalently downward when property valuations are reassessed upward.

Vermont property tax credit calculator. For a family living in a house with a market value of 300000 and a school tax rate of 150 per 100 of assessed property. Vermont taxes most forms of retirement income at rates ranging from 335 to 875. You can find free help to file your homestead declaration and property tax.

Vermonts property tax rates rank among the highest in the US. On average Vermont homeowners pay more than 4300 per year in property taxes which leads to a 186 average effective rate. Tue 02162021 - 1200.

There is a 15 late fee after April 15. Some of your clients may be eligible to file Form HS-122 Section B Property Tax Credit Claim if their property qualifies as a homestead and they meet the income and other eligibility requirements. How does Vermont rank.

The first step towards understanding Vermonts tax code is knowing the basics. Vermont offers a property tax credit which assists some homeowners with paying their property taxes. IN-111 IN-112 IN-113 IN-116 HS-122 PR-141 HI.

HS-122 2021 PTC Calculatorxls 895 KB File Format. City government is not allowed to significantly increase taxes because of a reappraisal with much higher property values. PA-1 Special Power of Attorney.

This booklet includes forms and instructions for. For this year the maximum household income. File Your Homestead Declaration and Vermont Property Tax Credit Claim online through myVTax.

HS-122W Vermont Homestead Declaration andor Property Tax Credit Withdrawal. Learn how to file your claim online by viewing our videos and guides at taxvermontgov. 2021 Property Tax Credit Calculator.

If the vehicle is currently registeredtitled to you or your spouse or party to. W-4VT Employees Withholding Allowance Certificate. Mon 01112021 - 1200.

This includes Social Security retirement benefits and income from most retirement accounts. Vermont Property Tax. It also has some of the highest property taxes.

At that rate annual taxes on a home worth 200000 would be 4140. The average effective property tax rate in Windsor County is 207 highest in the state. See how your monthly payment changes by.

Use this free Vermont Mortgage Calculator to estimate your monthly payment including taxes homeowner insurance principal and interest. If you earn over 90000 that formula determines your school taxes. Vermont School District Codes.

Visit the Vermont Department of Taxes website to file your homestead declaration and property tax credit form online. That is the fifth-highest average effective property tax rate in the country. Tuesday February 16 2021 - 1200.

Individuals Personal Income Tax Property Tax Credit. With a population of almost 56000 Windsor County is the fourth-most populous county in Vermont. IN-111 Vermont Income Tax Return.

8903Purchase and Use Tax is due at the time of registration andor title at a percentage of the purchase price or the National Automobile Dealers Association NADA clean trade-in value whichever is greater minus the value of the trade-in vehicle or any other allowable credit. There are four tax brackets that vary based on income level and filing status. 2021 Property Tax Credit Calculator.

The states top tax rate is 875 but it only applies to single filers making more than 204000 and joint filers making more than 248350 in taxable income. Vermonts tax rates are among the highest in the country. Our Vermont Property Tax Calculator can estimate your property taxes based on similar properties and show you how your property tax burden compares to the average property tax on similar properties in Vermont and across the entire United States.

Our mission is to serve Vermonters by collecting the proper amount of tax revenue in a timely and efficient manner. You cant get a property tax credit if you file after October 15. 2020 Income Tax Return Booklet.

Property taxes in Vermont are among the highest in the nation but sales taxes are below average. Purchase and Use Tax 32 VSA. Tax Year 2019 Instructions HS-122 HI-144 Homestead Declaration AND Property Tax Credit.

Below we have highlighted a number of tax rates ranks and measures detailing Vermonts income tax business tax sales tax and property tax systems. The Property Tax Credit Claim for 2020 is due April 15 and no later than Oct. 2020 Vermont Income Tax Return Booklet.

Click the tabs below to explore. Overview of Vermont Retirement Tax Friendliness.

Pin By Edward Anou On Dsds Reverse Mortgage Home Equity Equity

Pin By Edward Anou On Dsds Reverse Mortgage Home Equity Equity

5 Rfp Digital Marketing Templates Word Excel Templates Marketing Template Digital Marketing Proposal Templates

5 Rfp Digital Marketing Templates Word Excel Templates Marketing Template Digital Marketing Proposal Templates

Closing Costs Who Pays What When Buying Or Selling A Home Tilo Team Real Estate Closing Costs Selling House Home Repairs

Closing Costs Who Pays What When Buying Or Selling A Home Tilo Team Real Estate Closing Costs Selling House Home Repairs

Mortgage Debt To Income Ratio Calculator Tutorial

New Hampshire Property Tax Calculator Smartasset

New Hampshire Property Tax Calculator Smartasset

Internal Application Form Best Of 9 Job Application Rejection Letters Templates For The Application Form Lettering Job Application

Internal Application Form Best Of 9 Job Application Rejection Letters Templates For The Application Form Lettering Job Application

Amortization Schedule 487 Amortization Schedule Mortgage Interest Mortgage Payoff

Amortization Schedule 487 Amortization Schedule Mortgage Interest Mortgage Payoff

Home Mortgage Life Home Loans Loan Mortgage Loan Calculator

Home Mortgage Life Home Loans Loan Mortgage Loan Calculator

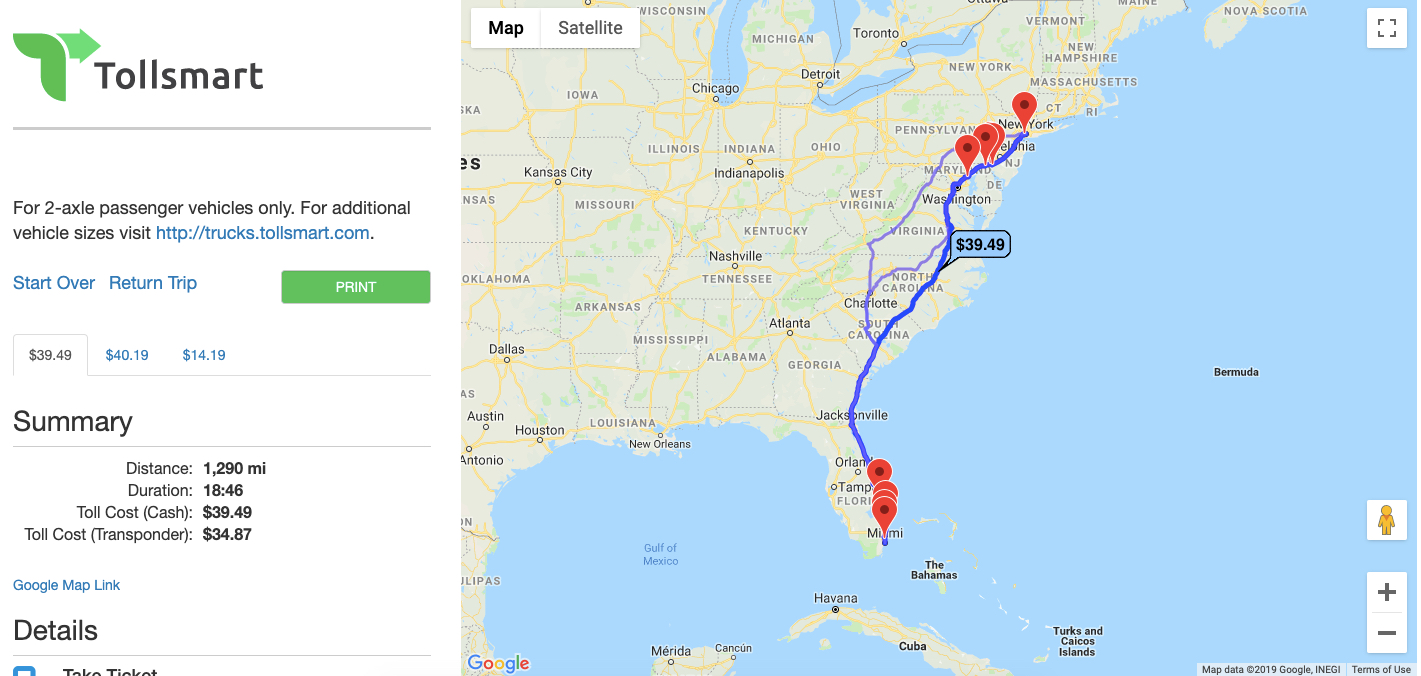

Free Google Maps Toll Calculator Tollsmart

Free Google Maps Toll Calculator Tollsmart

Alameda County Ca Property Tax Calculator Smartasset

Alameda County Ca Property Tax Calculator Smartasset

Vermont Property Tax Calculator Smartasset

Vermont Property Tax Calculator Smartasset

Auto Loan Calculator With Tax Calculate By State With Trade

Auto Loan Calculator With Tax Calculate By State With Trade

This Calculator Helps Estimate How Much You Need To Live Off Dividends Dividend Stock Ticker Investing

This Calculator Helps Estimate How Much You Need To Live Off Dividends Dividend Stock Ticker Investing

New India Health Insurance Plans Health Insurance Plans Health Insurance Health Check

New India Health Insurance Plans Health Insurance Plans Health Insurance Health Check

Car Tax By State Usa Manual Car Sales Tax Calculator

Car Tax By State Usa Manual Car Sales Tax Calculator

How To Calculate Property Taxes Millionacres

How To Calculate Property Taxes Millionacres

Mortgage Calculator Sonoma County Sonoma County Mortgages

Mortgage Calculator Sonoma County Sonoma County Mortgages

Calculate Child Support Payments Child Support Calculator Dcbl Personal Bankr Child Support Quote Calc Bankruptcy Child Support Quotes Child Support Laws

Calculate Child Support Payments Child Support Calculator Dcbl Personal Bankr Child Support Quote Calc Bankruptcy Child Support Quotes Child Support Laws

Labels: calculator, property, vermont

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home