Property Tax Relief Fund Nj

An Act concerning State school aid to certain school districts. This property tax relief program does not actually freeze your taxes but will reimburse you for any property tax increases you have once youre in the program.

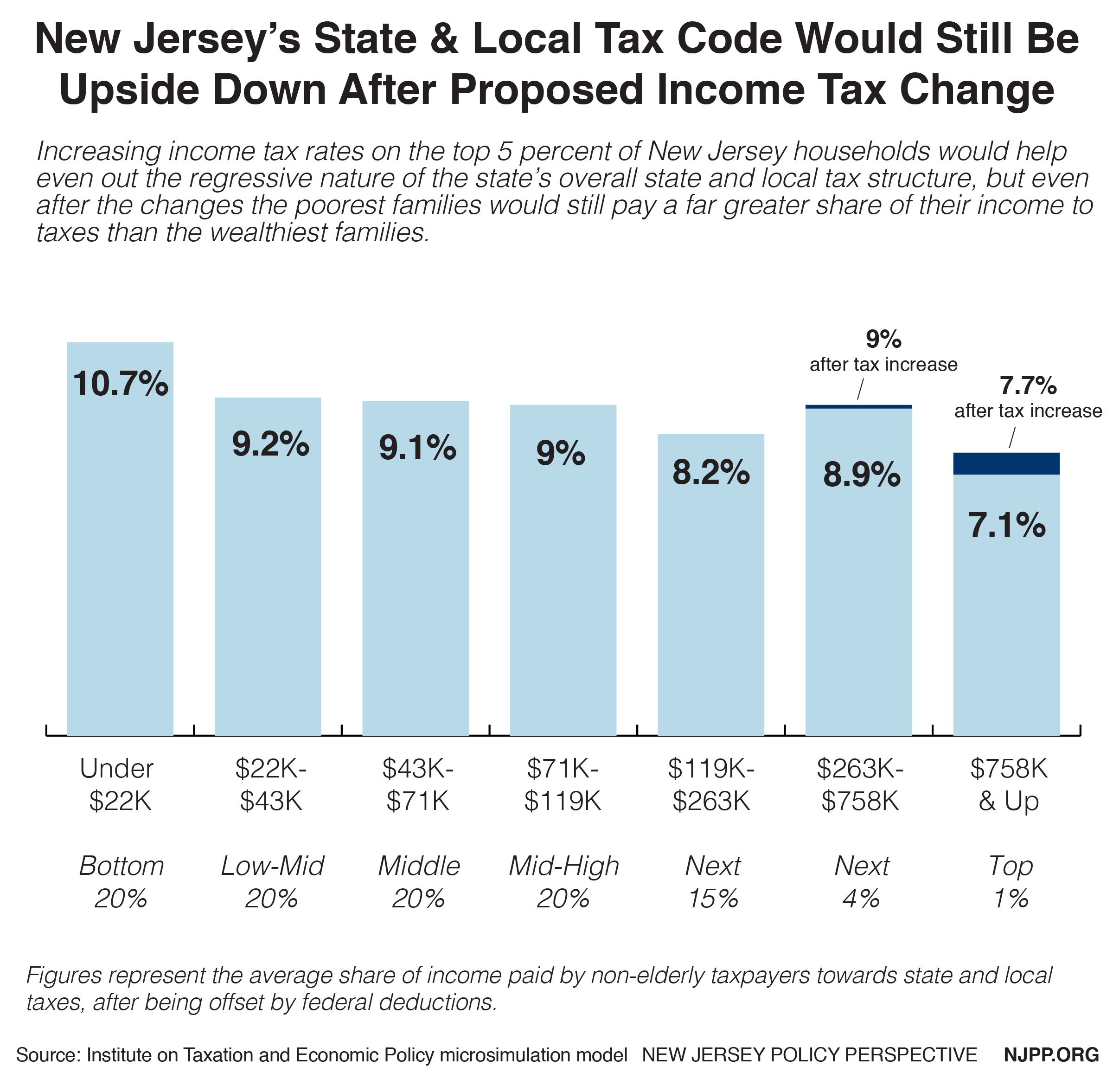

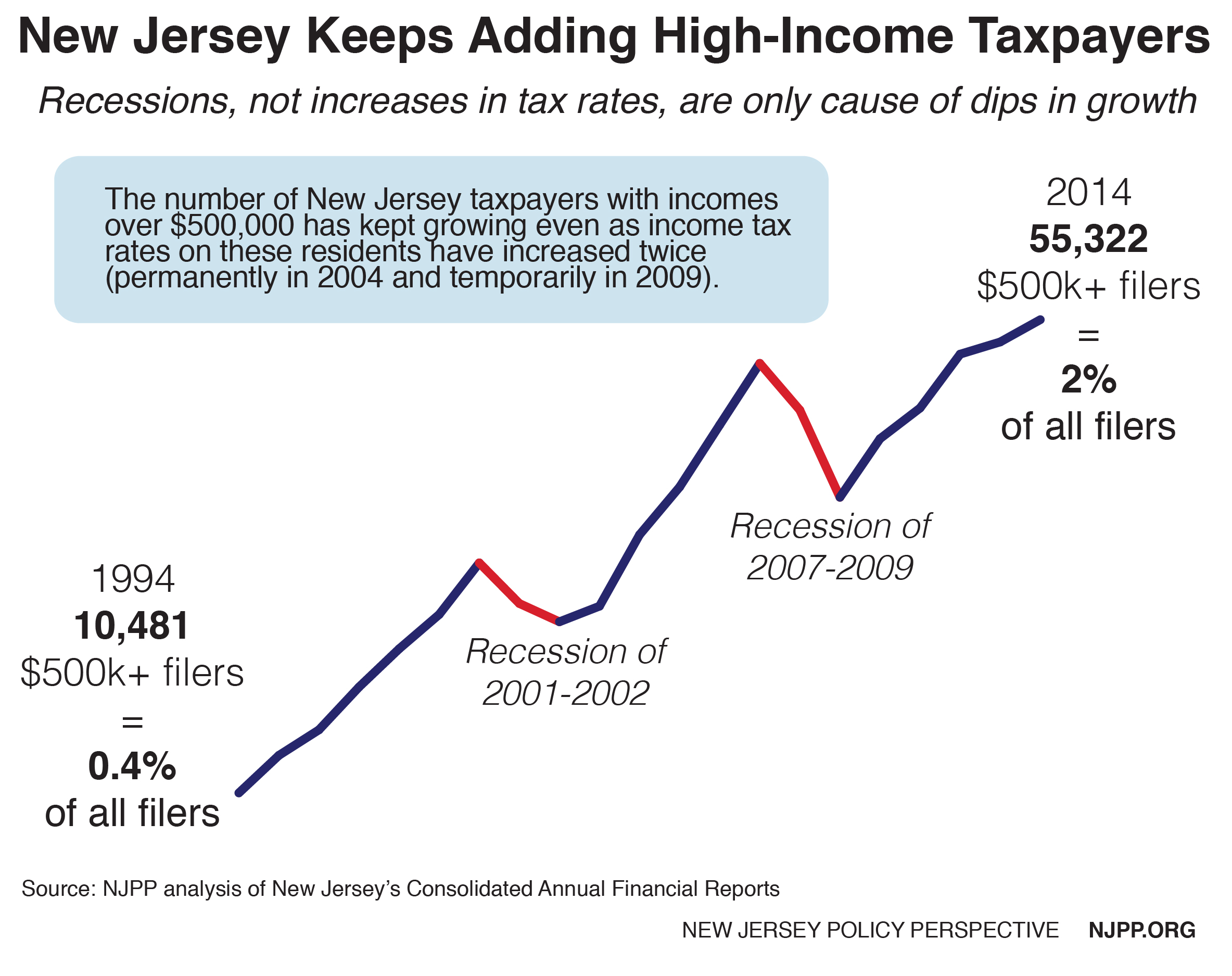

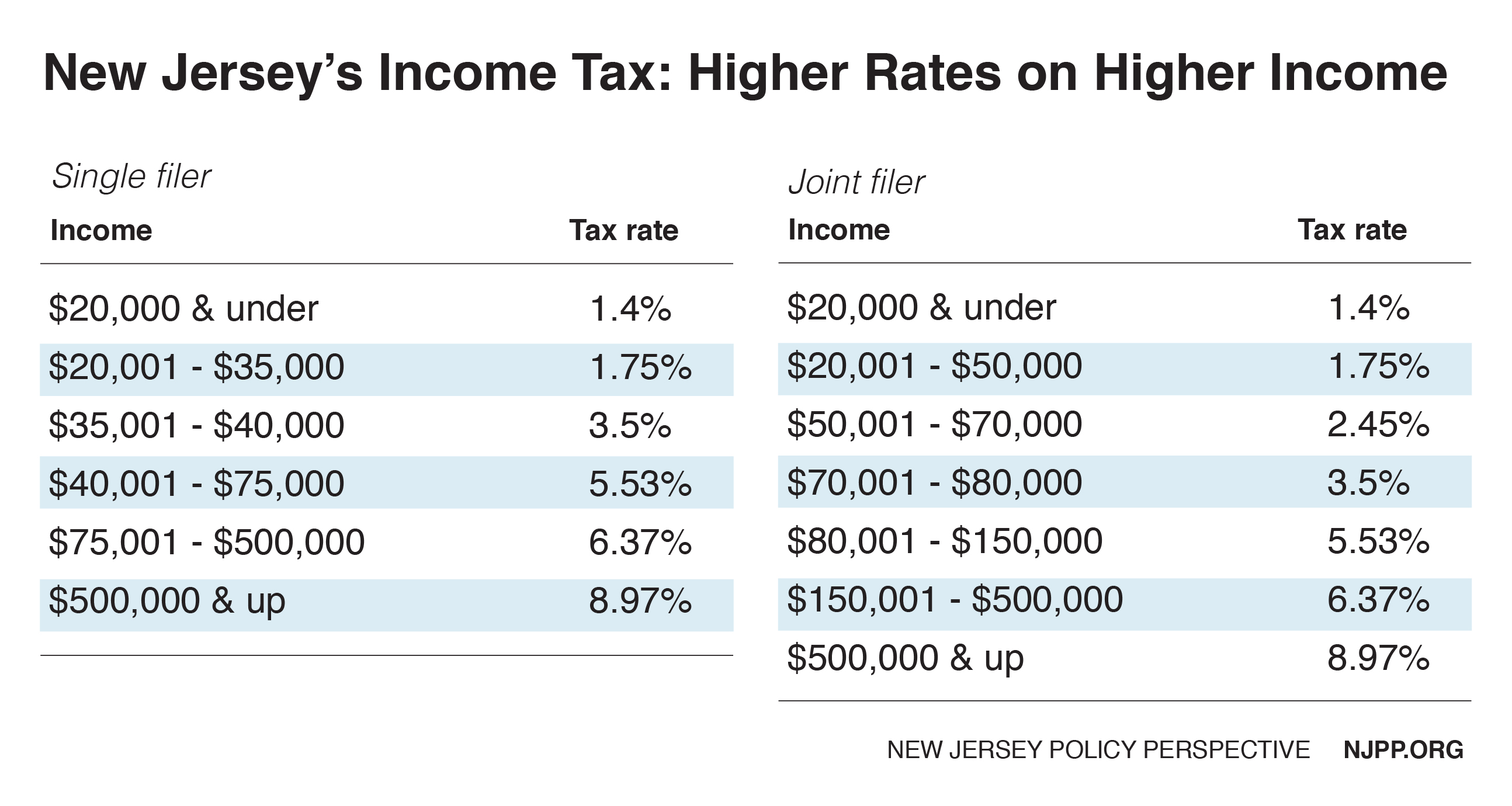

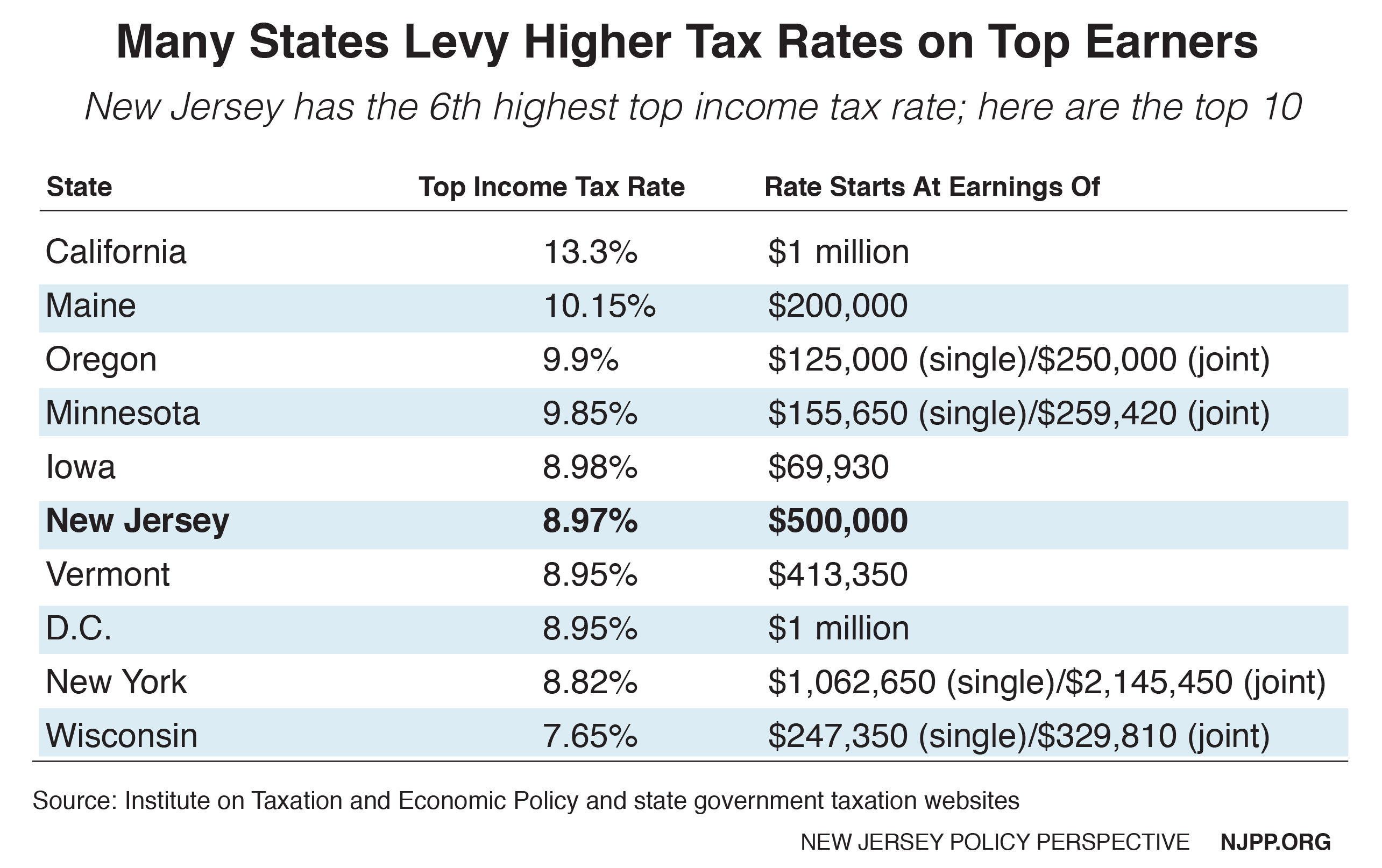

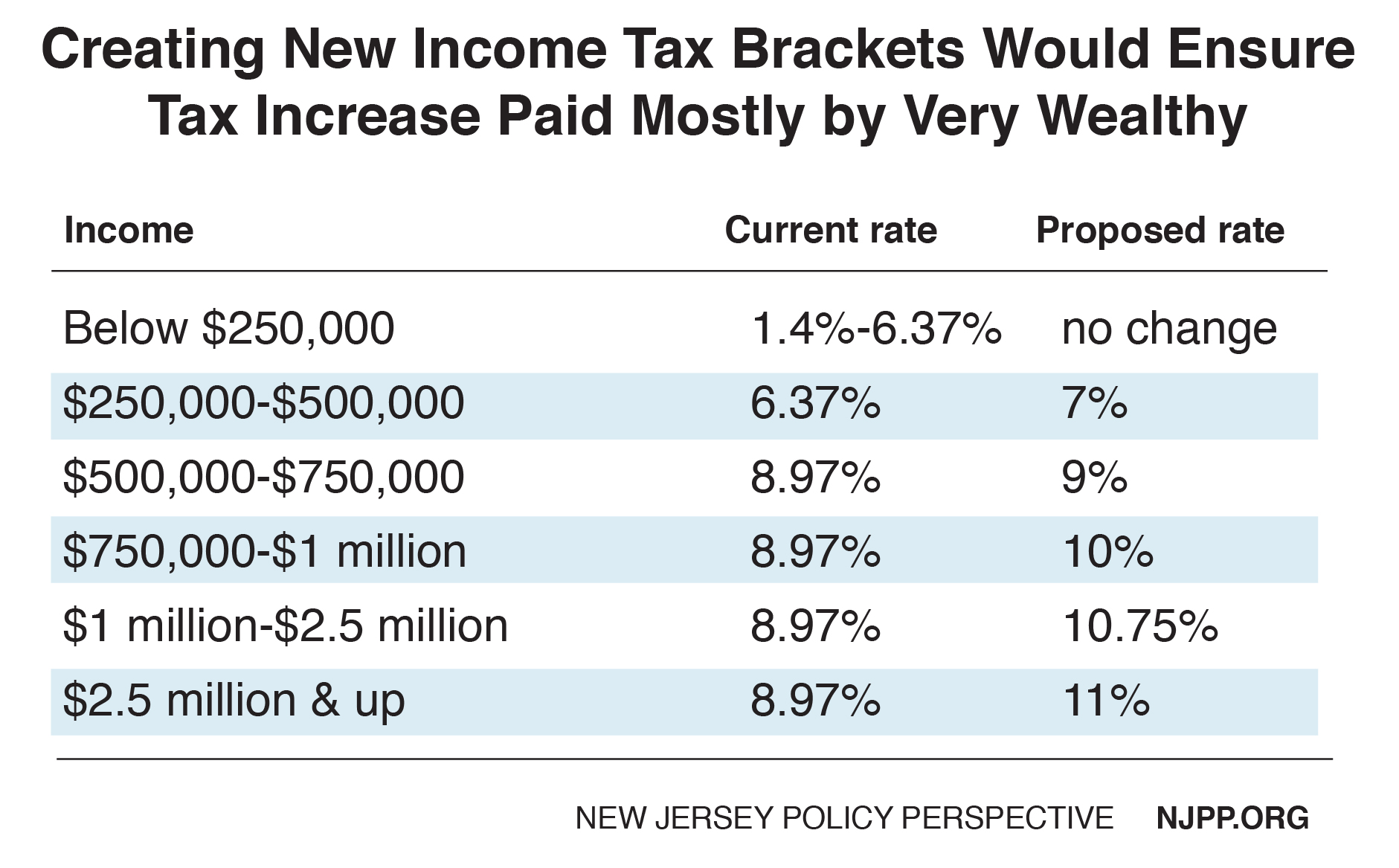

Reforming New Jersey S Income Tax Would Help Build Shared Prosperity New Jersey Policy Perspective

Reforming New Jersey S Income Tax Would Help Build Shared Prosperity New Jersey Policy Perspective

Department of the Treasury Division of Taxation PO Box 281 Trenton NJ 08695-0281.

Property tax relief fund nj. Out of State Residents. New Jersey Property Tax Reduction Through Exemptions and Deductions. Senior Freeze Property Tax Reimbursement Inquiry.

Funding for some of the states most popular property-tax relief programs would also be held flat or even go down in some cases in the new fiscal year according to budget documents the Murphy. There are appropriated from the Property Tax Relief Fund such amounts as necessary to ensure that total State aid to a school district in the 2021-2022 school year is no less than the amount of total State aid received in the 2017-2018 school year in. A highly anticipated and desperately needed 353 million rental relief fund will open up to New Jersey renters who havent been able to make.

Active military service property tax deferment. The People of New Jersey. Senior Freeze Property Tax Reimbursement Program.

If a reimbursement has been issued the system will tell you the amount of the reimbursement and the date it was issued. Aside from tax relief programs you may be eligible for property tax exemptions in NJ. Commencing July 1 1997 there is established the Energy Tax Receipts Property Tax Relief Fund as a special dedicated fund in the State Treasury into which there shall be credited annually commencing in State fiscal year 1998 the sum of 740000000 or the amount determined pursuant to subsection e.

The resolution notes that New Jerseys two main formula-driven general municipal property tax relief programs though often referred to as State Aid programs are actually revenue replacement programs intended to replace property tax relief funding that was formerly generated through taxes. You will get the difference between your base year first year of eligibility property tax amount and the current year property tax amount as long as the current year is higher than the base year and you met all other eligibility. These are the most common programs.

The Garden State is home to the highest levies on property in the nation with a mean effective property tax rate of 221 according to the Tax. NJ Division of Taxation. All Property Tax Relief Benefits are Subject to Change NJ FY 2019 Budget Passed July 1 2018.

Check the status of your New Jersey Senior Freeze Property Tax Reimbursement. Of this section from the following. Local Property Tax Relief Programs.

This is the time to look ahead. Be It Enacted by the Senate and General Assembly of the State of New Jersey. Phil Murphy s proposed 324 billion spending plan includes 275 million for the property tax relief program which lowers tax bills for about 580000 seniors disabled or low-income.

Veteran property tax deduction. Letter of Ineligibility for Out-of-State Residents Complete Request for a Letter of Property Tax Relief. Permanently Disabled Veterans or Surviving Spouses.

10 Energy Tax Receipts Property Tax Relief Fund as a special 11 dedicated fund in the State Treasury into which there shall be 12 credited annually commencing in State fiscal year 1998 and. 500 New Jersey Avenue NW Washington DC 20001-2020 202-383-1000. The State of NJ site may contain optional links information services andor content from other websites operated by third parties that are provided as a convenience such as Google Translate.

Net payments under the Sales and Use Tax Act PL1966 c30. There are four main tax exemptions we will get into in detail. We wont allow New Jersey to be pulled backward.

New Jersey Income Tax Author. 100 disabled veteran property tax exemption. Among the initiatives in line for more funding is the property-tax relief program that lets New Jersey homeowners deduct from their state income taxes the full cost of their annual property tax.

There are two separate and distinct property tax relief programs available to New Jersey homeowners. To use this service you will need the Social Security number that was listed first on your Senior Freeze application Form PTR. Even as we continue to confront the challenges presented by the COVID-19 pandemic we cannot and we will not allow our state to sit still.

State of New Jersey Property Tax Relief Programs The State of New Jersey offers tax relief in various forms to certain property owners. Forms are sent out by the State in late Februaryearly March. Today I present my proposed Fiscal Year 2022 Budget for the State of New Jersey.

Nj Property Tax Relief Program Updates Access Wealth

Nj Property Tax Relief Program Updates Access Wealth

Reforming New Jersey S Income Tax Would Help Build Shared Prosperity New Jersey Policy Perspective

Reforming New Jersey S Income Tax Would Help Build Shared Prosperity New Jersey Policy Perspective

Why Are Nj Property Taxes So Incredibly High When It Is The Most Densely Populated State In The Country Shouldn T Nj Residents Pay Less Property Tax Since There Are More People Per

Publication 590 A 2018 Contributions To Individual Retirement Arrangements Ira Social Security Benefits Social Security Disability Benefits Social Security

Publication 590 A 2018 Contributions To Individual Retirement Arrangements Ira Social Security Benefits Social Security Disability Benefits Social Security

Reforming New Jersey S Income Tax Would Help Build Shared Prosperity New Jersey Policy Perspective

Reforming New Jersey S Income Tax Would Help Build Shared Prosperity New Jersey Policy Perspective

Nj Property Tax Relief Program Updates Access Wealth

Nj Property Tax Relief Program Updates Access Wealth

Will You Get A Break On Your N J Property Taxes During Coronavirus Crisis Nj Com

N J Property Taxes Bounced Back In 2019 Whyy

N J Property Taxes Bounced Back In 2019 Whyy

Reforming New Jersey S Income Tax Would Help Build Shared Prosperity New Jersey Policy Perspective

Reforming New Jersey S Income Tax Would Help Build Shared Prosperity New Jersey Policy Perspective

Unprecedented State To Extend 2020 Fiscal Year Delay Tax Filing Deadline To July 15 Nj Spotlight News

Unprecedented State To Extend 2020 Fiscal Year Delay Tax Filing Deadline To July 15 Nj Spotlight News

Interactive Map Where Nj S High Property Taxes Are Highest And Lowest Nj Spotlight News

Interactive Map Where Nj S High Property Taxes Are Highest And Lowest Nj Spotlight News

Reforming New Jersey S Income Tax Would Help Build Shared Prosperity New Jersey Policy Perspective

Reforming New Jersey S Income Tax Would Help Build Shared Prosperity New Jersey Policy Perspective

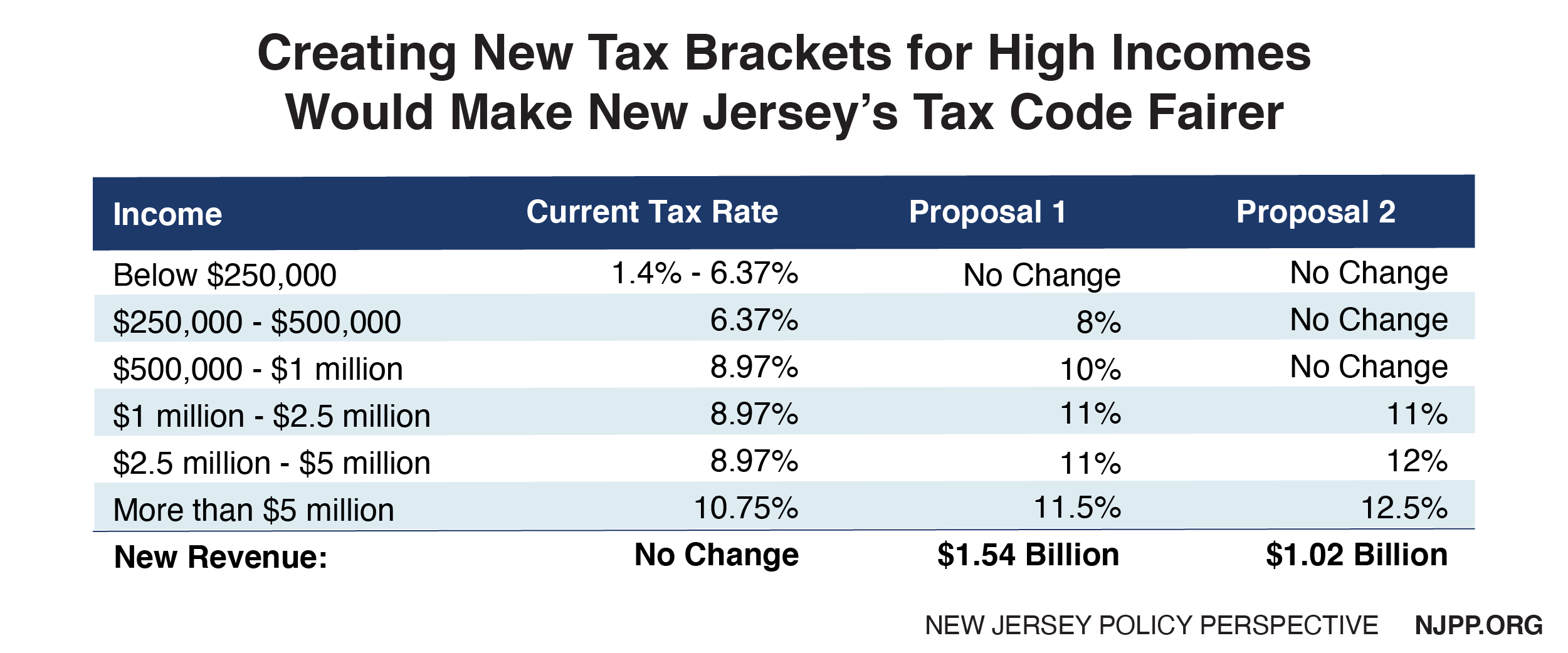

The Covid 19 Crisis Proves The Point New Jersey Needs More Revenue To Support Workers Families And Businesses New Jersey Policy Perspective

The Covid 19 Crisis Proves The Point New Jersey Needs More Revenue To Support Workers Families And Businesses New Jersey Policy Perspective

N J Freezes Property Tax Relief Other State Programs Whyy

N J Freezes Property Tax Relief Other State Programs Whyy

New Jersey Economic Development Incentives And Financing Programs

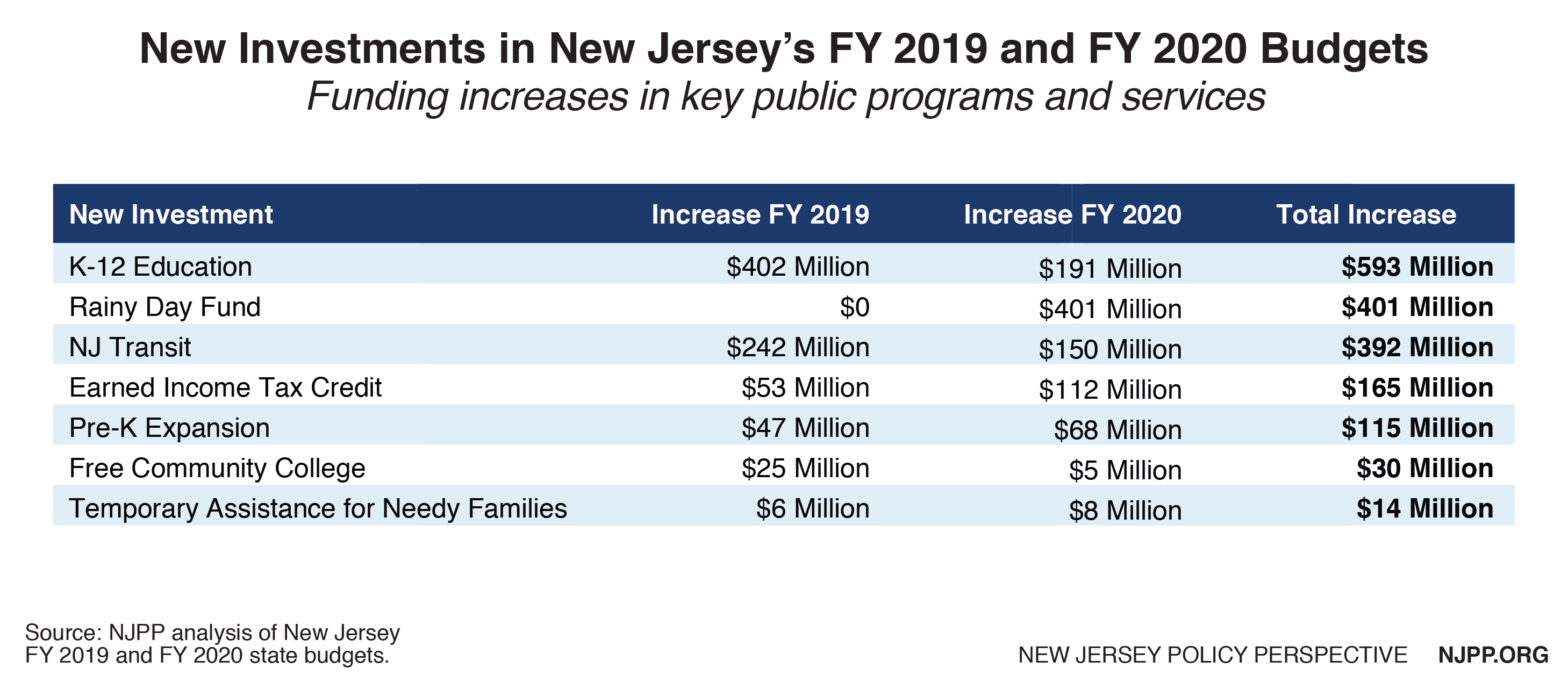

Road To Recovery Reforming New Jersey S Income Tax Code New Jersey Policy Perspective

Road To Recovery Reforming New Jersey S Income Tax Code New Jersey Policy Perspective

How Can You Lower Your Property Taxes In Nj Askin Hooker Llc

How Can You Lower Your Property Taxes In Nj Askin Hooker Llc

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home