Property Taxes Marion County Ohio

Delinquent Tax List In compliance with Ohio Revised Code Section 572103B 1 there will be published in this newspaper November 6 2020 and November 20 2020 a list of those persons who are delinquent in payment of real estate andor manufactured home taxes. Get driving directions to this office.

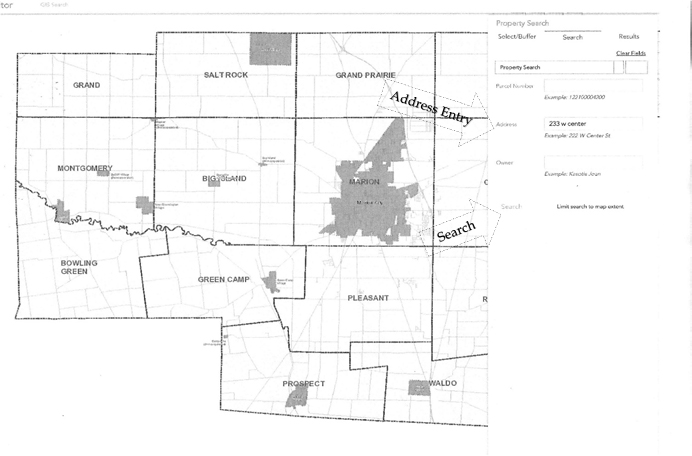

Marion County Maps Marion County Engineer S Office Ohio

740 223 4020 Phone The Marion County Tax Assessors Office is located in Marion Ohio.

Property taxes marion county ohio. In-depth Marion County OH Property Tax Information. Marion County Assessors Office Services. Ohio law limits the amount of taxation without a vote of the people to what is known as the 10 mill limitation 1000 per 1000 of assessed valuation.

Board of Revision Per Ohio Revised Code 571519 Complaint Against Value forms are only accepted from January 1st through March 31st. You will need either your social security number or your income tax account number to get set up. The median property tax in Marion County Ohio is 122500.

All of the Marion County information on this page has been verified and checked for accuracy. Marion County Auditor 222 W. When finished click the Continue button and you will be asked to review the information for accuracy before your payment is processed.

Second Half Property Taxes are Due June 20th. Getting started is easy just click on the online income tax payment link. CAUV Initial and Renewal applications are to be filed between the first day in January until the first Monday of March.

Property Taxes in Marion County Property tax is a tax on real estate mobile homes and business personal property. Marion County Property Tax Payments Annual Marion County Ohio. For example through the Homestead Exemption a home with a county auditors value of 100000 would be billed as if it is.

Marion County collects on average 124 of a propertys assessed fair market value as property tax. Please complete the form below. Marion County Property Records are real estate documents that contain information related to real property in Marion County Ohio.

In order to determine the tax bill your local tax assessors office takes into account the propertys assessed value the current assessment rate as well as any tax exemptions or abatements for that property. Marion County Tax Records are documents related to property taxes employment taxes taxes on goods and services and a range of other taxes in Marion County Ohio. The First Half Property Tax due date has been extended to February 19th.

Find property records for Marion County. Ohio is ranked 1139th of the 3143 counties in the United States in order of the median amount of property taxes collected. Center Street Marion Ohio 43302 Phone.

222 West Center Street. The Marion County Tax Assessor is the local official who is responsible for assessing the taxable value of all properties within Marion County and may establish the amount of tax due on that property. Use this section of the website to pay your property taxes and to learn about property tax rates deductions and exemptions how property taxes are used and other frequently asked questions.

Public Property Records provide information on homes land or commercial properties including titles mortgages property deeds and a range of other documents. Click Here to LoginSignup. The Homestead Exemption program allows qualifying Marion County residents to shield some of the market value of their principal place of residence from taxation.

Any additional real estate taxes for any purpose must be voted by county residents. Qualified homeowners will be exempted 25000 of the auditors market value of their home from property taxes. Marion County Property Tax Payments Annual Marion County Ohio.

The City of Marion income tax customers now have the option of paying their income tax billpayments with a credit card over the Internet. Your tax rate is an. These records can include Marion County property tax assessments and assessment challenges appraisals and income taxes.

Find the tax assessor for a different Ohio county. Median Property Taxes Mortgage 1358. Median Property Taxes Mortgage 1358.

The average yearly property tax paid by Marion County residents amounts to about 244 of their yearly income. Dog Tags All dogs must be licensed by 3 months of age or within 30 days of taking ownership of the dog. Median Property Taxes No Mortgage 1072.

Marion County Maps Marion County Engineer S Office Ohio

Treasurer Marion County Ohio Jan Draper Treasurer

Marion Ohio Oh 43302 Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Marion County Maps Marion County Engineer S Office Ohio

Marion County Maps Marion County Engineer S Office Ohio

Marion County Maps Marion County Engineer S Office Ohio

Marion County Oh Real Estate Homes For Sale From 49 500

Marion County Oh Real Estate Homes For Sale From 49 500

Zoning Code Information The City Of Marion Ohio

Zoning Code Information The City Of Marion Ohio

Marion County Maps Marion County Engineer S Office Ohio

Https Www Marionohioplanning Org Files Luplan Chapter 4 Pdf

Townships Allen County Treasurer S Office

Townships Allen County Treasurer S Office

Marion County Maps Marion County Engineer S Office Ohio

Treasurer Marion County Ohio Jan Draper Treasurer

Marion County Auditor Marion County Auditor S Office

Marion County Auditor Marion County Auditor S Office

Marion Ohio Oh 43302 Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Auditor Marion County Ohio Joan M Kasotis Auditor

Marion County Maps Marion County Engineer S Office Ohio

Marion County Maps Marion County Engineer S Office Ohio

Auditor Marion County Ohio Joan M Kasotis Auditor

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home