Property Tax Rate Fort Bend County

The Fort Bend County budget will raise more total property taxes than last years budget by 11098062 or 373 and of that amount 9070625 is tax revenue to be. The average effective property tax rate is 223 and most homeowners pay over 5000 a year in taxes.

Fort Bend County Appraisal District Fill Online Printable Fillable Blank Pdffiller

Fort Bend County Appraisal District Fill Online Printable Fillable Blank Pdffiller

Fort Bend County collects on average 248 of a propertys assessed fair market value as property tax.

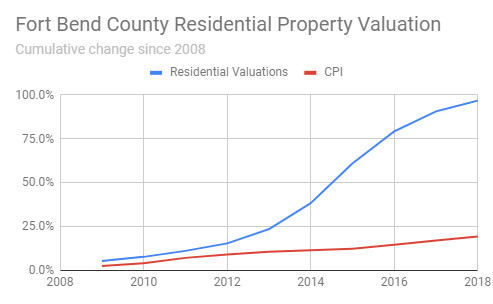

Property tax rate fort bend county. These large increases are part of the impetus for Senate Bill 2 which caps taxes for school at 25 and cities counties at 35 per year for existing property plus the value of new construction. 209 of total minimum fee of 100. Fort Bend County commissioners unanimously approved a lowered tax rate for 2020 as the county deals with the pains of the COVID-19 pandemic.

The median property tax also known as real estate tax in Fort Bend County is 426000 per year based on a median home value of 17150000 and a median effective property tax rate of 248. The Fort Bend County Tax Office does not warrant the accuracy authority completeness usefulness timeliness or fitness for a particular purpose of its information or services. If you are unable to attend your ARB hearing in person you may submit your Property Tax Reduction Report via mail with a completed affidavit.

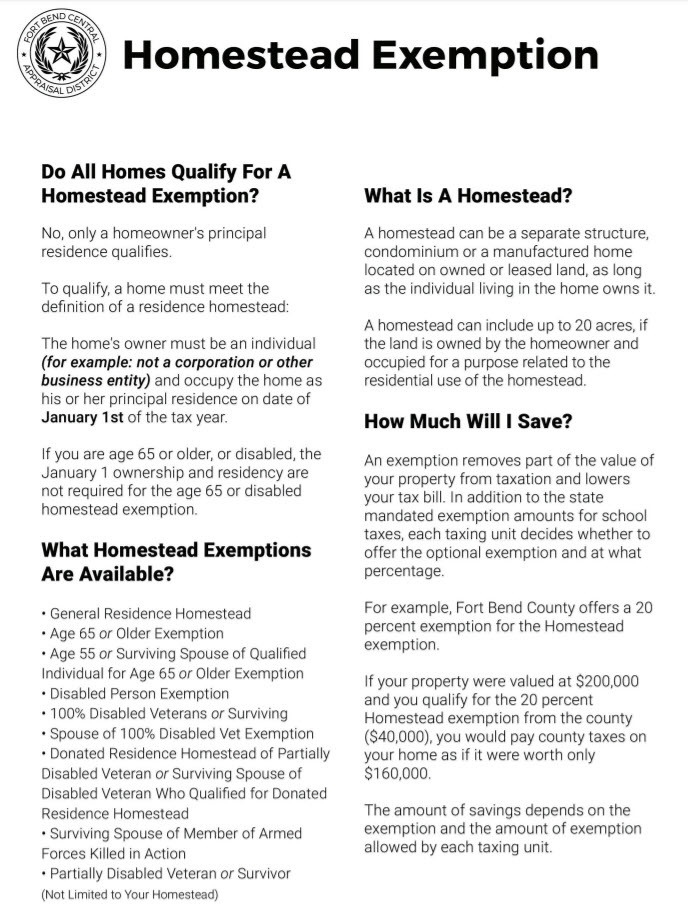

The effective tax rate of 223 which is twice as much as the national average. Terry Blvd Rosenberg Texas 77471. These mandated changes have been issued in an effort to prevent property owners from applying for homestead exemptions on more than one property.

The Tax Assessor-Collector provides friendly efficient and professional tax collection services for taxpayers of Fort Bend County as well as tax research and information referral. The Fort Bend County Tax Office provides this World Wide Web WWW site information and services as is without warranty of any kind either expressed or implied. There are many special tax districts in Fort Bend County over 200 that require levies on top of the usual property taxes a major contributing factor in the high rates residents pay.

Fort Bend Central Appraisal District 2801 B. Houston Com Col. As an agent for the state the Tax Assessor-Collector also collects automobiletruck and trailer taxes vehicle registration fees and beerwine liquor fees.

Fort Bend CAD Property Search. This is a46 increase over 4 years. This website only contains information about values.

Register to Receive Certified Tax Statements by email. Over 10 per year. Residents are fed up and fired up about rising property appraisals in Fort Bend County.

301 Jackson St Richmond TX 77469 View on Google Maps. The market value of Fort Bend County taxable property rose from 62 billion in 2014 to 91 billion in 2018. CREDITDEBIT CARD CONVENIENCE FEES APPLY.

00173 3329. Fort Bend County has the leading average real estate tax payment estimated to be 5198 annually per average homeowner in Texas. It continues a trend of the.

Protester Allison Walla said Every year we are taxed at 10 percent minimum that tax is. Shortly after filing your protest you will be notified via mail of your ARB hearing date. Fort Bend County has one of the highest median property taxes in the United States and is ranked 57th of the 3143 counties in order of median property taxes.

Eight percent was the previous tax rate increase cap before the 35 percent limit went into effect this year. The median property tax in Fort Bend County Texas is 4260 per year for a home worth the median value of 171500. Surratt added These applications must be filed with the Fort Bend Central Appraisal District 2801 B F Terry Blvd Rosenberg TX 77471.

Now Fort Bend County like many others wants to invoke a provision in Senate Bill 2 that allows local governments in the year of a disaster to designate the property tax rate increase at 8 percent. 6 rows Tax rate Tax amount. Last August Fort Bend County Judge KP.

Information Hosted by Carmen Turner Fort Bend County Tax AssessorCollector Tax Rate Information For all Fort Bend County Taxing Units Turn off pop-up blockers or allow pop-ups from wwwfortbendcountytxgov. The median property tax on a 17150000 house is 425320 in Fort Bend County The median property tax on a 17150000 house is 310415 in Texas The median property tax on a 17150000 house is 180075 in the United States. The ARB will review your.

By clicking the link above you will be leaving the Fort Bend Central Appraisal Districts website. Property Tax Payments can be made at all locations by cash check and most major credit cards. The new tax rate is 0424967 per 100 which is lower from 2019s rate of 04447 per 100.

Inquiresearch property tax information. Online Property Tax Payment Fees.

Fort Bend County Appraisal District How To Protest Property Taxes

Fort Bend County Appraisal District How To Protest Property Taxes

Where Do Texas Homeowners Pay The Highest Property Taxes Texas Scorecard

Where Do Texas Homeowners Pay The Highest Property Taxes Texas Scorecard

Fort Bend County Property Tax Loans Home Tax Solutions

Fort Bend County Property Tax Loans Home Tax Solutions

2021 Best Places To Buy A House In Fort Bend County Tx Niche

2021 Best Places To Buy A House In Fort Bend County Tx Niche

Protest Property Tax In Fort Bend County Fbcad Property Tax Reduction

Protest Property Tax In Fort Bend County Fbcad Property Tax Reduction

Sugar Land Has One Of The Lowest Property Tax Rates In Texas

Fort Bend County Plans To Cut Tax Rate By 1 83 Cents

Fort Bend County Plans To Cut Tax Rate By 1 83 Cents

Property Taxes In Fort Bend Tx Bret Wallace

Property Taxes In Fort Bend Tx Bret Wallace

Protest Property Tax In Fort Bend County Fbcad Property Tax Reduction

Protest Property Tax In Fort Bend County Fbcad Property Tax Reduction

Fort Bend County Property Tax Records Fort Bend County Property Taxes Tx

Fort Bend County Property Tax Records Fort Bend County Property Taxes Tx

Covid 19 Resources Fort Bend County Tx

Fort Bend County Property Tax Records Fort Bend County Property Taxes Tx

Fort Bend County Property Tax Records Fort Bend County Property Taxes Tx

Fort Bend County Chamber Membership Directory 2020 By Rcavazos Issuu

Fort Bend County Chamber Membership Directory 2020 By Rcavazos Issuu

Property Tax Information City Of Meadows Place

Property Tax Information City Of Meadows Place

Property Tax Payment Deadline Jan 31

Property Tax Payment Deadline Jan 31

Property Taxes In Fort Bend Tx Bret Wallace

Property Taxes In Fort Bend Tx Bret Wallace

Fighting Cad Appraisals Fort Bend County Precinct Three

Fighting Cad Appraisals Fort Bend County Precinct Three

Katy Property Taxes Information By Local Area Expert

Katy Property Taxes Information By Local Area Expert

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home