Property Tax Missouri City Texas

3 rows Missouri City Tax Collector Contact Information. In most cases the voter-approval tax rate is the highest tax rate a taxing unit can adopt without holding an election.

46 Sullivans Lnd Missouri City Tx 77459 Photo 46 Sullivans Landing Your Home Your Casa Missouri City Sullivans House Styles

46 Sullivans Lnd Missouri City Tx 77459 Photo 46 Sullivans Landing Your Home Your Casa Missouri City Sullivans House Styles

2020 TAX RATE Tax Rate Notice City of Missouri City adopted a tax rate that will raise more taxes for maintenance and operations than last years tax rate.

Property tax missouri city texas. These mandated changes have been issued in an effort to prevent property owners from applying for homestead exemptions on more than one property. A 25 percent property tax cap could save the average City resident who owns a 100000 home about 1655 a year or 138 a month which would only be enough to purchase about 34 gallon of gas today. Texass median income is 62353 per year so the median yearly property tax paid by Texas.

The property tax levies for Liberty citizens for all government entities are. Texas has one of the highest average property tax rates in the country with only thirteen states levying higher property taxes. 307 Texas Parkway Ste 113 Missouri City TX 77489-1151 Telephone.

Property taxes are collected for Missouri City by the Fort Bend County Tax Office. Most people in Missouri City TX drove alone to work and the average commute time was 291 minutes. A reputable law firm in Missouri City Texas James H.

Find property tax in Missouri City TX on Yellowbook. Monday - Friday from 800 AM - 430 PM CLOSED County Holidays Alternate Locations. Hard Jr Attorney at Law specializes in helping clients with Property Tax issues.

Main Office Katy Branch Needville Branch Sienna Branch Sugar Land Branch. Get reviews and contact details for each business including videos opening hours and more. The Missouri City Assessor located in Missouri Texas determines the value of all taxable property in Fort Bend County TX.

The average car ownership in Missouri City TX was 2 cars per household. The assessed value for personal property such as vehicles is 33 13 of market value. 2814038500 Contact Us Hours Monday - Friday 800 am -.

209 of total minimum fee of 100. The Missouri City City Council on Monday voted to increase the citys 2017 property tax rate by 712 percent in part to fund infrastructure improvements. More information about property taxes can be found by contacting their local branch at.

Missouri City TX 77489 Ph. Missouri City TX 77489 Phone. Register to Receive Certified Tax Statements by email.

The CollectorTreasurer conduct the Annual Land Tax Certificate Sale on the 4th Monday of August each year at 10 AM. Jackson County Courthouse 415 E 12th Street Kansas City MO 64106 Phone. For more information on tax sales merchants license or property taxes contact the office of the CollectorTreasurer.

Taxable property includes land and commercial properties often referred to as real property or real estate and fixed assets owned by businesses often referred to as personal property. Tax Rate per 100 of the Assessed Value. Real estate property assessed value is 19 for residential 32 for commercial and 12 for agricultural property.

Jason FochtmanStaff photographer Show More Show Less 11 of 32 City of Missouri City Proposed 2017 tax rate. Address Phone Number and Hours for Missouri. Property Tax Lawyers Houston Office Serving Missouri City TX.

In each case these rates are calculated by dividing the total amount of taxes by the current taxable value with adjustments as required by state law. 2019 Current 2018 Previous City. The rates are given per 100 of property value This years no-new-revenue tax rate.

Texas Property Tax Reform and Relief Act of 2019. 06 per 100 Tax before exemptions on a 200000 home. Inquiresearch property tax information.

Office hours for the Missouri City branch at Monday from 700 am to 600 pm and Tuesday through Friday from 800 am to 430 pmFort Bend County Tax Office. Pay property taxes online by credit card or e-check. The median property tax in Texas is 227500 per year for a home worth the median value of 12580000.

How much will a 25 percent property tax cap save a Missouri City resident on property taxes. Surratt added These applications must be filed with the Fort Bend Central Appraisal District 2801 B F Terry Blvd Rosenberg TX. Online Property Tax Payment Fees.

In 2018 the median property value in Missouri City TX was 180800 and the homeownership rate was 807. Counties in Texas collect an average of 181 of a propertys assesed fair market value as property tax per year.

Houses For Rent In Missouri City Tx 21 Homes Zillow

Houses For Rent In Missouri City Tx 21 Homes Zillow

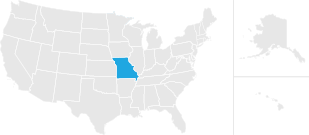

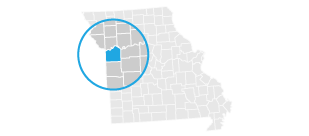

Missouri Property Tax Calculator Smartasset

Missouri Property Tax Calculator Smartasset

Missouri City Community Connector Rideshare Metro Houston Tx

Missouri City Community Connector Rideshare Metro Houston Tx

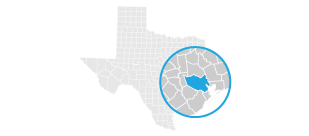

Which Texas Mega City Has Adopted The Highest Property Tax Rate

Which Texas Mega City Has Adopted The Highest Property Tax Rate

Sienna New Home Community Houston Texas Lennar Homes

Sienna New Home Community Houston Texas Lennar Homes

Motor Vehicle Information Fort Bend County Tx

Jackson County Mo Property Tax Calculator Smartasset

Jackson County Mo Property Tax Calculator Smartasset

Harris County Tx Property Tax Calculator Smartasset

Harris County Tx Property Tax Calculator Smartasset

Oklahoma Property Tax Calculator Smartasset

Oklahoma Property Tax Calculator Smartasset

Stafford Tx Real Estate Guide Stafford Homes For Sale

Stafford Tx Real Estate Guide Stafford Homes For Sale

4 Bedroom House With 2 Bathrooms For Rent At 3831 Lexington Grove Court 77459 For 1 525 Per Month Apartments For Rent Renting A House City Apartment

4 Bedroom House With 2 Bathrooms For Rent At 3831 Lexington Grove Court 77459 For 1 525 Per Month Apartments For Rent Renting A House City Apartment

3 Vieux Carre Missouri City Tx 77459 Har Com Sale House Renting A House Best Flooring

3 Vieux Carre Missouri City Tx 77459 Har Com Sale House Renting A House Best Flooring

14 Lost Oak Ct Missouri City Tx 77459 Photo Why Wait To Build Save Time And Missouri City House Styles Oak

14 Lost Oak Ct Missouri City Tx 77459 Photo Why Wait To Build Save Time And Missouri City House Styles Oak

3710 Kiamesha Drive Missouri City Tx 77459 Har Com Missouri City House Styles Tile Bedroom

3710 Kiamesha Drive Missouri City Tx 77459 Har Com Missouri City House Styles Tile Bedroom

New Homes In Sienna Home Builder In Missouri City Tx

New Homes In Sienna Home Builder In Missouri City Tx

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home