Do Nonprofits Pay Property Taxes In Texas

Nonprofits are also exempt from paying sales tax and property tax. The state would no longer share about 60 million in revenue with local governments but it would make up for at least some of that lost revenue by requiring cities and towns to levy property taxes on 50 percent of the value of nonprofit-owned real estate valued at more than 500000.

Texas Disabled Veteran Benefits Explained The Insider S Guide Va Claims Insider

Texas Disabled Veteran Benefits Explained The Insider S Guide Va Claims Insider

Certain exemptions from the franchise tax are outlined in Texas Tax Code Chapter 171 Subchapter B.

Do nonprofits pay property taxes in texas. The local tax appraisal district makes the final determination for the organizations qualification of the exemption based on the use of the property see Tax Code Section 11184. The lessee will pay the taxes one way or another either directly a net lease or indirectly through the lease payment. Although it varies by location many states counties and municipalities make allowances.

While the income of a nonprofit organization may not be subject to federal taxes nonprofit organizations do pay employee taxes. Some nonprofit organizations may also be eligible for property tax exemptions. TX-2021-02 February 22 2021 TEXAS Victims of winter storms that began February 11 2021 now have until June 15 2021 to file various individual and business tax returns and make tax payments the Internal Revenue Service announced today.

As long as they already have incorporated nonprofit organizations often do not have to pay property taxes. Nonprofit entities that have requested and been granted an exemption from the Comptrollers office do not have to file franchise tax reports including the Public Information Report or Ownership Information Report. Certain nonprofit and government organizations are eligible for exemption from paying Texas taxes on their purchases.

There is no state property taxProperty tax brings in the most money of all taxes available to local government to pay for schools roads police and firemen emergency response services libraries parks and other services provided by local government. Joshua Escalante Troesh CFP MBA. Payments in Lieu of Taxes Local governments provide services to nonprofits even though they dont pay property taxes.

If another charitable non-profit organization owns the property then the situation is the same as 1 above. A Texas nonprofit organizationwhether a corporation or an unincorporated associationis not automatically exempt from federal or state taxes. Property tax in Texas is a locally assessed and locally administered tax.

For non-profit organizations to receive property tax exemptions they must apply to the County Appraisal District in which the property is. The property tax status of the property will depend on who owns the property. Federal and Texas government entities are automatically exempt from applicable taxes.

In addition the association may but is not required to file a statement of authorization as to real property with the county clerk. Non-profits are exempt from all state property taxes because they have an official exemption from the IRS which. Updated on 031221 to include information affecting farmers or fishermen.

If not how do I become tax-exempt. According to a recent study. Certain organizations can apply to our office for exemption from franchise tax from sales taxes on purchases necessary to the organizations exempt purpose or from hotel tax when traveling on behalf of the exempt organization.

Nonprofit organizations must apply for exemption with the Comptrollers office and receive exempt status before making tax-free purchases. Since property taxes are state taxes the exemption will depend on the laws in your individual state. The property should be exempt from property taxes if the rent is 0 or some nominal amount.

An unincorporated nonprofit association may but is not required to file an appointment of an agent for service of process. Simply leasing a property to a non-profit will not on its own exempt a private individual from having to pay property taxes. As to real property with the county clerk.

Typical organizations receiving property tax exemption are schools churches cemeteries hospitals social service agencies character building organizations nursing homes homes for the aging museums performing arts facilities and public meeting halls. Is an unincorporated nonprofit association a tax-exempt entity. Under PILOT Payment In Lieu of Taxes agreements nonprofits such as colleges hospitals and human service agencies - all of which are exempt from property taxes - are asked to voluntarily contribute to their city or towns budget.

If the administration is unfamiliar to your company the lessor should pay as they have volume and efficiency and. Texas tax laws allow a non-profit business to pay no property taxes on all real property and business personal property owned by the non-profit business. See Form 706 Word 88kb PDF 58kb.

Organizations engaged primarily in charitable activities and 501 c 2 corporations that hold title to property for such organizations may be eligible for a local option property tax exemption. Usually lessees pay the taxes directly on longer-term leases while the lessor pays for shorter term contracts. If the entity has not requested or been granted an exemption it must file all reports.

Because of nonprofits tax.

Agriculture Taxes In Texas Texas A M Agrilife Extension Service

Agriculture Taxes In Texas Texas A M Agrilife Extension Service

San Antonio Suburb Approves Tax District Districts Mixed Use Construction Jobs

San Antonio Suburb Approves Tax District Districts Mixed Use Construction Jobs

Agriculture Taxes In Texas Texas A M Agrilife Extension Service

Agriculture Taxes In Texas Texas A M Agrilife Extension Service

Property Tax Comparison By State For Cross State Businesses

Property Tax Comparison By State For Cross State Businesses

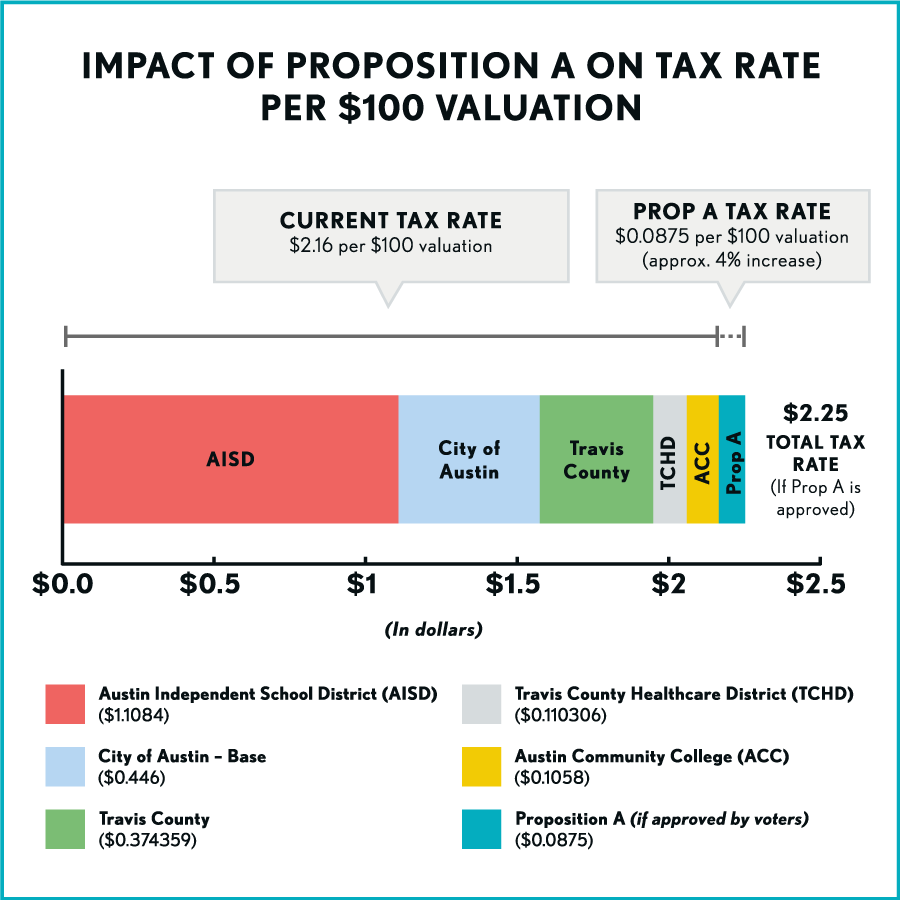

2020 Mobility Elections Proposition A Austintexas Gov

2020 Mobility Elections Proposition A Austintexas Gov

Texas Budget And Revenue Texas Government

Texas Budget And Revenue Texas Government

States With Highest And Lowest Sales Tax Rates

States With Highest And Lowest Sales Tax Rates

Pin By Bobbie Persky Realtor On Finance Real Estate Property Tax Tax Attorney Debt Relief Programs

Pin By Bobbie Persky Realtor On Finance Real Estate Property Tax Tax Attorney Debt Relief Programs

Property Tax Map Tax Foundation

Property Tax Map Tax Foundation

Understanding The Property Tax Protest Industry Of Houston

Understanding The Property Tax Protest Industry Of Houston

Texas Non Profits Pay Zip Zero Nada In Property Taxes

Texas Non Profits Pay Zip Zero Nada In Property Taxes

Do You Know How Much You Pay In Federal State And Local Taxes Bean Counter Tax Federal Income Tax

Do You Know How Much You Pay In Federal State And Local Taxes Bean Counter Tax Federal Income Tax

Agriculture Taxes In Texas Texas A M Agrilife Extension Service

Agriculture Taxes In Texas Texas A M Agrilife Extension Service

Forming Non Profit Txrevrev10 Pdf Texas C Bar Forming A Nonprofit Tax Exempt Corporation In Texas Non Profit Start Up Coding

Forming Non Profit Txrevrev10 Pdf Texas C Bar Forming A Nonprofit Tax Exempt Corporation In Texas Non Profit Start Up Coding

Understanding The Property Tax Protest Industry Of Houston

Understanding The Property Tax Protest Industry Of Houston

Pin By Candy Bryson On Homework So I Can Cite Later Texas Department Health Services Paying Taxes

Pin By Candy Bryson On Homework So I Can Cite Later Texas Department Health Services Paying Taxes

Kennedy If You Re 65 You Don T Have To Pay Property Taxes Fort Worth Star Telegram

Kennedy If You Re 65 You Don T Have To Pay Property Taxes Fort Worth Star Telegram

Monday Map State Local Property Tax Collections Per Capita Property Tax Map Best Places To Retire

Monday Map State Local Property Tax Collections Per Capita Property Tax Map Best Places To Retire

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home