Pay Vehicle Property Tax Greenville Sc

Greenville County collects on average 066 of a propertys assessed fair market value as property tax. Currently the Richland County Treasurers Office accepts Visa and Mastercard online.

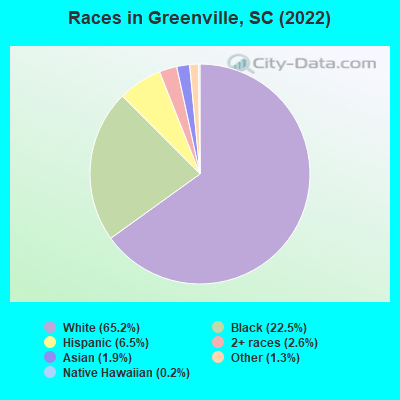

Greenville South Carolina Sc Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Greenville South Carolina Sc Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Payment of the taxes on the real property.

Pay vehicle property tax greenville sc. As of 500 pm. You must pay the property tax bill to the county treasurer before you can register your vehicle in this state. All online tax payments received after 500 pm will be posted the next business day.

Days ticking down before sales tax increases on cars. After you pay your taxes the plate or registration decal is mailed to the customer from the SCDMV the next working day. Columbia SC 29211 A Richland County receipt is issued by mail.

Vehicles are also subject to property taxes which the NC. Spartanburg County Treasurer is no longer accepting 2020 real property tax payments. Citizens can pay Vehicle taxes through mail drop box phone or internet.

For your convenience McCormick County is now providing the ability to search view and pay your current property and vehicle taxes online. Citizens can pay property taxes through the mail the internet or by using the convenient dropbox located outside the Tax Office. A leasehold interest will be subject to ad valorem tax if real property that is subject to a property tax exemption is leased for a definite term and the lessee does not qualify for an exemption.

Real and personal property are subject to the tax. In this state you must pay your personal vehicle property taxes before a license plate can be renewed and a new decal issued. The current fee for paying online with your DEBIT CARD is 395 per checkout.

When you visit the SCDMV you must bring your paid property tax receipt with you. Yearly median tax in Greenville County. The amount you owe is based on the items sales price.

066 of home value. If you have sold or traded your vehicle or transferred the license plate please make sure you are paying on the correct vehicle. 864-271-5333 Greenville Cares Information Center.

Pay Taxes Online Please note payments made online may take up to 48 hours to process. For inquiries regarding real property tax for 2020 and prior please contact the Tax Collector at 864-596-2597. Property tax is administered and collected by local governments with assistance from the SCDOR.

Greenville County Tax Collector SC 301 University Ridge Greenville SC 29601 864-467-7050. Visit the SCDMV with all of the following. 206 S Main Street Greenville SC 29601 Police Non-Emergency.

SC Code 12 -37-610 and 12-49-20. You must bring the original paid property tax receipt to the SCDMV. All property taxes are paid to the county treasurer.

All Greenwood County tax payments are processed through PayPal. Division of Motor Vehicles collects as defined by law on behalf of counties Revenue from the highway-use tax goes to the North Carolina Highway Trust Fund and the North Carolinas General Fund. Also you may now pay by phone at.

After payment is processed receipts andor decals with vehicle registration will be mailed within 7 - 10 business days. We are currently working to streamline the instructions on these pages and allow you to pull and pay bills just by searching for your name. This will then allow you to use PayPal or choose a different payment option.

Even if you do not have a PayPal account you will need to click the Pay with PayPal button. See Clarendon County ex rel. Pay your taxes online by credit card or e-check.

Greenville County encourages those needing to pay taxes to avoid coming inside County Square. You will visit the auditors office and he or she will generate a property tax bill for the vehicle. 864-232-2273 Webmail Timesheet ESS Citynet.

The median property tax in Greenville County South Carolina is 971 per year for a home worth the median value of 148100. Starting July 1 500 cap on sales tax in SC and also a new 250 one time registration fee on each vehicle for NEW residents in addition to the usual property tax and license fees. March 232020 Spartanburg County will waive all CreditDebit card fees until further notice.

You can pay both the vehicle property taxes and renewal fees at the county treasurers office. South Carolina is ranked 1523rd of the 3143 counties in the United States in order of the median amount of property taxes. Approximately two-thirds of county-levied property taxes are used to support public education.

Moving To Greenville Sc 10 Things You Ll Love About Your Move To Greenville Sc

Moving To Greenville Sc 10 Things You Ll Love About Your Move To Greenville Sc

19 Adger St Greenville Sc 29605 Home For Rent Realtor Com

19 Adger St Greenville Sc 29605 Home For Rent Realtor Com

122 Edgeworth St Greenville Sc 29607 Loopnet Com

122 Edgeworth St Greenville Sc 29607 Loopnet Com

3900 E North St Greenville Sc 29615 Realtor Com

3900 E North St Greenville Sc 29615 Realtor Com

8 Post Oak Rd Greenville Sc 29605 Realtor Com

8 Post Oak Rd Greenville Sc 29605 Realtor Com

302 S Calhoun St Greenville Sc 29601 Realtor Com

302 S Calhoun St Greenville Sc 29601 Realtor Com

1 Lakeside Rd Greenville Sc 29611 Realtor Com

1 Lakeside Rd Greenville Sc 29611 Realtor Com

2 Meteora Way Greenville Sc 29609 Realtor Com

2 Meteora Way Greenville Sc 29609 Realtor Com

1113 Woodruff Rd Greenville Sc 29607 Loopnet Com

1113 Woodruff Rd Greenville Sc 29607 Loopnet Com

2424 Old Buncombe Rd Greenville Sc 29609 Loopnet Com

2424 Old Buncombe Rd Greenville Sc 29609 Loopnet Com

122 Awendaw Way Greenville Sc 29607 Realtor Com

122 Awendaw Way Greenville Sc 29607 Realtor Com

490 Wenwood Rd Greenville Sc 29607 Realtor Com

490 Wenwood Rd Greenville Sc 29607 Realtor Com

520 Guess St Greenville Sc 29605 Realtor Com

520 Guess St Greenville Sc 29605 Realtor Com

36 Gardenview Ave Greenville Sc 29601 Realtor Com

36 Gardenview Ave Greenville Sc 29601 Realtor Com

Greenville South Carolina Best Cities And Places To Live Real Estate Scorecard

Greenville South Carolina Best Cities And Places To Live Real Estate Scorecard

1230 Rutherford Rd Greenville Sc 29609 Loopnet Com

1230 Rutherford Rd Greenville Sc 29609 Loopnet Com

11 Jaben Dr Greenville Sc 29611 Realtor Com

11 Jaben Dr Greenville Sc 29611 Realtor Com

Liberty Sc Homes For Sale And Real Estate In Liberty Sc Realtortlowe Yeahthatgreenville Move To Greenville Keller Will Real Estate Prices Real Estate Estates

Liberty Sc Homes For Sale And Real Estate In Liberty Sc Realtortlowe Yeahthatgreenville Move To Greenville Keller Will Real Estate Prices Real Estate Estates

Labels: property

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home