How To Pay Franklin County Property Taxes

Please have your tax bill and credit card information available as you will need information from both to complete this transaction. No warranties expressed or implied are provided for the data herein its use or interpretation.

You can now pay your Franklin Township property taxes online using a credit card or e-check.

How to pay franklin county property taxes. April 16 2021 You may begin by choosing a search method below. Franklin County Real Estate Tax Payment. It also allows you to pay with a credit card or e-check all from the comfort of your own home.

Franklin County collects on average 208 of a propertys assessed fair market value as property tax. Franklin County Treasurer Website Safe Secure. The median property tax in Franklin County New York is 1848 per year for a home worth the median value of 88800.

The Franklin County Tax Commissioners Office makes every effort to produce and publish the most accurate information possible. Real Estate Tax Information Real Estate Tax Inquiry. New application provides a simple search by your parcel owner name or property address.

Pay taxes online Your payment will be considered accepted and paid on the submitted date. Franklin Countys due date for first-half manufactured-homes tax payments is Monday March 1 2021. Pay your bills anytime anywhereon-the-go or via computer.

This information is from a working tax roll and thus information may change throughout the year. Search and Pay Taxes. Welcome to the Tennessee Trustee Tax Payment Solution Service.

Your payment will be posted within minutes of transaction approval. However this material may be slightly dated which would have an impact on its accuracy. 123 Main Parcel ID Ex.

To Pay Online Visit. Pay your real estate taxes online by clicking on the link below. The Franklin County Treasurer makes every effort to produce and publish the most current and accurate information possible.

4th Ave Pasco WA outside the security building. Payments of property taxes can be made via mail but must be postmarked April 30 2020. Use this inquiry search to access Franklin Countys real estate tax records.

Franklin County has one of the highest median property taxes in the United States and is ranked 544th of the 3143 counties in order of median property taxes. Franklin County Tax Payments. Franklin County Real Estate Tax Inquiry Real Estate Tax Payments.

Pay Franklin County Ohio property taxes online using this service. If you would like to speak in person with a Delinquent Tax Coordinator please call 614-525-3431 to make an appointment. The Franklin County Treasurers Office wants to make paying your taxes as easy as possible.

It is your responsibility to send a completed form to the assessor by March 1 listing all the taxable personal property you owned January 1. You can search and pay Franklin County taxes online or you can pay your taxes over the phone by calling 1-888-272-9829. Please note you cannot use home equity line of credit checks or money market account to make an online payment.

Click here to pay now. This service gives you the freedom to pay and search 24 hours a day 7 days a week. However it may take 2-4 business days for processing.

View an Example Taxcard. You will need to know your parcel zip code bill number tax year and tax account number in order to make a payment by phone. This website gives you the ability to view search and pay taxes online and is beneficial for all taxpayers locally and worldwide.

Property tax information last updated. Please note that fees apply. Welcome to Franklin County MO Bill Pay Website for Real Estate and Personal Property Taxes.

Search for a Property Search by. The County assumes no responsibility for errors in the information and does not guarantee that the. As a courtesy a second notice is typically mailed in mid March.

Please provide a good daytime telephone number. Pay Taxes online. To Pay by Phone CALL.

The following provides you with information on property tax payments. Quickly search submit and confirm payment through the Pay Now button. If you live in Franklin County as of January 1st of that year you must file with the assessors office.

Any errors or omissions should be reported for investigation. Envelopes to put your payment in. Please note that it usually takes the County Treasurer 2-4 days to process your payment once it is made.

The Tax Collector makes every effort to produce the most accurate information possible. John Smith Street Address Ex. All data is subject to change.

In addition a payment drop box is available at the parking lot of the Courthouse 1016 N.

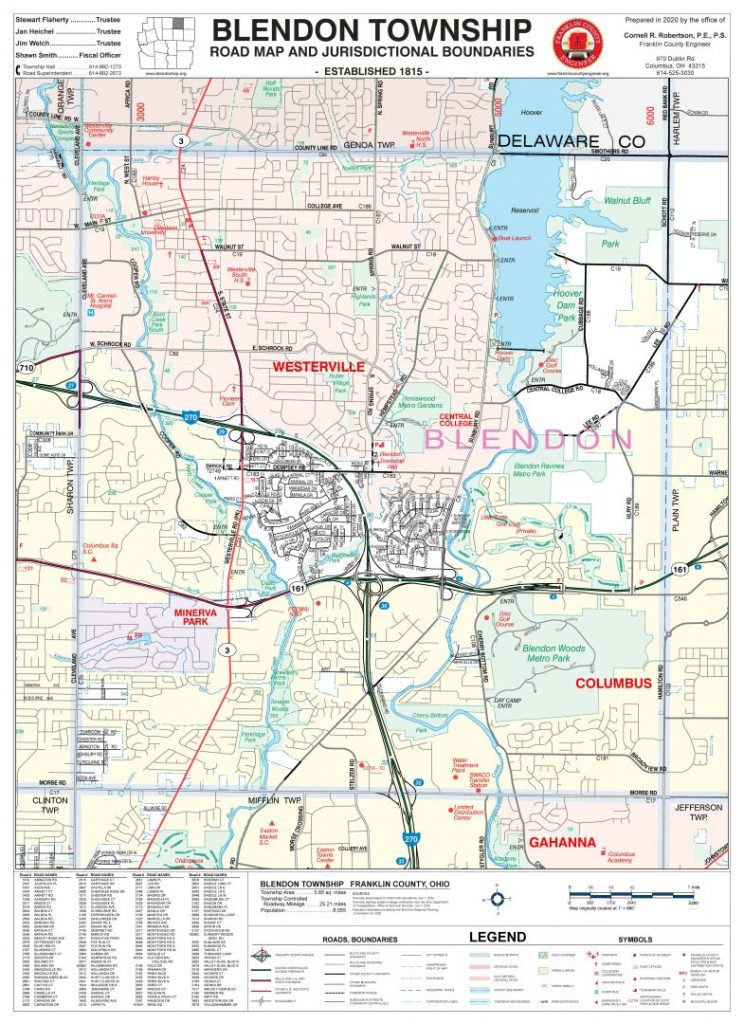

Township Maps Franklin County Engineer S Office

Township Maps Franklin County Engineer S Office

Map Of Franklin County Illinois 1900 Library Of Congress

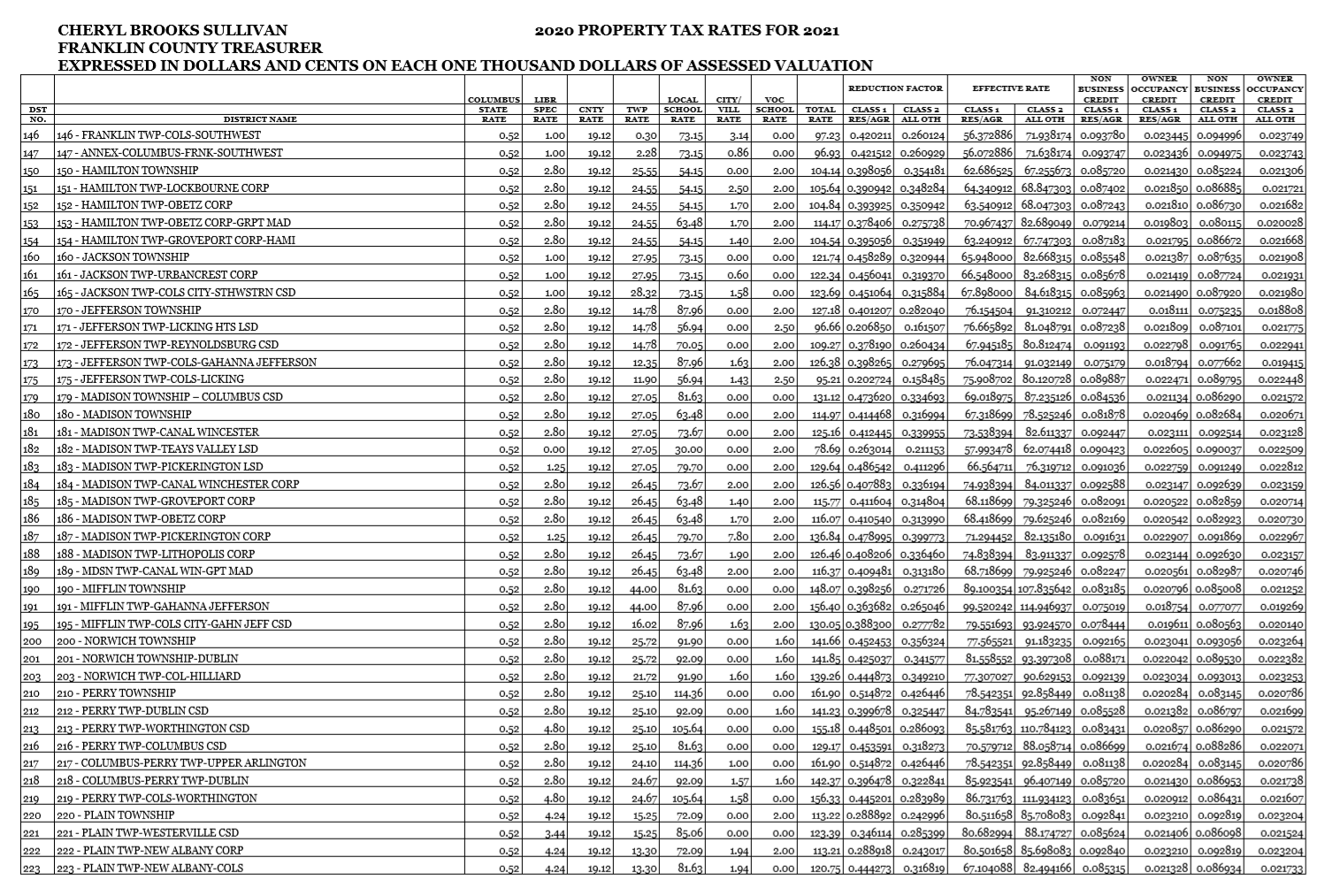

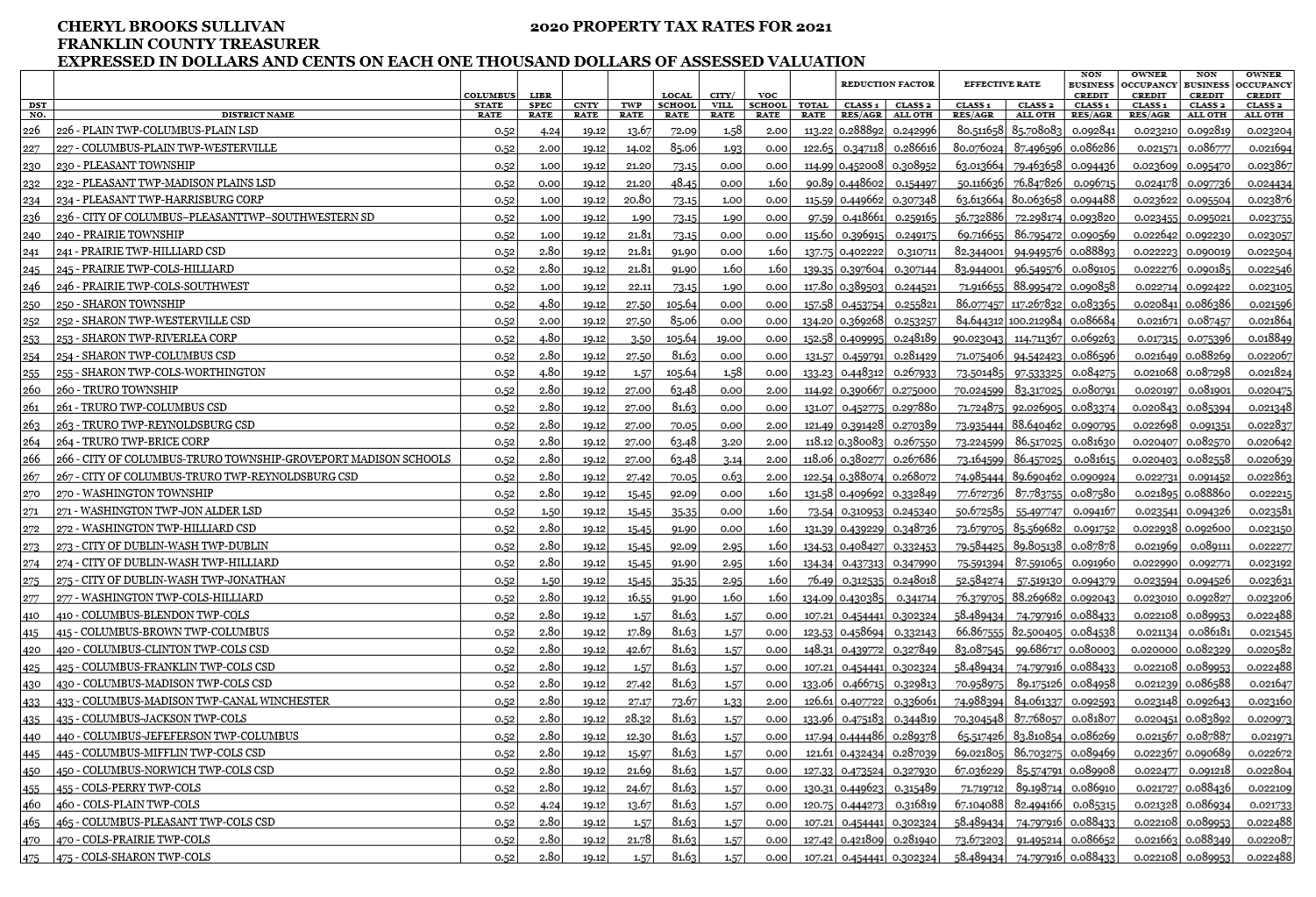

Franklin County Treasurer Tax Rates

Franklin County Treasurer Tax Rates

10 Things You Need To Know About Your Property Tax Bill Entertainment Life The Columbus Dispatch Columbus Oh

10 Things You Need To Know About Your Property Tax Bill Entertainment Life The Columbus Dispatch Columbus Oh

Franklin County Treasurer Tax Rates

Franklin County Treasurer Tax Rates

Franklin County Ohio Treasurer Payments

Franklin County Ohio Treasurer Payments

Franklin County Treasurer Tax Rates

Franklin County Treasurer Tax Rates

Franklin County Maine United States Britannica

Franklin County Maine United States Britannica

10 Things You Need To Know About Your Property Tax Bill Entertainment Life The Columbus Dispatch Columbus Oh

10 Things You Need To Know About Your Property Tax Bill Entertainment Life The Columbus Dispatch Columbus Oh

Franklin County Virginia Map 1911 Rand Mcnally Rocky Mount Neva Gogginsville Taylors Store Stanopher Redwood S Franklin County Virginia Map Virginia

Franklin County Virginia Map 1911 Rand Mcnally Rocky Mount Neva Gogginsville Taylors Store Stanopher Redwood S Franklin County Virginia Map Virginia

Tax Sale For Franklin County Florida Fl Tax Lien Certificates And Tax Deeds Franklin County Tax Lawyer Tax Attorney

Tax Sale For Franklin County Florida Fl Tax Lien Certificates And Tax Deeds Franklin County Tax Lawyer Tax Attorney

Franklin County Treasurer Property Search Property Search Franklin County Tax Reduction

Franklin County Treasurer Property Search Property Search Franklin County Tax Reduction

Franklin County Property Tax Inquiry

Franklin County Property Tax Inquiry

Franklin County Tax Assessor S Office

Franklin County Tax Assessor S Office

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home