How To Appeal A Property Tax Assessment In Georgia

When Filing For Your Appeal When filing your appeal you must choose one of the three options for appeal. The assessment notice includes the mailing address and contact information of the BOA.

Bookkeeping In Atlanta Ga Bookkeeping Services Small Business Accounting Accounting Services

Bookkeeping In Atlanta Ga Bookkeeping Services Small Business Accounting Accounting Services

You may want to do this even if you think the assessors market value estimate is.

How to appeal a property tax assessment in georgia. You can participate in a non-binding arbitration on the basis of your valuation only You may have your appeal heard in front of a Hearing Officer fees and additional costs may apply. It must be filed with the BOA office within 45 days of the date of the notice. You may have a hearing before the Board of Equalization.

PT-311A Appeal of Assessment Form. For information related to unemployment income please read FAQ 3. The taxpayers appeal may be based on taxability value uniformity andor the denial of an exemption.

Appeals must be filed by May 21. Appealing a Property Tax Assessment in Georgia Taxpayer can appeal an assessment within 45 or 30 days by mailing notice of appeal to county board of tax assessors. The State of Georgia provides a uniform appeal form for use by property owners.

The deadline for appealing an assessment is exactly 45 days after the notice of assessment was mailed by the County Tax Commissioner. To appeal your assessment use form PT-311-A. If no.

Upon receipt of this Assessment Notice the property owner desiring to appeal the assessment may do so within 45 days of the date the Assessment Notice was mailed. Your tax bill is temporary and reduced from the full amount while your value is in appeal. We can file 2020 appeals by mail or online and work the 2020 hearings when they are scheduled.

To protect your appeal rights you must file your property tax appeal with the County Board of Tax Assessors within 45 days of the date the Assessment Notice was mailed. We accomplish Tax Reductions by aggressively appealing the Assessors opinion of the Property. The state of Georgia is automatically extending the 2020 individual income tax filing and payment deadline from April 15 2021 to May 17 2021 without penalties or interest.

In Georgia you can normally appeal your residential property taxes by filing a Property Tax Return or appealing directly to the Board of Assessors If your property is valued at over a million dollars you can appeal to a hearing officer which is technically a third optionhowever since it does not apply to a large number of consumers it will not be discussed in this article. And each County Tax Commissioner decides when he or she will. For information related to unemployment income please read FAQ 3.

EQUITAX Georgias leading property tax consulting firm can reduce your property tax liability for Georgia Commercial Residential Real Estate Investments and Industrial real estate. It is based on either the 2019 value or 85 of the 2020 value whichever is lower. Additionally in Georgia settling your property tax appeal at a formal hearing caps your taxable value for three years.

In Texas assessments are generally sent out in April and homeowners have until the middle of May to appeal them. Fill out the appeal form by providing the property owners contact information and property description. If corrections or changes are made the taxpayer can appeal to the county board of equalization within 21 days.

The written appeal is filed initially with the Board of Tax Assessors. In that initial written dispute the property owner must declare their chosen method of appeal. The state of Georgia is automatically extending the 2020 individual income tax filing and payment deadline from April 15 2021 to May 17 2021 without penalties or interest.

In South Florida homeowners only.

Equitax Georgia Property Tax Appeal Services Tax Liability Reduction

Equitax Georgia Property Tax Appeal Services Tax Liability Reduction

How To Lower Your Property Taxes In 4 Easy Steps Clark Howard

How To Lower Your Property Taxes In 4 Easy Steps Clark Howard

Your Guide On Property Taxes In Atlanta Georgia Atlanta Dream Living

Your Guide On Property Taxes In Atlanta Georgia Atlanta Dream Living

Property Taxes On Owner Occupied Housing Property Tax Buying Property Infographic

Property Taxes On Owner Occupied Housing Property Tax Buying Property Infographic

Property Tax Appeals When How Why To Submit Plus A Sample Letter

Property Tax Appeals When How Why To Submit Plus A Sample Letter

Soon After Taking The Oath Dehradun S New Mayor Sunil Uniyal Gama Hinted To Revise House Tax In The City Property Tax Tax Consulting Tax Payment

Soon After Taking The Oath Dehradun S New Mayor Sunil Uniyal Gama Hinted To Revise House Tax In The City Property Tax Tax Consulting Tax Payment

Easyknock The Guide To Georgia Property Tax Rates And Options

Easyknock The Guide To Georgia Property Tax Rates And Options

Property Tax Appeals When How Why To Submit Plus A Sample Letter

Property Tax Appeals When How Why To Submit Plus A Sample Letter

Tax Commissioner Marion County Georgia

Tax Commissioner Marion County Georgia

Carroll County Board Of Tax Assessors

Carroll County Board Of Tax Assessors

Board Of Equalization Cobb County Superior Court Clerk

Lisle Township Assessor Property Tax Lisle Tax Rate

Lisle Township Assessor Property Tax Lisle Tax Rate

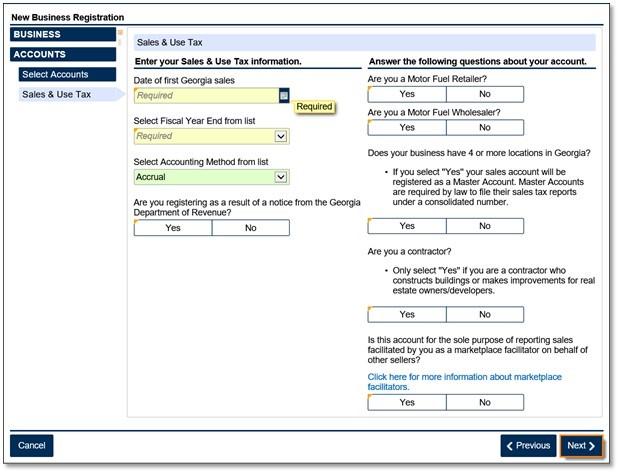

Marketplace Facilitators Georgia Department Of Revenue

Marketplace Facilitators Georgia Department Of Revenue

Property Tax Appeals When How Why To Submit Plus A Sample Letter

Property Tax Appeals When How Why To Submit Plus A Sample Letter

Property Tax Appeal Get The Guide For This Process Property Tax Property Valuation Tax Reduction

Property Tax Appeal Get The Guide For This Process Property Tax Property Valuation Tax Reduction

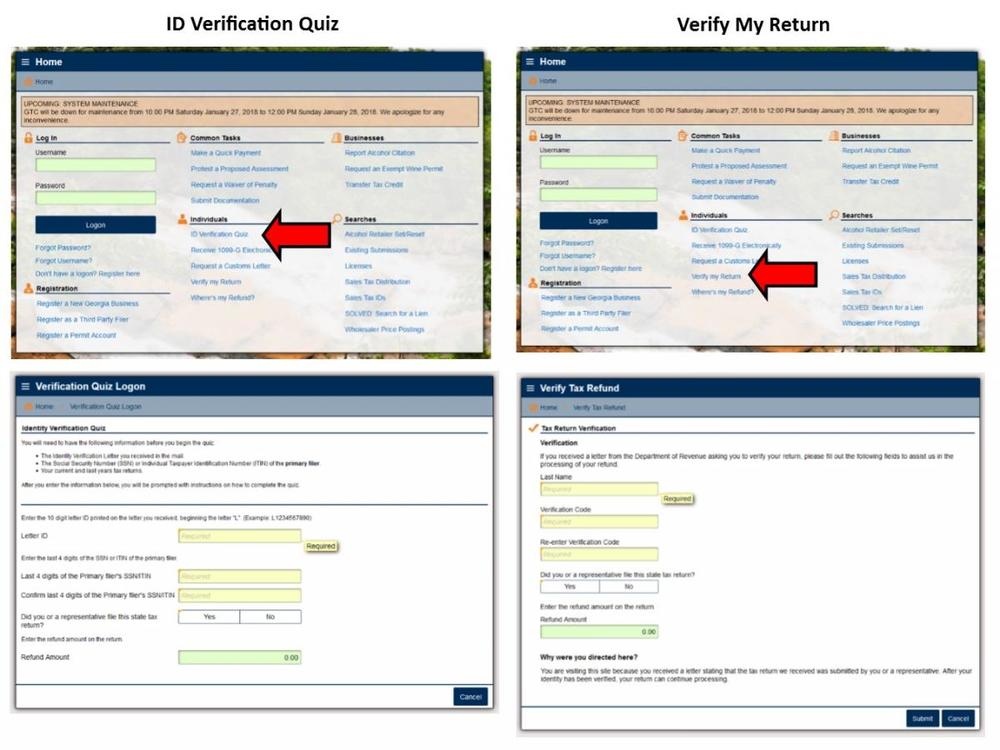

Return Verification Id Verification Quiz Georgia Department Of Revenue

Return Verification Id Verification Quiz Georgia Department Of Revenue

Https Dor Georgia Gov Document Training Program Appeals Procedure Workshop Download

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home